After 4 years of absence due to COVID, two of our fund managers returned to China where they spent 2 weeks.

After 4 years of absence due to COVID, two of our fund managers returned to China where they spent 2 weeks: company visits in Beijing, Shanghai, Hangzhou, Chengdu, Shenzhen, Huizhou and Dongguan, participation at the 10th annual conference of HSBC in Shenzhen (nearly 80 Chinese companies, many macro speakers). In total, we met up with 40 companies; 15 on site and 25 at the conference; 15 in consumer sector, 14 in new energies, 5 in healthcare, 3 in software, 2 in telecommunications and 1 bank.

In Shenzhen, the first impression is strong: 40% of vehicles (including all taxis) are now electric, as well as all 2-wheelers. The general appearance, quality and size of skyscrapers are more reminiscent of those in Singapore than a city in an emerging country. Such observation could lead to the conclusion that China is now more of a developed country than a developing country. Beyond this year's post-COVID rebound (about +5%), growth could slow down structurally while consumption is to become the main driver. Such paradigm shifts are unprecedented. In the long term, they are positive, growth will be less strong but of better quality (less boosted by the increase in debt). In the short term, they create a certain level of uncertainty that is translated by weak confidence from the middle class which has been affected by stagflation (or decline) of household income (rise in unemployment, fall in variable income, low order visibilities for exporting companies) and by the deleterious climate prevailing in Sino-American relations. In April, retail sales,

In Shenzhen, the first impression is strong: 40% of vehicles (including all taxis) are now electric, as well as all 2-wheelers. The general appearance, quality and size of skyscrapers are more reminiscent of those in Singapore than a city in an emerging country. Such observation could lead to the conclusion that China is now more of a developed country than a developing country. Beyond this year's post-COVID rebound (about +5%), growth could slow down structurally while consumption is to become the main driver. Such paradigm shifts are unprecedented. In the long term, they are positive, growth will be less strong but of better quality (less boosted by the increase in debt). In the short term, they create a certain level of uncertainty that is translated by weak confidence from the middle class which has been affected by stagflation (or decline) of household income (rise in unemployment, fall in variable income, low order visibilities for exporting companies) and by the deleterious climate prevailing in Sino-American relations. In April, retail sales, which nevertheless rose by 18.4% y/y, came at lower than expected and youth unemployment was over 20%.

which nevertheless rose by 18.4% y/y, came at lower than expected and youth unemployment was over 20%.

However, have we reached the “peak” as suggested by the front cover of The Economist magazine?

From the political perspective, Sino-US relations are permanently affected with US long-term investors becoming structurally underweight or even absent from Chinese assets. In the very short term, however, exchanges between Beijing and Washington seem to improve marginally and Secretary of State Antony Blinken’s visit to Beijing on June 18-19 confirmed this trend. For those who expected “positive and concrete actions”, the outcome was disappointing as few specifics had been delivered. But as the main aim for both governments was to restore consistent official communications (disrupted after House speaker Nancy Pelosi’s visit to Taiwan last year), this goal seems to have been achieved. From the economic perspective, the realignment of world trade is reflected in permanently weaker exports and structural overcapacity in certain sectors.

Will China become the Japan of the past 30 years? Our field trips tend to point a different path. Real estate remains in surplus but not everywhere. In Shenzhen, property prices are already very high, resist to fall and yet the city is currently suffering from the decline in export orders. But still, if the export of smartphones to Europe and the United States is falling, that of electric cars is soaring.

To date, BYD (Build Your Dreams) sells nearly 200,000 vehicles per month, including around 12,000 internationally. It is now the leading manufacturer of electric cars in the world (more than 3 million planned this year, ow which 200,000 to 250,000 are destinated for export). Its new models and premunization strategy have enabled the company to increase its domestic market share to 39% in the 1st quarter, more than double compared to that of Tesla.The company is also vertically integrated and manufactures its own EV batteries (legacy business) as well as part of its electronics (around 70%). Thus, in terms of E

To date, BYD (Build Your Dreams) sells nearly 200,000 vehicles per month, including around 12,000 internationally. It is now the leading manufacturer of electric cars in the world (more than 3 million planned this year, ow which 200,000 to 250,000 are destinated for export). Its new models and premunization strategy have enabled the company to increase its domestic market share to 39% in the 1st quarter, more than double compared to that of Tesla.The company is also vertically integrated and manufactures its own EV batteries (legacy business) as well as part of its electronics (around 70%). Thus, in terms of E BITDA margin, the company has reported almost 10%, a level well above that of its local competitors but still below Tesla's 17%. The comparison with the American leader is also eloquent: turnover and EBITDA of $90bn and $9bn respectively for BYD vs. $100bn and $17bn for Tesla, market cap of $102bn for BYD vs. $800bn for Tesla. Also for a margin certainly 2x higher, the American is 8x more capitalized! Worth noting that sales growth for both companies is estimated at c.30% in 2024. At the balance sheet level, the financial situation of the Chinese manufacturer is very healthy (no debt) and ROE is 20%. Despite these solid figures, Berkshire Hathaway, a historical shareholder is unfortunately selling its shares in the short term. The emblematic investor prefers to withdraw from the Chinese market for political reasons.

BITDA margin, the company has reported almost 10%, a level well above that of its local competitors but still below Tesla's 17%. The comparison with the American leader is also eloquent: turnover and EBITDA of $90bn and $9bn respectively for BYD vs. $100bn and $17bn for Tesla, market cap of $102bn for BYD vs. $800bn for Tesla. Also for a margin certainly 2x higher, the American is 8x more capitalized! Worth noting that sales growth for both companies is estimated at c.30% in 2024. At the balance sheet level, the financial situation of the Chinese manufacturer is very healthy (no debt) and ROE is 20%. Despite these solid figures, Berkshire Hathaway, a historical shareholder is unfortunately selling its shares in the short term. The emblematic investor prefers to withdraw from the Chinese market for political reasons.

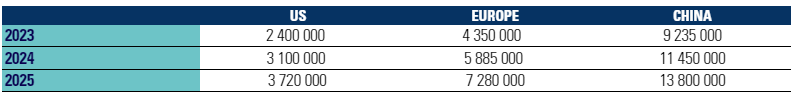

Global Electric Vehicle (EV) market :

In 2022, 80 million cars were sold globally, of which 60 million were with internal combustion engines. EV accounted for only 25% of sales. By region, this penetration rate breaks down as follows: 13% in the US, 26% in Europe and 29% in China. By 2025, the global EV penetration could reach c.45% (24% in the United States, 43% in Europe and 48% in China).

Market size by volume (pure EV, plug-in hybrid, hybrid):

Market growth in volume (2022-2025 annualized): +21% in China, +24% in Europe, +27% in the United States. Given an already high penetration rate today, China is growing less but remains largely the world's leading market.

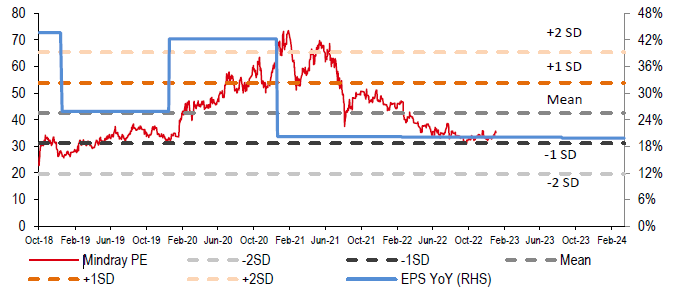

Mindray, the Chinese leader in medical monitoring equipment (monitors, respirators, defibrillators, ultrasound scanners, etc...) founded in 1991 is the world's nb2 in its sector. Its sales revenue, related to export (about 50%) as well as the domestic market, has not weakened and has even increased by 24% over the last 3 years. In 2022 it reached $4.5bn and current forecasts target an annual increase of 20% over the next 3 years. Its net sales revenue by product group is as the following: 44% medical surveillance equipment, 34% in-vitro diagnostics and 21% ultrasound equipment. Its R&D expenditure is at 10% of revenues and provides support to the growth. Since 2020, the EBITDA margin has stabilized at 36%. The financial health is solid (no debt) and ROE exceeds 30%. Let’s not forget that globally, as in China, the COVID pandemic has pushed hospitals to step up investments in intensive care units. Hence the medical equipment sector enjoys a strong growth momentum. In China, consolidation is also a catalyst. Indeed, the purchasing policy of public hospitals considerably limit the margins of manoeuvre of purchasing managers and impact negatively the distributors. In the long-term, it favors players such as Mindray, which does not hesitate to make acquisitions to enlarge its addressable market. Since 2021, the company has participated in centralized hospital procurement purchases at provincial level (Anhui, Jiangsu), in particular for the supply of chemical reagents used for in-vitro diagnostics.

Mindray, the Chinese leader in medical monitoring equipment (monitors, respirators, defibrillators, ultrasound scanners, etc...) founded in 1991 is the world's nb2 in its sector. Its sales revenue, related to export (about 50%) as well as the domestic market, has not weakened and has even increased by 24% over the last 3 years. In 2022 it reached $4.5bn and current forecasts target an annual increase of 20% over the next 3 years. Its net sales revenue by product group is as the following: 44% medical surveillance equipment, 34% in-vitro diagnostics and 21% ultrasound equipment. Its R&D expenditure is at 10% of revenues and provides support to the growth. Since 2020, the EBITDA margin has stabilized at 36%. The financial health is solid (no debt) and ROE exceeds 30%. Let’s not forget that globally, as in China, the COVID pandemic has pushed hospitals to step up investments in intensive care units. Hence the medical equipment sector enjoys a strong growth momentum. In China, consolidation is also a catalyst. Indeed, the purchasing policy of public hospitals considerably limit the margins of manoeuvre of purchasing managers and impact negatively the distributors. In the long-term, it favors players such as Mindray, which does not hesitate to make acquisitions to enlarge its addressable market. Since 2021, the company has participated in centralized hospital procurement purchases at provincial level (Anhui, Jiangsu), in particular for the supply of chemical reagents used for in-vitro diagnostics.

At 30x 2023 earnings, the stock is not cheap, but the quality of management, its governance and the company's growth opportunities justify such a premium.

Regarding consumption, the traffic recovery is strong while per capita spending is still below the 2019 level. Low confidence is the main reason, as consumers are more cautious facing a difficult macroeconomic context. As most companies have focused on value-for-money offerings (ex. Yum China), very few are still confident about the near-term premiumization trend. China Resources Beer remains an exception. Its management continues to aim for increases in both volumes and selling prices (thanks to a better mix effect) this year. While luxury and mass market are outperforming, the polarization of consumer segments appears to be a lasting trend. Mengiu Dairy and Hangzhou Robam share this observation.

In the sportswear segment, Anta Sports Products believes that the recovery is on track to meet its expectations despite a turbulent environment. After having almost halved the level of its inventories at distributors at 4-5 months, management aims at achieving double-digit sales growth this year with an expansion of margins. We are particularly impressed by China's leading cosmetics company Proya Cosmetics. The implementation

In the sportswear segment, Anta Sports Products believes that the recovery is on track to meet its expectations despite a turbulent environment. After having almost halved the level of its inventories at distributors at 4-5 months, management aims at achieving double-digit sales growth this year with an expansion of margins. We are particularly impressed by China's leading cosmetics company Proya Cosmetics. The implementation  of star product and multi-brand strategies went hand in hand with Proya’s superior digital capacity and more efficient internal organization. They have propelled the company to enter a phase of strong growth since 2018. Despite a tougher operating environment, its main brand Proya reaffirmed its position as the domestic skincare leader in 1Q and also during the “6-18” shopping festival: it was the only local brand ranked in the top 5 on Tmall and Douyin with GMV grew 50% and 70%+ yoy respectively on above-mentioned platforms.

of star product and multi-brand strategies went hand in hand with Proya’s superior digital capacity and more efficient internal organization. They have propelled the company to enter a phase of strong growth since 2018. Despite a tougher operating environment, its main brand Proya reaffirmed its position as the domestic skincare leader in 1Q and also during the “6-18” shopping festival: it was the only local brand ranked in the top 5 on Tmall and Douyin with GMV grew 50% and 70%+ yoy respectively on above-mentioned platforms.

In the industrial sector, the automation companies we visited remain cautious about the recovery in demand due to growing macro-economic uncertainties in China and in export markets. They also noted increased competition. Therefore, we will not be surprised to see some companies to adjust their annual forecasts downwards despite promising growth prospects over the long term. This could be the case for Innovance (guided annual sales growth of 20 to 40% y/y this year). Demand for solar equipment and energy storage systems (ESS) is nonetheless still strong. Photovoltaic specialist SC New Energy forecasts that its sales will grow 50% in 2023 and 70 to 80% next year, as indicated by its strong order book. Eve Energy is also confident in its transition from a consumer battery leader to a major electric battery supplier. Despite concerns about overcapacity in the battery market, Eve is well positioned to enter the high-end EV battery segment and to benefit from the explosive growth of the ESS segment (installation +130% y/y in 2023, +40% in 2024).

increased competition. Therefore, we will not be surprised to see some companies to adjust their annual forecasts downwards despite promising growth prospects over the long term. This could be the case for Innovance (guided annual sales growth of 20 to 40% y/y this year). Demand for solar equipment and energy storage systems (ESS) is nonetheless still strong. Photovoltaic specialist SC New Energy forecasts that its sales will grow 50% in 2023 and 70 to 80% next year, as indicated by its strong order book. Eve Energy is also confident in its transition from a consumer battery leader to a major electric battery supplier. Despite concerns about overcapacity in the battery market, Eve is well positioned to enter the high-end EV battery segment and to benefit from the explosive growth of the ESS segment (installation +130% y/y in 2023, +40% in 2024).

Ariel Ying Wang / Bruno Vanier