We also interact with private equity firms such as Unifonic, Saudi Technology Ventures, Impact 46 in Saudi and Dubai Future District Fund in Dubai. In Riyadh, we met Banque Saudi Fransi, stock exchange Saudi Tadawul Group, internet broker Derayah Financial. In UAE, we met 2 holding companies (Abu Dhabi Development Holding, Alpha Dhabi Holding), 2 of the largest banks (First Abu Dhabi Bank and Abu Dhabi Commercial Bank), soon-to-be listed Etihad Airways and Apparel Group as well as Dubai Stock Exchange (DFM) and Parkin Co. Later on, we also met Aramco and Adnoc Gas, 2 of the largest energy companies in our universe.

stock exchange Saudi Tadawul Group, internet broker Derayah Financial. In UAE, we met 2 holding companies (Abu Dhabi Development Holding, Alpha Dhabi Holding), 2 of the largest banks (First Abu Dhabi Bank and Abu Dhabi Commercial Bank), soon-to-be listed Etihad Airways and Apparel Group as well as Dubai Stock Exchange (DFM) and Parkin Co. Later on, we also met Aramco and Adnoc Gas, 2 of the largest energy companies in our universe.

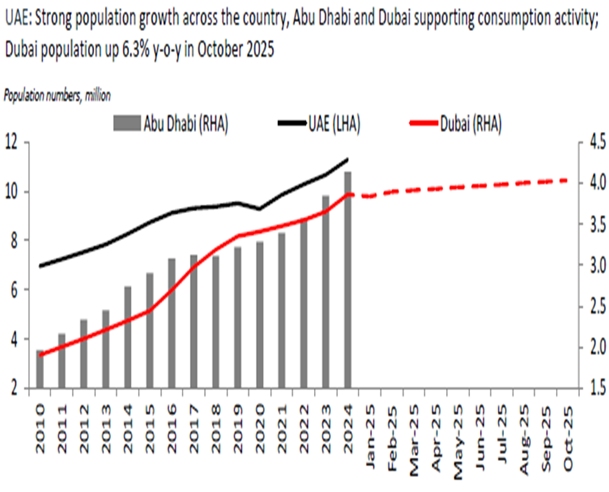

During this trip, we were undoubtedly more impressed by UAE than by KSA. In the Emirates, the local economy is driven by population growth and infrastructure investment, while in Saudi Arabia, mega projects have been scaled down, and budget deficit has been constrained by weaker oil price. This year’s market performance reflects this dichotomy: Riyadh Tadawul All Shares is down 12% while Dubai DFM General Index is up 26%. Emirati banks expect strong credit momentum to be sustained in 2026, while Saudi banks expect a slowdown in credit growth from around 15% in the last 2 years to 10% in 2026. Nonetheless and looking forward, Saudi stocks are now more attractively priced, expectations have retreated and retail investors who have favored overseas markets in 2025 (they bought over $150bn worth of US stocks in 9M25) could well return to their domestic favorites in 2026. Saudi QFI (Qualified Foreign Investors) rules and FOL (Foreign Ownership Limit) consultations were key subjects of our discussions and are likely to be key drivers in 2026. As Mohammed El-Kuwaiz, chairman of the kingdom’s Capital Market Authority, said: “We will be revisiting foreign ownership limits next year”. “Whether or not we will eliminate foreign ownership limits or more gradually decrease them on multiple stages, this will really become the output of our analysis. The current system of restricting market access to qualified foreign investors will end, before the ownership cap is reviewed, he said. Saudi remains one of the most under owned markets in EM. Only 60% of GEMs funds and 4% of global funds have exposure there. We think a potential increase in the FOL, which could materialize in 1H26, could be a trigger for more funds to own Saudi stocks as they try and match the shift in benchmark weight. For example, a move to a 100% FOL could lift Saudi’s EM benchmark weight by 1ppt and attract approximately $10bn in passive flows.

During this trip, we were undoubtedly more impressed by UAE than by KSA. In the Emirates, the local economy is driven by population growth and infrastructure investment, while in Saudi Arabia, mega projects have been scaled down, and budget deficit has been constrained by weaker oil price. This year’s market performance reflects this dichotomy: Riyadh Tadawul All Shares is down 12% while Dubai DFM General Index is up 26%. Emirati banks expect strong credit momentum to be sustained in 2026, while Saudi banks expect a slowdown in credit growth from around 15% in the last 2 years to 10% in 2026. Nonetheless and looking forward, Saudi stocks are now more attractively priced, expectations have retreated and retail investors who have favored overseas markets in 2025 (they bought over $150bn worth of US stocks in 9M25) could well return to their domestic favorites in 2026. Saudi QFI (Qualified Foreign Investors) rules and FOL (Foreign Ownership Limit) consultations were key subjects of our discussions and are likely to be key drivers in 2026. As Mohammed El-Kuwaiz, chairman of the kingdom’s Capital Market Authority, said: “We will be revisiting foreign ownership limits next year”. “Whether or not we will eliminate foreign ownership limits or more gradually decrease them on multiple stages, this will really become the output of our analysis. The current system of restricting market access to qualified foreign investors will end, before the ownership cap is reviewed, he said. Saudi remains one of the most under owned markets in EM. Only 60% of GEMs funds and 4% of global funds have exposure there. We think a potential increase in the FOL, which could materialize in 1H26, could be a trigger for more funds to own Saudi stocks as they try and match the shift in benchmark weight. For example, a move to a 100% FOL could lift Saudi’s EM benchmark weight by 1ppt and attract approximately $10bn in passive flows.

Macro: United Arab Emirates (UAE) - Dubai

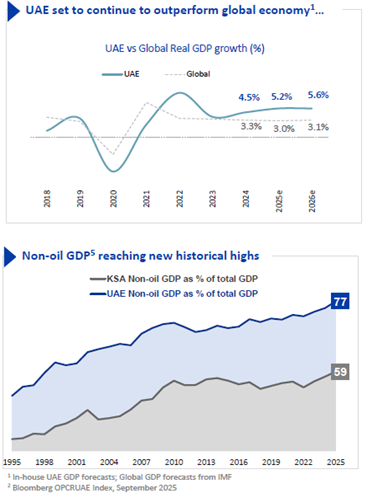

We remain positive on the UAE’s economic outlook, with ongoing strong performance in the non-oil sectors, a better ability to withstand lower oil prices (vs. historically and other GCC countries), balance sheet strength and a proactive policy stance. GDP growth is expected to strengthen to 5.2% in 2025 and 4.3% in 2026, from 4.0% in 2024. Central to this forecast acceleration in headline  GDP growth will be an expanding contribution from the hydrocarbon sector (i.e. production changes). The sector already made a positive contribution in 2024, driven by higher gas output. A 300K increase in the UAE’s OPEC baseline oil production (between April 2025 and September 2026) and the unwinding of earlier production cuts should provide a boost to real hydrocarbon and headline growth in 2025. Current account and fiscal surpluses are expected, despite a lower oil price forecast. Strong fundamentals in the UAE put the government in a solid position to support domestic demand and progress with medium-term development and diversification plans, even in a weak external backdrop scenario. More specifically in Dubai, the government adopted yet another expansionary annual budget and decided to even accelerate the pace of its expenditure growth, from an already high base. The government budgeted for 15% yoy growth in public spending to AED99.5bn for 2026, on top of the 9% growth budgeted for 2025. The higher spending will be led, once again, by the infrastructure and transport category, highlighting the emirate’s investment-led growth. Furthermore, social development (including healthcare, education, etc.), as well as security and justice were budgeted for a 15% annual increase. In line with the emirate’s healthy growth backdrop, the government is budgeting for a 10% yoy increase in revenues to AED107.7bn. With expenditure growth set to outstrip that of revenues, for the first time in the last six years, the government is budgeting for almost a 33% drop in the fiscal surplus to AED8.2bn, from AED11.4bn in 2025. Accelerated spending plans reflect well on the emirate’s already solid economic growth backdrop. GDP growth accelerated to 4.3% in 1H25, from 3.2% a

GDP growth will be an expanding contribution from the hydrocarbon sector (i.e. production changes). The sector already made a positive contribution in 2024, driven by higher gas output. A 300K increase in the UAE’s OPEC baseline oil production (between April 2025 and September 2026) and the unwinding of earlier production cuts should provide a boost to real hydrocarbon and headline growth in 2025. Current account and fiscal surpluses are expected, despite a lower oil price forecast. Strong fundamentals in the UAE put the government in a solid position to support domestic demand and progress with medium-term development and diversification plans, even in a weak external backdrop scenario. More specifically in Dubai, the government adopted yet another expansionary annual budget and decided to even accelerate the pace of its expenditure growth, from an already high base. The government budgeted for 15% yoy growth in public spending to AED99.5bn for 2026, on top of the 9% growth budgeted for 2025. The higher spending will be led, once again, by the infrastructure and transport category, highlighting the emirate’s investment-led growth. Furthermore, social development (including healthcare, education, etc.), as well as security and justice were budgeted for a 15% annual increase. In line with the emirate’s healthy growth backdrop, the government is budgeting for a 10% yoy increase in revenues to AED107.7bn. With expenditure growth set to outstrip that of revenues, for the first time in the last six years, the government is budgeting for almost a 33% drop in the fiscal surplus to AED8.2bn, from AED11.4bn in 2025. Accelerated spending plans reflect well on the emirate’s already solid economic growth backdrop. GDP growth accelerated to 4.3% in 1H25, from 3.2% a year earlier, with 2Q25 growth reaching a nearly three-year high of 4.7%. All key sectors of the economy recorded strong growth, including accommodation, logistics, transport and construction. We expect accelerated spending to help, forecasting growth of 4% in 2026. In addition to public spending, we expect tourism to print another record year, while construction sustains its strong growth (+14.9% in 2Q25), supported by public spending and ongoing real estate/hospitality projects. Post pandemic, Dubai’s fiscal story thrived, with the impressive economic recovery boosting the emirate’s fiscal position and enabling the local authorities to embrace a sustained deleveraging policy. The trend continued in 2025, with estimates suggesting the emirate’s public debt dropped to 26.6% of GDP, from 32.2% in 2024 and a peak of 76.6% in 2020. The notable deleveraging came on the back of growing GDP, in addition to significant repayments over the past few years. The emirate has, indeed, cut its sovereign borrowing by 74% (AED119bn) over the past five years and repaid part of its debt owed to Abu Dhabi. We expect further deleveraging in 2026 as the debt-to-GDP ratio falls to 24.3%, with the budget set to print yet another surplus.

year earlier, with 2Q25 growth reaching a nearly three-year high of 4.7%. All key sectors of the economy recorded strong growth, including accommodation, logistics, transport and construction. We expect accelerated spending to help, forecasting growth of 4% in 2026. In addition to public spending, we expect tourism to print another record year, while construction sustains its strong growth (+14.9% in 2Q25), supported by public spending and ongoing real estate/hospitality projects. Post pandemic, Dubai’s fiscal story thrived, with the impressive economic recovery boosting the emirate’s fiscal position and enabling the local authorities to embrace a sustained deleveraging policy. The trend continued in 2025, with estimates suggesting the emirate’s public debt dropped to 26.6% of GDP, from 32.2% in 2024 and a peak of 76.6% in 2020. The notable deleveraging came on the back of growing GDP, in addition to significant repayments over the past few years. The emirate has, indeed, cut its sovereign borrowing by 74% (AED119bn) over the past five years and repaid part of its debt owed to Abu Dhabi. We expect further deleveraging in 2026 as the debt-to-GDP ratio falls to 24.3%, with the budget set to print yet another surplus.

Macro: Kingdom of Saudi Arabia

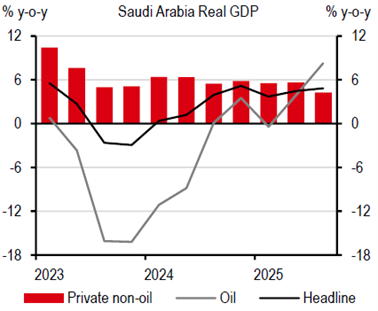

Earlier this month, Saudi Arabia’s Ministry of Finance presented the 2026 Budget with its updated economic and financial projections for the economy.The Saudi economy is expected to sustain growth rates in the medium term, with real GDP picking up from +4.4% yoy in 2025 to +4.6% yoy in 2026, supported by growth in non-oil activities. These forecasts exceed the IMF’s forecast (4.0%) for both years. Total actual revenues for 2025 are expected to underperform the budget by around 8%, reflecting lower-than-expected oil revenues, which offset improvements in non-oil revenue. Total actual expenditures are expected to overshoot budget by 4%. Expenditures typically overshoot budget in Saudi by a margin of 10%-15%, so this year’s overshoot was modest by historical standards. The net result is that the budget deficit for 2025 is estimated at SAR245bn ($65bn; 5.3% of GDP). This would result in government debt rising to 32% of GDP in 2025, from 26% of GDP the previous year. With lower oil price assumption (ranging between $60-$63/bbl, the budget deficit could reach 6% of GDP in 2026 and 5.2% in 2027 and 2028. These forecasts would result in a steady increase in the government debt burden, albeit remaining at a low level, to 44% of GDP by 2028.

Earlier this month, Saudi Arabia’s Ministry of Finance presented the 2026 Budget with its updated economic and financial projections for the economy.The Saudi economy is expected to sustain growth rates in the medium term, with real GDP picking up from +4.4% yoy in 2025 to +4.6% yoy in 2026, supported by growth in non-oil activities. These forecasts exceed the IMF’s forecast (4.0%) for both years. Total actual revenues for 2025 are expected to underperform the budget by around 8%, reflecting lower-than-expected oil revenues, which offset improvements in non-oil revenue. Total actual expenditures are expected to overshoot budget by 4%. Expenditures typically overshoot budget in Saudi by a margin of 10%-15%, so this year’s overshoot was modest by historical standards. The net result is that the budget deficit for 2025 is estimated at SAR245bn ($65bn; 5.3% of GDP). This would result in government debt rising to 32% of GDP in 2025, from 26% of GDP the previous year. With lower oil price assumption (ranging between $60-$63/bbl, the budget deficit could reach 6% of GDP in 2026 and 5.2% in 2027 and 2028. These forecasts would result in a steady increase in the government debt burden, albeit remaining at a low level, to 44% of GDP by 2028.

Company focus: Derayah Financial Company (Market Capitalization: $1.9bn, Sales: $300M)

Derayah is the leading independent digital investment platform in the KSA, empowering investors with seamless access to financial markets (local, regional and international). Since its inception in 2009, Derayah has been at the forefront of financial markets, using its cutting-edge technology and customer-centric solutions. The company offers a market-leading digital brokerage platform alongside a fast-growing asset and wealth management business. The company was officially listed on 10

Derayah is the leading independent digital investment platform in the KSA, empowering investors with seamless access to financial markets (local, regional and international). Since its inception in 2009, Derayah has been at the forefront of financial markets, using its cutting-edge technology and customer-centric solutions. The company offers a market-leading digital brokerage platform alongside a fast-growing asset and wealth management business. The company was officially listed on 10 March 2025. KSA has an economically active population (58% of which are of working age) and is benefiting from rising per capita wealth and high levels of digitalization with c.100% internet penetration. Digital brokerage market grew at 18% annually from 2019 to 2024, with expected continued double-digit growth annually through 2028, driven by increased online trading and market expansion. The asset management sector saw 16% AUM growth from 2019 to 2024 and is projected to grow at double-digit rates annually through 2028, providing favorable conditions in the Saudi Capital Markets.

March 2025. KSA has an economically active population (58% of which are of working age) and is benefiting from rising per capita wealth and high levels of digitalization with c.100% internet penetration. Digital brokerage market grew at 18% annually from 2019 to 2024, with expected continued double-digit growth annually through 2028, driven by increased online trading and market expansion. The asset management sector saw 16% AUM growth from 2019 to 2024 and is projected to grow at double-digit rates annually through 2028, providing favorable conditions in the Saudi Capital Markets.

Today, Derayah provides access to 10 local and regional markets through a single access point, offering equity and fixed income, in addition to derivatives. The company also provides its clients with international brokerage access to 33 global markets (stocks, options, futures, CFDs, bonds and commodities). With a market share in local online and international brokerage of 20%, Derayah ranks nb1 (m/s of 11% in local online trading, m/s of 45% in international trading).

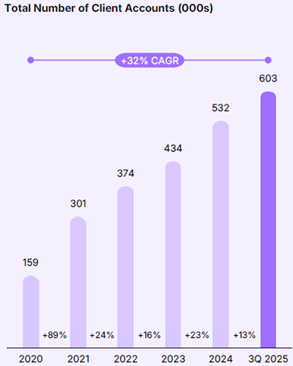

As of 3Q25, the company had 603,000 client accounts opened. The company has expanded its business to Asset Management (now 16% of revenue), covering both private and public markets. Its AUM now stands at $5bn. In 2018, the company incubated D360, the first Shariah-compliant digital bank in KSA (2M clients) and currently owns a 20% minority stake. 40% of the company workforce is in technology, as management believe it is key for client service.

We met the whole management team (CEO Mohammed Al Shammasi, CFO Bilal Bushnag and IRO Ghida Obeid) and have been particularly impressed by CEO Mohammed who is considered a charismatic leader, giving all his employees access to the success at Derayah via a share plan. Company’ s revenue is expected to reach $300M in 2026, from $166 in 2023. Net income margin is expected to reach 50% and ROE was 50% in 2024. Over the last 5 years, dividend per share has increased consistently with a payout of 60%. The stock now trades at 12x 2026 EPS and is likely to perform well in an environment where domestic investors return to Saudi stocks.

Company focus: Parkin (Market Capitalization: $4.8bn, Sales: $380M)

Parkin is Dubai’s parking leader. It is majority owned by the government of Dubai who offered 25% of the share to the public through an IPO in March 2024. The company has access to around 220,000 parking spaces scattered across the emirate, 90% of which are public parking (100% market share) that will be operated through a 49-year concession agreement with the Roads & Transport Authority (RTA). The mechanism in place ensures net tariff is inflation-adjusted, subject to necessary approvals, with Parkin’s interests also protected against early termination or adverse legislative actions. Additional revenue streams include enforcement (parking fines), the issuance of seasonal permits, parking reservations and other commercial activities. In addition to operational leadership, Parkin’s attractiveness as a potential investment opportunity lies in its strong visibility of earnings and cash flow generation, leveraging on its solid business model; hence, its ability to distribute lucrative dividends. The company’s exclusivity to operate the public parking spaces through a long-term concession agreement, along with its capex-light model, negligible working capital requirement, gives confidence in the company’s maintaining high free cash flow (FCF). Its 3Q25 performance is as follows :

Parkin is Dubai’s parking leader. It is majority owned by the government of Dubai who offered 25% of the share to the public through an IPO in March 2024. The company has access to around 220,000 parking spaces scattered across the emirate, 90% of which are public parking (100% market share) that will be operated through a 49-year concession agreement with the Roads & Transport Authority (RTA). The mechanism in place ensures net tariff is inflation-adjusted, subject to necessary approvals, with Parkin’s interests also protected against early termination or adverse legislative actions. Additional revenue streams include enforcement (parking fines), the issuance of seasonal permits, parking reservations and other commercial activities. In addition to operational leadership, Parkin’s attractiveness as a potential investment opportunity lies in its strong visibility of earnings and cash flow generation, leveraging on its solid business model; hence, its ability to distribute lucrative dividends. The company’s exclusivity to operate the public parking spaces through a long-term concession agreement, along with its capex-light model, negligible working capital requirement, gives confidence in the company’s maintaining high free cash flow (FCF). Its 3Q25 performance is as follows :

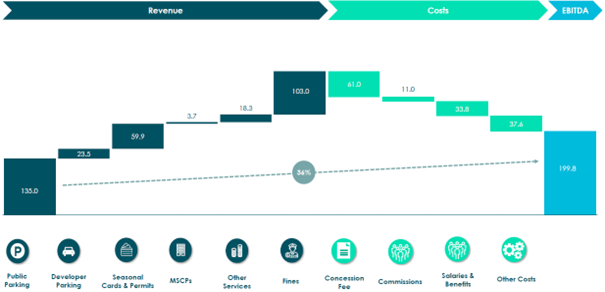

As seen below, public parking, which is the main source of income, accounts for 40% of sales, while fines account for 30%. EBITDA margin is close to 60% and allows the company to generate high FCF. EBITDA growth at 36% in the last know quarter is also unusually high for such a utility business and reflects the strong growth in car ownership in the city state.

Total 2025 revenue is expected to reach AED1.3bn ($355M), a 42% growth from 2024. CFO Khattab Abu Qaoud and IR Max Zaltsman explained to us that revenue from fines could be much higher if they wanted to increase the means to enforcement, but this could be perceived negatively by the public. Nonetheless, management believes that fines and private parking (none subject to concession fees) will remain a consistent revenue stream in the medium term, with growth supported by the increase in Dubai’s population and a higher number of operated parking spots. On private parking, the company sees further opportunities to grow and noted that the contract of the operator of Dubai Airport’s parking facilities is set to expire in 2026 – Parkin aims to participate in the tendering process, expected anytime soon. Overall, total number of parking spaces could increase by 30,000 by 2028 (+14% in next 3 years), ensuring steady growth.

Parkin’s share price is up 40% in the past year, outperforming the UAE market on better-than-expected earnings and increasing guidance. The stock now trades at a 2026 EV/BITDA of 21x and offers a dividend yield of 4%.

Bruno Vanier