We also participate in the Jefferies Asia forum in Hong Kong, an event which connects international investors and executives from 150 Asian companies.

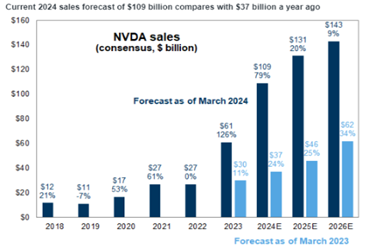

Over 10 days, we visited 20 Taiwanese companies of which 16 in their respective head-office in Taipei and Hsinchu (the semiconductor valley), the rest and 5 Chinese companies at the Jefferies Hong Kong forum. Most of the companies we met have been in the tech sector; semiconductor foundry, packaging and testing, IC design, components manufacturing and assembly: TSMC, UMC, ASE, King Yuan Electronics, Hon Hai, Delta Electronics, Mediatek, Lite-On Tech, Wistron, Wywinn, Advantech, etc… Many of the above companies are part of the Nvidia outsourcing value chain. They may not have the same gross margin as the US tech giant, but they undoubtedly benefit from its explosive growth (see below the change of sales expectation for Nvidia over the last 12 months). TSMC, the largest EM company and the world leading semiconductor foundry expects that AI related sales will contribute close to 30% of its total sales in 2027. King Yuan Electronics is the exclusive final tester of Nvidia chips.

Over 10 days, we visited 20 Taiwanese companies of which 16 in their respective head-office in Taipei and Hsinchu (the semiconductor valley), the rest and 5 Chinese companies at the Jefferies Hong Kong forum. Most of the companies we met have been in the tech sector; semiconductor foundry, packaging and testing, IC design, components manufacturing and assembly: TSMC, UMC, ASE, King Yuan Electronics, Hon Hai, Delta Electronics, Mediatek, Lite-On Tech, Wistron, Wywinn, Advantech, etc… Many of the above companies are part of the Nvidia outsourcing value chain. They may not have the same gross margin as the US tech giant, but they undoubtedly benefit from its explosive growth (see below the change of sales expectation for Nvidia over the last 12 months). TSMC, the largest EM company and the world leading semiconductor foundry expects that AI related sales will contribute close to 30% of its total sales in 2027. King Yuan Electronics is the exclusive final tester of Nvidia chips.

Artificial Intelligence (AI) is poised to reshape the global economy and human societies soon. Its reverberations are also being clearly felt throughout Asia's electronics sector. Every major commercialized AI application, from chatbots to autonomous vehicles, relies on powerful electronic hardware, such as advanced semiconductor chips, to function properly. As a result, certain electronic producers enjoy robust demand even as the surrounding macroeconomy remains sluggish. Much of AI's electronics demand comes f rom data servers that require vast quantities of advanced semiconductors. High bandwidth memory (HBM) chips are seeing particularly strong demand as cloud storage services expand. Besides memory, AI is also generating growth for high-performance processors (CPUs and GPUs). AI-related chip demand could grow further as smartphone makers implement more on-device AI features. For instance, Samsung's new Galaxy S24 runs its generative AI features through Qualcomm's latest AI-capable Snapdragon processors. According to one industry estimate, the share of AI-capable smartphones shipped could grow from 5% this year to 45% by 2027 (Financial Times, 18 January 2024). In Asia, the AI boom generates substantial demand growth for Korean memory chips, as well as high-end Taiwanese processor chips.

rom data servers that require vast quantities of advanced semiconductors. High bandwidth memory (HBM) chips are seeing particularly strong demand as cloud storage services expand. Besides memory, AI is also generating growth for high-performance processors (CPUs and GPUs). AI-related chip demand could grow further as smartphone makers implement more on-device AI features. For instance, Samsung's new Galaxy S24 runs its generative AI features through Qualcomm's latest AI-capable Snapdragon processors. According to one industry estimate, the share of AI-capable smartphones shipped could grow from 5% this year to 45% by 2027 (Financial Times, 18 January 2024). In Asia, the AI boom generates substantial demand growth for Korean memory chips, as well as high-end Taiwanese processor chips.

High performance computing (HPC) serves as a crucial foundation for the development and implementation of AI. As AI software demands higher performance and more advanced functions, hardware upgrades to higher computing power are necessary. HPC chips, such as GPUs (Graphic Processing Units) and ASICs (Application-specific integrated circuits), are now the key components driving the training process for AI algorithms. At present, HPC chip design is dominated by US players, such as Nvidia, AMD and Intel, and those HPC chips are all fabricated by TSMC. Furthermore, the advanced packaging required for HPC chips used in AI applications is predominantly supplied through TSMC's CoWoS (Chip on Wafer on Substrate) service.

On the macro situation, the most recent Taiwan data has confirmed that a cyclical pickup is underway. Real GDP grew 4.9% yoy in 4Q23. Exports rose 12.9% yoy in 1Q24. The gearing of Taiwan’s economy to semiconductors remains hard to exaggerate. Exports of integrated circuits totaled $167bn in 2023, or 22% of nominal GDP and a 32% m/s of global semiconductor sales. Judging from the ground, local consumption remains healthy, restaurants in Taipei are full and local people do not seem to be bothered by China-Taiwan political uncertainties. Interest rates stay at a low 2% and government debt to GDP has actually declined to a low 27% of GDP. The TWD has weakened 5% against USD YTD, a tough less than the KRW and the JPY. On a REER basis, it looks rather undervalued.

Company focus: TSMC (Market Cap: $660bn, sales revenue: $85bn, 10% of GemEquity and GemAsia)

Founded in 1987 as a JV between Taiwan government and Philips, TSMC is the largest company in Taiwan and the largest market cap in EM, Asian and Taiwan indices. It is also the world’s largest pure-play semiconductor foundry with the most advanced technology. It controls around 60% global market share in the foundry market. It is a pionee r in leading edge semiconductor process development and manufacturing, with a ~90% market share in advanced nodes (N7, N5, N3). Such nodes (N7 and below) set to account for 65/70% of corporate revenue in 2026/2027, helped by structural HPC (high performance computing) growth. As foundries are not involved in the designing and selling of semiconductor products (“neutral” and not competing against customers). As such, the foundry model has seen rising traction in the last 20 years and now accounts for close to 30% of the Semi (ex-Memory) market.

r in leading edge semiconductor process development and manufacturing, with a ~90% market share in advanced nodes (N7, N5, N3). Such nodes (N7 and below) set to account for 65/70% of corporate revenue in 2026/2027, helped by structural HPC (high performance computing) growth. As foundries are not involved in the designing and selling of semiconductor products (“neutral” and not competing against customers). As such, the foundry model has seen rising traction in the last 20 years and now accounts for close to 30% of the Semi (ex-Memory) market.

Most of its manufacturing base (fabs) is in Taiwan. But the company has also fabs in China, US and Japan. A German fab is in the planning stage and its US operations are to be further expanded. Being so essential in the manufacturing of semiconductors, the company is geopolitically important and expansion in the US, Europe and Japan reduced the geopolitical risk of being concentrated in Taiwan. TSMC recently announced that the US DoC and TSMC Arizona have signed a non-binding preliminary memo for a US$6.6bn in grant under the US Chip Act. TSMC will also have a third leading edge N2 fab in Arizona. Including the third leading fab, the total investment in the US will be up to US$65bn. They will also receive US$5bn in loans and can get up to 25% of the qualified capex at its Arizona fab. By 2030, it is estimated that 20% of the company sales will come from its international bases.

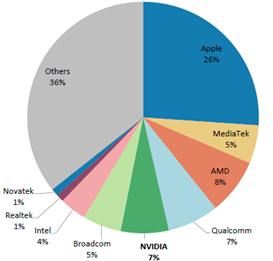

TSMC leadership is not only in sales but also in capex. At around $30bn, it accounts for 55% of the foundry spending. Nb2 Samsung accounts for 25%, nb3 Shanghai based SMIC for 15%. During our interview, TSMC maintains its mid-to-long term target of a 15-20% CAGR in its revenue with a 53% target for its GM and 25% for its ROE (see the company’s client base on the left). We also forecast the company will grow its FCF from $17bn in 2023 to $50bn in 2026, despite high capex.

TSMC leadership is not only in sales but also in capex. At around $30bn, it accounts for 55% of the foundry spending. Nb2 Samsung accounts for 25%, nb3 Shanghai based SMIC for 15%. During our interview, TSMC maintains its mid-to-long term target of a 15-20% CAGR in its revenue with a 53% target for its GM and 25% for its ROE (see the company’s client base on the left). We also forecast the company will grow its FCF from $17bn in 2023 to $50bn in 2026, despite high capex.

With its price having risen 35% in $ YTD, the stock now trades at 2024 and 2025 PER of 21x and 17x earnings estimates. For information, Nvidia trades at 35 and 30x earnings estimates of 2024 and 2025.

Company focus: King Yuan Electronics (Market Cap: $4bn, sales revenue: $1.2bn, 1% of GemEquity and 1.5% of GemAsia)

Established in 1987, King Yuan is the leading pure semiconductor testing provider with a diversified application and growing customer base. With 15% m/s in IC testing, KYEC is the nb2 vendor globally (ASE is nb1 with 24% m/s). Devices tested by KYEC have been widely used in various applications, including consumer, communicatio

Established in 1987, King Yuan is the leading pure semiconductor testing provider with a diversified application and growing customer base. With 15% m/s in IC testing, KYEC is the nb2 vendor globally (ASE is nb1 with 24% m/s). Devices tested by KYEC have been widely used in various applications, including consumer, communicatio n, automotive, data computing and industrial. 50% of the global top 50 semi companies use the company’s test services. As an industry leader in the IC testing market, KYEC is likely to continue benefiting from stronger component builds for 5G, automotive, HPC related segments, as well as longer testing time required for higher end products and new applications following the ongoing technology upgrade cycle. The company is one the beneficiaries in the growing AI smartphone market, thanks to the longer testing time and higher testing value for larger/higher-complexity SoCs, which should be a megatrend in coming years with smartpho

n, automotive, data computing and industrial. 50% of the global top 50 semi companies use the company’s test services. As an industry leader in the IC testing market, KYEC is likely to continue benefiting from stronger component builds for 5G, automotive, HPC related segments, as well as longer testing time required for higher end products and new applications following the ongoing technology upgrade cycle. The company is one the beneficiaries in the growing AI smartphone market, thanks to the longer testing time and higher testing value for larger/higher-complexity SoCs, which should be a megatrend in coming years with smartpho ne vendors’ aggressive plan in generative-AI-empowered handsets. The company should benefit from Mediatek (its largest customer with 20% of sales) 20%+ sales growth. From our interview with the company, we felt that the company should be able to maintain 100% market share in AI GPU business at NVIDIA over 2024-25. This AI related revenue should contribute 15-20% of sales by 2025 and be the largest contributor to the company’s top line growth in 2024 and 2025. With the semiconductor downcycle from 2021 to 2023, company sales have stagnated at around $1bn and utilization rate went down to 56.4%. But EBITDA margin slightly rose from 47% in 2021 to 50% in 2023. Going forward, we forecast King Yuan could grow its sales by 15% pa and its earnings by 22% pa from 2023 to 2025. With its price having risen 20% in $ YTD, the stock now trades at 2024 and 2025 PER of 19x and 15x earnings estimates.

ne vendors’ aggressive plan in generative-AI-empowered handsets. The company should benefit from Mediatek (its largest customer with 20% of sales) 20%+ sales growth. From our interview with the company, we felt that the company should be able to maintain 100% market share in AI GPU business at NVIDIA over 2024-25. This AI related revenue should contribute 15-20% of sales by 2025 and be the largest contributor to the company’s top line growth in 2024 and 2025. With the semiconductor downcycle from 2021 to 2023, company sales have stagnated at around $1bn and utilization rate went down to 56.4%. But EBITDA margin slightly rose from 47% in 2021 to 50% in 2023. Going forward, we forecast King Yuan could grow its sales by 15% pa and its earnings by 22% pa from 2023 to 2025. With its price having risen 20% in $ YTD, the stock now trades at 2024 and 2025 PER of 19x and 15x earnings estimates.