In June, we attended the JP Morgan Asia Pacific All Star Forum in London. Over these 2 days, we met up with 9 companies. The corporate list included Taiwanese technology players like Hon-Hai and ASE Technology, Chinese automakers X-Peng and Li-Auto, content platform Bilibili, or the Indian online travel booking platform MakeMyTrip, Indonesian noodle producer Indofood, Thai conglomerate Siam Cement Group and Singapore Stock Exchange.

Previously, either at the Hong Kong UBS AIC conference or in our office in Paris, we also met the following companies: TSMC and Mediatek in the technology sector, KT Corp and KB Financial from Korea, ASEAN banks such as DBS Group from Singapore, CIMB from Malaysia, BDO Unibank and Bank of Philippines Islands from the Philippines and Bank Syariah Indonesia and Bank Negara Indonesia from Indonesia.

Asian technology sector:

In the first 4 months of the year, the AI sector faced several challenges including macro concerns tied to tariffs, likely lower capex from US hyper-scalers, and production amongst Nvidia server-related ODMs resulting in potential order cuts. Meanwhile, the non-AI space in consumer tech segment (smartphone and PC) have benefited from China’s subsidy-driven consumption and pull-in demand due to US tariffs.

However, since May, AI names such as TSMC, SK Hynix and other Taiwanese tech companies have strongly rebounded.

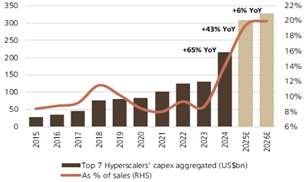

SK Hynix rebounded more than 40% driven by optimism in the industry after Computex 2025. This optimism was further supported by Nvidia, who expressed strong confidence in the sustainability of AI Datacenter demand driven by spending from hyper-scalers along with a new set of customers such as Middle East Sovereign AI Funds. The confidence of Nvidia arises from the top 7 hyper-scalers who are expected to spend $300bn (+43% yoy) towards AI-related capex in 2025. As per experts, 55% of the demand will be captured by Nvidia, 40% by ASIC (Application Specific Integrated Circuits) and the remaining 5-10% by Intel.

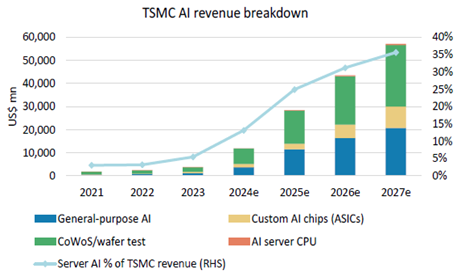

In order to tap into the growing opportunity of AI spending, TSMC plans to incur a capex of $40bn in 2025 towards their advanced packaging plants in Taiwan and USA. As TSMC expands its CoWoS capacity, AI’s contribution to TSMC’s revenue is expected to rise from the mid-teens in 2024 to 35% by 2027. Meanwhile, during our discussions with industry experts, we realized that TSMC is aiming to raise prices by 6-10% in $ in 2026 which should support gross margins (~55-58%).

Furthermore, Hon-Hai, an ODM supplier for Nvidia, has been suffering shipments of GB200 (Nvidia Blackwell system) due to production issues impacting their yields. In our discussion with them, we understood that Hon-Hai along with other ODM suppliers have been able to resolve their production challenges..

Hence, industry shipments for GB200 can increase from 1,500 units (1Q25) to 11,000 units (4Q25). With a 40% market share in Nvidia’s supply chain, Hon Hai expect their AI revenue contribution to expand from 12% in 2024 to 21% in 2025. With 50% of their server production based in Mexico, it is likely to see lower impact from US tariffs.

Hence, industry shipments for GB200 can increase from 1,500 units (1Q25) to 11,000 units (4Q25). With a 40% market share in Nvidia’s supply chain, Hon Hai expect their AI revenue contribution to expand from 12% in 2024 to 21% in 2025. With 50% of their server production based in Mexico, it is likely to see lower impact from US tariffs.

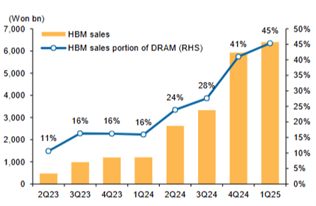

Meanwhile, Korean memory makers are also benefitting from these investments, as every new generation of GPU released by Nvidia comes with higher computing unit which needs to be supported by bigger memory unit in the form of HBM. The positive sentiment around AI has led to more DRAM-to-HBM capacity shift, hence pushing up price of legacy DDR4 DRAM (+30% vs. 1Q25). Meanwhile, SK Hynix expands their stronghold in HBM leadership with a m/s of nearly 55% and maintains its dominance in 12-high HBM shipments. The company is also positioning itself ahead of its peers in HBM4 contract negotiations, at the same time product range from HBM3e 12-hi/16-hi allows them to benefit from ASIC market expansion. HBM is expected to contribute over 70% of SK Hynix’s profits by 2026.

Korea – Corporate Value Up Program back to the front scene:

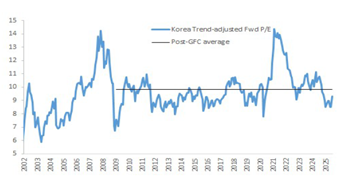

Staying in Korea, in June, the KOSPI gained 15%, driven by sharp rallies in SK Hynix and Naver. The election of Democratic Party candidate Mr. Lee Jae-Myung as President was a trigger for the return of political stability. With this victory, there is now unified leadership in the government, with the Democratic Party already enjoying a majority in the National Assembly (until 2028). The new congress has voted to pass the Commercial Code Act which has key agendas such as strengthening fiduciaries duties of directors to the company, mandat electronic shareholder meetings, replacing “outside director” with “independent director” and voting rights for audit committee. Meanwhile, there is an expectation that the act can be further boosted by tax reforms such as separate tax regime for dividend income with 35% payout ratio and share cancellations, a follow up from the Corporate Value-up program. Korean banks which have been the primary beneficiaries of the value-up program (gaining 50% since early 2024) are likely to raise their dividend pay-out ratio to 35% over mid to long term. Given this backdrop, we continue to prefer our value-up stocks: KB Financial, Hyundai Motors and KT Corp.

ASEAN banks:

Moving on to ASEAN, the MSCI ASEAN Index delivered negative returns (-6%), lagging MSCI Emerging Markets Index (+2%) in € on YTD basis. ASEAN equities have been impacted on fears related to global economic recession and uncertainty brought by US tariff policies. Since the US elections, the region has witnessed one of its sharpest outflows of $15bn. While a rebound in flows is possible if macro visibility improves, particularly around US trade policies, markets currently expect average tariffs to settle between 15–18% as the US seeks to curb transshipment from China. Within the region, Indonesia continues to face an uncertain macroeconomic situation, as the new government under Mr. Prabowo refrains from fiscal spending. While central bank Bank Indonesia has eased monetary policy by cutting interest rates by 50bp to 5.5%, liquidity remains tight in the country. Meanwhile, banks will continue to benefit from a high-interest rate environment in the US. Given this uncertain environment, we remain underweight the ASEAN region. We favor defensive banks in the region: Bank Central Asia in Indonesia and DBS Group in Singapore (via GemAsia).

DBS Group is the largest commercial banking group in Singapore and Southeast Asia. The bank has built a regional network of more than 280 branches across 50 cities and operates in 15 markets, mainly in Singapore and Hong-Kong which accounted for nearly 90% of their profits in 2024. However, they have also expanded into emerging markets such as India and Indonesia which contribute to 5% of their profit pool. Over the last 15 years (2009-2024), the bank has doubled the group profit contribution (from 24% to 50%) of high ROE segments such as Wealth management, Global Transaction Services and Treasury Customer Sales. During the same period, ROE has expanded from 9% to 17%. Over the medium term, the bank maintains a ROE target of 15-17%, as higher ROE segments continue to grow. DBS maintains a healthy CET1 ratio of 15.2% and is committed to return excess capital of about $6.3bn to its shareholders. The Bank trades at FY2025 P/B of 1.9x with a dividend yield of 6.7%. GemAsia has invested around 4% of its assets in the company.

The merger of 3 state-owned Islamic banks in 2021, Bank BRI Syariah, Bank Syariah Mandiri and Bank Mega Syariah, led to the formation of Bank Syariah Indonesia (BSI), the largest shariah bank in the country and the 5th largest overall in terms of reach with more than 1,000 branches and a consumer base of 21.5M in March-25 (vs. 14.4M pre-merger). Inheriting three different businesses at time of merger, BSI has diversified its financing portfolio across Consumer (55%), Corporate (21%), Commercial (7%), Micro financing (9%) and SME (8%). The bank aims to increase its presence in the consumer segment to 60% (mid-term) of the financing portfolio led by payroll and gold-based financing (one of the two banks to have a bullion license). Interestingly, the bank is solidifying the business in a tight liquidity environment by focusing on zero-cost deposits Hajj savings (which often remain on deposit for up to 30 years). The bank has a 48% share of total deposits in the segment. The management is confident about growing its portfolio by 16% in 2025. BSI trades at a 2025 PBV of 2.4x, a premium justified by its unique position in the shariah lending activities and by the low cost of its deposits.