Marcos Ramirez Miguel

Marcos Ramirez Miguel is the CEO of Grupo Financiero Banorte. Since joining the group in 2010, Marcos has held key management positions such as CEO of Wholesale Banking and member of Board of Directors of the Financial group. Prior to Grupo Financiero Banorte, he worked for Santander Mexico, Nacional Financiera and Banca Mayorista Global. In addition, he served as the President of Mexican Association of Stock Market Intermediaries. He received a B.S. degree in Actuary from the Anhuac University in Mexico, Master’s degree in Business Administration from ESADE in Barcelona and Post graduate degree in Finance from Autonomous Technical Institute of Mexico.

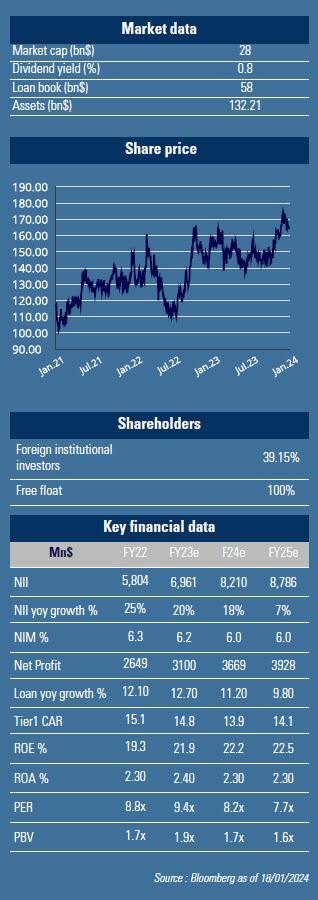

Founded in 1899, Grupo Financiero Banorte is the 2nd largest banking institution in Mexico with assets of $132bn and c.15% of both loan and deposit market shares as of September 2023.

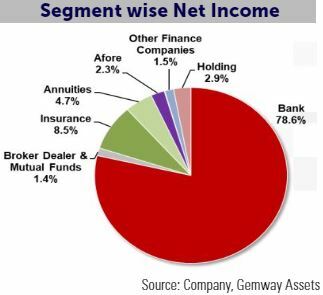

It is the largest Mexican bank that is still controlled by local shareholders. Despite the increased competition from its foreign-controlled peers since the early 2000s, Banorte managed to expand rapidly. Its loan book has grown by 9.7% pa between 2012 and 2022 and expanding ROE from 15% to 19.2%. The once regional bank has transformed itself into a national player with diversified operations in insurance, asset management, and brokerage. It serves 19 million clients through a network of 1,160 branches and 10,262 ATMs across the country.

It is the largest Mexican bank that is still controlled by local shareholders. Despite the increased competition from its foreign-controlled peers since the early 2000s, Banorte managed to expand rapidly. Its loan book has grown by 9.7% pa between 2012 and 2022 and expanding ROE from 15% to 19.2%. The once regional bank has transformed itself into a national player with diversified operations in insurance, asset management, and brokerage. It serves 19 million clients through a network of 1,160 branches and 10,262 ATMs across the country.

After a year of solid expansion (GDP +3.4%), Mexican economy is set to grow at 2.5-3.5% in 2024, according to its government.

While elections (Mexico in June and the US in November) are likely to generate volatilities, private consumption and higher level of investment are likely to support the momentum. Thanks to its geographical proximity and cultural alignment with the US, the country is particularly well positioned to benefit from nearshoring, a structural change and long-term tailwind. Mexico has already emerged as the US’s largest trading partner in 2023, surpassing China. Amid cooling inflationary pressure, Banxico (the Central Bank) is prepared to implement interest rate cuts this year (from 11.25% now to 9% in 2024e). As such, Mexican banks are likely to enjoy resilient double digit loan growth, as a reflection of a benign credit cycle and healthy macro environment. Has observed positive impact from nearshoring since 3Q23, Banorte upgraded its 2023 loan growth target from 6-8% yoy to 10-12%. The group has reinforced its workforce by adding 1200 workers in the first 9 months last year, will add 700 more in 2024 in order to better address the expected sustainable uptick in demand. With interest rate cuts, the bank could benefit from lower funding cost. We expect its net interest income (NII) to expand by double digit and able to sustain even expand its solid ROE (20.5-21.5% in 2023). The success of Banco Bineo, its digital bank launched this month, could further enhance its efficiency, and improve its cots-to-income ratio (34% in 3Q23, among the best in LATAM region). While the Brazilian Neobank competitor Nu bank (1% in GemEquity) has already secured a 4.3m customer base in Mexico and yet to breakeven, Banorte targets 2-3m customers in 5 years with an ROE of 25-30%.

digit loan growth, as a reflection of a benign credit cycle and healthy macro environment. Has observed positive impact from nearshoring since 3Q23, Banorte upgraded its 2023 loan growth target from 6-8% yoy to 10-12%. The group has reinforced its workforce by adding 1200 workers in the first 9 months last year, will add 700 more in 2024 in order to better address the expected sustainable uptick in demand. With interest rate cuts, the bank could benefit from lower funding cost. We expect its net interest income (NII) to expand by double digit and able to sustain even expand its solid ROE (20.5-21.5% in 2023). The success of Banco Bineo, its digital bank launched this month, could further enhance its efficiency, and improve its cots-to-income ratio (34% in 3Q23, among the best in LATAM region). While the Brazilian Neobank competitor Nu bank (1% in GemEquity) has already secured a 4.3m customer base in Mexico and yet to breakeven, Banorte targets 2-3m customers in 5 years with an ROE of 25-30%.

On top of the above, the group’s strong capital position also provides downside protection and offers potential for additional dividend distribution. Its CET ratio is ~15%, compared to the target at 12-13%. The management has been vocal about distributing extraordinary dividends, as an enhancement to its regular payout (>50%). At 1.7x FY24PB, the Banorte stock trades at a premium compared to its Mexican peers. It reflect the bank’s strong profitability and superior dividend yield (estimated at 7.4% in 2024). We have invested 3.5% of GemEquity in the company.