We also attended the Kotak Mid-Cap conference which gathered more than 119 corporates and 550 funds. In total, we met 22 companies and conducted plant visits to auto and auto component  manufacturers. We met up with government representatives, industry experts and corporates. The corporate list includes financial companies like ICICI Bank, Aadhar Housing Finance, telecom operator Bharti Airtel, telecom infrastructure providers like Indus Towers and Tejas Network, auto manufacturers like Mahindra & Mahindra, Hyundai Motors, Escorts Kubota, auto component manufacturers like Sundaram Fasteners, ZF Commercial Vehicle Control Systems, electronic manufacturing service providers like Dixon Technologies, Avalon Technologies, hotel chain operators Juniper Hotels, Samhi Hotels, consumer discretionary players like Eternal, Tata Consumer, Le Travenues Technology (Ixigo), IT service providers like Infosys, Tech Mahindra, KPIT Technologies and cables & wires manufacturers like KEI Industries and RR Kabel.

manufacturers. We met up with government representatives, industry experts and corporates. The corporate list includes financial companies like ICICI Bank, Aadhar Housing Finance, telecom operator Bharti Airtel, telecom infrastructure providers like Indus Towers and Tejas Network, auto manufacturers like Mahindra & Mahindra, Hyundai Motors, Escorts Kubota, auto component manufacturers like Sundaram Fasteners, ZF Commercial Vehicle Control Systems, electronic manufacturing service providers like Dixon Technologies, Avalon Technologies, hotel chain operators Juniper Hotels, Samhi Hotels, consumer discretionary players like Eternal, Tata Consumer, Le Travenues Technology (Ixigo), IT service providers like Infosys, Tech Mahindra, KPIT Technologies and cables & wires manufacturers like KEI Industries and RR Kabel.

The conferences took place right after the festive season of Diwali, as Indian corporates sounded optimistic on growth on buoyance in consumer demand. We believe, this optimism arises as Modi 3.0 push forward an economic stimulus such as reduction in Income tax rate for middle class, GST rate reduction and welfare schemes for women will boost consumption by $70bn (1.6% of GDP) between F26-F27. Furthermore, the government introduced labor reforms to modernize labor regulations, expand social security coverage, gender pay parity, rights and safety for women workers, national floor for minimum wages. The new labor code will reduce the number of regulations from 1,436 to 351, enabling ease of doing business. We interacted with Minister of Commerce Piyush Goyal, who highlighted the government’s focus on macro stability and reforms (improvement in Insolvency & Bankruptcy code, simplification of regulatory process, etc…). Furthermore, the minister mentioned “good economics leads to good politics”, as India aims to double its economy every 8 years corresponding to nominal growth of 9% per year. He also underlined India ambition of reaching 500GW of renewable energy (Currently ~250GW) coupled with robust national grid to support energy intensive AI Data centers in the country. There was emphasis on boosting the domestic manufacturing of electronics and expanding the industry from $130bn to $500bn within which share of exports to increase from $35bn to $100bn by 2030. India has rolled out an electronic component manufacturing scheme (ECMS) with incentives of ~$2bn to support manufacturers. The Indian government has so far approved 24 projects with an investment of $1.2bn. The commerce minister also, indicated India that remains in negotiations with USA for a trade deal however few critical issues remain to be resolved. For a reminder to our readers, in 2024 India had a goods trade surplus of ~$40bn with the US and are for most South East Asian countries. A trade deal with the US could act as sentiment boost as uncertainty risk towards India - USA relations would subside. India is more reliant on US exports for services than for goods. When we had visited the country in February 2025, Indian policy makers were cognizant of the changing times in Trump 2.0 and have taken the route of reforms to boost domestic productivity.

double its economy every 8 years corresponding to nominal growth of 9% per year. He also underlined India ambition of reaching 500GW of renewable energy (Currently ~250GW) coupled with robust national grid to support energy intensive AI Data centers in the country. There was emphasis on boosting the domestic manufacturing of electronics and expanding the industry from $130bn to $500bn within which share of exports to increase from $35bn to $100bn by 2030. India has rolled out an electronic component manufacturing scheme (ECMS) with incentives of ~$2bn to support manufacturers. The Indian government has so far approved 24 projects with an investment of $1.2bn. The commerce minister also, indicated India that remains in negotiations with USA for a trade deal however few critical issues remain to be resolved. For a reminder to our readers, in 2024 India had a goods trade surplus of ~$40bn with the US and are for most South East Asian countries. A trade deal with the US could act as sentiment boost as uncertainty risk towards India - USA relations would subside. India is more reliant on US exports for services than for goods. When we had visited the country in February 2025, Indian policy makers were cognizant of the changing times in Trump 2.0 and have taken the route of reforms to boost domestic productivity.

Macro Focus :

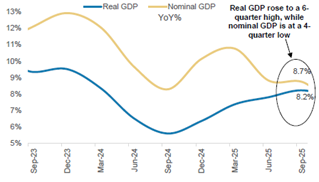

In 3Q25 the Indian economy reported a strong print of 8.2%, benefiting from a cyclical boost along with some statistical anomalies. On the cyclical front, private consumption grew by 7.2% on back of improved policy support which has contributed to nascent pick-up in urban demand, complementing the robust rural consumption. Investment grew at a healthy pace of 7.3%, as government front loaded their capital expenditure, while private sector finally stepped up with investments in data centers, semi-conductors and power. On statistical front, a low base effect and deflator issues supported the growth further.

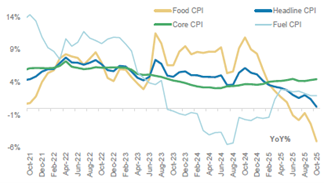

back of improved policy support which has contributed to nascent pick-up in urban demand, complementing the robust rural consumption. Investment grew at a healthy pace of 7.3%, as government front loaded their capital expenditure, while private sector finally stepped up with investments in data centers, semi-conductors and power. On statistical front, a low base effect and deflator issues supported the growth further.  Central Bank RBI has raised FY03/26 GDP forecast by 50bps to 7.3%, owing to a broadening of consumption recovery, strong 1H26 though implying growth to moderate in 2H26. Tax revenues have been lower than government estimates (tax cuts + lower nominal GDP growth). Hence, Indian policymakers could prune some spends in 2H26 as they maintain their path towards fiscal consolidation. The government had set a fiscal deficit target at 4.4% for FY03/26. Meanwhile, inflation continues to surprise on the downside with October CPI inflation at 0.25%, as food and commodity prices continued to fall. RBI further eased its policy rate by 25bp to 5.25%. Since beginning of 2025 India has cut rates by 125bp. It also lowered its headline CPI forecast from 2.6% to 2% for FY03/26. However, the INR on a trade weighted basis has fallen by ~10% in 2025, driven by a wider trade deficit (driven by increased gold imports), weak FDI and FII flows and US trade deal uncertainty.

Central Bank RBI has raised FY03/26 GDP forecast by 50bps to 7.3%, owing to a broadening of consumption recovery, strong 1H26 though implying growth to moderate in 2H26. Tax revenues have been lower than government estimates (tax cuts + lower nominal GDP growth). Hence, Indian policymakers could prune some spends in 2H26 as they maintain their path towards fiscal consolidation. The government had set a fiscal deficit target at 4.4% for FY03/26. Meanwhile, inflation continues to surprise on the downside with October CPI inflation at 0.25%, as food and commodity prices continued to fall. RBI further eased its policy rate by 25bp to 5.25%. Since beginning of 2025 India has cut rates by 125bp. It also lowered its headline CPI forecast from 2.6% to 2% for FY03/26. However, the INR on a trade weighted basis has fallen by ~10% in 2025, driven by a wider trade deficit (driven by increased gold imports), weak FDI and FII flows and US trade deal uncertainty.

Market Focus: Bottom of EPS downgrades.

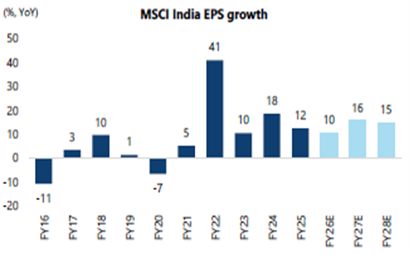

Since January 2025, Indian equities have been up modestly +2.5% in USD vs. MSCI EM Index +30%. This underperformance has been the largest in the past two decades. A combination of factors such as high valuation, cyclical slowdown in growth and corporate earnings, INR depreciation (-5%) and intense foreign selling ($16bn YTD and $30bn over 1 year). Foreign ownership in BSE-500 is now at a decade low of 19.5%. On the domestic front, liquidity continues to remain supportive as inflows remained solid at $80bn YTD within which monthly SIP flows of $3.2bn (vs. $2.7bn in 2024). Though equity issuances continue to remain high at $24bn, which has taken away ~50% of the domestic liquidity. Meanwhile, MSCI India FY03/26 corporate earnings has been cut by 4% to 10%, impacted by weather disruptions, subdued consumer demand and policy rate cuts reducing profitability of banks in the short term. Looking forward, MSCI India FY03/27 EPS is expected to grow by 16%, as combination of easing financial conditions, uptick in consumption demand and earnings from GST rate cut, along with recovery in rural spending and banking deregulations should boost profit growth. MSCI India Index premium to MSCI EM was 105%. It has now reversed to its 10-year average premium of 62%. While Nifty 50 forward PER trades at 18.2x, pockets of opportunities are visible in financials, auto and hospitals where valuations are attractive.

such as high valuation, cyclical slowdown in growth and corporate earnings, INR depreciation (-5%) and intense foreign selling ($16bn YTD and $30bn over 1 year). Foreign ownership in BSE-500 is now at a decade low of 19.5%. On the domestic front, liquidity continues to remain supportive as inflows remained solid at $80bn YTD within which monthly SIP flows of $3.2bn (vs. $2.7bn in 2024). Though equity issuances continue to remain high at $24bn, which has taken away ~50% of the domestic liquidity. Meanwhile, MSCI India FY03/26 corporate earnings has been cut by 4% to 10%, impacted by weather disruptions, subdued consumer demand and policy rate cuts reducing profitability of banks in the short term. Looking forward, MSCI India FY03/27 EPS is expected to grow by 16%, as combination of easing financial conditions, uptick in consumption demand and earnings from GST rate cut, along with recovery in rural spending and banking deregulations should boost profit growth. MSCI India Index premium to MSCI EM was 105%. It has now reversed to its 10-year average premium of 62%. While Nifty 50 forward PER trades at 18.2x, pockets of opportunities are visible in financials, auto and hospitals where valuations are attractive.

Company focus: Bharti Airtel (Sales: $23bn - Market Capitalization: $140bn)

Founded in 1984, by Sunil Bharti Mittal as Bharti Telecom, the company focused on importing and assembly of push button phones under the brand “Beetel” to replace the

Founded in 1984, by Sunil Bharti Mittal as Bharti Telecom, the company focused on importing and assembly of push button phones under the brand “Beetel” to replace the rotary phones. In the early 1990’s, the privatization of telecom sector in India led Bharti Telecom to partner with French telecom operator “Vivendi” to qualify as a telecom operator. In 1995, the company launched mobile services in India and renamed themselves as Bharti Airtel. Over the years, Bharti Airtel established itself as a pan-India telecom operator for mobile consumers and expanded to other segments such as broadband internet, digital television (DTH) and connectivity solutions for enterprise customers. In 2010, the company ventured into Africa by acquiring Zain Telecom for $10.7bn. Airtel has now presence in 17 countries including India, Sri-Lanka, Bangladesh and 14 countries in Africa with 623mn customers. As on september 2025, India Mobile contributes to ~60% of Group EBITDA (vs. ~55% in 2025) and has established itself as a strong number 2 operator in India with 364M consumers and market share of 39.5% (vs. 32.2% in FY18). The African and rest of the Indian operations contribute to ~20% of Group EBITDA respectively. In 2015, the company faced its toughest survival battle as Reliance JIO entered the sector which led to a massive consolidation (11 players to 3 players) and ARPU (revenue per user) declining from $1.7 per month (F15) to $1 per month (F19). Bharti Airtel implemented “Project Leap” a ~$7bn network transformation and modernization initiative, which helped them transform into a modern 4G/5G operator. The transformation enabled the company to increase their ARPU (revenue per user) from $1.3 to ~$3 (FY03/25), below its internal target of $3.5. Recently, Bharti Airtel partnered with Google to setup a 1GW AI data center in India, as it sees data centers as a new growth engine. We think the company has space to increase tariffs for India mobile operations as they aspire to achieve ROCE of ~20% (vs. currently ~15%). Over a 3-year period (2025-2028), the company is expected to generate cumulative free cash flow of $20bn and EPS growth 34% per annum. The stock trades at FY03/26 EV/EBITDA of 12.5x. We have invested 3.5% of GemEquity and 4% of GemAsia in the company.

rotary phones. In the early 1990’s, the privatization of telecom sector in India led Bharti Telecom to partner with French telecom operator “Vivendi” to qualify as a telecom operator. In 1995, the company launched mobile services in India and renamed themselves as Bharti Airtel. Over the years, Bharti Airtel established itself as a pan-India telecom operator for mobile consumers and expanded to other segments such as broadband internet, digital television (DTH) and connectivity solutions for enterprise customers. In 2010, the company ventured into Africa by acquiring Zain Telecom for $10.7bn. Airtel has now presence in 17 countries including India, Sri-Lanka, Bangladesh and 14 countries in Africa with 623mn customers. As on september 2025, India Mobile contributes to ~60% of Group EBITDA (vs. ~55% in 2025) and has established itself as a strong number 2 operator in India with 364M consumers and market share of 39.5% (vs. 32.2% in FY18). The African and rest of the Indian operations contribute to ~20% of Group EBITDA respectively. In 2015, the company faced its toughest survival battle as Reliance JIO entered the sector which led to a massive consolidation (11 players to 3 players) and ARPU (revenue per user) declining from $1.7 per month (F15) to $1 per month (F19). Bharti Airtel implemented “Project Leap” a ~$7bn network transformation and modernization initiative, which helped them transform into a modern 4G/5G operator. The transformation enabled the company to increase their ARPU (revenue per user) from $1.3 to ~$3 (FY03/25), below its internal target of $3.5. Recently, Bharti Airtel partnered with Google to setup a 1GW AI data center in India, as it sees data centers as a new growth engine. We think the company has space to increase tariffs for India mobile operations as they aspire to achieve ROCE of ~20% (vs. currently ~15%). Over a 3-year period (2025-2028), the company is expected to generate cumulative free cash flow of $20bn and EPS growth 34% per annum. The stock trades at FY03/26 EV/EBITDA of 12.5x. We have invested 3.5% of GemEquity and 4% of GemAsia in the company.

Company focus: Dixon Technologies (Sales: $6.2bn - Market Capitalization: $9bn)

Founded in 1993, Dixon Technologies was a small contract manufacturer making 14-inch TVs, Sega video game consoles, Philips video recorder and push button phones for Bharti Airtel. In 2017, the company got listed and since then their sales have grown by a CAGR of 16% over 8 years. This strong growth is supported by Dixon entering new segments such as Mobiles & EMS (65% of operating profit), Consumer electronics (7%), Home appliances (10%), Lighting Products and Security Surveillance Systems. At the same time, the company diversified itself from a contract manufacturer to original design manufacturing (ODM) and electronic manufacturing service provider (EMS), which is supported by 24 manufacturing facilities and 6 R&D centers spread across 4.5M sq.ft. These facilities have production capacity of 200M LED lamps, 40Msmartphone units, 30M feature phone units, 6M units of printed circuit boards and smart TVs and 2.4M washing machine units. The service and production capability has enabled Dixon to partner with global brands such as Google, Xiaomi, Samsung, Oppo, Vivo and Motorola. Interestingly, the customers of Dixon account for 60% of the Indian smartphone market. Meanwhile, the company is aiming to increase the domestic value addition in mobile manufacturing from current 18% to 40%. Dixon aims to increase the level of backward integration in display modules, camera modules, lithium-ion batteries through Joint Venture as part of electronic component scheme launched by the government. Interestingly, Dixon has formed interesting Joint Ventures with Chinese firms such as HKC to manufacture display modules to setup facility for 24mn units, Q Technology to manufacture camera modules and Chongqing Yuhai for precision component manufacturing. As India’ aims to grow its electronic industry from $130bn to $500bn by 2030, we believe Dixon with its tech-expertise is likely to be one of the front-runners in this industry. Over the next 3 years (2025-2028), the company is expected to grow its sales by 20% and EPS by 21% per annum. The stock trades at a high FY26 P/E of 69x, given its strong growth prospects.

Founded in 1993, Dixon Technologies was a small contract manufacturer making 14-inch TVs, Sega video game consoles, Philips video recorder and push button phones for Bharti Airtel. In 2017, the company got listed and since then their sales have grown by a CAGR of 16% over 8 years. This strong growth is supported by Dixon entering new segments such as Mobiles & EMS (65% of operating profit), Consumer electronics (7%), Home appliances (10%), Lighting Products and Security Surveillance Systems. At the same time, the company diversified itself from a contract manufacturer to original design manufacturing (ODM) and electronic manufacturing service provider (EMS), which is supported by 24 manufacturing facilities and 6 R&D centers spread across 4.5M sq.ft. These facilities have production capacity of 200M LED lamps, 40Msmartphone units, 30M feature phone units, 6M units of printed circuit boards and smart TVs and 2.4M washing machine units. The service and production capability has enabled Dixon to partner with global brands such as Google, Xiaomi, Samsung, Oppo, Vivo and Motorola. Interestingly, the customers of Dixon account for 60% of the Indian smartphone market. Meanwhile, the company is aiming to increase the domestic value addition in mobile manufacturing from current 18% to 40%. Dixon aims to increase the level of backward integration in display modules, camera modules, lithium-ion batteries through Joint Venture as part of electronic component scheme launched by the government. Interestingly, Dixon has formed interesting Joint Ventures with Chinese firms such as HKC to manufacture display modules to setup facility for 24mn units, Q Technology to manufacture camera modules and Chongqing Yuhai for precision component manufacturing. As India’ aims to grow its electronic industry from $130bn to $500bn by 2030, we believe Dixon with its tech-expertise is likely to be one of the front-runners in this industry. Over the next 3 years (2025-2028), the company is expected to grow its sales by 20% and EPS by 21% per annum. The stock trades at a high FY26 P/E of 69x, given its strong growth prospects.