China's "Whatever it takes" moment?

Recent developments in China, especially PBoC's growth support package and Politburo's stimulus push have captured investors' full attention. Amid global uncertainty, Chinese authorities are adjusting their economic policies to revive domestic growth and reinforce financial stability.

The Chinese Economic Context:

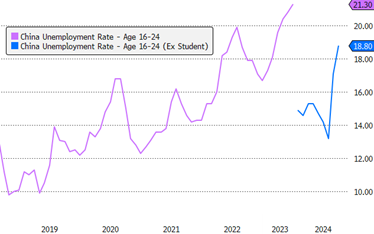

Chinese economic health has continued to deteriorate despite pro-growth rhetoric from Beijing for last 18 months. The second quarter was particularly weak, with the economy further softening  (the various measures introduced thus far have been modest and supply-focused), with macro data generally below expectations (industrial production up 4.5% yoy in August compared to 5.1% in July, retail sales at +2.1% versus 2.7% in July, and youth unemployment at 18.8%). Investors are increasingly skeptical about Chinese authorities' ability to reverse the deflationary spiral affecting the country, also question about this year’s GDP growth target.

(the various measures introduced thus far have been modest and supply-focused), with macro data generally below expectations (industrial production up 4.5% yoy in August compared to 5.1% in July, retail sales at +2.1% versus 2.7% in July, and youth unemployment at 18.8%). Investors are increasingly skeptical about Chinese authorities' ability to reverse the deflationary spiral affecting the country, also question about this year’s GDP growth target.

Announcements from Beijing:

On September 24, following the Fed’s lead, the PBoC initiated a monetary pivot, surprising with extraordinary measures on three fronts:

- Monetary: policy rate cut by 20 bp and the RRR (required reserve ratio) 50 bp cut

- Real Estate: lowered effective borrowing rates and minimum down payment, with loan guarantees from the PBoC

- Stock Market: RMB 800bn ($114bn) in financing facilities for stock purchases

The exceptional Politburo meeting held two days after above-mentioned announcements suggests that Beijing recognizes the urgency to act decisively, with many observers drawing parallels to Mario Draghi's famous "whatever it takes" speech. Government sources reported a potential fiscal stimulus plan of RMB 2tn ($284bn), funded by special bond issuance, aimed at boosting consumer spending and assisting indebted municipalities.

Chinese Markets' reactions:

While the concrete details of the fiscal measures remain to be clarified, Chinese stocks were so depressed that they became highly sensitive to any policy change. As a result, we witnessed a spectacular rally amplified by a short squeeze (short sales on the Hong Kong market dropped from 22% on 9/16 to 10.2% on 9/30), a rise in margin financing (margin purchases of A-shares rose to 10.5% of total trading volume on 9/27 compared to 7.4% on 9/20), as well as increased participation from

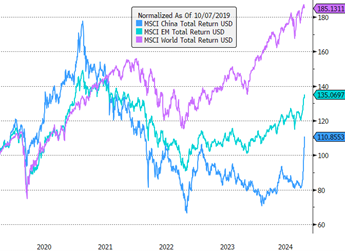

spectacular rally amplified by a short squeeze (short sales on the Hong Kong market dropped from 22% on 9/16 to 10.2% on 9/30), a rise in margin financing (margin purchases of A-shares rose to 10.5% of total trading volume on 9/27 compared to 7.4% on 9/20), as well as increased participation from  retail investors motivated by FOMO (fear of of missing out) just before a week-long domestic market closure for the national holiday (Golden Week). The daily trading volume of A-shares reached $370 billion on 9/30, 3.5 times the 2024 ADV, a historically high. Last week’s rally, sparked by the new wave of stimulus measures in China, ended the underperformance of emerging markets. After significant underperformance of 27% over 3 years and 54% over 5 years, EMs remain slightly underperforming ytd, despite the recent rebound (cf. right chart).

retail investors motivated by FOMO (fear of of missing out) just before a week-long domestic market closure for the national holiday (Golden Week). The daily trading volume of A-shares reached $370 billion on 9/30, 3.5 times the 2024 ADV, a historically high. Last week’s rally, sparked by the new wave of stimulus measures in China, ended the underperformance of emerging markets. After significant underperformance of 27% over 3 years and 54% over 5 years, EMs remain slightly underperforming ytd, despite the recent rebound (cf. right chart).

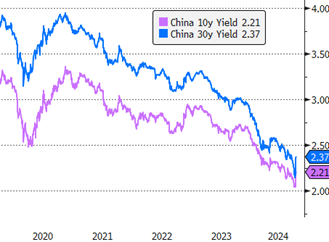

Regarding Chinese government debt, yields surged following these announcements, but nominal levels (2.20% and 3.37% at 10 and 30 years, respectively) remain at historically low (cf. left chart). This suggests that bond investors remain cautious about Beijing's ability to implement decisive fiscal measures despite the pivot.

Fund Operations:

At the end of September, within GemChina, we reduced our exposure to low-beta sectors/stocks such as telecommunications and added companies more sensitive to sentiment shifts and economic recovery. Thus, before the market closed for Golden Week, we added Shenzhen Innovance-A (1.5%), an industrial automation company; SNIBE-A (1%), a medical equipment company; and increased our position in Beijing Oriental Yuhong-A (3%), a waterproofing supplier linked to real estate and construction activities. We also strengthened our position in Anta (1.3%), the Chinese sportswear company. As of now, 27.5% of the fund is invested in A-shares. Note that all subscriptions made during China's holiday week (October 1-7) will be taken into account when Chinese markets reopen on October 8.

Outlook:

After a 25% rise in A-shares in a week, short-term consolidation is possible. Nonetheless, the current rally certainly has more legs if Beijing accelerates the implementation of decisive counter-cyclical measures and restores confidence quickly. While this arsenal of measures appears very comprehensive, there is still too little information about details. It remains uncertain whether stiumulus measures will reach a sufficient level to break the cycle of excess savings, overcapacity, export dependence, and deeply entrenched disinflationary pressures. But Beijing seems determined this time. For instance, the governor of the PBoC has stated that the RMB 800bn ($114 bn) in stock support could be increased threfold or even if necessary. The primary risk, both on the upside and downside, lies in the execution of this program. Nevertheless, the initial reaction of Chinese markets suggests that Beijing's actions should be taken seriously. Beyond China, the challenge for emerging economies, especially those commodity exporters, is whether the upcoming measures will revive domestic demand-driven growth. Fiscal measures which enable a rebalancing of China's growth model from exports toward domestic consumption would eventually drive up global demand for goods and raw materials, thus benefiting emerging countries, notably Indonesia, Thailand, and Brazil.

In this context, an underweight position in emerging markets, as seen in the majority of portfolios today, is no longer appropriate.