In May, we travelled in Mexico to visit companies both in Mexico City and in Monterrey.

We also participated in the HSBC conference in Mexico City, an event that connects international investors and local executives and macro analysts. Overall, we interacted with 20 companies. We met both local banks Grupo Banorte, Banco del Bajio and microcredit specialist Gentera. With a focus on nearshoring, we had the chance to meet 4 REITS operators: Fibra Monterrey, Fibra Prologis, Fibra Uno and Terrafina. With a focus on industrial land, these real estate developers are in the ce nter of the industrial expansion Mexico experiences in the North and the Centre of the country. In the consumer sector, we met Coca bottler Arca Continental, OTC drugs and personal care products manufacturer Genomma and hygiene products maker Kimberley Clark. We also met distribution operators Walmex, Chedraui and Liverpool. In Monterrey, we visited Auna’s hospital and auto parts manufacturer Nemak’s head office. We also interacted with airport operators OMA (mainly Monterrey airport) and Azur (mainly Cancun airport). Lastly, we met GMexico Transportes and Traxion, both industrial companies specialized in transport.

nter of the industrial expansion Mexico experiences in the North and the Centre of the country. In the consumer sector, we met Coca bottler Arca Continental, OTC drugs and personal care products manufacturer Genomma and hygiene products maker Kimberley Clark. We also met distribution operators Walmex, Chedraui and Liverpool. In Monterrey, we visited Auna’s hospital and auto parts manufacturer Nemak’s head office. We also interacted with airport operators OMA (mainly Monterrey airport) and Azur (mainly Cancun airport). Lastly, we met GMexico Transportes and Traxion, both industrial companies specialized in transport.

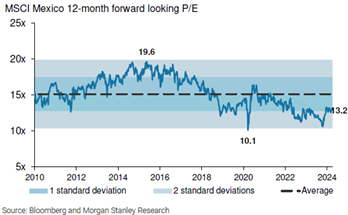

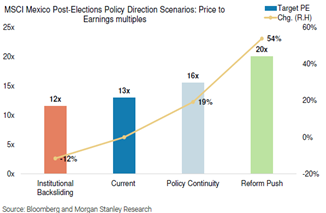

On the political front, the 2 June 2024 Mexican election will likely result in a more balanced congress, key to capping policy risks further. Th e ruling party's presidential candidate, Claudia Sheinbaum, is ahead on the polls, but the gap could continue to narrow. The higher the election turnout, the greater the likelihood for the opposition candidate, Xochitl Galvez, to surprise, according to the expert analyst we hosted. This general election will be the largest in the country’s history, and its importance cannot be understated. The incoming President will serve a six-year term, while leadership in both chambers in Congress and nine governorships will be renovated. Key opportunities include a more aggressive plan to boost private investments, U.S.-Mexico collaboration deepening and an option to benefit of global supply chains reshaping for years to come. Twin elections in Mexico and the US amplify the importance of the year, particularly in shaping the two countries’ bilateral relationship and especially given Mexico’s recent surpassing of China as the U.S.’s top trading partner. Market valuation, currently at a 15% discount to long term average is likely to be affected by policy direction.

e ruling party's presidential candidate, Claudia Sheinbaum, is ahead on the polls, but the gap could continue to narrow. The higher the election turnout, the greater the likelihood for the opposition candidate, Xochitl Galvez, to surprise, according to the expert analyst we hosted. This general election will be the largest in the country’s history, and its importance cannot be understated. The incoming President will serve a six-year term, while leadership in both chambers in Congress and nine governorships will be renovated. Key opportunities include a more aggressive plan to boost private investments, U.S.-Mexico collaboration deepening and an option to benefit of global supply chains reshaping for years to come. Twin elections in Mexico and the US amplify the importance of the year, particularly in shaping the two countries’ bilateral relationship and especially given Mexico’s recent surpassing of China as the U.S.’s top trading partner. Market valuation, currently at a 15% discount to long term average is likely to be affected by policy direction.

On the macro front, our key conclusion is that Mexico's investment opportunities are still solid, given its more relevant role in the current global political landscape  and despite short term uncertainties (both Mexican and US elections).

and despite short term uncertainties (both Mexican and US elections).

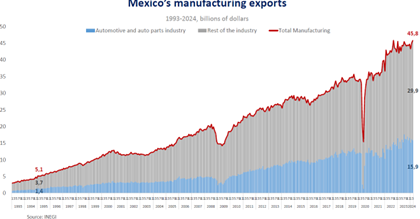

On trade policy, the US-Mexico relationship is likely to deepen further. Mexico is taking up part of the US export market share lost by China. The nearshoring narrative looks solid; trade deficit changes between the US and select countries, including Mexico, reflect the progress made so far and the potential more clearly. Mexico  is now the first exporter to the US with 16% of US imports, ahead of Canada and China. But even more importantly, Mexico is 16% of total US exports, 2nd to Canada, making the US-Mexico relationship quite balanced and less subject to any US protectionist rhetoric. This has been achieved mainly through private investment in manufacturing. As a matter of fact, the country received $20.3Bn worth of Foreign Direct Investment in 1Q24, +9% vs. 1Q23, an all-time high according to the Economic Ministry. Half of this amount is from US. Mexico’s manufacturing exports has increased 50% from $30Bn in 2017 to now $46Bn and is likely to further rise given the increase in investment. Hence domestic macro framework remains benign, but in the short term, attention has shifted towards fiscal and monetary policy developments. On the fiscal front, wider deficits this year creates uncertainty, as do fiscal aid to Pemex. On the monetary side, we think Central Bank Banxico new inflation path reduces the room for surprise. Local interest rate should be cut, but only when we see a similar move in US interest rates.

is now the first exporter to the US with 16% of US imports, ahead of Canada and China. But even more importantly, Mexico is 16% of total US exports, 2nd to Canada, making the US-Mexico relationship quite balanced and less subject to any US protectionist rhetoric. This has been achieved mainly through private investment in manufacturing. As a matter of fact, the country received $20.3Bn worth of Foreign Direct Investment in 1Q24, +9% vs. 1Q23, an all-time high according to the Economic Ministry. Half of this amount is from US. Mexico’s manufacturing exports has increased 50% from $30Bn in 2017 to now $46Bn and is likely to further rise given the increase in investment. Hence domestic macro framework remains benign, but in the short term, attention has shifted towards fiscal and monetary policy developments. On the fiscal front, wider deficits this year creates uncertainty, as do fiscal aid to Pemex. On the monetary side, we think Central Bank Banxico new inflation path reduces the room for surprise. Local interest rate should be cut, but only when we see a similar move in US interest rates.

Overall, the growth prospects of Mexico remain attractive in the long term. From a geopolitical point of view, we see no issue with Mexico clearly anchored in the Western camp of the world. A structural overweight in the country is therefore a must.

Company focus: Fibra Monterrey (market cap: $1.55Bn, assets: $1.75Bn)

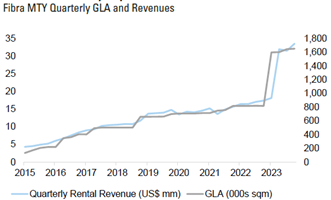

Fibra Monterrey (FMTY) is the smallest of the industrial pure play Mexican real estate companies at 1.4 M sqm of GLA focused on industrial as of 4Q23, compared to peers Fibra Prologis at 4.3 M and Vesta at 3.4 M sqm. Yet FMTY is arguably one of the companies most impacted by nearshoring with 80% of the portfolio by revenue exposed to manufacturing and 65% exposed to Northern Mexico (one of the largest exposure to the North among its peers) and 31% to the Bajio. It is the only industrial-focused REIT that is internally managed (i.e., it pays no asset management fees externally); our view is that this characteristic reduces perceptions of mixed incentives, as management is compensated on a combination of hitting guidance in the near term and growing AFFO/sh (Adjusted Funds From Operations) above inflation over a three-year period, rather than increasing asset size. Overall, this approach has led to FMTY having one of the highest EBITDA margins in the sector and lowest administrative

Fibra Monterrey (FMTY) is the smallest of the industrial pure play Mexican real estate companies at 1.4 M sqm of GLA focused on industrial as of 4Q23, compared to peers Fibra Prologis at 4.3 M and Vesta at 3.4 M sqm. Yet FMTY is arguably one of the companies most impacted by nearshoring with 80% of the portfolio by revenue exposed to manufacturing and 65% exposed to Northern Mexico (one of the largest exposure to the North among its peers) and 31% to the Bajio. It is the only industrial-focused REIT that is internally managed (i.e., it pays no asset management fees externally); our view is that this characteristic reduces perceptions of mixed incentives, as management is compensated on a combination of hitting guidance in the near term and growing AFFO/sh (Adjusted Funds From Operations) above inflation over a three-year period, rather than increasing asset size. Overall, this approach has led to FMTY having one of the highest EBITDA margins in the sector and lowest administrative expenses per sqm. We also note that the company does not have a controlling shareholder and has separated its CEO and Chairman positions, with the CEO not being a board member. From a governance point of view, it is undoubtedly a plus.

expenses per sqm. We also note that the company does not have a controlling shareholder and has separated its CEO and Chairman positions, with the CEO not being a board member. From a governance point of view, it is undoubtedly a plus.

In the last 9 years, FMTY has been a material acquirer, growing its portfolio 12x and 7x by GLA and revenue, acquiring 1.8 M sqm for $1.5Bn at an 8.4% average cap rate. Having recently raised $460M, the company is now focused on acquiring a potential $1.1Bn pipeline that includes $287M in recently announced MOUs expected to close in the near term.

Comparing FMTY’s in-place rents to market rents (for which data is available), we find that markets representing ~70% of FMTY’s industrial revenues (Monterrey, Saltillo, Tijuana and Reynosa in the North, Guadalajara in the Bajio) on average show a +15% difference between market rents and current portfolio rents. Given that ~30% of FMTY’s industrial leases mature over the next three years, we believe that the company can see material mark to market upside given the supply/demand delta.

Valuation wise, FMTY is worth MXN15 (vs. current price of MXN10.4 and most recent placement price of MXN12.2), based on a DCF analysis (12% cost of equity, 5% cost of debt in USD vs. Mexican 10-year risk free rate of 6% in USD, 7.5M cap rate applied to the terminal value Net Operating Income (NOI)). With the current consolidation going on in the Fibra sector, we believe FMTY could be a target. As of now, the attention is on Terrafina which has expressed interest in receiving bids from other players. Fibra Uno and Fibra Prologis are the most favored contenders to this take over, but only one will win. We believe the nb2 will be very keen to do acquisition to remain a significant player. Taking over FMTY will allow such goal.

Bruno Vanier

President Gemway Assets