This trip followed our two-week visit to China at the end of the second quarter, where we met with leading domestic players as well as Asian corporates in Hong Kong (cf. our previous travel report in June). We returned with the aim of reassessing the landscape: in recent months, Chinese equities have rallied despite still-weak macro fundamentals, supported by emerging “silver linings” in areas such as AI-driven humanoid robotics, biotechnology, and new consumption trends. While tariff uncertainties continue to linger, the AI boom has also underpinned Asia’s export performance, with technology products representing over 60% of total yoy export growth in the first half of the year. Taiwan stood out as a key beneficiary: its exports rose 30% yoy in August, underscoring the tech sector’s dominance in its economy. We estimate that Taiwan contributed roughly one-third of the region’s total export gains that month. This time, our itinerary included participation in highly attended CLSA CITIC 32nd Investors’ Forum, followed by targeted company visits and UBS’s Taiwan Summit. Over the course of the trip, we engaged with 54 companies across diverse sectors, including the following :

Healthcare: BeOne Medicine, Innovent, Sino Biopharma

Industrial automation/Robotics: Shenzhen Inovance, Estun, AirTac, Shuanghuan Driveline, Orbbec, UBTech, Dobot

Consumer discretionary: Mao Geping Cosmetics, Chow Tai Fook, Haier, Xiaomi, BYD

Internet platforms: Bilibili, Full Truck Alliance, Trip.com

Semiconductors: MediaTek, GUC, Vanguard, Win Semi

Semiconductor equipment: ASMPT, Advanced Micro-Fabrication Equipment

Electronic components: Delta Electronics, Elite Materials, Yageo

Financials: KB Financial (Korea), CIMB (Malaysia), BCA & Bank Mandiri (Indonesia), China Merchants Bank

Macro: Taiwan & China

Taiwan: In AI we trust!

With its heavy reliance on electronics and unique role in regional geopolitics and supply chains, Taiwan has been a prime beneficiary of strong global tech demand driven by the AI boom. Despite lingering uncertainties around potential semiconductor tariffs and ongoing US-Taiwan trade discussions (reciprocal tariffs remain relatively high at 20%), policymakers have revised Taiwan’s 2025 real GDP growth forecast up to 4.5% from 3.1% previously. In the near term, exports are likely to stay resilient, underpinned by buoyant AI infrastructure demand (high-end chips and data centers).

Corporate sentiment in the AI supply chain remains constructive. TSMC is well positioned to capture strong demand for advanced nodes from 2026 as

Corporate sentiment in the AI supply chain remains constructive. TSMC is well positioned to capture strong demand for advanced nodes from 2026 as leading AI chips (Nvidia Rubin, Meta, OpenAI, Google TPU) transition to 3nm. The rising contribution of these cutting-edge products should drive ASP growth and help offset lower gross margins at its US fabs (management estimates a 2-3% gap). AI server ODMs such as Hon Hai and Quanta stand to benefit from robust US cloud service providers’ capex growth in 2025-2026. Delta Electronics, the market leader in AI server power and cooling systems, continues to expect solid growth through 2027 with margin upside. Semiconductor testing leader KYEC should also benefit from longer test times required by advanced AI chips. We remain confident in AI’s long-term structural appeal but have turned more cautious on short-term stock momentum following the recent strong rally.

leading AI chips (Nvidia Rubin, Meta, OpenAI, Google TPU) transition to 3nm. The rising contribution of these cutting-edge products should drive ASP growth and help offset lower gross margins at its US fabs (management estimates a 2-3% gap). AI server ODMs such as Hon Hai and Quanta stand to benefit from robust US cloud service providers’ capex growth in 2025-2026. Delta Electronics, the market leader in AI server power and cooling systems, continues to expect solid growth through 2027 with margin upside. Semiconductor testing leader KYEC should also benefit from longer test times required by advanced AI chips. We remain confident in AI’s long-term structural appeal but have turned more cautious on short-term stock momentum following the recent strong rally.

China: Macroeconomy remains challenging, but the market remains focus on the other side of the valley!

Chinese equities have staged a sharp rebound from their April lows and are now among the best-performing global markets year to date, with Hong Kong and A-shares up 34% and 21% respectively in USD terms. The rally was triggered by DeepSeek’s R1 model release in late January and has since gained momentum on improving private-sector conditions, renewed confidence in innovation, easing US–China tensions, and continued policy support. Ample liquidity underpins the market, with households sitting on nearly US$7 Tr in excess savings and the “national team” remaining active in stabilizing sentiment.

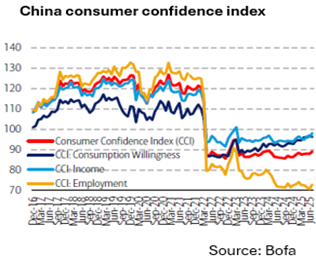

Compared with our last visit in late May, however, China’s macro backdrop remains subdued. After a stronger-than-expected first half (GDP growth of 5.3% YoY versus 5.0% in 2024), supported by fiscal stimulus and resilient exports amid tariff uncertainty, momentum weakened again in 3Q. Deflationary pressures persist, with both CPI and PPI in negative territory. The housing sector continues to drag on activity: despite a brief rebound in volumes and prices following policy easing, the recovery faltered in 2Q25 and deteriorated further over the summer. New home sales volumes fell 5% YoY in the first eight months, compounding sharp declines of 14% YoY in 2024 and 17% YoY in 2023. The labor market is also under stress. The official unemployment rate climbed to 5.3% in August from 5% at end-2024, while youth unemployment reached 18.9% (seasonally lifted by graduation) up from 15.7% in December 2024. Against this backdrop, consumption remains weak: retail sales growth slowed to a nine-month low of 3.4% YoY. That said, consumer sentiment indicators suggest a modest improvement in willingness to spend, especially on discretionary items. Domestic “new retail” leaders such as Laopu, Pop Mart, and Trip.com are best positioned to benefit from rising demand for products and services offering emotional fulfilment.

Compared with our last visit in late May, however, China’s macro backdrop remains subdued. After a stronger-than-expected first half (GDP growth of 5.3% YoY versus 5.0% in 2024), supported by fiscal stimulus and resilient exports amid tariff uncertainty, momentum weakened again in 3Q. Deflationary pressures persist, with both CPI and PPI in negative territory. The housing sector continues to drag on activity: despite a brief rebound in volumes and prices following policy easing, the recovery faltered in 2Q25 and deteriorated further over the summer. New home sales volumes fell 5% YoY in the first eight months, compounding sharp declines of 14% YoY in 2024 and 17% YoY in 2023. The labor market is also under stress. The official unemployment rate climbed to 5.3% in August from 5% at end-2024, while youth unemployment reached 18.9% (seasonally lifted by graduation) up from 15.7% in December 2024. Against this backdrop, consumption remains weak: retail sales growth slowed to a nine-month low of 3.4% YoY. That said, consumer sentiment indicators suggest a modest improvement in willingness to spend, especially on discretionary items. Domestic “new retail” leaders such as Laopu, Pop Mart, and Trip.com are best positioned to benefit from rising demand for products and services offering emotional fulfilment.

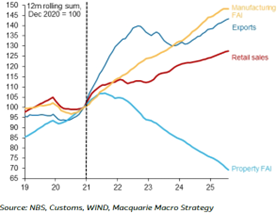

Recently, a fading fiscal impulse has also weighed on activity. Infrastructure capex slowed notably from July (FAI down 5.2% YTD), reflecting both a high base of earlier government support and tighter local government liquidity. Yet at the micro level, sentiment appears to be improving. Shenzhen Inovance, the automation leader, reported easing tariff headwinds, a return to double-digit order growth in June-July, and stronger expected demand in 2H25. Optimism was also evident at the 2025 China International Industry Fair (23-27 September), where industry leaders confidently mentioned key growth drivers: such as AI-related hardware, consumer electronics upgrades linked to AI adoption, overseas expansion, and industry consolidation. Suffice to say, the Chinese economy is on an ongoing 2-speed model since 2021 (as shown in the graph).

improving. Shenzhen Inovance, the automation leader, reported easing tariff headwinds, a return to double-digit order growth in June-July, and stronger expected demand in 2H25. Optimism was also evident at the 2025 China International Industry Fair (23-27 September), where industry leaders confidently mentioned key growth drivers: such as AI-related hardware, consumer electronics upgrades linked to AI adoption, overseas expansion, and industry consolidation. Suffice to say, the Chinese economy is on an ongoing 2-speed model since 2021 (as shown in the graph).

On the corporate side, a major positive surprise came from the sharp rebound in industrial profits in August, up more than 20% YoY after three months of contraction. This improvement may reflect the deepening of the “anti-involution” campaign, as Beijing moves to curb excess supply and rein in destructive price competition. Importantly, the breadth of earnings estimates revisions (net numbers of consensus estimate increases) for MSCI China turned positive in August 2025, after three consecutive quarters of in-line results since 4Q24 (a marked improvement after three and a half years of consistent misses since 2021). In the near term, anti-involution policies may have mixed effects on growth, but we view them as directionally positive: they should accelerate industry consolidation, improve return on investment and ultimately favor established leaders.

Looking ahead, attention is shifting to the upcoming Fourth Plenum (20-23 October) and the launch of the 15th Five-Year Plan (2026–2030). We expect further structural policies to be unveiled, with technological self-sufficiency likely to remain a top priority, complemented by incremental measures to support consumption. We are also closely watching the potential Xi Trump meeting at the November APEC Summit, which could help shape the external environment.

China Internet Cloud market:

China internet cloud revenue grew 25% YoY in 2Q25, aligning with growth of US hyper-scalers. The Chinese cloud companies expect rapid AI revenue growth to be sustained into 2H25 with encouraging cross-selling from AI to traditional cloud storage, computing, database and big data. They see competition as benign overall and see Bytedance as the only one with aggressive pricing. AliCloud's prices are the lowest among listed vendors but within a reasonable range. All the listed vendors said they would not follow ByteDance’s prices and hold a steady profit margin outlook.

Strong Cloud revenue growth with robust demand:

- Alibaba’s internal and external cloud revenue both grew 26% YoY in 2Q25, with AI contribution to external revenue rising to c.20%. External demand is mainly from internet, EV, financial and increasingly from traditional manufacturers. It expects cloud revenue to accelerate in 2H, with surging AI inference and solid AI training demand.

increasingly from traditional manufacturers. It expects cloud revenue to accelerate in 2H, with surging AI inference and solid AI training demand.

- Baidu’s cloud revenue grew 27% YoY in 2Q25, with AI IaaS up 50% YoY. Subscription revenue contributes >50% of enterprise cloud. It serves 20 of the 30 major robotic companies. It expects cloud revenue growth to be slower in 2H25 given project-based business fluctuations. It plans to raise subscription mix to smooth quarterly revenue.

Steady margin outlook amid rational competition

- Alibaba retains high single-digit cloud Ebitda margin guidance for coming quarters (relatively higher margin for public cloud) due to high capex cycle, upfront R&D for AI tools and services, and competition from Bytedance, but sees margin upside mid-term from scale effects of utilization efficiency and rising mix from high margin AI agent business.

- Baidu has achieved low teens OPM and attributes the better than peers’ profitability to higher AI revenue mix and self-designed chips applied to both internal and external customers.

Capex and computing resource pool expansion on track

- Alibaba is confident that its product portfolio and supply chain partnership will prepare it to navigate geopolitical risks and achieve its Rmb380bn capex three-year target. It aims to strike a balance between external and internal demand.

- Tencent is less aggressive in capex and is prioritizing internal use over external offerings. While AI training is predominantly on Nvidia architecture, it sees more room to shift inference workload to non-Nvidia, where most of its current workload resides.

- Baidu plans to further expand the computing resource pool, allocating between capex and rental servers flexibly.

Overall, the cloud has very strong growth outlook in China. Major players include Tencent, Alibaba, Bytedance (unlisted) and Baidu. We prefer Tencent and Alibaba.

Company focus: Huaming Power Equipment (Market Capitalization: $2.5bn, Sales: $400M)

We met Mr. Xiao Yi, founder and Chairman of Huaming Power Equipment, the largest manufacturer of tap changers in China. Often described as the “brain” of a transformer, tap changers are critical components that regulate voltage, ensure stability, and safeguard grid reliability. With grid modernization, renewable integration, and electrification driving a new global investment cycle in power infrastructure, demand for both transformers and tap changers is on a structural upswing. Yet despite their strategic importance, the tap

We met Mr. Xiao Yi, founder and Chairman of Huaming Power Equipment, the largest manufacturer of tap changers in China. Often described as the “brain” of a transformer, tap changers are critical components that regulate voltage, ensure stability, and safeguard grid reliability. With grid modernization, renewable integration, and electrification driving a new global investment cycle in power infrastructure, demand for both transformers and tap changers is on a structural upswing. Yet despite their strategic importance, the tap changer market remains relatively small, estimated at just ~$360M in China in 2024. A single unit typically represents only 5-15% of a transformer’s cost, with an average selling price of ~$14,000. This limited TAM with high market share concentration (global top 3 control 70%+) discourages new entrants, who would in any case face significant barriers: technical complexities (each tap changer contains thousands of precision components), customized engineering requirements, stringent safety and reliability standards, and the need to build long-term trust with transformer manufacturers. The result is an environment that favors entrenched leaders whose scale, reputation, and reliability reinforce their commanding positions. Therefore, the high margin (60%) is likely to sustain in the foreseeable future. As the Chinese leader with more than 60% of market share, Huaming solidified its leadership in the 35kv-220kv segment (>90% market share) after acquiring its key competitor Changzheng Electric. In the medium to long term, the most significant domestic opportunity lies in the localization of ultra-high voltage tap changers, a segment still dominated by international players such as Maschinenfabrik Reinhausen (MR) and Hitachi. Huaming’s presence here remains limited, but the company is off to a promising start, having successfully delivered its first off-load tap changer for a 1,000kV UHV transformer in 2021, with support from the State Grid Corporation of China and the China Electric Power Research Institute.

changer market remains relatively small, estimated at just ~$360M in China in 2024. A single unit typically represents only 5-15% of a transformer’s cost, with an average selling price of ~$14,000. This limited TAM with high market share concentration (global top 3 control 70%+) discourages new entrants, who would in any case face significant barriers: technical complexities (each tap changer contains thousands of precision components), customized engineering requirements, stringent safety and reliability standards, and the need to build long-term trust with transformer manufacturers. The result is an environment that favors entrenched leaders whose scale, reputation, and reliability reinforce their commanding positions. Therefore, the high margin (60%) is likely to sustain in the foreseeable future. As the Chinese leader with more than 60% of market share, Huaming solidified its leadership in the 35kv-220kv segment (>90% market share) after acquiring its key competitor Changzheng Electric. In the medium to long term, the most significant domestic opportunity lies in the localization of ultra-high voltage tap changers, a segment still dominated by international players such as Maschinenfabrik Reinhausen (MR) and Hitachi. Huaming’s presence here remains limited, but the company is off to a promising start, having successfully delivered its first off-load tap changer for a 1,000kV UHV transformer in 2021, with support from the State Grid Corporation of China and the China Electric Power Research Institute.

International markets remain a key growth avenue, already accounting for 26% of sales in 2024. With MR, the unlisted global leader, constrained by capacity and extended lead times, Huaming is well-positioned to fill this gap through its cost advantage (80% vertical integration), faster delivery, and growing brand recognition. Management is targeting ~40% revenue growth this year and is confident in its ability to structurally expand market share from the current low base of just 3%.

Company focus: Delta (Market Capitalization: $73bn, Sales: $17bn)

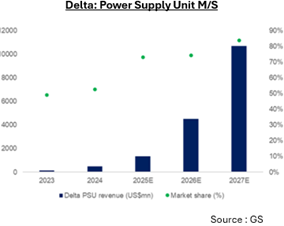

Founded in 1971, Delta Electronics is a global leader in power and thermal management solutions, serving data centers, consumer electronics, industrial automation, and electric vehicles. The company holds leading positions in power supply and liquid cooling, backed by long-standing partnerships with Nvidia and major U.S. hyper-scalers. It owns 63% of Delta Thailand ($63bn market cap) and operates a diversified manufacturing base across China (40%), Thailand (30%), Taiwan (10%), as well as the U.S., India, and Slovakia. With AI infrastructure spending projected to exceed $400bn annually by 2027-28, and power and cooling accounting for ~25-30% of build costs, Delta is strongly positioned to benefit from the secular upcycle in AI data center investment.

Founded in 1971, Delta Electronics is a global leader in power and thermal management solutions, serving data centers, consumer electronics, industrial automation, and electric vehicles. The company holds leading positions in power supply and liquid cooling, backed by long-standing partnerships with Nvidia and major U.S. hyper-scalers. It owns 63% of Delta Thailand ($63bn market cap) and operates a diversified manufacturing base across China (40%), Thailand (30%), Taiwan (10%), as well as the U.S., India, and Slovakia. With AI infrastructure spending projected to exceed $400bn annually by 2027-28, and power and cooling accounting for ~25-30% of build costs, Delta is strongly positioned to benefit from the secular upcycle in AI data center investment.

On the server power front, GPUs and AI accelerators are pushing electricity requirements to unprecedented levels, with next-generation platforms such as Nvidia’s Rubin (2026) and Rubin Ultra (2027) expected to require advanced high-voltage direct current (HVDC) power racks. Reliable

On the server power front, GPUs and AI accelerators are pushing electricity requirements to unprecedented levels, with next-generation platforms such as Nvidia’s Rubin (2026) and Rubin Ultra (2027) expected to require advanced high-voltage direct current (HVDC) power racks. Reliable power delivery has therefore become mission-critical for AI data centers. Delta, as a leading supplier of high-efficiency power supplies and rack-level solutions, is on track to secure 65-70% market share in GB200/300 power systems by year-end and into 2026, supported by both TAM expansion and specification upgrades. Looking beyond 2027, we see sustained growth momentum, with Delta’s leadership (40%+ share in AI server power) reinforced by the industry-wide shift toward HVDC designs that rely on higher-value, more complex components.

power delivery has therefore become mission-critical for AI data centers. Delta, as a leading supplier of high-efficiency power supplies and rack-level solutions, is on track to secure 65-70% market share in GB200/300 power systems by year-end and into 2026, supported by both TAM expansion and specification upgrades. Looking beyond 2027, we see sustained growth momentum, with Delta’s leadership (40%+ share in AI server power) reinforced by the industry-wide shift toward HVDC designs that rely on higher-value, more complex components.

On the liquid cooling front, thermal management is emerging as another powerful growth driver. AI accelerators now exceed 700-1000W per chip, generating heat loads that traditional air cooling can no longer manage. Delta has built strong positions in liquid cooling systems and direct-to-chip solutions, collaborating closely with hyper-scalers on system-level design and deployment. In addition, the company is developing next-generation liquid cooling technologies to address future thermal requirements. As adoption of liquid cooling accelerates from niche to mainstream potentially reaching more than 50% of AI data centers by 2030 Delta’s integrated capabilities and diversified customer base make it a prime beneficiary of this structural shift.

We met the group both in Hong Kong and in Taiwan shortly after its strong August revenue release (NT$47.9bn, +55% MoM, +27% YoY), marking a new monthly record on the back of AI demand. Management expressed strong confidence in the business outlook. According to industry experts, Delta’s AI server revenue TAM (AC/DC power and liquid cooling) is expected to grow from $1bn in 2024 to $12bn by 2027, with AI server-related revenue rising from 5% to 24% of total sales over the same period, supporting margin expansion. We currently hold the stock in GemEquity (1.6% of portfolio) and in GemAsia (2.1%).