HIGHER-FOR-LONGER INTEREST RATE ENVIRONMENT AND MACROECONOMIC DIVERGENCES

We went to Marrakech, Morocco, from October 11 to 13 for this year's autumn meeting of the International Monetary Fund (IMF) and the World Bank (WB). We had the opportunity to meet 11 central bankers and one finance minister. All the participants congratulated the host country on the quality of the organization of this event after the earthquake that affected the country at the beginning of September.

KEY TAKEAWAYS: If higher-for-longer rates are currently the consensus across the central banking community, this does not appear to be a problem for most emerging economies as they pursue their monetary policies. Except for specific cases involving countries with significant pre-pandemic vulnerabilities, the major emerging countries can manage monetary policies based more on their domestic developments. In this sense, they are more independent of US Federal Reserve policy, at least to some extent in the short term. For now, most are adjusting their projections to take account of the recent further tightening of global financial conditions. The representative from Banxico (Mexico) appeared to be the most determined to tighten domestic financial conditions, followed by representatives from Hungary and South Africa. Monetary normalization, which began this year mainly in the LatAm region, should continue cautiously (Brazil, Peru). Chile's central bank seemed a little more aggressive in terms of expected easing, in line with the deceleration in inflation and domestic activity. Despite its economic slowdown, Colombia is unlikely to begin normalizing its monetary policy this year, with still very high inflation and unemployment at a 5-year low. In Mexico, Banxico is keeping all options open and seems ready for further rate hikes given the domestic context (upward revision of growth, pressure on demand expected with the 2024 budget, unemployment rate at its lowest - see Focus below).

Turkey (Presidential republic, population of 83.6M, GDP (ppp) of $2.668Tn)

Red with a vertical white crescent moon (the closed portion is toward the hoist side) and white five-pointed star centered just outside the crescent opening. The flag colors and designs

Red with a vertical white crescent moon (the closed portion is toward the hoist side) and white five-pointed star centered just outside the crescent opening. The flag colors and designs  closely resemble those on the banner of the Ottoman Empire, which preceded modern-day Turkey. The crescent moon and star serve as insignia for Turkic peoples. According to one interpretation, the flag represents the reflection of the moon and a star in a pool of blood of Turkish warriors.

closely resemble those on the banner of the Ottoman Empire, which preceded modern-day Turkey. The crescent moon and star serve as insignia for Turkic peoples. According to one interpretation, the flag represents the reflection of the moon and a star in a pool of blood of Turkish warriors.

Macroeconomic turnaround or just a detour?

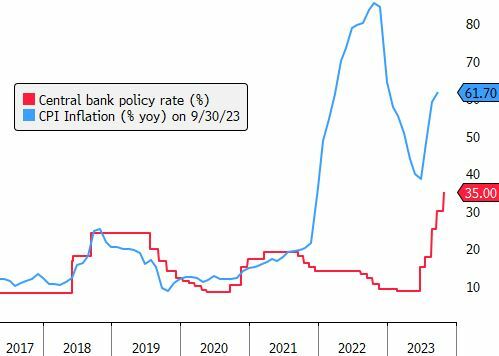

We had the opportunity to meet Mehmet Simsek, Minister of Treasury and Finance, and Hafize Gaye Erkan, Governor of the Central Bank, to review the country's economic and monetary outlook. For several weeks, the two officials have been working hard to communicate their macroeconomic adjustment program transparently and accurately. It aims to restore a rational approach after years of unorthodox policies pursued by President Erdogan. The adjustment program must address six macro challenges: attaining price stability, restoring fiscal health, rebalancing growth, narrowing the current account deficit and rebuilding foreign exchange reserves, exiting the protected Turkish Lira deposit scheme, and implementing structural reforms. A hard-to-implement program in a challenging global backdrop of mediocre trade growth and rising geopolitical risk. The number-one problem facing the Turkish economy is persistently high inflation. The central bank is determined to continue its monetary tightening (see chart 1) until it sees a permanent decline in inflation expectations. Consumer price growth was 61.5% at the end of September and should rise slightly to 65% by the end of the year. The central bank expects inflation to reach 33% by the end of 2024, 15% by the end of 2025, and 8.5% by the end of 2026. The economy is currently in a transition phase and should begin its disinflation phase in mid-2024. For now, prices remain underpinned by imported inflation due to currency depreciation, the spreading of higher oil prices to other sectors, and the fiscal adjustments made by the government before the summer. The monetary tightening process followed a holistic approach, with the increase in policy rates accompanied by quantitative tightening and selective credit tightening, such as a growth cap on loans. Market rates have evolved in line with the convergence of commercial loan and deposit rates. Consumer credit growth normalization is underway to allocate loans more towards productive activity. The 4.4% growth forecast for this year is quite robust compared with the average of the last 20 years (5.4%). The monetary institution projects medium-term growth revised downwards to 4%. The government now wants better quality growth, as the current composition of growth is inflationary. However, the rebalancing of Turkish growth has only just begun and will be a lengthy process. Consumption is still strong, and supply is stable but insufficient overall. Domestic demand remains the main driver of growth. Exports are currently weak due to sluggish external demand. On the fiscal front, February's earthquake will have a significant but transitory impact on the budget deficit (6.4% expected in 2023). Excluding related exceptional expenditures, the budgetary adjustment will continue (structural deficit below 3% this year), helping to keep public debt levels low. At 33% of GDP, indebtedness is less than half the average for emerging countries. To avoid any sustained fiscal deterioration, the government acted on the revenue front as soon as it took office, tripling taxes on gasoline, raising VAT on many goods and services, and increasing corporate income tax by 5 points to 25%. The current account deficit (-5.7% of GDP) worsened compared to 2022 due to gold and food imports. This current deficit (-$57Bn) is covered half by foreign direct investment (FDI). This year, two-thirds of the CA deficit is due to gold imports by households and companies willing to diversify away from largely negative interest rates. Depositors now face positive ex-ante real return. By improving the predictability of the country's economic p olicy, the government hopes to increase FDI (1.6% of GDP on average over the last 20 years). The country is recording a strong tourism performance and is targeting $100Bn in tourism-related revenues by 2028, making it the world's 3rd tourist destination, ahead of the United States. The government aims to reduce its energy dependency by increasing domestic production (>35% of national consumption vs. 31% at the end of 2022), which should help rebuild the country's foreign exchange reserves. These rose from $98Bn at the end of May to $122Bn at the end of September. Household deposits on guaranteed Turkish Lira accounts (known as KKM) and FX deposits have shown signs of inflection since the summer, with an increase in non-guaranteed Lira deposits. The government intends to move forward gradually, offering a more attractive rate of return on unguaranteed Lira deposits to avoid the undesirable effects of a sudden closure of KKM accounts. The country's size, high growth outperformance, central geographical location, high-quality infrastructure, and position as a global energy hub are all major assets. Through structural reforms, the government aims to boost the country's productivity by enhancing human capital and labor market flexibility. The success of this program will depend on the Turkish leadership's ability to establish a virtuous circle: implementation of sound policies, restoration of investor confidence, return of financial inflows, appreciation of the real exchange rate, and disinflation. Although Erdogan has endorsed this new economic program, investors and economists are concerned about how long the President's patience with monetary policy tightening will last. If policy moves in a more orthodox direction, Erdogan's long-standing emphasis on growth presents a serious challenge to policymakers trying to keep inflation under control. March 2024 Local elections, in which Erdogan's AKP is seeking to regain control of Turkey's biggest city, Istanbul, as well as the capital Ankara, are seen as a potential pinch point. If the economy slows down too much, this could lead to a reversal of economic policy, as investors have been used to so many times in recent years. However, the mandate given to the Minister of the Economy seems solid, and it should not be disavowed for local political reasons, as the country is now facing a problem more structural than cyclical in nature. Moreover, the current policy aims to address the electorate's main concern at the last general election, namely inflation.

olicy, the government hopes to increase FDI (1.6% of GDP on average over the last 20 years). The country is recording a strong tourism performance and is targeting $100Bn in tourism-related revenues by 2028, making it the world's 3rd tourist destination, ahead of the United States. The government aims to reduce its energy dependency by increasing domestic production (>35% of national consumption vs. 31% at the end of 2022), which should help rebuild the country's foreign exchange reserves. These rose from $98Bn at the end of May to $122Bn at the end of September. Household deposits on guaranteed Turkish Lira accounts (known as KKM) and FX deposits have shown signs of inflection since the summer, with an increase in non-guaranteed Lira deposits. The government intends to move forward gradually, offering a more attractive rate of return on unguaranteed Lira deposits to avoid the undesirable effects of a sudden closure of KKM accounts. The country's size, high growth outperformance, central geographical location, high-quality infrastructure, and position as a global energy hub are all major assets. Through structural reforms, the government aims to boost the country's productivity by enhancing human capital and labor market flexibility. The success of this program will depend on the Turkish leadership's ability to establish a virtuous circle: implementation of sound policies, restoration of investor confidence, return of financial inflows, appreciation of the real exchange rate, and disinflation. Although Erdogan has endorsed this new economic program, investors and economists are concerned about how long the President's patience with monetary policy tightening will last. If policy moves in a more orthodox direction, Erdogan's long-standing emphasis on growth presents a serious challenge to policymakers trying to keep inflation under control. March 2024 Local elections, in which Erdogan's AKP is seeking to regain control of Turkey's biggest city, Istanbul, as well as the capital Ankara, are seen as a potential pinch point. If the economy slows down too much, this could lead to a reversal of economic policy, as investors have been used to so many times in recent years. However, the mandate given to the Minister of the Economy seems solid, and it should not be disavowed for local political reasons, as the country is now facing a problem more structural than cyclical in nature. Moreover, the current policy aims to address the electorate's main concern at the last general election, namely inflation.

Mexico (Federal presidential republic, population of 129.9M, GDP (ppp) of $2.418Tn)

Three equal vertical bands of green (hoist side), white, and red. Mexico’s coat of arms (an eagle with a snake in its beak perched on a cactus) is centered in the white band; gr

Three equal vertical bands of green (hoist side), white, and red. Mexico’s coat of arms (an eagle with a snake in its beak perched on a cactus) is centered in the white band; gr een signifies hope, joy, and love; white represents peace and honesty; red stands for hardiness, bravery, strength, and valor. The coat of arms is derived from a legend that the wandering Aztec people were to settle at a location where they would see an eagle on a cactus eating a snake. The city they founded, Tenochtitlan, is now Mexico City. Similar to the flag of Italy, which is shorter, uses lighter shades of green and red, and does not display anything in its white band.

een signifies hope, joy, and love; white represents peace and honesty; red stands for hardiness, bravery, strength, and valor. The coat of arms is derived from a legend that the wandering Aztec people were to settle at a location where they would see an eagle on a cactus eating a snake. The city they founded, Tenochtitlan, is now Mexico City. Similar to the flag of Italy, which is shorter, uses lighter shades of green and red, and does not display anything in its white band.

Policy-mix desynchronization

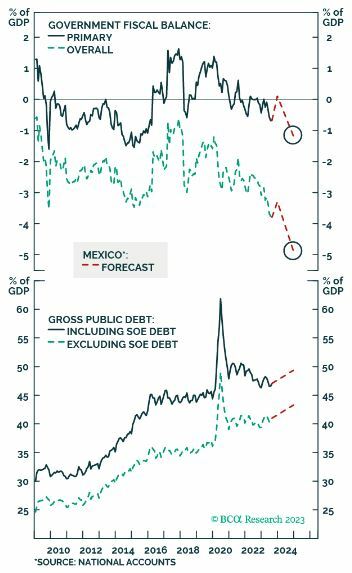

The announcement in early September of a surprisingly expansionary pre-election budget led to the underperformance of Mexican assets within the emerging markets universe. Although the projected budget deficit of 4.9% of GDP is the largest since 1988, it remains relatively limited by international standards and results in a contained primary balance deficit of -1.2% of GDP (see chart 2). It also follows five years of unrivaled fiscal conservatism. Moreover, the level of public debt is low (40% of GDP, 47% including unguaranteed sovereign-owned entities) and would be marginally affected (+2.3 points of additional debt expected - see chart 2). Against this backdrop, we were particularly interested to hear from Jonathan Heath, a leading member of Mexico's central bank (Banxico), on how he may incorporate the expansionary budget into monetary policy. To start, the deputy governor stressed that the volatile components of inflation are beyond the central bank's control and that it is therefore focusing exclusively on core inflation. For him, the disinflation of the general price index (+4.5% yoy to the end of September) was linked to volatile elements (+0.6% yoy) and was mainly the result of luck. This downward trend is now bottoming and should pick up again shortly, requiring increased vigilance from Banxico. On the underlying components (+ 5.8% yoy), merchandise prices (4.6% yoy) tend to follow the global pattern, which is currently going down. The much-mediatic rise in food prices continues to decelerate but remains at a very high level (+7.6% yoy). Services inflation also remains stable at a high level (+5.2% yoy). Banxico has revised its inflation forecasts slightly higher, with a negative output gap and a very tight labor market reflecting vigorous economic activity. The current growth rate is unprecedented for the past decade, underpinned by accelerating investment spending (+21% yoy in Q2) and robust consumer spending growth of around 4% yoy. Unemployment is at an all-time low, and credit growth to both businesses and households remains dynamic. Total economic growth should exceed 3% by the end of the year, probably settling close to 3.5%. In northern Mexico, industrial plants are running at 100% capacity while facing a shortage of workers in the meantime. There are also electricity transmission issues, creating huge bottlenecks. The announcement of a substantial budget deficit for 2024 came as a surprise to the members of the Monetary Committee. It is also a source of concern insofar as it will not help them to bring inflation down. The desynchronization of the policy mix will make their task harder. Banxico will have to pull the brake in 2024 with the government increasing spending. And it will most likely be difficult for the new administration to tighten fiscal policy in 2025.

5.8% yoy), merchandise prices (4.6% yoy) tend to follow the global pattern, which is currently going down. The much-mediatic rise in food prices continues to decelerate but remains at a very high level (+7.6% yoy). Services inflation also remains stable at a high level (+5.2% yoy). Banxico has revised its inflation forecasts slightly higher, with a negative output gap and a very tight labor market reflecting vigorous economic activity. The current growth rate is unprecedented for the past decade, underpinned by accelerating investment spending (+21% yoy in Q2) and robust consumer spending growth of around 4% yoy. Unemployment is at an all-time low, and credit growth to both businesses and households remains dynamic. Total economic growth should exceed 3% by the end of the year, probably settling close to 3.5%. In northern Mexico, industrial plants are running at 100% capacity while facing a shortage of workers in the meantime. There are also electricity transmission issues, creating huge bottlenecks. The announcement of a substantial budget deficit for 2024 came as a surprise to the members of the Monetary Committee. It is also a source of concern insofar as it will not help them to bring inflation down. The desynchronization of the policy mix will make their task harder. Banxico will have to pull the brake in 2024 with the government increasing spending. And it will most likely be difficult for the new administration to tighten fiscal policy in 2025.

In short, the Mexican economy is currently showing signs of overheating, and new demand pressures will emerge under the effects of the announced fiscal stimulus. Therefore, Banxico has to extend its path, and its next decision, depending on the data, could be to increase its policy rate rather than lower it. The number-one priority is inflation, and fiscal dominance is not an issue. Having tightened its monetary policy well ahead of the US Federal Reserve, Banxico can afford a little leeway at present and focus more on domestic issues. As a result, it could tolerate a narrowing of the rate differential up to a certain point in the event of further Fed tightening. When the central bank feels ready to start normalizing its monetary policy, it will look at what its American counterpart will do. Both central banks have historically had a high degree of synchronization, with Banxico reacting faster than the Fed.

Guillaume Riteau