Lei Jun

Lei Jun is the Founder and CEO of Xiaomi Corporation. Since establishing the company in 2010, he has played a pivotal role in transforming Xiaomi from a start-up into one of the world’s leading technology companies. Under his visionary leadership, Xiaomi has become synonymous of high-quality, affordable smartphones and innovative technology products. Often referred to as “Steve Jobs of China”, Lei Jun is celebrated for his focus on product innovation, design simplicity and user-centric solutions. In 2015, Lei Jun was recognized as one of TIME Magazine’s 100 most influential people. Before founding Xiaomi, he served as the CEO of Kingsoft Corporation, a leading software company in China. He holds a Bachelor of Science degree in Computer Engineering from Wuhan University

Founded in 2010, Xiaomi has emerged as a leading consumer electronics manufacturer in China.

nitially established as a platform for internet services, it launched MIUI (rebranded as HypeOS), a system designed to integrate software and hardware seamlessly. In 2011, Xiaomi introduced the Mi-1, its first smartphone powered by its proprietary operating system.

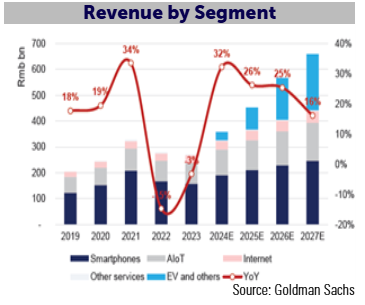

By 2014, it became China’s largest smartphone vendor, surpassing Samsung and Apple, and began expanding internationally. Xiaomi also entered the Internet of Things (IoT) space, offering over 600 lifestyle products in 200+ categories, including tablets, smart TVs, home appliances, and wearables. In 2021, the company announced plans to enter the electric vehicle (EV) industry, aiming to rank among the top five global automakers. Today, Xiaomi operates in over 100 countries, with 13,000 offline stores in China and a global user base of 685 million.

With its market share growing from 4% to over 13% in just 6 years, Xiaomi is now the world’s 3rd-largest smartphone manufacturer, shipping approximately 146M units annually.

Over 75% of its smartphones are sold in international markets, where it ranks among the top 3 players in India, the Middle East, Europe, and Latin America. Significant growth potential remains in these markets, particularly in Latin America, where localization efforts are expected to enhance its price competitiveness.

In China, Xiaomi is the 4th-largest smartphone maker, holding a ~14% market share. Its premiumization strategy has increased the average selling price of its smartphones by over 70% in 5 years to $308 today, although it still lags behind peers like Huawei, Apple, and Samsung, leaving room for further growth.

Xiaomi boasts the world’s largest Artificial Intelligence of Things (AIoT) ecosystem, with over 800M connected devices. It ranks 5th globally in the tablet market (6% share) and sixth in smart TVs (5%), with ambitions to break into the top three for both categories.

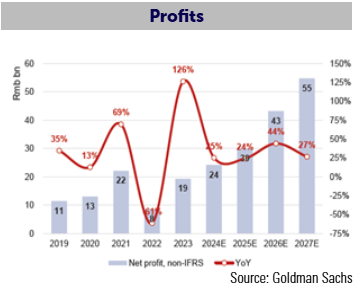

Its HypeOS platform enhances its consumer electronic offerings and supports internet services, which contributed 11% of revenue but 39% of gross profit in 2023. As premium smartphone adoption grows, internet services revenue is expected to rise, driven by higher search ad yields on premium devices. Xiaomi’s strengths in software, smartphones, AIoT, and its vast global user base position it as a strong EV contender. The company launched its first EV, the SU7, in March 2024, with projected sales of over 130,000 units in its first year. Despite intense competition in China’s EV market, Xiaomi is achieving gross margins of 5 – 10% and plans to break even at 500,000 units annually by 2027.

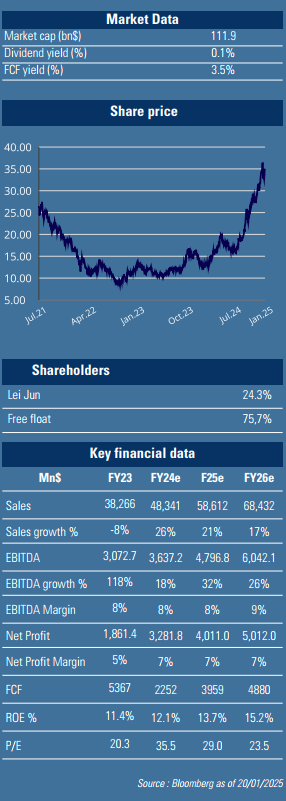

At 29x P/E 2025, Xiaomi trades at a premium valuation, supported by its strong growth prospect (revenue and profit are projected to grow at a 21% CAGR over 2023-26) and significant barriers to entry across multiple facets of its business. These barriers stem from Xiaomi's integrated ecosystem, economies of scale, and focus on innovation.

GemEquity (2.5%), GemAsia (2.6%), and GemChina (6.2%) have invested in the company, reflecting confidence in its long-term potential.