Carlos Augusto Leone Piani, a seasoned executive with extensive experience in finance, infrastructure, and corporate restructuring, was appointed CEO of SABESP in October 2024 to lead its privatization and expansion toward universal sanitation by 2029. Before joining SABESP, Piani held key leadership roles, serving as CEO of Equatorial Energia and Realty, as well as President of Kraft Heinz Canada. He also co-founded HPX Corp. (SPAC) and chaired Equatorial Energia. Renowned for his expertise in financial structuring and operational efficiency, Piani plays a pivotal role in enhancing SABESP’s governance, attracting investors, and ensuring sustainable growth. He holds degrees from IBMEC-RJ and PUC-Rio and is a CFA charterholder.

Carlos Augusto Leone Piani, a seasoned executive with extensive experience in finance, infrastructure, and corporate restructuring, was appointed CEO of SABESP in October 2024 to lead its privatization and expansion toward universal sanitation by 2029. Before joining SABESP, Piani held key leadership roles, serving as CEO of Equatorial Energia and Realty, as well as President of Kraft Heinz Canada. He also co-founded HPX Corp. (SPAC) and chaired Equatorial Energia. Renowned for his expertise in financial structuring and operational efficiency, Piani plays a pivotal role in enhancing SABESP’s governance, attracting investors, and ensuring sustainable growth. He holds degrees from IBMEC-RJ and PUC-Rio and is a CFA charterholder.

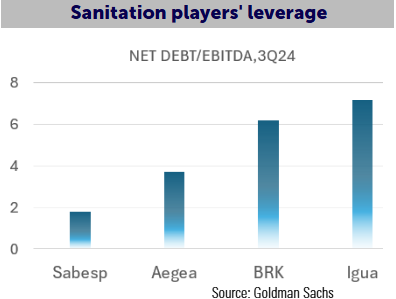

Brazil’s water and sewage industry is undergoing a major transformation, creating a promising opportunity for investment as the government seeks to bridge the country’s  long-standing infrastructure gap. With only about half of the population having access to adequate sewage treatment, and over 16% lack safe drinking water, millions of Brazilians are exposed to serious public health risks. In order to address this issue, policymakers approved Sanitation Legal Framework (Marco Legal do Saneamento) in 2020, a landmark reform aimed at expanding access to clean water and sanitation services nationwide. Under the new regulations, the government has set ambitious targets for 2033: ensuring 99% of the population has access to safe drinking water and 90% to sewage collection and treatment. To meet these goals, authorities estimate that more than BRL 700 bn ($140 bn) in investments will be required over the next decade. As most of the state-owned companies present in the sector lack the financial capacity to make investments, the new framework opened the sector to private investment. As such, competitive bidding processes were introduced, ending the long-standing practice of granting automatic contracts to state-owned sanitation companies. Also, clear performance targets were established to improve efficiency and accelerate progress.

long-standing infrastructure gap. With only about half of the population having access to adequate sewage treatment, and over 16% lack safe drinking water, millions of Brazilians are exposed to serious public health risks. In order to address this issue, policymakers approved Sanitation Legal Framework (Marco Legal do Saneamento) in 2020, a landmark reform aimed at expanding access to clean water and sanitation services nationwide. Under the new regulations, the government has set ambitious targets for 2033: ensuring 99% of the population has access to safe drinking water and 90% to sewage collection and treatment. To meet these goals, authorities estimate that more than BRL 700 bn ($140 bn) in investments will be required over the next decade. As most of the state-owned companies present in the sector lack the financial capacity to make investments, the new framework opened the sector to private investment. As such, competitive bidding processes were introduced, ending the long-standing practice of granting automatic contracts to state-owned sanitation companies. Also, clear performance targets were established to improve efficiency and accelerate progress.

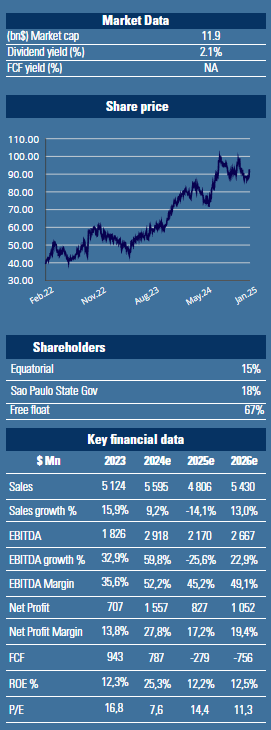

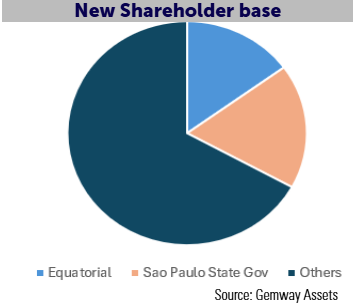

Among the key players in this sector, SABESP (Companhia de Saneamento Básico do Estado de São Paulo) stands out as Brazil’s largest sanitation company and the leading provider of water and sewage services in the country’s economic powerhouse, which contributes 31% of the national GDP. The company serves over 28 million people across 375 of Sao Paulo’s 645 municipalities. Following a privatization process initiated in January 2023, coinciding with the inauguration of Sao Paulo’s new state government, the election of new management, the implementation of efficiency measures, and key legislative and regulatory changes, SABESP was privatized in July 2024, becoming Brazil’s first fully privatized, publicly traded sanitation utility. As a result of the transaction, Equatorial, a major energy company known for its strategic investments and operational efficiency, became the reference investor with a 15% stake, while 17% was sold to the market. This reduced the State of Sao Paulo’s ownership from 50% to 18%, generating BRL 14.7 bn in proceeds. At least 30% of these funds will be allocated to a newly created fund aimed at reducing consumer tariffs in the coming years.

Following a privatization process initiated in January 2023, coinciding with the inauguration of Sao Paulo’s new state government, the election of new management, the implementation of efficiency measures, and key legislative and regulatory changes, SABESP was privatized in July 2024, becoming Brazil’s first fully privatized, publicly traded sanitation utility. As a result of the transaction, Equatorial, a major energy company known for its strategic investments and operational efficiency, became the reference investor with a 15% stake, while 17% was sold to the market. This reduced the State of Sao Paulo’s ownership from 50% to 18%, generating BRL 14.7 bn in proceeds. At least 30% of these funds will be allocated to a newly created fund aimed at reducing consumer tariffs in the coming years.

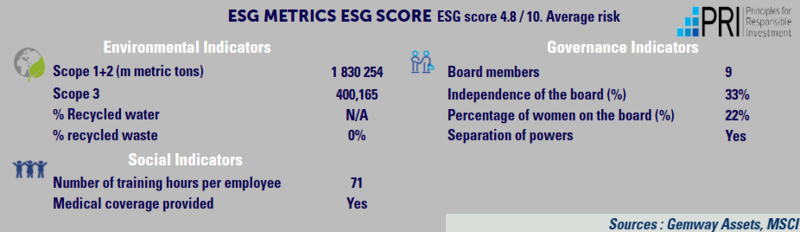

As for SABESP, several potential catalysts could drive its share performance over the next couple of years. First, an amendment to its concession contract, aimed at reducing the current 18-month lag between CAPEX execution and tariff recognition, would accelerate cost recovery and improve cash flow. Additionally, it is well-positioned to capitalize on upcoming sanitation auctions in Sao Paulo, where the privatization of 133 municipalities is expected as early as the second half of 2025. Furthermore, the introduction of a new efficiency gain-sharing formula which offers stronger incentives for utilities should enhance cost-cutting efforts and drive greater value creation. These growth drivers, combined with SABESP’s long free cash flow duration (12 years) and an 11% real Internal Rate of Return (IRR), make it particularly attractive in the current environment: as Brazil’s economy faces potential GDP deceleration due to high interest rates (SELIC at 13.25%), the company remains a defensive asset as it has low correlation to GDP growth and benefits inflation protection through tariff adjustments. GemEquity has invested 3.4% of its assets in this company.