We were in Budapest and Bucharest on March 14 and 15 to review the Hungarian and Romanian political and economic situation.

On site, we've met with central bankers, deputy finance ministers, heads of issuing agencies, local representatives of the European Commission, and the chief economists of the leading local banks (OTP and Raiffeisen).

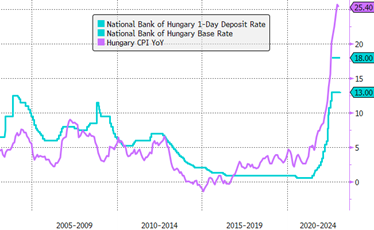

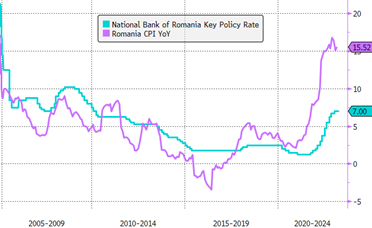

In addition to a common border and NATO membership, these two Eastern European countries share economic similarities. Despite relatively early and significant monetary tightening in nominal terms, annual inflation dynamics of 25.4% in Hungary and 15.5% in Romania are currently among the highest across emerging countries (see Charts 1 a

In addition to a common border and NATO membership, these two Eastern European countries share economic similarities. Despite relatively early and significant monetary tightening in nominal terms, annual inflation dynamics of 25.4% in Hungary and 15.5% in Romania are currently among the highest across emerging countries (see Charts 1 a nd 2). Behind these unfavorable price dynamics are economies externally dependent on food and energy prices and in full employment when the Russian invasion started. A conducive cocktail for second-round effects, with currently double figures annual wage increases (+15%). Unemployment rates remain historically low (respectively 4% and 5.6%). The beginning of the easing of labor markets since H2 2022 due to the tightening of the policy mix (fiscal consolidation and monetary tightening) should continue and contribute, together with the fall in energy prices, to the adjustment of current account balances. With recession fears for 2023 recently downgraded and inflationary dynamics remaining very high, central banks seem more cautious than the market about potential rate cuts this year. These are reassuring approaches in the context of sub-optimal policy mixes.

nd 2). Behind these unfavorable price dynamics are economies externally dependent on food and energy prices and in full employment when the Russian invasion started. A conducive cocktail for second-round effects, with currently double figures annual wage increases (+15%). Unemployment rates remain historically low (respectively 4% and 5.6%). The beginning of the easing of labor markets since H2 2022 due to the tightening of the policy mix (fiscal consolidation and monetary tightening) should continue and contribute, together with the fall in energy prices, to the adjustment of current account balances. With recession fears for 2023 recently downgraded and inflationary dynamics remaining very high, central banks seem more cautious than the market about potential rate cuts this year. These are reassuring approaches in the context of sub-optimal policy mixes.

Hungary (Parliamentary republic, population of 9.7m, GDP (ppp) de $326.2bn)

Three equal horizontal bands of red (top), white, and green; the flag dates to the national movement of the 18th and 19th centuries, and fuses the medieval colors of the Hungarian coat of arms with the revolutionary tricolor form of the French flag; folklore attributes virtues to the colors: red for strength, white for faithfulness, and green for hope; alternatively, the red is seen as being for the blood spilled in defense of the land, white for freedom, and green for the pasturelands that make up so much of the country.

Three equal horizontal bands of red (top), white, and green; the flag dates to the national movement of the 18th and 19th centuries, and fuses the medieval colors of the Hungarian coat of arms with the revolutionary tricolor form of the French flag; folklore attributes virtues to the colors: red for strength, white for faithfulness, and green for hope; alternatively, the red is seen as being for the blood spilled in defense of the land, white for freedom, and green for the pasturelands that make up so much of the country.

Coordination of fiscal and monetary policies needed for a more efficient policy mix

Hungarian growth slowed significantly to +0.4% yoy in Q4 2022 from +8.2% yoy in Q1. Technically, the economy entered a recession with a contraction in the activity of -0.4% in Q4 after -0.7% in the previous quarter. Higher-than-expected inflation and monetary tightening should continue to affect domestic demand, with an expected contraction in private consumption and investment. Only net exports are likely to contribute positively to growth this year, supported by the development of the electric vehicle market and improved price competitiveness (decline in the Forint against the Euro). The cyclical low point is expected in H1 of this year with a contraction of 1% yoy in Q1 and 0.9% in Q2, for an annual growth of 0.3% yoy. Policy measures to protect households from price shocks are a source of uncertainty. For example, last December, the government was forced to abandon the retail fuel price cap introduced at the end of 2021 due to worsening shortages. Other price controls have also proven ineffective, with food price inflation approaching 50 percent by the end of 2022 - the highest rate in the EU and double the regional average - even as the authorities maintain caps on some food items. Despite this, the government has extended its interventions in the financial markets, extending the mortgage rate freeze initiated in November 2021 to mid-2023 and extending the cap measures to loans to SMEs and students. The government also extended for two more years the pre-natal loan scheme, a zero-interest loan for households initially set to expire at the end of 2022. In addition to the economic distortions they cause, these measures limit the central bank's efforts in its fight against inflation. With the price of gas (TTF) currently below 50€/MWh, the dynamic of the balance of payments has improved significantly. The economic slowdown combined with lower energy prices should translate into an improvement of the current account deficit to -4.5% of GDP in 2023 (see Chart 3). In addition, stable gas prices at current levels should translate into a significant improvement in the country's public finances, in the order of 2% of GDP. On the budgetary front, the government wants to quickly comply with the Maastricht deficit  criteria (max. 3% of GDP). The government has presented a budget deficit of 3.9% for this year (see Chart 3). After falling by 6.4 percentage points to 72.9% of GDP by the end of 2022, the country's debt should converge towards 70% this year. Concerning European funds, the government is determined to comply with the requirements of the European Commission to obtain the funds' payment. The local correspondents of the European Commission have constructive professional relations with the Hungarian technical teams. The subject of conditionalities is politically sensitive, and the main point of contention is related to judiciary independence. Many anti-corruption and public procurement measures have already been passed, but the Commission believes additional elements are still missing. Successful negotiations should relieve some pressure off interest rates. Given the uncertainty about the effective release of the European funds, the easing of interest rates - the highest in the EU - should materialize from mid-2023 onwards with falling inflation. In this context, the National Bank of Hungary could gradually reduce its overnight deposit rate (18%) towards its main policy rate (13%) in the coming months, with inflation and the exchange rate as priorities. Given the specific risks and the international financial environment, the NBH will maintain a cautious and patient approach. The open conflict between the government and the NBH should not call into question the independence of the monetary institution. For local observers, it is a communication issue for internal political purposes. Both parties have an aligned political goal for a decrease in inflation. For Deputy Governor B. Virag, the government should emphasize growth for 2024, as the target of 1.5% for this year seems difficult to achieve. In his view, the country needs positive real interest rates for the time being, and in the current highly volatile environment, there is no chance of monetary policy easing materializing in the near term. An explicitly restrictive NBH combined with lower energy prices should benefit the Forint. The central bank has no fears about the banking system in connection with the collapse of Credit Suisse or SVB. The sector liquidity is very high, as are capitalization and profitability. Finally, the current level of the country's foreign exchange reserves is around €40Bn, which covers more than the short-term external debt (€34Bn). The debt agency AKK has already completed 80% of its 2023 external financing program after the multi-tranche issue on January 4 for $4.7Bn. The remaining financing should be done in euros in this year's second semester.

criteria (max. 3% of GDP). The government has presented a budget deficit of 3.9% for this year (see Chart 3). After falling by 6.4 percentage points to 72.9% of GDP by the end of 2022, the country's debt should converge towards 70% this year. Concerning European funds, the government is determined to comply with the requirements of the European Commission to obtain the funds' payment. The local correspondents of the European Commission have constructive professional relations with the Hungarian technical teams. The subject of conditionalities is politically sensitive, and the main point of contention is related to judiciary independence. Many anti-corruption and public procurement measures have already been passed, but the Commission believes additional elements are still missing. Successful negotiations should relieve some pressure off interest rates. Given the uncertainty about the effective release of the European funds, the easing of interest rates - the highest in the EU - should materialize from mid-2023 onwards with falling inflation. In this context, the National Bank of Hungary could gradually reduce its overnight deposit rate (18%) towards its main policy rate (13%) in the coming months, with inflation and the exchange rate as priorities. Given the specific risks and the international financial environment, the NBH will maintain a cautious and patient approach. The open conflict between the government and the NBH should not call into question the independence of the monetary institution. For local observers, it is a communication issue for internal political purposes. Both parties have an aligned political goal for a decrease in inflation. For Deputy Governor B. Virag, the government should emphasize growth for 2024, as the target of 1.5% for this year seems difficult to achieve. In his view, the country needs positive real interest rates for the time being, and in the current highly volatile environment, there is no chance of monetary policy easing materializing in the near term. An explicitly restrictive NBH combined with lower energy prices should benefit the Forint. The central bank has no fears about the banking system in connection with the collapse of Credit Suisse or SVB. The sector liquidity is very high, as are capitalization and profitability. Finally, the current level of the country's foreign exchange reserves is around €40Bn, which covers more than the short-term external debt (€34Bn). The debt agency AKK has already completed 80% of its 2023 external financing program after the multi-tranche issue on January 4 for $4.7Bn. The remaining financing should be done in euros in this year's second semester.

Romania (Semi-presidential republic, population of 18.3m, GDP (ppp) de $588.4bn)

Three equal vertical bands of cobalt blue (hoist side), chrome yellow, and vermilion red; modeled after the flag of France, the colors are those of the principalities of Walachia (red and yellow) and Moldavia (red and blue), which united in 1862 to form Romania; the national coat of arms that used to be centered in the yellow band has been removed. Now similar to the flag of Chad, whose blue band is darker; also resembles the flags of Andorra and Moldova.

Three equal vertical bands of cobalt blue (hoist side), chrome yellow, and vermilion red; modeled after the flag of France, the colors are those of the principalities of Walachia (red and yellow) and Moldavia (red and blue), which united in 1862 to form Romania; the national coat of arms that used to be centered in the yellow band has been removed. Now similar to the flag of Chad, whose blue band is darker; also resembles the flags of Andorra and Moldova.

A restrictive policy mix required by twin deficits and high inflation

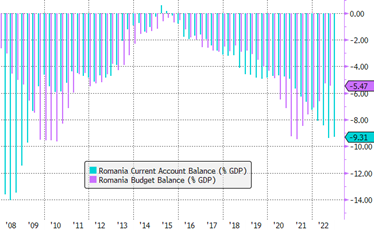

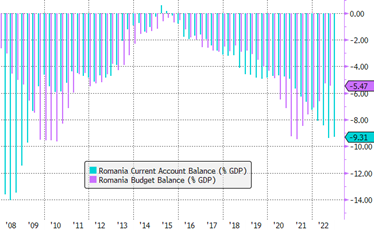

The Romanian economic activity remains particularly robust, with a 4.6% yoy growth in Q4 2022. Domestic consumption slowed in H2 due to the contraction in public spending while the investment grew strongly, particularly in the tax-supported construction and digital sectors. The deceleration of growth to 2% yoy expected this year could surprise the upside due to the investment momentum fueled by European funds. Over 20 22, Romania has received €6.3Bn from the European Recovery and Resilience Plan RRF and €5.3Bn from the Cohesion Fund, for a total of 4% of GDP. The country is currently trying to absorb the remaining 2014-2020 cohesion funds (€10Bn) before the end of the 2023 deadline. It should also benefit from substantial flows from the RRF. The government has forecast a 28% yoy increase in public investment this year, allowing total investment growth of 6% yoy. High inflation (+15.5% yoy to end-February) will continue to affect households' disposable incomes. It should be the main headwind to growth in the Romanian economy this year. Despite an anticipated halving of private consumption growth compared to 2022, the slowdown may not be sufficient to reduce inflation. As in Hungary, the March release shows more persistent core inflation than expected. However, momentum has slowed, mainly due to processed food products, which account for half of the index excluding volatile items. This slowdown should continue and deepen in the coming months, spreading more broadly to goods and services. However, the expected disinflation this year will not be sufficient to bring inflation back to the Central Bank's target (NBR), with the government having planned substantial wage increases this year: a 17% increase in the minimum wage, a 10% increase in public sector wages and a 12.5% indexation of pensions. If these increases are below the inflation rate at the end of 2022, real wage growth should move into positive territory in the second half. The current tensions in the labor market could translate into sustained high nominal wage growth, with the risk of halting the disinflationary momentum expected this year. Apart from a global recession, the robust economic dynamics combined with a tight labor market and insufficiently restrictive real rates could lead the NBR to tighten monetary policy further in the second half of the year. This tightening could take the form of less of a rate hike than liquidity withdrawals from the banking sector. Current account and fiscal balance adjustments progress should be slow, with deficits expected to be respectively -8% and -5% this year, after -9.3% and -6.2% in 2022 (see Chart 4). The twin deficits represent the country's main vulnerability. Unlike Hungary, Romania's current account deficit is more structural, as the country is not really energy dependent. The financing of the current account deficit is partially secured by tra

22, Romania has received €6.3Bn from the European Recovery and Resilience Plan RRF and €5.3Bn from the Cohesion Fund, for a total of 4% of GDP. The country is currently trying to absorb the remaining 2014-2020 cohesion funds (€10Bn) before the end of the 2023 deadline. It should also benefit from substantial flows from the RRF. The government has forecast a 28% yoy increase in public investment this year, allowing total investment growth of 6% yoy. High inflation (+15.5% yoy to end-February) will continue to affect households' disposable incomes. It should be the main headwind to growth in the Romanian economy this year. Despite an anticipated halving of private consumption growth compared to 2022, the slowdown may not be sufficient to reduce inflation. As in Hungary, the March release shows more persistent core inflation than expected. However, momentum has slowed, mainly due to processed food products, which account for half of the index excluding volatile items. This slowdown should continue and deepen in the coming months, spreading more broadly to goods and services. However, the expected disinflation this year will not be sufficient to bring inflation back to the Central Bank's target (NBR), with the government having planned substantial wage increases this year: a 17% increase in the minimum wage, a 10% increase in public sector wages and a 12.5% indexation of pensions. If these increases are below the inflation rate at the end of 2022, real wage growth should move into positive territory in the second half. The current tensions in the labor market could translate into sustained high nominal wage growth, with the risk of halting the disinflationary momentum expected this year. Apart from a global recession, the robust economic dynamics combined with a tight labor market and insufficiently restrictive real rates could lead the NBR to tighten monetary policy further in the second half of the year. This tightening could take the form of less of a rate hike than liquidity withdrawals from the banking sector. Current account and fiscal balance adjustments progress should be slow, with deficits expected to be respectively -8% and -5% this year, after -9.3% and -6.2% in 2022 (see Chart 4). The twin deficits represent the country's main vulnerability. Unlike Hungary, Romania's current account deficit is more structural, as the country is not really energy dependent. The financing of the current account deficit is partially secured by tra nsfers from the EU (4-5% of GDP per year) and stable FDI (around 2% of GDP). The structural budget deficit feeds this external deficit. The government's budget forecasts of -4.4% of GDP this year and -3% in 2024 seem ambitious for both the markets and the NBR. The heavy 2024 electoral calendar (parliamentary, presidential, and local elections) reinforces general skepticism. However, the country benefits from political stability with a rotating coalition committed to fiscal consolidation and the structural reforms attached to European funds. It should result in new inflows to Romania, which will be positive for the balance of payments and the value of the Leu. The managed floating exchange rate regime improves macro-financial stability in the current environment. The Central Bank is clearly in no hurry to pivot. It lacks visibility on the future path of underlying inflation and wants to see several consecutive months of positive real rates before considering a potential easing of policy rates. For the NBR the banking sector's liquidity and capital ratios are adequate, and profitability is high. The level of intermediation is low (at 26%, the lowest in the EU), and the loan-to-deposit ratio is around 70%. The January Eurobond issues ($4.3Bn and €2Bn) covered a large part of the needs for this year (€7Bn). As for Hungary, this is technical support for the country's sovereign credit risk. The remaining external financing for 2023 should be done in H2, in EUR or USD. It could take the form of a green or social bond, the debt agency finalizing its ESG framework with the technical support of the World Bank. Finally, European funds transfers and external bond issues have helped boost the country's foreign exchange reserves (€58Bn) to an all-time high.

nsfers from the EU (4-5% of GDP per year) and stable FDI (around 2% of GDP). The structural budget deficit feeds this external deficit. The government's budget forecasts of -4.4% of GDP this year and -3% in 2024 seem ambitious for both the markets and the NBR. The heavy 2024 electoral calendar (parliamentary, presidential, and local elections) reinforces general skepticism. However, the country benefits from political stability with a rotating coalition committed to fiscal consolidation and the structural reforms attached to European funds. It should result in new inflows to Romania, which will be positive for the balance of payments and the value of the Leu. The managed floating exchange rate regime improves macro-financial stability in the current environment. The Central Bank is clearly in no hurry to pivot. It lacks visibility on the future path of underlying inflation and wants to see several consecutive months of positive real rates before considering a potential easing of policy rates. For the NBR the banking sector's liquidity and capital ratios are adequate, and profitability is high. The level of intermediation is low (at 26%, the lowest in the EU), and the loan-to-deposit ratio is around 70%. The January Eurobond issues ($4.3Bn and €2Bn) covered a large part of the needs for this year (€7Bn). As for Hungary, this is technical support for the country's sovereign credit risk. The remaining external financing for 2023 should be done in H2, in EUR or USD. It could take the form of a green or social bond, the debt agency finalizing its ESG framework with the technical support of the World Bank. Finally, European funds transfers and external bond issues have helped boost the country's foreign exchange reserves (€58Bn) to an all-time high.