After 18 months, we returned to Brazil, and visited companies in Curitiba and Jaragua do Sul in the state of Parana (south of Sao Paulo), store-checked shopping centers and real estate projects, and participated in the JP Morgan annual conference (nearly 50 Brazilian companies, multiple keynote speakers).

Overall, we met 15 companies, of which 5 on site and 10 at the conference. In Jaragua do Sul, we visited WEG's main production facility and appreciated the plant incredible efficiency. In Curitiba, we visited the head office, maintenance unit and control center of RUMO, Latin America's largest rail freight company (agricultural freight). We also visited state power company COPEL and had the chance to look through its successful privatization. In Sao Paulo, we visited one of the main distribution centers of cosmetic leader Natura and visited 2 high-end real estate projects launched by Brazil leading property developer Cyrela. The visit to WEG (0.5% of GemEquity) factory in Jaragua do Sul helped us better understand its vertical integration which enables this electric motor manufacturer (in head-to-head competition with Siemens and ABB worldwide) to have the lowest costs. At the JP Morgan conference, we met Brazilian oil major Petrobras (1% of GemEquity) as well as country's largest oil junior PRIO (0.5%). We also had the opportunity to talk to the management of 2 other oil juniors, Petroreconcava and 3R Petroleum. These exchanges  of view reinforced our confidence in the potential of "pre-salt" fields off the coast of Rio, the exploration of which would almost double Brazilian production by 2028. We also had the chance to meet David Vélez, one of the 3 founders of Nu Bank. A neo-bank created in 2013 in Sao Paulo, the fintech ($39bn capitalization, li

of view reinforced our confidence in the potential of "pre-salt" fields off the coast of Rio, the exploration of which would almost double Brazilian production by 2028. We also had the chance to meet David Vélez, one of the 3 founders of Nu Bank. A neo-bank created in 2013 in Sao Paulo, the fintech ($39bn capitalization, li sted in New York) now boasts 90 million customers (vs. 12 million in 2019) and aims to replicate its Brazilian success in Colombia and Mexico. Still in the banking sector, we also met with investment bank BTG Pactual. While it continues to expand in asset management (AUM of $130bn), its CFO highlighted domestic investors’ still lack of enthusiasm (high rates, political uncertainties). In retail sector, we talked to Lojas Renner (the equivalent of Zara here). The group (which owns the department store we visited in Curitiba), suffers active competition from Shein. Nevertheless, the fashion retailer’s like-for-like sales growth seem to have improved since last summer. We also met the management of Assai (1% of GemEquity). The Cash & Carry retail chain operator, formerly owned by Casino, is now independent. Following the acquisition of Extra (70 stores), it now owns over 300 stores and employs 80,000 people. The integration of Extra and the conversion of its stores to the Cash & Carry format will be completed this year. The group continues to gain market share. However, it has revised down its 2024 expansion plan (from 25 to 15 new stores) in order to reduce its high financial leverage (Debt/EBITDA of 4.4x). Still in consumer goods, we met Natura, the owner of the distribution center which we visited during our field trip. Over the past decade, the company has made three acquisitions: 2 unsuccessful ones (Avon and The Body Shop) and one gem (Aesop). Aesop was sold to L'Oréal this year for $2.5bn (purchased for $100 million), enabling the group to considerably reduce its debt burden. The Body Shop (bought from L'Oréal for $1bn) has just been sold for $250 million only, which is good news despite the capital loss. Avon remains a challenge, and its integration with Natura is not yet complete. However, Natura continue to enjoy a strong brand equity domestically, with an evolutionary distribution model. The investment case is interesting because of its attractive valuation, but Avon continues to burn money. Last, we also met Suzano, the world's leading producer of pulp and paper, Totvs (Brazil's equivalent of SAP) and Localiza (Latin America's leading car rental company), the latter two should benefit from lower interest rates.

sted in New York) now boasts 90 million customers (vs. 12 million in 2019) and aims to replicate its Brazilian success in Colombia and Mexico. Still in the banking sector, we also met with investment bank BTG Pactual. While it continues to expand in asset management (AUM of $130bn), its CFO highlighted domestic investors’ still lack of enthusiasm (high rates, political uncertainties). In retail sector, we talked to Lojas Renner (the equivalent of Zara here). The group (which owns the department store we visited in Curitiba), suffers active competition from Shein. Nevertheless, the fashion retailer’s like-for-like sales growth seem to have improved since last summer. We also met the management of Assai (1% of GemEquity). The Cash & Carry retail chain operator, formerly owned by Casino, is now independent. Following the acquisition of Extra (70 stores), it now owns over 300 stores and employs 80,000 people. The integration of Extra and the conversion of its stores to the Cash & Carry format will be completed this year. The group continues to gain market share. However, it has revised down its 2024 expansion plan (from 25 to 15 new stores) in order to reduce its high financial leverage (Debt/EBITDA of 4.4x). Still in consumer goods, we met Natura, the owner of the distribution center which we visited during our field trip. Over the past decade, the company has made three acquisitions: 2 unsuccessful ones (Avon and The Body Shop) and one gem (Aesop). Aesop was sold to L'Oréal this year for $2.5bn (purchased for $100 million), enabling the group to considerably reduce its debt burden. The Body Shop (bought from L'Oréal for $1bn) has just been sold for $250 million only, which is good news despite the capital loss. Avon remains a challenge, and its integration with Natura is not yet complete. However, Natura continue to enjoy a strong brand equity domestically, with an evolutionary distribution model. The investment case is interesting because of its attractive valuation, but Avon continues to burn money. Last, we also met Suzano, the world's leading producer of pulp and paper, Totvs (Brazil's equivalent of SAP) and Localiza (Latin America's leading car rental company), the latter two should benefit from lower interest rates.

MACRO FOCUS :

After a n uncertain 1Q, and just as in 2022, the Brazilian market outperformed in dollar terms (+16% for the Ibovespa and +8% for the BRL = +24% in dollar). The new government led by Lula, whose spendthrift program was feared at the beginning of the year, has not stepped back on pension reform, at least for the time being. The center-right Congress

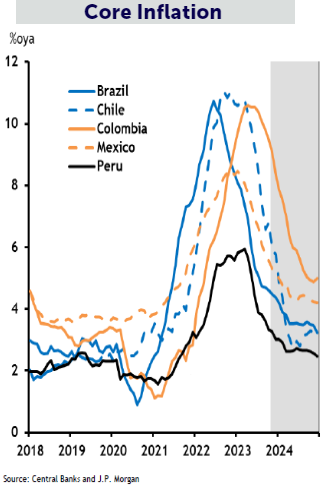

n uncertain 1Q, and just as in 2022, the Brazilian market outperformed in dollar terms (+16% for the Ibovespa and +8% for the BRL = +24% in dollar). The new government led by Lula, whose spendthrift program was feared at the beginning of the year, has not stepped back on pension reform, at least for the time being. The center-right Congress is a salutary counter power and leads a vigorous opposition. For now, the Central Bank, which has proactively increased interest rates from 2% in February 2021 to 13.75% in July 2022, has not been heckled by the government. The change of governor is however scheduled for March 2025. Nonetheless, Banco Central has started monetary easing since last July (3 cuts of 50bp) and should continue to do so in an environment of falling inflation. A further 325bp of easing is expected between now and the end of 2024, with a target of 9% for the SELIC.

is a salutary counter power and leads a vigorous opposition. For now, the Central Bank, which has proactively increased interest rates from 2% in February 2021 to 13.75% in July 2022, has not been heckled by the government. The change of governor is however scheduled for March 2025. Nonetheless, Banco Central has started monetary easing since last July (3 cuts of 50bp) and should continue to do so in an environment of falling inflation. A further 325bp of easing is expected between now and the end of 2024, with a target of 9% for the SELIC.

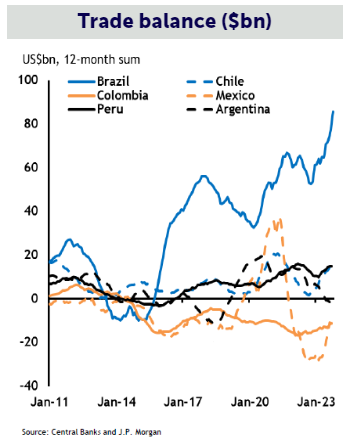

The balance of trade is also healthy, with record exports of cereals and oil. Therefore, even though the interest rate differential between SELIC and FED rate has been narrowing, the currency is holding steady at around 5BRL/$. In terms of exports, it is estimated that the country's oil production will rise from 3.7 Mb/d today to 5-5.5 by 2027, which will represent around 4-5% of world production and a significant source of foreign currency.

This hydrocarbon bonanza should also keep energy costs relatively competitive. In this regard, it is worth noting that Brazil's electricity mix is one of the greenest on the planet: 85-90% renewables (65-70% hydro, 10-12% solar and wind, 8% biomass, 2% nuclear) and around 10-15% fossil.

On the economic front, growth is stronger than expected this year, thanks to the favorable impact of exports (mainly oil and cereals). It should reach 3% in 2023. In 2024, growth is expected to slow to 1.5-2%, but domestic activity will remain strong, with nominal growth at around 6%.

Value Focus: Nubank (market capitalisation of $39bn, 0.5% of GemEquity)

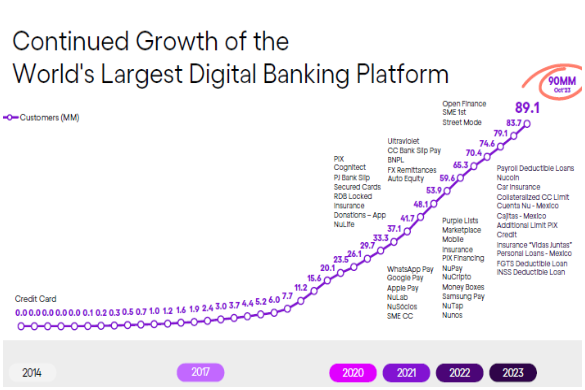

Created in 2013 by Brazilian Cristina Junqueira, Colombian entrepreneur David Vélez, and American Edward Wible, Nubank launched its first financial product in Brazil in 2014: a Mastercard credit card with no annual fee, which could be managed directly from a mobile app. In 2018, the company began offering debit card payments, and in 2019, Nubank became a unicorn, reaching a valuation of $1bn. Going public in December 2021 with supports from Warren Buffet and Sequoia Capital, the fintech has expanded its banking offering (credit cards, interest-bearing bank accounts, consumer credit, insurance, and investment services) in an environment where traditional Brazilian banks invest little in innovation and offer generally expensive services.

Created in 2013 by Brazilian Cristina Junqueira, Colombian entrepreneur David Vélez, and American Edward Wible, Nubank launched its first financial product in Brazil in 2014: a Mastercard credit card with no annual fee, which could be managed directly from a mobile app. In 2018, the company began offering debit card payments, and in 2019, Nubank became a unicorn, reaching a valuation of $1bn. Going public in December 2021 with supports from Warren Buffet and Sequoia Capital, the fintech has expanded its banking offering (credit cards, interest-bearing bank accounts, consumer credit, insurance, and investment services) in an environment where traditional Brazilian banks invest little in innovation and offer generally expensive services.

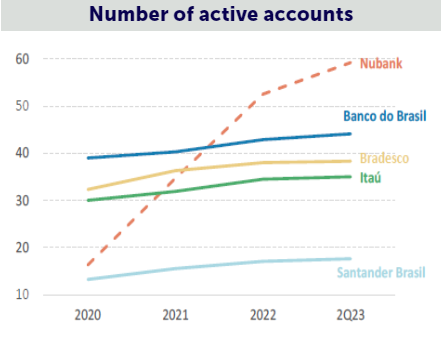

Nubank now has over 90M users, 75M of whom are active. It reaches 50% of the adult population in Brazil, and various surveys show the spectacular increase in its notoriety among Brazilian adults

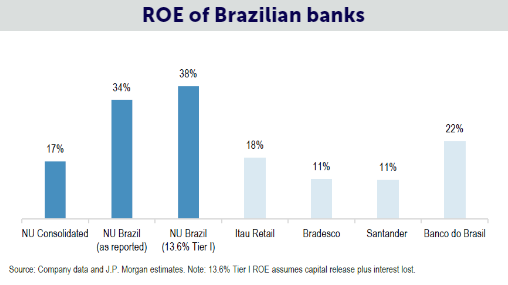

In 3Q23, the company recorded revenues of $2.1bn and net income of $356M (25% ROE). At $10, revenue generated per customer rose by 18% yoy, and the number of active customers by 30%. The loan portfolio (personal and credit cards) reached $15bn (+48% yoy) and deposits $19bn (+26% yoy). On the cost side, Nubank is far more efficient than its competitors. It costs $7 to acquire a customer and $0.9 per month to serve an active customer. Its consumer loan default rate is 6.1% (15% lower than the sector). Over the past 2 years, its cost/income ratio has fallen sharply, and is now at 35% (vs. 55% in 3Q22), in line with the sector. It should fall further, enabling the neo-ban k to win additional customers by taking advantage of this structural cost advantage. Its current ma

k to win additional customers by taking advantage of this structural cost advantage. Its current ma rket share is 15% for credit cards (transactions), 5% for consumer loans and 4% for deposits. The introduction of the portability of salary accounts, and the development of PIX (QR code) payments, have led to greater competition in the sector, which is to Nubank's advantage. In fact, the cost of serving an active customer ($0.9) has barely increased and remains 85% lower compared to that of traditional banks, while revenue per user has practically tripled since 2020 (from $3.4 to $10). It is set to rise further with the introduction of new products (payroll loans, financial products), reaching $23 by 2028.

rket share is 15% for credit cards (transactions), 5% for consumer loans and 4% for deposits. The introduction of the portability of salary accounts, and the development of PIX (QR code) payments, have led to greater competition in the sector, which is to Nubank's advantage. In fact, the cost of serving an active customer ($0.9) has barely increased and remains 85% lower compared to that of traditional banks, while revenue per user has practically tripled since 2020 (from $3.4 to $10). It is set to rise further with the introduction of new products (payroll loans, financial products), reaching $23 by 2028.

Today, the potential market in Brazil is estimated at around $85bn ($27bn for payroll loans, $26bn for personal loans, $23bn for credit cards and $10bn for financial products) and $17bn in Mexico. Cross-selling in Brazil is an opportunity that could double the bank's value. For example, Nubank can grant payroll loans to 8% of its active clientele today, rising to almost 15% within 5 years. As for products such as personal loans and BNPL (Buy Now Pay Later), the penetration rate is still low, and traditional players are not taking an aggressive approach. In Mexico and Colombia, 2 countries where banking services are expensive, are two new markets where Nubank can replicate its Brazilian success. By 2028, Nubank's market share in Brazil is expec

payroll loans to 8% of its active clientele today, rising to almost 15% within 5 years. As for products such as personal loans and BNPL (Buy Now Pay Later), the penetration rate is still low, and traditional players are not taking an aggressive approach. In Mexico and Colombia, 2 countries where banking services are expensive, are two new markets where Nubank can replicate its Brazilian success. By 2028, Nubank's market share in Brazil is expec ted to double (from 8% to 16%), its revenues to rise from $7.5bn to $31bn, and

ted to double (from 8% to 16%), its revenues to rise from $7.5bn to $31bn, and  its profits from $1bn to $8bn. Return on equity should reach 21% this year. It is already higher today than the majority of Brazilian banks and could reach 35% by 2028 if its expansion into Mexico and Colombia are deemed successful.

its profits from $1bn to $8bn. Return on equity should reach 21% this year. It is already higher today than the majority of Brazilian banks and could reach 35% by 2028 if its expansion into Mexico and Colombia are deemed successful.

Bruno Vanier, President of Gemway Assets