In the month of May, we spent two weeks in India (Mumbai, Bengaluru and New Delhi), where we met around 30 companies and conducted a field trip wherein we interacted with dealers & visited stores.

In Mumbai, we visited the stores of Reliance Smart (grocery), Nexa by Maruti Suzuki, Tata Motors, D-mart Ready, Voltas, Nykaa, Tira (make-up retail chain launched by Reliance), Mom & Pop grocery stores and spoke with dealers of Asian paints and Polycab. In Bengaluru, we spoke with residential & commercial property developer Prestige estates and visited branches of NBFC player L&T Financial Services. In New Delhi, we attended the 2nd Jefferies India Forum which had 70+ companies and around 150 investors (Domestic & International). We had meetings with government agencies, political experts, industry experts and corporates: HDFC Bank, ICICI Bank, HDFC Life, Paytm, SBI Cards, Aditya Birla Capital & Aptus Value Housing Finance from financial sector, Maruti Suzuki & Sona Comstar from auto sector, Titan, Varun Beverages, Vedant Fashions & MamaEarth (unlisted) from consumer sector, Infosys & Tech Mahindra from IT sector, Max Healthcare from healthcare sector and Bharti Airtel from telecom sector.

In Mumbai, we visited the stores of Reliance Smart (grocery), Nexa by Maruti Suzuki, Tata Motors, D-mart Ready, Voltas, Nykaa, Tira (make-up retail chain launched by Reliance), Mom & Pop grocery stores and spoke with dealers of Asian paints and Polycab. In Bengaluru, we spoke with residential & commercial property developer Prestige estates and visited branches of NBFC player L&T Financial Services. In New Delhi, we attended the 2nd Jefferies India Forum which had 70+ companies and around 150 investors (Domestic & International). We had meetings with government agencies, political experts, industry experts and corporates: HDFC Bank, ICICI Bank, HDFC Life, Paytm, SBI Cards, Aditya Birla Capital & Aptus Value Housing Finance from financial sector, Maruti Suzuki & Sona Comstar from auto sector, Titan, Varun Beverages, Vedant Fashions & MamaEarth (unlisted) from consumer sector, Infosys & Tech Mahindra from IT sector, Max Healthcare from healthcare sector and Bharti Airtel from telecom sector.

Macro Focus

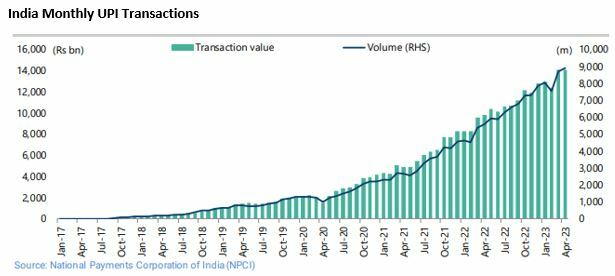

In the past few years, India has taken several initiatives such as the Formalization of Economy. This has enabled the widening of the tax bucket. The GST implementation has improved tax collection which has an all-time high of $22bn in April-23 while the number of GST taxpayers has increased from 6.6M in mid-2017 to 14M+ at end of 2022 Another amazing development since 2020 has been the adoption of digital payment system UPI (United Payments Interface) which is now running at 9bn transactions per month and in value terms totaled $1.7tr last fiscal year. We believe Covid-19 created a habit change amongst Indians to move towards a cashless society which has led to a wide acceptance of UPI across local businesses and consumers. On a personal note, most of the payment transactions made by us on the trip were being processed via UPI. Interestingly, the RBI has opened the UPI platform to travelers from G20 countries to carry out peer-to-merchant transactions. On supply side reforms; there is a strong e mphasis to transform the physical infrastructure in the country with a stated aim to reduce logistics costs from 14-16% of GDP to 9% of the GDP in the next 3 years. Recently, India has commissioned 2,100 km of the 3,500km long rail dedicated to transport goods on the Western and Eastern corridors of the country. The project is expected to achieve 100% completion by March 2024. Meanwhile, there has been a push towards domestic manufacturing which led to the launch of Production Linked Incentive (PLI) schemes with an outlay of $35bn. The PLI scheme has started to attract domestic & international manufacturers, with Foxconn being the latest to announce their manufacturing unit for Apple. These measures undertaken by the government will enable share of manufacturing in GDP to rise from 15.6% in 2022 to 21% in 2031. Last but not least, the Real Estate (Regulation & Development) Act has increased efficiency and accountability in property development. This has led to a sizable cut in residential inventory (a 11-year low in top 7 cities). The property market is expected to sustain a structural recovery with pent-up demand volumes for housing estimated to grow 15% p.a in the next few years.

mphasis to transform the physical infrastructure in the country with a stated aim to reduce logistics costs from 14-16% of GDP to 9% of the GDP in the next 3 years. Recently, India has commissioned 2,100 km of the 3,500km long rail dedicated to transport goods on the Western and Eastern corridors of the country. The project is expected to achieve 100% completion by March 2024. Meanwhile, there has been a push towards domestic manufacturing which led to the launch of Production Linked Incentive (PLI) schemes with an outlay of $35bn. The PLI scheme has started to attract domestic & international manufacturers, with Foxconn being the latest to announce their manufacturing unit for Apple. These measures undertaken by the government will enable share of manufacturing in GDP to rise from 15.6% in 2022 to 21% in 2031. Last but not least, the Real Estate (Regulation & Development) Act has increased efficiency and accountability in property development. This has led to a sizable cut in residential inventory (a 11-year low in top 7 cities). The property market is expected to sustain a structural recovery with pent-up demand volumes for housing estimated to grow 15% p.a in the next few years.

From a political point of view, general elections are scheduled in April-May 2024 and as things stand in the political environment, the c urrent ruling party (BJP) led by Prime Minister Narendra Modi remains favorite to return to power.

urrent ruling party (BJP) led by Prime Minister Narendra Modi remains favorite to return to power.

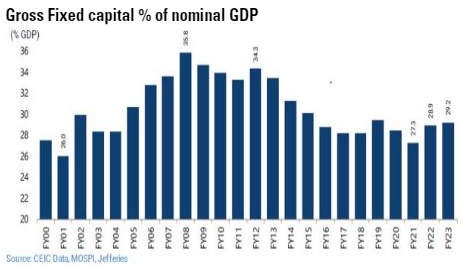

Indian economy continues to show signs of resiliency (GDP +6.5% in FY03/24e), after 2 years of strong growth and despite sluggish global growth. Formalization of economy has led to higher visibility on tax collection. This has allowed the central government to increase investment to 3.3% of GDP in FY03/24 from 2.7% in FY03/23 and has also started to drive private sector confidence as there has been a surge in new project announcements YTD. The gross capital formation to  GDP ratio which had declined from 35.8% in 2008 to 27.1% in 2021, is now back at 29.2% in FY23; indicating India is on cusp of a major capex upcycle (as shown on the graph on the right). The corporate debt-to-equity ratio for large listed companies was at 0.6x, lowest level since 2006 and bank gross Non Performing Loan ratio at 4% lowest since 2018.

GDP ratio which had declined from 35.8% in 2008 to 27.1% in 2021, is now back at 29.2% in FY23; indicating India is on cusp of a major capex upcycle (as shown on the graph on the right). The corporate debt-to-equity ratio for large listed companies was at 0.6x, lowest level since 2006 and bank gross Non Performing Loan ratio at 4% lowest since 2018.

We also observe that Aadhar-based authentication and centralization of credit scoring mandated by Central Bank RBI have been helping lenders in credit disbursal process and improving underwriting outcomes. These factors have created a strong foundation for a more sustainable credit growth. In recent months, CPI inflation has moderated to 4.7% (May 23) vs. 6.1% at the start of the year driven by softer commodity prices, though RBI has kept interest rates unchanged at 6.5%. Meanwhile, rural wages have seen an increase of 5.8% YoY in March 23. This is likely to drive consumption in rural India.

Company Focus: Polycab India Ltd (Sales: $2bn, Market Cap: $7bn)

Started in 1964 as a store for electrical products such as fans, lighting, switches and wires. The company has become one of the largest integrated manufacturers of wires and cables and a prominent player in FMEG (Fast moving electrical goods) segment. It has been listed since 2019. The group has been prioritizing value creation at every stage of the value chain; for instance, they have a unique advantage due to pricing options in their raw material procurement contracts. This enables them to mitigate the volatility of commodity prices. Over the yearsn, Polycab has built a strong manufacturing base : 25 facilities with total annual capacity of 5.4M km of wires & cables, 10.2M fans, 12M switches and 12M switchgears allowing them to manufacture 95% of products in-house. The company has also built-up a wide distribution network of 4,300+ authorized dealers with touch point across 205,000+ retail outlets. They also have fully digitalized this distribution channel, allowing them to deliver products within a period of 24 hours and maintain inventory at optimum levels. These capabilities have enabled the group to obtain a m/s of close to 20% in wires & cable.

Started in 1964 as a store for electrical products such as fans, lighting, switches and wires. The company has become one of the largest integrated manufacturers of wires and cables and a prominent player in FMEG (Fast moving electrical goods) segment. It has been listed since 2019. The group has been prioritizing value creation at every stage of the value chain; for instance, they have a unique advantage due to pricing options in their raw material procurement contracts. This enables them to mitigate the volatility of commodity prices. Over the yearsn, Polycab has built a strong manufacturing base : 25 facilities with total annual capacity of 5.4M km of wires & cables, 10.2M fans, 12M switches and 12M switchgears allowing them to manufacture 95% of products in-house. The company has also built-up a wide distribution network of 4,300+ authorized dealers with touch point across 205,000+ retail outlets. They also have fully digitalized this distribution channel, allowing them to deliver products within a period of 24 hours and maintain inventory at optimum levels. These capabilities have enabled the group to obtain a m/s of close to 20% in wires & cable.

In 2014, the group has expanded into the FMEG segment (synergies with wires & cable segment in terms of raw material sourcing and end consumer) where it grew sales by ~30% CAGR ever since. In this segment, the company has recorded losses in 2022 but has set a goal to achieve EBITDA margin of 10-12% (FY26e). In order to enhance their own R&D and improve product capabilities in this segment, the company has acquired IoT firm Silvan in 2021. It has also partnered with Swiss cable manufacturer Brugg Cables to procure the high-end technology which will allow them to enter the Extra High Voltage market.

Overall, the group is now well positioned to participate in the opportunity arising from the infrastructure-based capex upcycle and the housing demand revival. The company can achieve sales of $2.5bn+ by FY03/26 representing a CAGR of 18%+ with EBITDA margin of 14.5% and ROCE of 30%.

The stock currently trades at a FY03/24e PER of 36.7x.

Company focus: Varun Beverages (Sales: $2bn; Market Cap: $13bn)

In 1991, Varun Beverages entered into bottling and trademark licensing agreement with Pepsico for one region in India. In the past 31 years, the company has formed a strategic relationship with Pepsico; wherein they handle the manufacturing, sales and distribution of brands owned by Pepsico in both carbonated (Pepsi, Pepsi Black, Mountain Dew, Mirinda & 7up) and non carbonated beverages (i.e Energy Drink, Juice based drinks, Ice Tea, Sports Drink, Packaged Water & Diary based beverages) in 6 countries (India, Sri Lanka, Nepal, Morocco, Zambia & Zimbabwe).

In 1991, Varun Beverages entered into bottling and trademark licensing agreement with Pepsico for one region in India. In the past 31 years, the company has formed a strategic relationship with Pepsico; wherein they handle the manufacturing, sales and distribution of brands owned by Pepsico in both carbonated (Pepsi, Pepsi Black, Mountain Dew, Mirinda & 7up) and non carbonated beverages (i.e Energy Drink, Juice based drinks, Ice Tea, Sports Drink, Packaged Water & Diary based beverages) in 6 countries (India, Sri Lanka, Nepal, Morocco, Zambia & Zimbabwe).

From 2018 to 2022, the group has grown volume by 24% p.a to 802 million cases (81% from India). The internal objective is to achieve sales volume of 1 bil lion cases by 2025. Meanwhile in 2019, Pepsico extended the licensing agreement for India with the group until April 2039.

lion cases by 2025. Meanwhile in 2019, Pepsico extended the licensing agreement for India with the group until April 2039.

The group has a strong focus on execution which has led them to build an end-to-end value chain from Manufacturing to Category development to widespread distribution network. The company has 38 production facilities of which 32 are based in India and 6 in international markets. In 2019, the group relaunched an energy drink "Sting" at an attractive price point. This has led the product to achieve a m/s of 88% in its category in 2022 and contributed to 15% of the entire Varun Beverages volumes in India. Currently, the company has presence in 3 million retail outlets in India, with an objective to expand presence to 4.5 million outlets of which 500,00 will be exclusive. The execution capabilities of the group have helped them in building a strong operating leverage in the business, as EBITDA margin has expanded from 18.9% in 2020 to 21.6% in 2022 despite gross margin declining from 56.5% to 51.5% in the same period.

We remain extremely confident on the group's ability to achieve sales growth of 17%+ and EPS growth of 19%+ over 3-year CAGR (2022-2025e), based on their ability to expand product portfolio and gain m/s in south & west regions due to expansion of distribution network.

The stock trades at FY24e PER of 43.9x.

Rishabh CHUDGAR