In the month of September, we spent one week in New Delhi. We attended the 3rd Jefferies India Forum which gathered more than 90 companies and 250 investors. It is worth noting that we also met a few global investors who explored India for the first time. In total, we met 18 companies and conducted field visits to several financial companies’ branches. We met up with government

met a few global investors who explored India for the first time. In total, we met 18 companies and conducted field visits to several financial companies’ branches. We met up with government  agencies and representatives, industry experts and corporates. The corporate list includes financial companies likes ICICI Bank, AXIS Bank, Shriram Finance, ICICI Lombard General Insurance and HDFC Life Insurance, consumer discretionary players like Varun Beverages and Honasa Consumer, auto manufacturers and component makers like Maruti Suzuki, Eicher Motors and Sona Comstar, cables & wires manufacturers like Polycab India and KEI Industries, property developer Oberoi Realty, tile manufacturer Kajaria Ceramics, electronics manufacturing service provider Amber Enterprise, pharmaceutical distributor Entero Healthcare, IT service provider Tech Mahindra and textiles & paints manufacturer Grasim Industries.The conference took place as the National Democratic Alliance (NDA), a coalition led by BJP, marked its 100 days. At this occasion, Mr. Piyush Goyal, the Minister of Commerce and Mr. Ashwini Vaishnaw, the Minister of Railways & Technology emphasized India’s ambition to become the 3rd world largest economy by 2027, while maintaining fiscal prudence (lowered fiscal deficit target to 4.9% in FY25 from 5.1%

agencies and representatives, industry experts and corporates. The corporate list includes financial companies likes ICICI Bank, AXIS Bank, Shriram Finance, ICICI Lombard General Insurance and HDFC Life Insurance, consumer discretionary players like Varun Beverages and Honasa Consumer, auto manufacturers and component makers like Maruti Suzuki, Eicher Motors and Sona Comstar, cables & wires manufacturers like Polycab India and KEI Industries, property developer Oberoi Realty, tile manufacturer Kajaria Ceramics, electronics manufacturing service provider Amber Enterprise, pharmaceutical distributor Entero Healthcare, IT service provider Tech Mahindra and textiles & paints manufacturer Grasim Industries.The conference took place as the National Democratic Alliance (NDA), a coalition led by BJP, marked its 100 days. At this occasion, Mr. Piyush Goyal, the Minister of Commerce and Mr. Ashwini Vaishnaw, the Minister of Railways & Technology emphasized India’s ambition to become the 3rd world largest economy by 2027, while maintaining fiscal prudence (lowered fiscal deficit target to 4.9% in FY25 from 5.1% previously). The key drivers of this growth would be Infrastructure, Inclusive Development, Manufacturing and Simplification of laws. Additionally, Mr. V. Anantha Nageswaran, the Chief Economic Advisor, highlighted agriculture as an additional potential growth engine, while stressing the importance of wage growth. Such comment could signal a slight tilt towards welfare-oriented policies.

previously). The key drivers of this growth would be Infrastructure, Inclusive Development, Manufacturing and Simplification of laws. Additionally, Mr. V. Anantha Nageswaran, the Chief Economic Advisor, highlighted agriculture as an additional potential growth engine, while stressing the importance of wage growth. Such comment could signal a slight tilt towards welfare-oriented policies.

Macro focus

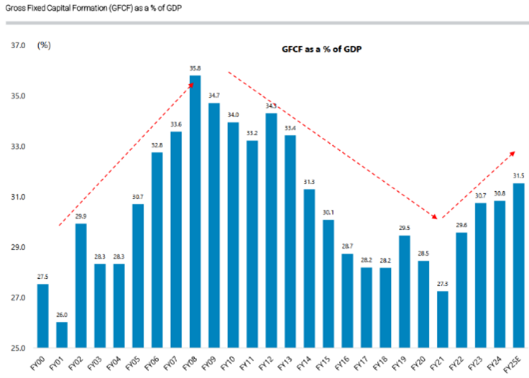

With GDP growing at 6.7% in FY2Q24, India’s economy has shown resilience. The government targets a sustainable growth rate of 6-8% over the next 5 years. As a result of this positive momentum and structural reform on tax collection (GST implementation), New Delhi benefited from increased tax collection (Tax/GDP increase from 16.5% in FY14 to 18.9% in FY24) and made higher contribution to capital expenditure (from 1.9% in FY14 to 11.1% in FY25). This shift of priority is evident as gross fixed capital formation now accounts for 31.5% of GDP in FY25 (vs. 27.3% in FY21). From the monetary perspective, RBI has kept policy rate unchanged at 6.5% despite easing inflationary pressure (3.7% in August). However, the central bank has changed its stance to neutral and opens the door to a shallow easing cycle: market now forecasts 25bp of first cut in 1Q25.

With GDP growing at 6.7% in FY2Q24, India’s economy has shown resilience. The government targets a sustainable growth rate of 6-8% over the next 5 years. As a result of this positive momentum and structural reform on tax collection (GST implementation), New Delhi benefited from increased tax collection (Tax/GDP increase from 16.5% in FY14 to 18.9% in FY24) and made higher contribution to capital expenditure (from 1.9% in FY14 to 11.1% in FY25). This shift of priority is evident as gross fixed capital formation now accounts for 31.5% of GDP in FY25 (vs. 27.3% in FY21). From the monetary perspective, RBI has kept policy rate unchanged at 6.5% despite easing inflationary pressure (3.7% in August). However, the central bank has changed its stance to neutral and opens the door to a shallow easing cycle: market now forecasts 25bp of first cut in 1Q25.

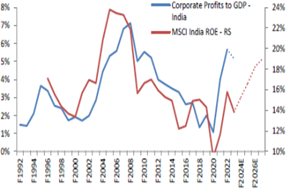

This dynamic has a positive impact on business sentiment. The stability at macro and political level is especially appreciated, as highlighted by Mr. Sajjan Jindal, the Chairman of JSW Group, one of the largest steel manufacturers: “Election outcome (is) not as expected, however outcome demonstrates the strong electoral system. India will have enough speed to grow the economy, maybe speed slows but we are okay”. In addition, Indian corporates continue to remain in a healthy position, with steady improvement of capacity utilization rates to 76% in 2024 (vs. 72% in 2022), and the reduced leverage (at the lowest in a decade). While private sector investments have already ramped up in past years and further acceleration is expected in FY25. So far, sectors such as Power, Airports, Paints and building materials have been especially boosted by buoyant investment. For instance, the Power sector capex is expected to grow at 19% pa in 2024-30, mainly driven by increased demand for renewable energy, power grids and transmission lines.

An evolving Equity Culture

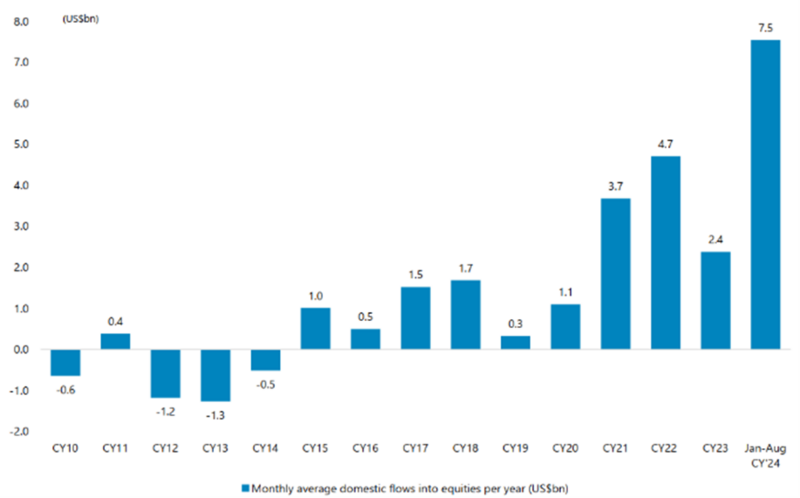

As India economy grows at a steady and fast pace, its capital market also shows a remarkable upsurge. In this environment, we also observed the rising equity culture in the country with sharply increased retail participation (both through direct retail shareholding and mutual funds). While Indian households only allocate 5.8% of their total assets ($12.8tn) into equities, much less compared to that in other countries (vs. 12% in EU) and other assets classes (13% to bank deposits, 15.2% to gold, 51.3% to property), the exposure has greatly increased since Covid. Of the $807bn managed by local asset management companies, $406bn is allocated into equities. While foreign ownership has declined in recent years because of India’s high valuation (90% premium vs. MSCI EM 2025 PE), domestic fund inflows remain robust, averaging $7bn per month from January to August 2024 and despite the recent hike in long-term capital gains tax (from 10% to 12%). Of which, the flows related to Systematic Investment Plan ($2.5bn in August), the investment channel which allows ordinary people (96M as of August) to invest a small and fixed portion (average at $26) of their monthly income into equities is considered very stable and provides a downside protection to the equity market. It also explains partially the reason of India’ high equity valuations.

As India economy grows at a steady and fast pace, its capital market also shows a remarkable upsurge. In this environment, we also observed the rising equity culture in the country with sharply increased retail participation (both through direct retail shareholding and mutual funds). While Indian households only allocate 5.8% of their total assets ($12.8tn) into equities, much less compared to that in other countries (vs. 12% in EU) and other assets classes (13% to bank deposits, 15.2% to gold, 51.3% to property), the exposure has greatly increased since Covid. Of the $807bn managed by local asset management companies, $406bn is allocated into equities. While foreign ownership has declined in recent years because of India’s high valuation (90% premium vs. MSCI EM 2025 PE), domestic fund inflows remain robust, averaging $7bn per month from January to August 2024 and despite the recent hike in long-term capital gains tax (from 10% to 12%). Of which, the flows related to Systematic Investment Plan ($2.5bn in August), the investment channel which allows ordinary people (96M as of August) to invest a small and fixed portion (average at $26) of their monthly income into equities is considered very stable and provides a downside protection to the equity market. It also explains partially the reason of India’ high equity valuations.

Company focus: Shriram Finance (Sales: $2.5bn - Market Capitalization: $15bn)

Founded in 1979 as Shriram  Finance, the company focused on serving the underbanked and economically weaker consumers by offering products tailored to their needs. Over time, Shriram established itself as a prominent player in financing pre-owned commercial vehicles, particularly for small truck operators. The company’s expertise in this niche enabled it to expand its offering to include new commercial vehicles, construction equipment and other specialized assets, growing into one of the largest private sector Non-Banking

Finance, the company focused on serving the underbanked and economically weaker consumers by offering products tailored to their needs. Over time, Shriram established itself as a prominent player in financing pre-owned commercial vehicles, particularly for small truck operators. The company’s expertise in this niche enabled it to expand its offering to include new commercial vehicles, construction equipment and other specialized assets, growing into one of the largest private sector Non-Banking Financial Service companies (NBFCs) with an AUM of $28bn. By 1Q25 commercial vehicle financing represented 46% of the business (vs. 98% in F22), while 54% of the business consisted of new products (Passenger Vehicles, motorcycles loans, Small Business Financing, Gold Loans and Insurance products). Shriram Finance serves its 8.7M customers through more than 3.000 branches. It has a significant market share of 20% in used commercial vehicle financing, bolstered by strong underwriting and collection practices. Having been impacted by a series of macroeconomic challenges in 2017-22, such as Demonetization (FY17), GST implementation (FY18), NBFC liquidity crisis (FY19) and Covid (F21) as such events had put pressure both on its growth and asset quality, Shriram finance diversified its funding source by incorporating foreign commercial borrowings and securitization. It has further diversified its portfolio in 2022 through the merger with Shriram City Union Finance, a sister company. Post merger, the company has improved its business model with lower cyclicality, higher-yielding product mix, and better growth visibility. We think the benefits of such structural improvements could be further boosted by upcoming interest rate cuts. Over a 3-year period (2024-2027e), the company is expected to increase their Loan Book by 20% and EPS by 18% per annum. The stock trades at FY03/25 P/B of 2.2x and at a 60% discount compared to its peer, Cholamandalam (P/B of 5.3x). We have invested c.2% of GemEquity and 2.3% of GemAsia in the company.

Financial Service companies (NBFCs) with an AUM of $28bn. By 1Q25 commercial vehicle financing represented 46% of the business (vs. 98% in F22), while 54% of the business consisted of new products (Passenger Vehicles, motorcycles loans, Small Business Financing, Gold Loans and Insurance products). Shriram Finance serves its 8.7M customers through more than 3.000 branches. It has a significant market share of 20% in used commercial vehicle financing, bolstered by strong underwriting and collection practices. Having been impacted by a series of macroeconomic challenges in 2017-22, such as Demonetization (FY17), GST implementation (FY18), NBFC liquidity crisis (FY19) and Covid (F21) as such events had put pressure both on its growth and asset quality, Shriram finance diversified its funding source by incorporating foreign commercial borrowings and securitization. It has further diversified its portfolio in 2022 through the merger with Shriram City Union Finance, a sister company. Post merger, the company has improved its business model with lower cyclicality, higher-yielding product mix, and better growth visibility. We think the benefits of such structural improvements could be further boosted by upcoming interest rate cuts. Over a 3-year period (2024-2027e), the company is expected to increase their Loan Book by 20% and EPS by 18% per annum. The stock trades at FY03/25 P/B of 2.2x and at a 60% discount compared to its peer, Cholamandalam (P/B of 5.3x). We have invested c.2% of GemEquity and 2.3% of GemAsia in the company.

Company focus: ICICI Lombard General Insurance (Sales: $2.3bn - Market Capitalization: $12.2bn

In 2001, the Indian government liberalized the non-life insurance sector which was dominated by state owned companies. This regulatory change allowed private sector players to enter the market, and the founding of ICICI Lombard General Insurance (ICICI Lombard), a JV between ICICI Bank and Fairfax Financial Holdings. While the general insurance industry was still at its infancy back then (0.5% of premium penetration vs. GDP), ICICI Lombard capitalized on the favorable competitive environment and developed a diverse range of products, such as Motor, Health, Travel and Personal accident insurance. The company has also built a robust multi-channel distribution network with 917 virtual offices, 217 corporates agents and 129K individual agents. The merger with Bharti-AXA in 2021 enhanced their Motor insurance offering, ans also contributed to their expansion into Tier 3 & 4 markets. As a digital frontrunner, the company now issues 99.3% of its 36M of policies electronically.

In 2001, the Indian government liberalized the non-life insurance sector which was dominated by state owned companies. This regulatory change allowed private sector players to enter the market, and the founding of ICICI Lombard General Insurance (ICICI Lombard), a JV between ICICI Bank and Fairfax Financial Holdings. While the general insurance industry was still at its infancy back then (0.5% of premium penetration vs. GDP), ICICI Lombard capitalized on the favorable competitive environment and developed a diverse range of products, such as Motor, Health, Travel and Personal accident insurance. The company has also built a robust multi-channel distribution network with 917 virtual offices, 217 corporates agents and 129K individual agents. The merger with Bharti-AXA in 2021 enhanced their Motor insurance offering, ans also contributed to their expansion into Tier 3 & 4 markets. As a digital frontrunner, the company now issues 99.3% of its 36M of policies electronically.

As a result of its faster pace of growth in 2001-24 (18% of gross direct premium income growth vs. 13% for peers), ICICI Lombard now dominates 9% of total market share and leads in motor segment (11%). While it lags in the health segment (6% of market share vs. 11% in 2014) because of increased competition from standalone health insurers, ICICI Lombard wants to make a comeback with its strong balance sheet. The company expects its health Gross Premium to grow 20% pa for 2024-27, compared to 17% growth of its total gross premium. While the company’s stock trades at a high valuation of 41.5x FY03/25, it is also distinguished with superior execution and as well as India’s structural growth opportunities. Despite doubling since 2001, non-life insurance penetration remains at just 1%. This is still significantly lower than that in many other countries, for instance China’s 1.9%.