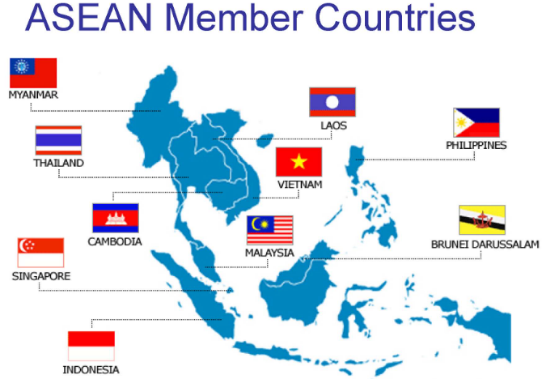

In the month of March, we returned to ASEAN, a region of diversity, versatility, and vibrancy.

As growth uncertainties in developed countries weight on ASEAN manufacturing and exports with spillover to domestic consumption, China reopening has offered a tim

As growth uncertainties in developed countries weight on ASEAN manufacturing and exports with spillover to domestic consumption, China reopening has offered a tim ely boost to partially offset the negative impact from the West. We wanted to better assess investment opportunities created by ongoing digital transformation which has been accelerated by the Covid pandemic, as well as the upside brought by global supply chain relocation. We also wanted to better understand Indonesia’s powerful structural catalysts created by the rise of processed metals exports and the development of Electric Vehicle (EV) supply chain. With these thoughts on mind, we have spent 2 weeks in Thailand and Indonesia, attending the Bangkok-held CLSA ASEAN forum, an annual event gathering 118 corporates and 240 investors (o/w 156 international). We have also conducted a field trip to Indonesia, visiting companies from internet, financial, EV and mining sectors. In total, we had more than 30 meetings with government officials, corporates, and industry experts; including Bank Rakyat, Bank Mandiri, Bank Jago, Dana International from financial sector, Central Retail, HomePro from Consumer Retail sector, Goto, Bukalapak, Bilibli.com from internet sector, BDMS, Medikaloka Hermina, IHH from Healthcare sector.

ely boost to partially offset the negative impact from the West. We wanted to better assess investment opportunities created by ongoing digital transformation which has been accelerated by the Covid pandemic, as well as the upside brought by global supply chain relocation. We also wanted to better understand Indonesia’s powerful structural catalysts created by the rise of processed metals exports and the development of Electric Vehicle (EV) supply chain. With these thoughts on mind, we have spent 2 weeks in Thailand and Indonesia, attending the Bangkok-held CLSA ASEAN forum, an annual event gathering 118 corporates and 240 investors (o/w 156 international). We have also conducted a field trip to Indonesia, visiting companies from internet, financial, EV and mining sectors. In total, we had more than 30 meetings with government officials, corporates, and industry experts; including Bank Rakyat, Bank Mandiri, Bank Jago, Dana International from financial sector, Central Retail, HomePro from Consumer Retail sector, Goto, Bukalapak, Bilibli.com from internet sector, BDMS, Medikaloka Hermina, IHH from Healthcare sector.

Macro focus: Thailand & Indonesia

In Thailand, service industry companies (ex. Central Retail) exhibited strong confidence in their annual outlook as tourism industry (18% of GDP 2019) normalizes with the return of international tourists. The return of Chinese tourists, which is estimated to reach 5.5M arrivals this year (50% of 2019 level and compared to 26M of total arrivals expected) could be a significant boost to tourist receipts and GDP. The potential pass-through, as well as stimulus optimism related to upcoming May general election (political parties pledge to unleash $92Bn) would provide a relief to household consumption. Consumer goods companies (ex. HomePro) are cautiously optimistic about such prospect, as uncertainties remain for farm income. Moreover, Thai economy continues to paint a mixed picture this year because of the weakness in the export-oriented manufacturing activities: after having recorded the lowest export growth in ASEAN in 2022 (+5.3% yoy), the sector faces a deteriorated external environment because of global economic slowdown. Its capacity utilization rate reached the low level of 60.4% in early 2023. As such, the private consumption is likely to remain the main driver of Thai economy (+3.7% yoy) in 2023.

In Indonesia, exports have been a key driver in post-pandemic recovery. We expect the economy to moderate (GDP +4.8% vs. +5.3% in 2022) as the commodity prices normalize. However, the country could benefit fr om its high exposure to domestic sector (84% of GDP) where the demand is resilient as witnessed by improving credit growth. By focus on priority sectors (Green economy) downstream development, Indonesia is set to generate higher value on exports, attract more foreign investments and benefit from positive spillovers across sectors. The country has been very prudent in terms of macro policy. With budget deficit at 2.4% of GDP in 2022 (vs. 4.9% projected initially), Indonesia reached its 3% budget deficit target 1 year ahead of schedule. In near term, it faces rising uncertainty related to 2024 elections. But we also appreciate the structural tailwinds the country enjoys from reform agendas in green energy transitions and EV ecosystem. Besides, it is well prepared to weather external weakness with a solid policy buffer.

om its high exposure to domestic sector (84% of GDP) where the demand is resilient as witnessed by improving credit growth. By focus on priority sectors (Green economy) downstream development, Indonesia is set to generate higher value on exports, attract more foreign investments and benefit from positive spillovers across sectors. The country has been very prudent in terms of macro policy. With budget deficit at 2.4% of GDP in 2022 (vs. 4.9% projected initially), Indonesia reached its 3% budget deficit target 1 year ahead of schedule. In near term, it faces rising uncertainty related to 2024 elections. But we also appreciate the structural tailwinds the country enjoys from reform agendas in green energy transitions and EV ecosystem. Besides, it is well prepared to weather external weakness with a solid policy buffer.

Company focus: GoTo - Gojek Tokopedia (Sales: $1.3Bn; Market Cap: $7.5Bn)

Established in May 2021 via a merger of Gojek, an advanced mobile on-demand services and payments platform in Southeast Asia and Tokopedia, a leading marketplace in Indonesia, GoTo Group operates an ASEAN-based 3-pillar digital ecosystem (on-demand, e-commerce, fintech services) with established brand presence and localized offerings. The group was listed on the Indonesia Stock Exchan ge in April 2022 with strong shareholder support from Taobao China (Alibaba, 9%) and SVF GT Subco from Singapore (9%).

ge in April 2022 with strong shareholder support from Taobao China (Alibaba, 9%) and SVF GT Subco from Singapore (9%).

Thanks to its established market position in several key verticals such as mobility (on-demand transport), food delivery, logistics, e-commerce and fintech, GoTo Group is well-positioned to tap into structural trends in its home market (Indonesia = 99% of revenue) and able to benefit from the rising disposable income, changing lifestyles and economic digitalization. It offers a better medium/long-term growth outlook compared to its more diversified & larger ASEAN internet peers such as Grab and Sea Ltd (GemEquity 1.3%, GemAsia 2.5%) but also suffers higher short-term pressure: in an environment where growth momentum has turned soft for both food delivery and e-commerce because of post-Covid normalization (against a high base), and the sector is striving to demonstrate profitability; GoTo group lags in terms of take rates and margin profile. Despite its aggressive cost optimization measures (ex. cutting 2,000 jobs in 2022-23 or 20% of workforce), the group will only turn EBITDA positive in 2025. We expect the financial pressure to remain elevated as the group has failed to raise funds ($500M convertible bond issue) in an era of rising interest rates, whereas Grab and Sea have both paid down their debt ($600M and $800M respectively). This situation should be positive for Sea Ltd which competes directly with GoTo in Indonesian e-commerce and digital banking activities.

Company focus: Merdeka Copper Gold (Sales: $0.8Bn; Market Cap: $6.5Bn)

Founded in 2012 as a gold mining company with 3 well-connected shareholders (Boy Thohir, Provident Capital and the Saratoga group), Merdeka Copper Gold (MDKA) obtained a mining and production permit for its Tujuh Bukit (TB) gold mine and started construction of the project in 2014. The group was listed in 2015. It has funded an ambitious growth plan with several strategic M&A operations by continuously engaged in bond and equity issuance. Today, Merdeka Copper Gold has grown into a diversified multi-asset mining group with exposure to nickel, copper and gold. The company’s producing assets are Tujuh Bukit Gold (TB Gold) mine, Wetar copper mine and the newly listed subsidiary: Merdeka Battery Materials (MBM). It has formed a partnership with Chinese Tsingshan, the world’s largest refined nickel producer. Chinese EV battery leader CATL has also invested 5% in MDKA in April 2022. With 3 developing assets including Tujuh Bukit Copper project (one of the largest copper resources in the country), Pani gold project and Acid Iron Metal project, MDKA is set to produce >90,000 tons of nickel and 100,000 tons of copper by 2027. This is about 3.2% /0.4% of global expected production. As the only Indonesian company with exposure to both nickel and copper, MDKA is well positioned to participate in the development of EV battery supply chain.

Founded in 2012 as a gold mining company with 3 well-connected shareholders (Boy Thohir, Provident Capital and the Saratoga group), Merdeka Copper Gold (MDKA) obtained a mining and production permit for its Tujuh Bukit (TB) gold mine and started construction of the project in 2014. The group was listed in 2015. It has funded an ambitious growth plan with several strategic M&A operations by continuously engaged in bond and equity issuance. Today, Merdeka Copper Gold has grown into a diversified multi-asset mining group with exposure to nickel, copper and gold. The company’s producing assets are Tujuh Bukit Gold (TB Gold) mine, Wetar copper mine and the newly listed subsidiary: Merdeka Battery Materials (MBM). It has formed a partnership with Chinese Tsingshan, the world’s largest refined nickel producer. Chinese EV battery leader CATL has also invested 5% in MDKA in April 2022. With 3 developing assets including Tujuh Bukit Copper project (one of the largest copper resources in the country), Pani gold project and Acid Iron Metal project, MDKA is set to produce >90,000 tons of nickel and 100,000 tons of copper by 2027. This is about 3.2% /0.4% of global expected production. As the only Indonesian company with exposure to both nickel and copper, MDKA is well positioned to participate in the development of EV battery supply chain.