Sunjay Kapur

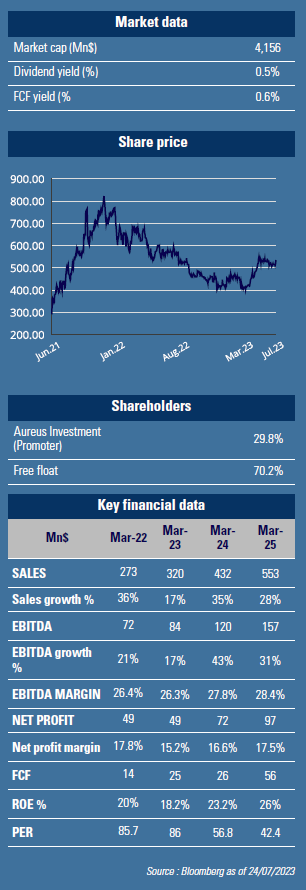

Sunjay Kapur is the Chairman & Non Executive Director of Sona Comstar. Born in 1971, Sunjay comes from the promoter group and has 21 years of experience in the automotive industry. The promoter entity Aureus Investment remains a key shareholder of Sona Comstar (30%). He was also the Managing Director of Sona Koyo Steering Systems. Currently, he serves as an independent director in Jindal Stainless Steel and is the Vice President of Automotive Component Manufacturers Association. He received a B.S degree from University of Buckingham, UK and completed the Owner President Management program at Harvard Business School.

Sonacomstar (Sona) is a leading automotive technology company supplying to Indian and Global OEMs, including leading EV markers.

The company is incorporated in 1995, as Sona Okegawa Precision Forgings, a JV between Sona Group and Mitsubishi Materials. A pioneer in technology of precision formed bevel gears, Sona has successfully expanded its  mono-product offering (in FY99) to a diversified portfolio (17 products in FY23) through both organic development and several value creative acquisitions. Meanwhile, it has also grown its customer base from 18 (FY19) to 68 (FY23).

mono-product offering (in FY99) to a diversified portfolio (17 products in FY23) through both organic development and several value creative acquisitions. Meanwhile, it has also grown its customer base from 18 (FY19) to 68 (FY23).

As a leading supplier of critical components for power transmission system for 4 wheelers, Sona offers differential gears, starter motors (ICEs/hybrids), and differential assembly (for EVs) to global auto makers. Thanks to its proven, cutting-edge technology (developed in-house post the exit of Mitsubishi from the JV) in differential assembly and gear business, and lower cost structure, Sona enjoys highly competitive positioning compared to its peers: it is a dominant player in India for differential gears (55-60% of domestic market share in PV, and 75-90% share in CV and tractor segments) and also a consolidator in differential assembly market (12% global m/s with the potential to reach 19% in FY25) driven by EV adoption with global automotive OEMS. Although the starter motor market volume growth is set to remain muted in the next decade as they are only used in ICEs or mild hybrid vehicles, Sona’s continuous market share gain (mainly from order wins in micro hybrid vehicles in Europe) could help to offset pressure.

market share in PV, and 75-90% share in CV and tractor segments) and also a consolidator in differential assembly market (12% global m/s with the potential to reach 19% in FY25) driven by EV adoption with global automotive OEMS. Although the starter motor market volume growth is set to remain muted in the next decade as they are only used in ICEs or mild hybrid vehicles, Sona’s continuous market share gain (mainly from order wins in micro hybrid vehicles in Europe) could help to offset pressure.

In the meantime, the most interesting opportunities are to be found in rising auto electrification and order wins for new components.

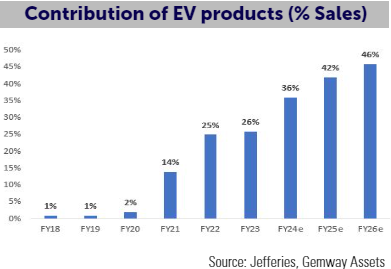

The company, which has been developing capabilities around EV components since 2016, has focused itself on higher-value-added products such as EDL (electronically locking differential) for EV, which is at about 8-10x in value compared to a set of gears. Backed by the first mover advantage and a differentiated & innovative product offer, Sona is uniquely positioned to benefit from this secular growth opportunity. As of 4QFY23, the company’s order book was at Rs215bn, almost 8x FY23 revenue, of which 77% is related to EV. We expect its BEV exposure to contribute to almost half of group sales by FY26 compared to 26% in FY23 and only 2% in FY20. As the growth momentum accelerates in medium term (sales +28% pa, earnings +38% pa for FY23-26), the company could further enhance its already-strong financials (ROE at 26% for FY25, 0 net debt). The stock trades at premium valuation (42x PE FY25) because of its strong fundamentals and the Indian market context. Both GemEquity (0.5%) and GemAsia (1%) have invested in the company.