In total, we met 23 companies and conducted store visits to fashion and lifestyle products. We met up with economic representatives, industry experts and corporates. The corporate list includes financial companies like ICICI Bank, Kotak Bank, Cholamandalam Finance, Shriram Finance, Nuvama Wealth Management and K-Fin Technologies, consumer discretionary players like Zomato, MakemyTrip, Phoenix Mills, Devyani International and Varun Beverages, building materials manufacturers like Pidilite Industries, Supreme Industries and Astral, cables & wires manufacturers like Polycab India and KEI Industries, IT service providers Infosys and HCL Technologies, auto manufacturer Hyundai India, Telecom operator Bharti Airtel, hospital chain Apollo Hospital, staffing provider Teamlease, and pharmaceutical manufacturer Lupin.

financial companies like ICICI Bank, Kotak Bank, Cholamandalam Finance, Shriram Finance, Nuvama Wealth Management and K-Fin Technologies, consumer discretionary players like Zomato, MakemyTrip, Phoenix Mills, Devyani International and Varun Beverages, building materials manufacturers like Pidilite Industries, Supreme Industries and Astral, cables & wires manufacturers like Polycab India and KEI Industries, IT service providers Infosys and HCL Technologies, auto manufacturer Hyundai India, Telecom operator Bharti Airtel, hospital chain Apollo Hospital, staffing provider Teamlease, and pharmaceutical manufacturer Lupin.

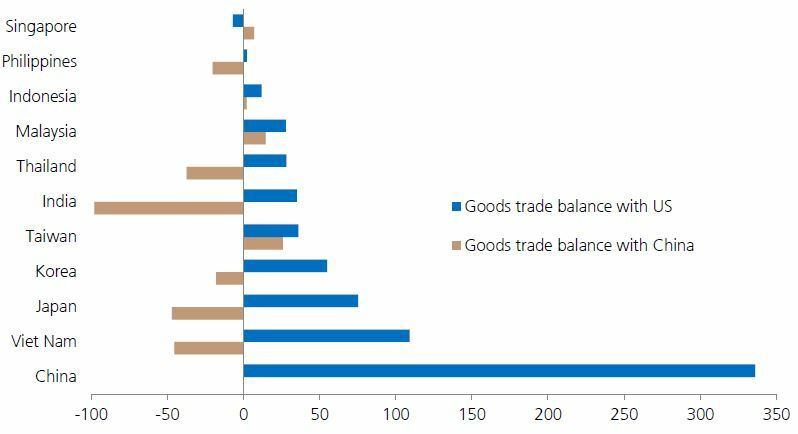

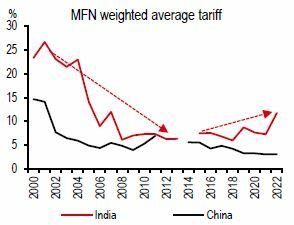

The conference took place at a time the Indian economy experiences a cyclical slowdown which has kept policymakers on their toes and are keeping an eye on policies of Trump 2.0. Currently, India has a trade surplus of $40bn with the US. As highlighted by Kotak Bank founder Uday Kotak, tariffs will be an important topic under the Trump era and India may have to change its trade structure across economies to rebalance its trade. He emphasized that India must make its domestic industry competitive by focusing on improving productivity, avoiding excessive protectionism and increasing share of manufacturing as percentage of GDP. Interestingly, between 2001-2010 India reduced its import tariffs to as low as China’s, which led to the Indian GDP growing at an average of ~7.8% per year. Indian policymakers remain cognizant of these changing times and are taking steps to improve the long-term growth by focusing on bilateral trade agreements and are in

The conference took place at a time the Indian economy experiences a cyclical slowdown which has kept policymakers on their toes and are keeping an eye on policies of Trump 2.0. Currently, India has a trade surplus of $40bn with the US. As highlighted by Kotak Bank founder Uday Kotak, tariffs will be an important topic under the Trump era and India may have to change its trade structure across economies to rebalance its trade. He emphasized that India must make its domestic industry competitive by focusing on improving productivity, avoiding excessive protectionism and increasing share of manufacturing as percentage of GDP. Interestingly, between 2001-2010 India reduced its import tariffs to as low as China’s, which led to the Indian GDP growing at an average of ~7.8% per year. Indian policymakers remain cognizant of these changing times and are taking steps to improve the long-term growth by focusing on bilateral trade agreements and are in process to establish a deregulation commission to boost productivity

process to establish a deregulation commission to boost productivity

Macro focus

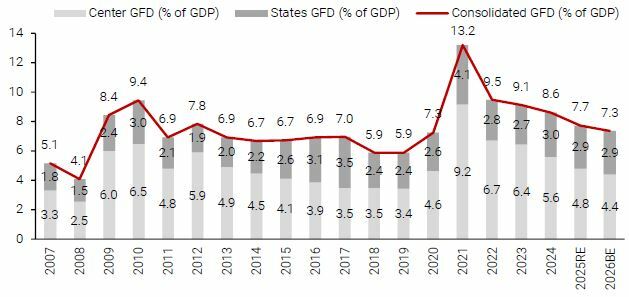

In our conversation with economic representatives and corporates, there was acknowledgement that tighter government policies played a role in the recent economic slowdown. We also found no reason to worry about structural growth of the Indian economy. In FY4Q24, the Indian economy witnessed a reversal with GDP growing at 6.2%. The pickup in growth has come through as an uptick in government spending (cumulative capex +5%  in 9 months vs. -15% in 1H25). This spending is supported by an increase in tax collections by 10% in 10 months as New Delhi benefits from the Tax reforms (GST implementation + simplification of tax laws). Tax/GDP has increased from 16.5% in FY14 to 19.2% in FY25. In February the government announced its budget wherein they highlighted Real GDP growth target of 6.3-6.8% in FY03/26. The budget was well balanced and will support a broad-based growth between capex and consumption, along with maintaining the path of fiscal consolidation (central fiscal deficit declining from 5.6% in 24 to 4.4% in 26). Public investment is pegged to grow at 10% (FY03/26) and its share in GDP will remain stable at c.3.1%. In the meantime, low/middle income consumers will benefit from cuts in income tax rate in tune of

in 9 months vs. -15% in 1H25). This spending is supported by an increase in tax collections by 10% in 10 months as New Delhi benefits from the Tax reforms (GST implementation + simplification of tax laws). Tax/GDP has increased from 16.5% in FY14 to 19.2% in FY25. In February the government announced its budget wherein they highlighted Real GDP growth target of 6.3-6.8% in FY03/26. The budget was well balanced and will support a broad-based growth between capex and consumption, along with maintaining the path of fiscal consolidation (central fiscal deficit declining from 5.6% in 24 to 4.4% in 26). Public investment is pegged to grow at 10% (FY03/26) and its share in GDP will remain stable at c.3.1%. In the meantime, low/middle income consumers will benefit from cuts in income tax rate in tune of $12bn (0.3% of GDP) which should boost consumption.

$12bn (0.3% of GDP) which should boost consumption.

The Central Bank (RBI) also had a change of head, with Mr. Sanjay Malhotra becoming the 26th governor. Since then, RBI policy has loosened with significant back-to-back relaxations. These measures include infusion of liquidity in the banking system (c.$40bn from January to March 25), reduction in risk weights for NBFC and an interest rate cut by 25bp to 6.25% (a first since May 20). The central bank inflation target is modest c.4.2% in FY03/26 because of a strong food harvest, which gives the Central Bank room to cut rates by an additional 25-50bp in 2025.

Meanwhile, there is hope around private sector capex, as Indian corporate balance sheets continue to remain under-leveraged with corporate debt to GDP declining from 72% (2012) to 55% (2024). As per government officials, the semi-conductor industry should see investments of $18bn in 2025 with support of government PLI program as India targets to increase electronics value addition from 18-20% to 35%. While power sector capex is expected to grow at 19% pa in 2024-30, on the back of improvement in economics with steady tariffs bids, lower equipment and borrowing costs supporting IRR’s (a test of animal spirits for corporate India).

Market Focus: Mid- Cycle correction

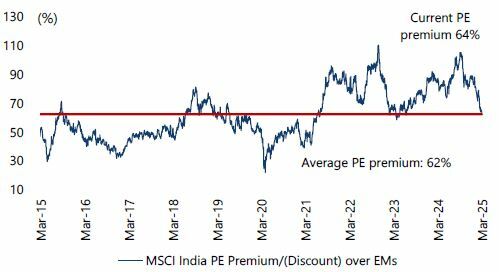

Since September 2024 the Nifty Index has corrected by c.15% and the Nifty Mid-cap 100 index by c.20%.The MSCI India Index (in $ terms) has under-performed the MSCI EM Index by 29%. This sell-off is primarily technical in nature reflecting a multiple compression rather than any major macro-economic issues. The driver of the sell-off has been slowing economic growth and corporate earnings, along with INR depreciation (-4% since Sept-24) and aggressive foreign selling of $26bn. FII ownership in BSE-500 stocks is at decade low of 19.5%. While domestic flows continue to remain strong with inflows of $17bn YTD, within which monthly SIP flows of c.$3bn. However, given the recent correction, especially in the Mid-cap index, domestic flows focused towards Mid and Small cap schemes face a risk of outflows. Prior to this correction, MSCI India Index premium to MSCI EM was 105%. It has now reversed to its 10-year average PE premium of 62%. We are starting to see pockets of opportunities in large cap stocks where valuations have turned favorable (1 year forward Nifty-50 P/E 18.9x).

sell-off is primarily technical in nature reflecting a multiple compression rather than any major macro-economic issues. The driver of the sell-off has been slowing economic growth and corporate earnings, along with INR depreciation (-4% since Sept-24) and aggressive foreign selling of $26bn. FII ownership in BSE-500 stocks is at decade low of 19.5%. While domestic flows continue to remain strong with inflows of $17bn YTD, within which monthly SIP flows of c.$3bn. However, given the recent correction, especially in the Mid-cap index, domestic flows focused towards Mid and Small cap schemes face a risk of outflows. Prior to this correction, MSCI India Index premium to MSCI EM was 105%. It has now reversed to its 10-year average PE premium of 62%. We are starting to see pockets of opportunities in large cap stocks where valuations have turned favorable (1 year forward Nifty-50 P/E 18.9x).

Company focus: Shriram Finance (Sales: $2.5 bn - Market Capitalization: $13 bn)

Founded in 1979 as Shriram Finance, the company focused on serving the underbanked and economically weaker consumers by offering products tailored to their needs. Over time, Shriram established itself as a prominent player in financing pre-owned commercial vehicles, particularly for small truck operators. The company’s expertise in this niche enabled it to expand its offering to include new commercial vehicles, construction equipment and other specialized assets, growing into one of the largest private sector Non-Banking Financial Service Companies (NBFCs) with an AUM of $29bn. By 3QFY03/25 commercial vehicle financing represented 45% of the business (vs. 98% in F22), while 55% of the business consisted of new products (passenger vehicles, 2W loans, Small Business Financing, Gold Loans and Insurance products). Shriram Finance serves its 9.5M customers through 3,196 branches. It has a significant market share of 20% in used commercial vehicle financing, bolstered by strong underwriting and collection practices. Having been impacted by a series of macroeconomic challenges in 2017-22, such as Demonetization (FY17), GST implementation (FY18), NBFC liquidity crisis (FY19) and Covid (F21) as such events had put pressure both on its growth and asset quality, Shriram Finance diversified its funding source by incorporating foreign commercial borrowings and securitization. It has further diversified its portfolio in 2022 through the merger with Shriram City Union Finance, a sister company. Post merger, the company has improved its business model with lower cyclicality, higher-yielding product mix, and better growth visibility. We think the benefits of such structural improvements could be further boosted by upcoming interest rate cuts. Over a 3-year period (2024-2027e), the company is expected to increase their loan book by 18% and EPS by 20% per annum. The stock trades at FY03/26 P/B of 1.4x and at a 70% discount compared to its peer, Cholamandalam. We have invested 2.5% of GemEquity and 2.7% of GemAsia in the company.

Founded in 1979 as Shriram Finance, the company focused on serving the underbanked and economically weaker consumers by offering products tailored to their needs. Over time, Shriram established itself as a prominent player in financing pre-owned commercial vehicles, particularly for small truck operators. The company’s expertise in this niche enabled it to expand its offering to include new commercial vehicles, construction equipment and other specialized assets, growing into one of the largest private sector Non-Banking Financial Service Companies (NBFCs) with an AUM of $29bn. By 3QFY03/25 commercial vehicle financing represented 45% of the business (vs. 98% in F22), while 55% of the business consisted of new products (passenger vehicles, 2W loans, Small Business Financing, Gold Loans and Insurance products). Shriram Finance serves its 9.5M customers through 3,196 branches. It has a significant market share of 20% in used commercial vehicle financing, bolstered by strong underwriting and collection practices. Having been impacted by a series of macroeconomic challenges in 2017-22, such as Demonetization (FY17), GST implementation (FY18), NBFC liquidity crisis (FY19) and Covid (F21) as such events had put pressure both on its growth and asset quality, Shriram Finance diversified its funding source by incorporating foreign commercial borrowings and securitization. It has further diversified its portfolio in 2022 through the merger with Shriram City Union Finance, a sister company. Post merger, the company has improved its business model with lower cyclicality, higher-yielding product mix, and better growth visibility. We think the benefits of such structural improvements could be further boosted by upcoming interest rate cuts. Over a 3-year period (2024-2027e), the company is expected to increase their loan book by 18% and EPS by 20% per annum. The stock trades at FY03/26 P/B of 1.4x and at a 70% discount compared to its peer, Cholamandalam. We have invested 2.5% of GemEquity and 2.7% of GemAsia in the company.

Company focus: MakeMyTrip (Sales: $1bn - Market Capitalization: $9.5bn)

Founded in 2000, by Deep Kalra, MakeMyTrip was focused on catering to the travel needs of the overseas Indian community between US and India. By 2005, the company ventured into India, by offering online flight bookings along with hotel reservations and holidays packages to Indian consumers. In 2010 MakeMyTrip got listed in the Nasdaq stock exchange. Travel being a mature category in global markets with penetration rate of 60% (USA) and 59% (China) vs. 39% in India, gives significant headroom for growth for MakeMyTrip. The low penetration rate in India; kept competitive intensity in high with presence of 4 domestic and 2 international players. However, in 2016 MakeMyTrip merged with Nasper-backed Ibibo group which owned prominent platforms such as Goibibo (air) and RedBus (bus) to deepen its presence in the market. This merger enabled MakeMyTrip to garner a market share of 29% in domestic (2nd largest player Clear-trip is at 9%) and 16% in international air bookings. The company also enjoys a market share of 40% in online hotel bookings, however the online penetration rate remains low at 28%. Over the years, MakeMyTrip has strengthened its services offerings which has led to 80mn lifetime transacted customers across its 3 brands (Makemytrip, Goibibo and RedBus) and quarterly new customer addition of 1.5-2.5mn. As of 2024, the company has gross bookings of $8bn with a take-rate of 10.3% (vs. 5% for Trip.com). Take-rates in India are higher than China, as air booking enjoys from convenience fee paid by customers (approved by regulators) and hotel bookings benefit from a fragmented supply chain. Interestingly, in 2016 China based Trip.com bought a 26.6% stake in the company and subsequently increased their strategic holding to 49%. Given the structural tailwind in the industry due to increase in penetration rate along with rise in affluent consumers in India, the company is expected to grow its sales by 23% and EPS by 26% per annum over a 3-year period (2024-2027e). The stock trades at FY25 P/E of 65x, given strong growth prospects.

Founded in 2000, by Deep Kalra, MakeMyTrip was focused on catering to the travel needs of the overseas Indian community between US and India. By 2005, the company ventured into India, by offering online flight bookings along with hotel reservations and holidays packages to Indian consumers. In 2010 MakeMyTrip got listed in the Nasdaq stock exchange. Travel being a mature category in global markets with penetration rate of 60% (USA) and 59% (China) vs. 39% in India, gives significant headroom for growth for MakeMyTrip. The low penetration rate in India; kept competitive intensity in high with presence of 4 domestic and 2 international players. However, in 2016 MakeMyTrip merged with Nasper-backed Ibibo group which owned prominent platforms such as Goibibo (air) and RedBus (bus) to deepen its presence in the market. This merger enabled MakeMyTrip to garner a market share of 29% in domestic (2nd largest player Clear-trip is at 9%) and 16% in international air bookings. The company also enjoys a market share of 40% in online hotel bookings, however the online penetration rate remains low at 28%. Over the years, MakeMyTrip has strengthened its services offerings which has led to 80mn lifetime transacted customers across its 3 brands (Makemytrip, Goibibo and RedBus) and quarterly new customer addition of 1.5-2.5mn. As of 2024, the company has gross bookings of $8bn with a take-rate of 10.3% (vs. 5% for Trip.com). Take-rates in India are higher than China, as air booking enjoys from convenience fee paid by customers (approved by regulators) and hotel bookings benefit from a fragmented supply chain. Interestingly, in 2016 China based Trip.com bought a 26.6% stake in the company and subsequently increased their strategic holding to 49%. Given the structural tailwind in the industry due to increase in penetration rate along with rise in affluent consumers in India, the company is expected to grow its sales by 23% and EPS by 26% per annum over a 3-year period (2024-2027e). The stock trades at FY25 P/E of 65x, given strong growth prospects.