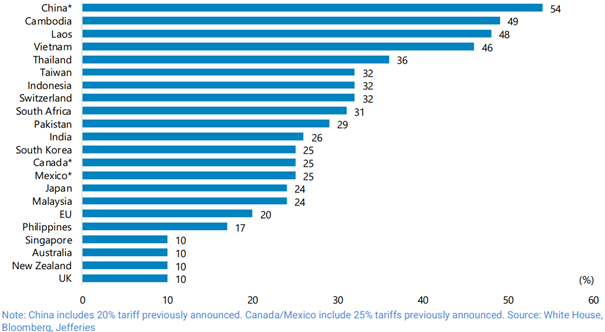

While incremental tariffs have long been expected, given their central role in Trump’s economic agenda as a tool to address the U.S'. chronic trade deficit, shield American industries, and gain negotiating “leverage”, markets had been anxiously awaiting the specifics. Even so, the scale and abruptness of the announcement took many by surprise, sending shockwaves through global financial markets. In fact, the measures exceeded market expectations in both breadth and severity. Beyond the introduction of a universal 10 percent tariff on imports from all countries except Canada and Mexico, effective April 5, the administration also announced country-specific reciprocal tariffs ranging from 10 to 50 percent, in addition to pre-existing duties, to take effect on April 9.

Almost all U.S. trading partners, more than 100 countries and territories are impacted by the tariff hikes. Among them, at least 60 countries are now subject to reciprocal tariffs. In Asia, China faces an additional 34 percent in tariffs on top of the 20 percent already announced. Six ASEAN countries face rates between 32 and 49 percent, with Vietnam at 46 percent. South Korea is subject to 25 percent. Mexico, despite being frequent target of Trump’s criticism in recent months, was spared from the new measures. The previous tariffs of 25% would remain for now, except for products covered by USMCA trade agreement. Also, some major import categories have been temporarily exempted from reciprocal tariffs, including pharmaceuticals, semiconductors, lumber, and energy. However, there is continued uncertainty about whether these categories might later be included under sector-specific tariffs.

Economic impact:

If we add the direct impact of lower trade and the indirect recessionary impact of lower demand from the USA and the global economy, this US policy is likely to negatively impact Emerging countries’ economies. Mostly affected countries include Vietnam, Cambodia, Thailand and Malaysia on one side and China, Taiwan and Korea on the other side. In Asia, India whose economy is more domestic is less impacted. Same thing for Brazil in Latin America. So far Mexico, being exempted, can be relieved in the short term.

Concerning China, the overall impact (exports cut and indirect impact on the domestic activity) is estimated at 2 percentage points of growth (i.e 40% of the forecast growth this year). We believe that Beijing is likely to increase stimulative measures (both monetary and fiscal) to achieve its 5% growth objective for 2025. Given its size, China is one the rare countries that can negotiate with the US. Hence the outcome may not be as bad as currently anticipated.

In India, we also estimate that Modi government has the means (and the will) to spur public investment. In addition, monetary policy is also supportive.

Elsewhere in Taiwan and in Korea, semiconductors are exempted for the moment. But TSMC and the Korean memory makers do not export to the US but to assembly plants based in China, ASEAN or in Mexico. And these plants are subject to tariffs. The only relief is that TSMC, SK Hynix or Samsung Electronics are quasi monopolistic in their fields, hence able to command pricing power.

Stock market reaction:

In the short term, the dollar (-2.2%) and developed markets (-3 to -5% in Japan, Europe and New York on 3 April 2025) are negatively impacted. With the exception of Vietnam and South Africa, Emerging markets are faring better: -1.5% in Hong Kong, -0.6% on the CSI300, -1% in Korea, -0.4% in India. Taiwan is closed but TSMC is losing 7.6% in New York. Saudi Arabia lost 1.2% (steep decline of the oil price).

In Latin America, Brazil and Mexico are rising, as their currencies. Among our investees, Lenovo (1.2% of GemEquity) and Sunny Optical (1.3%) in China, Techcombank (1%) in Vietnam, suffered the sharpest declines, each falling by 8-9%. Due to an uncertain macro-outlook in Vietnam and despite solid fundamentals, we have sold our Techcombank (whose share price is still up 6% in the last 3 months). We remain favorable on Lenovo and Sunny Optical. Lenovo stands to benefit as an enabler of Edge AI and AI infrastructure’s development in China, while Sunny Optical may continue to benefit from an improved operating environment in smartphone sector and could mitigate some of the auto component tariffs pressure through commercial strategies.

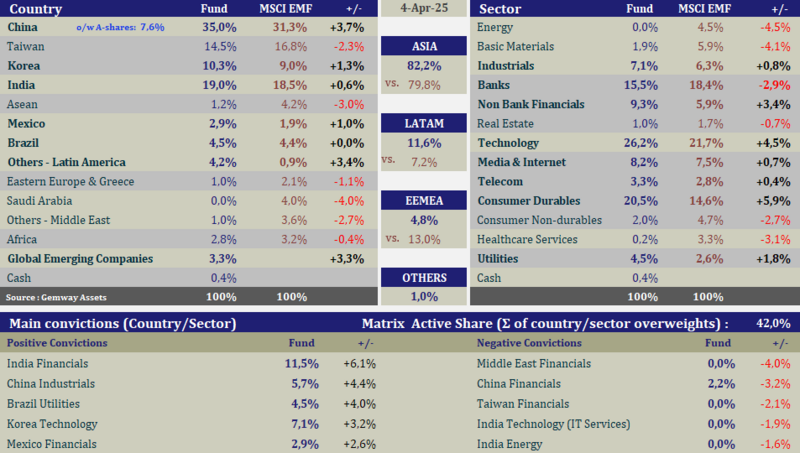

We continue to hold a positive stance toward Chinese equities (35% of GemEquity vs. 31.3% in the benchmark). While a notable slowdown in exports is expected on higher tariffs and high base effect, China remains among the best prepared with the most resources to withstand external shocks. Given its ample policy tools and fiscal capacity, we anticipate that Beijing will prioritize domestic stimulus over aggressive retaliation, stepping up policy easing to support internal demand.

In the short term, uncertainty is likely to remain and make stock markets volatile. Longer term, we believe that China, India and Latin America have the most attractive risk reward while ASEAN, Middle East and Eastern Europe should be underweighted.

How do you position GemEquity?

In the current environment, we maintain a focus on quality growth stocks primarily exposed to domestic demand, which account for three quarters of our portfolio.

We continue to hold a positive stance toward Chinese equities (35% of GemEquity vs. 31.3% in the benchmark). While a notable slowdown in exports is expected on higher tariffs and high base effect, China remains among the best prepared with the most resources to withstand external shocks. Given its ample policy tools and fiscal capacity, we anticipate that Beijing will prioritize domestic stimulus over aggressive retaliation, stepping up policy easing to support internal demand.

India accounts for 19% of our portfolio, with all holdings aligned with domestic structural growth themes.

In North Asia, we hold 10.3% in South Korea and 14.5% in Taiwan. Although both countries are exposed to tariff-related headwinds, most of our holdings are in the semiconductor sector. We continue to believe that the market underestimates the near-term upside in memory pricing, as well as the long-term potential of artificial intelligence.

Elsewhere in Asia, we reduced our ASEAN exposure to 1.2% (Bank Central Asia in Indonesia).

Outside of Asia, 11,6% of the funds are allocated to Latin America. Our most significant positions in the region include Sabesp, a leading Brazilian water utility which is little affected by weak domestic growth, Banco Banorte in Mexico and MercadoLibre, the dominant e-commerce and fintech leader in Latin America.