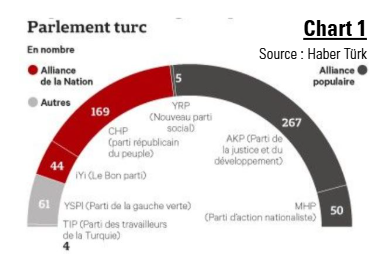

This situation resulted in a 3.5% drop in the Turkish Lira (after an initial 11% plunge before state banks intervened in the FX market) and a 9% decline in the Istanbul Stock Exchange. Local government bond yields surged by 2.1 percentage points to 28.5% for the 10-year maturity and by 3.2 percentage points to 39.2% for the 1-year maturity.

Imamoglu, aged 53, is a credible contender for the 2028 presidential election and was the frontrunner in the CHP primaries held over the weekend. His arrest, preceded by the invalidation of his university degree on March 18, appears part of a broader plan to sideline him as Erdogan’s main political rival. Such authoritarian tendencies are not new under Erdogan. Freedom House rates Turkey at 33 out of 100, a level that has remained stable for several years. The government, through Justice Minister Yilmaz Tunc, denies any political motivation behind these arrests.

Political Context and Responses from Fiscal and Monetary Authorities:

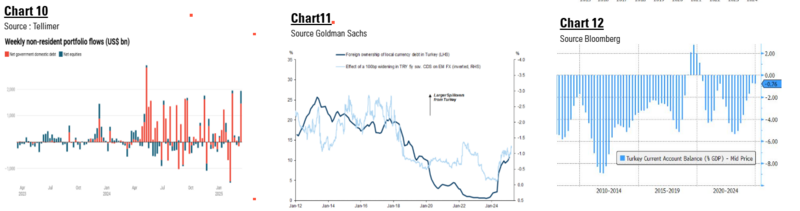

T his crackdown follows a dialogue between Erdogan’s AKP government and the PKK, which could enable him to expand his parliamentary coalition (see Table 1) and amend the Constitution to extend his presidency beyond 2028. Such a prospect could be negatively perceived by investors, especially as Turkey’s economic policy is currently undergoing a correction after years of unconventional monetary decisions. A critical step in Turkey’s macroeconomic adjustment aimed at restoring financial credibility and stabilizing the economy.

his crackdown follows a dialogue between Erdogan’s AKP government and the PKK, which could enable him to expand his parliamentary coalition (see Table 1) and amend the Constitution to extend his presidency beyond 2028. Such a prospect could be negatively perceived by investors, especially as Turkey’s economic policy is currently undergoing a correction after years of unconventional monetary decisions. A critical step in Turkey’s macroeconomic adjustment aimed at restoring financial credibility and stabilizing the economy.

At first glance, this political crisis should not derail the ongoing economic adjustment. Erdogan and the AKP need a stable economy ahead of the upcoming elections. Finance Minister Mehmet Simsek has reassured investors about the continuity of economic reforms. However, a key concern remains the potential loss of confidence among foreign investors and residents (re-dollarization). This risk prompted the Turkish Central Bank (CBRT) to raise its overnight lending rate by 200 basis points to 46% in a surprise meeting on March 20. Simultaneously, it introduced liquidity measures in TRY and foreign currencies to curb market volatility, and pledged further intervention if necessary.

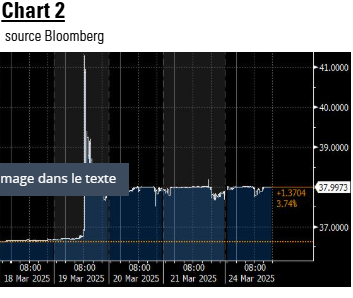

Bond Market Reactions:

Although the currency stabilized somewhat following the central bank’s intervention, the bond markets remained under

Although the currency stabilized somewhat following the central bank’s intervention, the bond markets remained under pressure as of the morning of March 21. However, signs of stabilization emerged before the New York market opened.

pressure as of the morning of March 21. However, signs of stabilization emerged before the New York market opened.

Initially, the Turkish lira dropped by 11%, then reduced its losses to 2.9% (see Chart 2) thanks to an estimated $12 billion in state bank interventions and the CBRT’s unexpected rate hike on March 20.

Local currency government bond yields surged sharply (see Chart 3):

- 10-year bonds: +4.6 percentage points to 30.9%

- 1-year bonds: +10.2 percentage points to 46.4%

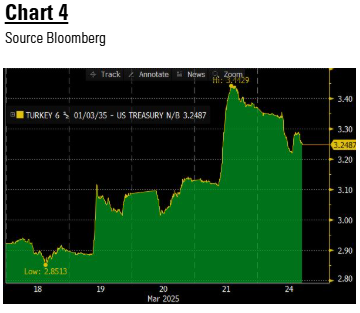

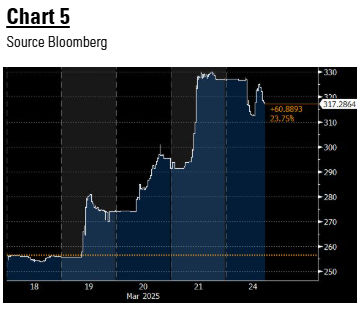

The impact on the credit market was more limited but accelerated on Friday, March 21:

The impact on the credit market was more limited but accelerated on Friday, March 21:

- +51bp to 344bp for the 10-year benchmark Eurobond spread (see Chart 4)

- +74bp to 330bp for the 5-year CDS (see Chart 5), marking their highest level since the early 2024 local elections.

Risk premiums have since slightly eased, with the Eurobond spread narrowing by 19bp and the CDS by 13bp.

GemBond’s Exposure:

The fund currently holds a 3.9% exposure to Turkish sovereign debt denominated in USD, compared to 4.3% for the benchmark index, mainly in short-term maturities between 3.5 and 5 years, except for a 2047-maturity bond representing 0.79% of the fund.

Within the fund’s diversification pocket:

Within the fund’s diversification pocket:

- Corporate exposure: the fund has a 1.1% exposure to We Soda, a UK-domiciled company specializing in natural soda ash production with assets in Turkey. With 100% of its revenues in foreign currencies, the company should be insulated from a potential currency crisis. All else being equal, given that part of its cost structure is in local currency, it could benefit from a depreciation of the Turkish Lira.

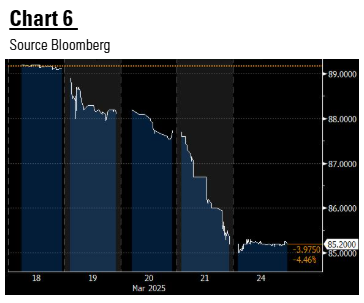

- Local currency debt: Wednesday 19th, the fund exited its position in Turkish local currency bonds maturity October 2025 (1.3% of the fund) at 88.16% of face value (see Chart 6). This local currency position, unhedged against FX risk, no longer fits within the fund’s strategy given asymmetric currency risks, CBRT’s tightening monetary policy, and the prohibitively high FX hedging cost (68% annualized over one month).

Outlook:

- Political Developments:

Turkey is witnessing widespread protests not only in Istanbul but across the country. While these demonstrations have not yet escalated into violence, the risk of

Turkey is witnessing widespread protests not only in Istanbul but across the country. While these demonstrations have not yet escalated into violence, the risk of escalation remains. The opposition, particularly the CHP, appears unified in its response to recent events. Despite the protest ban in Istanbul, now extended to Ankara and Izmir, Turkey’s three largest cities, the CHP officially nominated Imamoglu as its 2028 presidential candidate on Sunday, March 23. International reactions, particularly from the EU, have remained muted, likely due to Turkey’s growing geopolitical role amid declining US military support. The situation remains fluid, with significant uncertainties regarding its political and economic implications.

escalation remains. The opposition, particularly the CHP, appears unified in its response to recent events. Despite the protest ban in Istanbul, now extended to Ankara and Izmir, Turkey’s three largest cities, the CHP officially nominated Imamoglu as its 2028 presidential candidate on Sunday, March 23. International reactions, particularly from the EU, have remained muted, likely due to Turkey’s growing geopolitical role amid declining US military support. The situation remains fluid, with significant uncertainties regarding its political and economic implications.

- Economic and Financial Considerations:

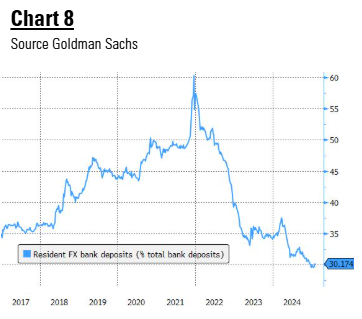

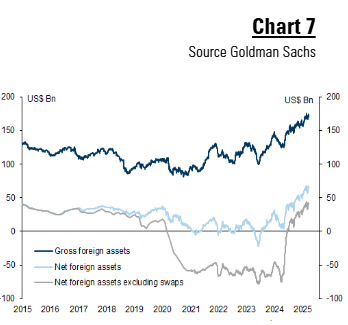

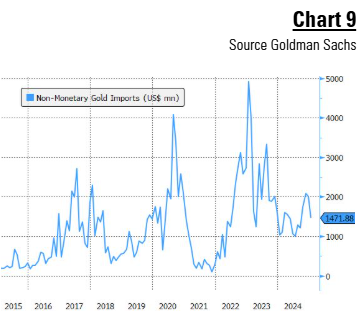

The key question is whether these events will trigger a confidence crisis in the Turkish lira, leading to a shift in resident deposits from TRY to foreign currencies, increased gold imports, or a sell-off of local assets by foreign investors. The CBRT has demonstrated its readiness to deploy all available tools to prevent a confidence crisis. With $171 billion in gross reserves and $62 billion in net reserves (see Chart 7), the central bank has substantial FX reserves to counter short-term volatility.

substantial FX reserves to counter short-term volatility.

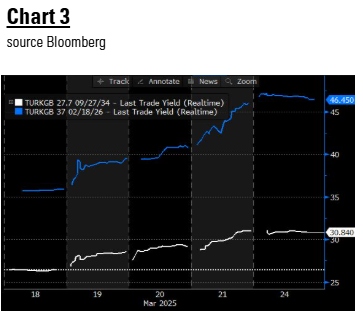

We closely monitor foreign currency deposit flows, gold imports, FX reserves, and foreign capital movements to detect any signs of a vicious cycle of currency depreciation (see Charts 7-10).

Currency stability is crucial for sustaining disinflation and domestic de-dollarization. Assuming no major shift in current economic policy, risk premiums should gradually ease.

While the rising participation of international investors in the local market poses a short-term risk (see Charts 10-11), and resident dollarization trends require close monitoring, Turkey’s fundamentals are currently in a much stronger position than during past crises (see Charts 7-8-12). As long as the government retains Erdogan’s support to continue its economic strategy, markets may overlook the ongoing democratic backsliding.

Given the fundamentally negative political developments, the fund’s slight underweight in Turkish sovereign debt should increase depending on market conditions (valuations and liquidity)