Deepinder Goyal

Deepinder Goyal is the Founder and CEO of Zomato. Since founding the company in 2008, Deepinder has been instrumental as the company expanded its offerings from a restaurant listing to food delivery to providing grocery services to restaurants and expanding to quick commerce services. Prior to founding Zomato, he worked for Bain and Co. He graduated with a master degree in mathermatics and computing from Delhi Indian Institute of Technology.

Zomato is India’s leading restaurant aggregator and food delivery company.

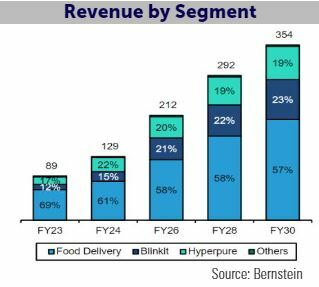

It pioneered a restaurant search and discovery website and later developed a platform that connects customers, restaurants, and delivery partners. The company has launched Food Delivery business in 2015 and has since  enjoyed the accelerated growth of Indian online food delivery market. It also operates a one-stop procurement solution Hyperpure, which supplies high quality ingredients and kitchen products to restaurant partners. Post its acquisition of Blinkit in 2022, the company has developed a major presence in quick commerce services (fast delivery for small orders of food and daily essentials) which competes with Kirana stores (unorganized mom and pop stores), as modern retail accounts for only 6-7% of the total retail spend. As of today, Zomato has built a vast network with 238,000 restaurants and 410,000 delivery partners in the Food Delivery business and a presence in 24 cities for Blinkit.

enjoyed the accelerated growth of Indian online food delivery market. It also operates a one-stop procurement solution Hyperpure, which supplies high quality ingredients and kitchen products to restaurant partners. Post its acquisition of Blinkit in 2022, the company has developed a major presence in quick commerce services (fast delivery for small orders of food and daily essentials) which competes with Kirana stores (unorganized mom and pop stores), as modern retail accounts for only 6-7% of the total retail spend. As of today, Zomato has built a vast network with 238,000 restaurants and 410,000 delivery partners in the Food Delivery business and a presence in 24 cities for Blinkit.

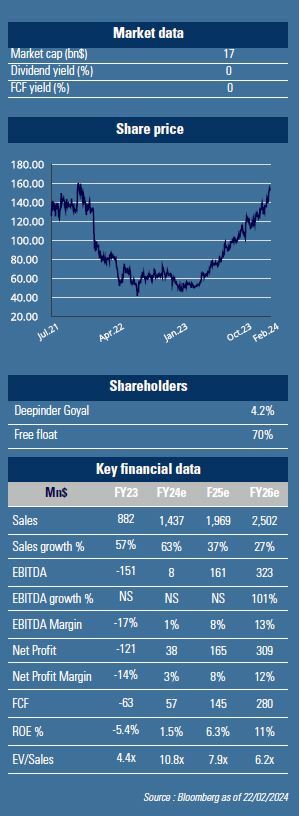

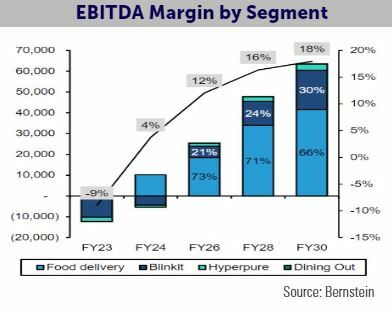

As the two largest food delivery platforms with more than 55% of market share, Zomato and Swiggy (its key competitor) are well positioned to enjoy a large addressable market and the ample growth potential of the industry. Zomato’s Monthly Transacting User base has grown from 1M in 2018 to 18.5M in 2023, with take-rate expanded from 9.8% to 20.3%. We expect such strong growth to be sustainable in the years to come. Because of ongoing urbanization (to add 416M people to its cities by 2050), steady per-capita income growth, and more women participation in workforce, the new generation of Indian consumers embraces a change in habit fro m home cooked food to restaurant food. Meanwhile, the industry has also attractive potential to further increase penetration rate, which is still in the early stages (14%) compared to that of more developed markets such as China (25%), as well as a benign competition environment. As such, the Online food and grocery delivery industry monthly transacting user base is expected to grow from current base of 30M to 80M by 2030. Such growth prospect is highly positive for Zomato. As a dominant leader, the company starts to benefit from economies of scale which leads to reduced delivery costs. After achieving adjusted-EBITDA breakeven for its consolidated business in 2023, Zomato management remains confident in further profit expansion. The company aims at 100% E-Bikes in its delivery fleet by 2030 to further enhance its cost structure. The breakeven of Blinkit, its quick commerce business, within the next 2 quarters would also contribute positively to the consolidated results. Since the acquisition, Zomato has scaled Blinkit impressively. The latter has sustained >100% of growth with improved margins. As its Monthly transacting user base increased from 1.5M to 4.7M in last 2 years, its take-rate expanded from 7% to 18%. Blinkit is today the leader in a 3-player market.

m home cooked food to restaurant food. Meanwhile, the industry has also attractive potential to further increase penetration rate, which is still in the early stages (14%) compared to that of more developed markets such as China (25%), as well as a benign competition environment. As such, the Online food and grocery delivery industry monthly transacting user base is expected to grow from current base of 30M to 80M by 2030. Such growth prospect is highly positive for Zomato. As a dominant leader, the company starts to benefit from economies of scale which leads to reduced delivery costs. After achieving adjusted-EBITDA breakeven for its consolidated business in 2023, Zomato management remains confident in further profit expansion. The company aims at 100% E-Bikes in its delivery fleet by 2030 to further enhance its cost structure. The breakeven of Blinkit, its quick commerce business, within the next 2 quarters would also contribute positively to the consolidated results. Since the acquisition, Zomato has scaled Blinkit impressively. The latter has sustained >100% of growth with improved margins. As its Monthly transacting user base increased from 1.5M to 4.7M in last 2 years, its take-rate expanded from 7% to 18%. Blinkit is today the leader in a 3-player market.

At 8x FY03/25 EV/Sales, Zomato trades at a premium compared to its global peer group. It is supported by better growth prospects (Gross Order Value +30% pa in FY24-26e) and improved profit outlook. It is uniquely positioned to offer the opportunity to invest in the structural growth in affluent Indian consumers/ digitization. We expect the valuation premium to be sustainable, as long as it continues with successful execution. Both GemEquity (1.6%) and GemAsia (1.6%) have invested in the company.