At the beginning of March, our compass pointed towards the Gulf countries.

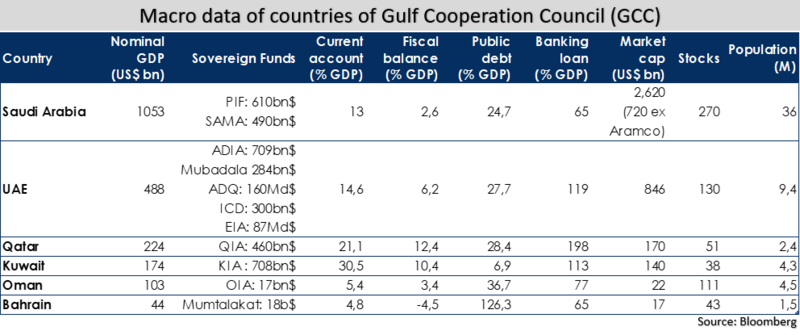

For a week, we met around twenty companies in Doha, Riyadh, Abu Dhabi and Dubai. In Qatar we spoke with the country's main banks (QNB, Masraf, QIB, QSB) as well as with Nakilat, the ma in liquefied gas carrier. In Saudi Arabia, we visited one of Al Hammadi's hospitals, the Nakheel shopping center, tested Americana's restaurants, visited the NCLE school center and met the insurer Tawuniya, the consumer companies Almarai and Jarir as well as Al Arabia, the local JC Decaux. In Abu Dhabi, we visited AD Ports (the country's main port and logistics operator), ADIB (the Emirate's leading bank), Adnoc Distribution (petrol stations) and Yahsat (satellite operator). In Dubai, we were welcomed by HE Saïd Mohammet Al Tayer, CEO of DEWA, the utility operator (water and electricity). We also met the property developer Emaar Properties, the Emirates NBD bank and Salik, the Emirate's motorway concession. First observation: the region remains extremely dynamic. In order to mitigate the region's vulnerability to the global economic cycle and to oil, regional leaders have set up substantial sovereign wealth funds (see table hereby). These allow governments to invest locally in new areas of activity and to diversify internationally. In addition, there is a certain rivalry between the Emirati

in liquefied gas carrier. In Saudi Arabia, we visited one of Al Hammadi's hospitals, the Nakheel shopping center, tested Americana's restaurants, visited the NCLE school center and met the insurer Tawuniya, the consumer companies Almarai and Jarir as well as Al Arabia, the local JC Decaux. In Abu Dhabi, we visited AD Ports (the country's main port and logistics operator), ADIB (the Emirate's leading bank), Adnoc Distribution (petrol stations) and Yahsat (satellite operator). In Dubai, we were welcomed by HE Saïd Mohammet Al Tayer, CEO of DEWA, the utility operator (water and electricity). We also met the property developer Emaar Properties, the Emirates NBD bank and Salik, the Emirate's motorway concession. First observation: the region remains extremely dynamic. In order to mitigate the region's vulnerability to the global economic cycle and to oil, regional leaders have set up substantial sovereign wealth funds (see table hereby). These allow governments to invest locally in new areas of activity and to diversify internationally. In addition, there is a certain rivalry between the Emirati  capitals to attract foreigners (tourists and investors).

capitals to attract foreigners (tourists and investors).

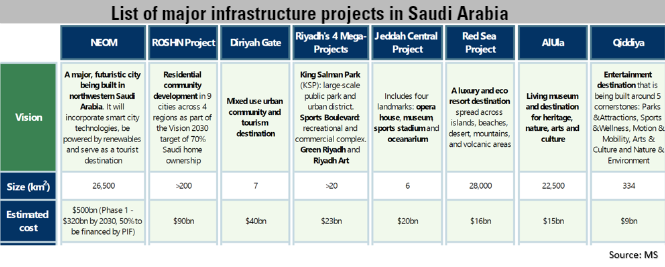

The Kingdom of Saudi Arabia is the largest economy in the region with 36M inhabitants, over $1tr in GDP and $1.1tr in sovereign assets. It is also the deepest financial market with 270 listed securities (and more to come) and a market capitalization (excluding Aramco) at 70% of GDP. Our first trip to the region dates back to January 2020. Today, on the occasion of our 3rd visit, we observed a meaningful change. Vision 2030, a development plan put in place in 2016 when Crown Prince Mohammed Bin Salman took over, continues to shape the country. First, there is an unprecedented openness of young and educated civil society. Cinemas, restaurants and amusement parks are becoming destinations of choice for Saudi families. The plan calls for a $10bn entertainment budget to be rolled out by 2030, with a dedicated ministry in charge. We were able to visit on the one hand Boulevard, a new theme park opening in 2022 and on the other hand, Al Diriyah, a district of the ancient city of Ad Diriyah (see the table of projects below and the photo hereby). In both cases, we were surprised by the influx of local visitors and especially in the theme park, despite the entrance ticket of $30. Secondly, infrastructure projects are going well, especially in the capital, whose population should increase from 7.7M inhabitants currently to 15M by 2030. The urban plan must be redesigned and new neighborhoods created. This densification of the population is an interesting investment theme, particularly through the consumer, health and education sectors. In addition, many other infrastructure projects are on the table (see table below). In doing so, the Saudi authorities also aim to reduce the economic weight of the State and do not hesitate to call on local and foreign private companies to make the execution of projects possible.

The United Arab Emirates (UAE) has 7 emirates, two of which are main: Abu Dhabi and Dubai. The first is rich in hydrocarbons and seeks to diversify into the industrial field, the second has become the main financial center of the region. In terms of GDP, the Emirates are half of Saudi Arabia but their sovereign wealth funds far exceed their Saudi counterparts. Thus they are more active in foreign investments. For foreigners the region is very attractive from a fiscal point of view. However, a corporate tax should be introduced from June 2023. It will vary from 9 to 15% depending on the size of the company. The impact on activity should be monitored in 2024.

become the main financial center of the region. In terms of GDP, the Emirates are half of Saudi Arabia but their sovereign wealth funds far exceed their Saudi counterparts. Thus they are more active in foreign investments. For foreigners the region is very attractive from a fiscal point of view. However, a corporate tax should be introduced from June 2023. It will vary from 9 to 15% depending on the size of the company. The impact on activity should be monitored in 2024.

Qatar, a country of 2.8M inhabitants, of which only 400,000 Qataris, is the 3rd economy of the GCC. Currently, the country digests the frenzy of the World Cup and wonders on the continuation. The streets of Doha are quiet. The banks we met mentioned the companies' lack of appetite for borrowing, the latter being rather in a repayment cycle. Liquidity in the system abounds. Already the world's leading exporter of liquefied gas, Qatar should see its global market share increase considerably with the development of the North Field gas field. Production would increase from 77 mmtpa in 2020 (21% of global demand) to 126 mmtpa by 2027 (26%).

Company focus : Tawuniya (Sales: $3bn; Market Cap: $3.2bn)

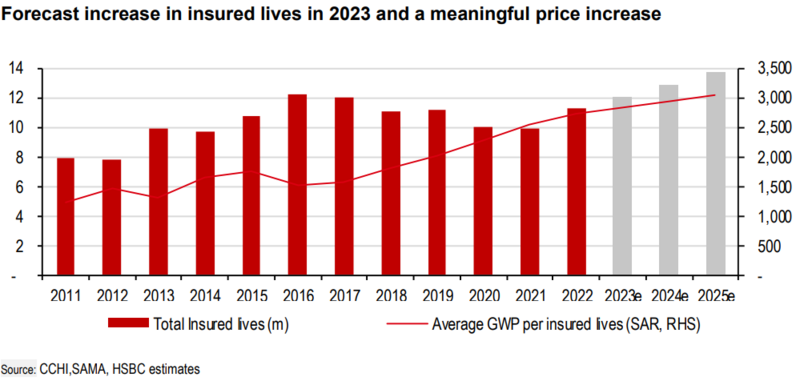

Tawuniya (or Company for Cooperative Insurance), is the second private Saudi insurer with 25% market share. The company, established in 1986, generates 77% of its premiums from health insurance, 6% from motorcycles and the rest from general insurance. Although affected by COVID 19, the market remains buoyant. The Vision 2030 plan counts the health sector and in particular medical insurance among the beneficiaries of the withdrawal of public services. The plan calls for moving Saudis insured by the public system to the private system. Currently, private insurance has 12M customers: 7.5M expatriates and 4.5M Saudis. By 2030 between 12 to 15M people should join the private s

Tawuniya (or Company for Cooperative Insurance), is the second private Saudi insurer with 25% market share. The company, established in 1986, generates 77% of its premiums from health insurance, 6% from motorcycles and the rest from general insurance. Although affected by COVID 19, the market remains buoyant. The Vision 2030 plan counts the health sector and in particular medical insurance among the beneficiaries of the withdrawal of public services. The plan calls for moving Saudis insured by the public system to the private system. Currently, private insurance has 12M customers: 7.5M expatriates and 4.5M Saudis. By 2030 between 12 to 15M people should join the private s ector. Already in 2022, the insured population has increased by 18%. In addition, a recent legislative change should allow insurers to integrate vertically by investing in the clinics and hospitals segment. During our interview, the CEO of Tawuniya shared with us his wish to launch clinics in order to improve the ratio of medical losses (costs of care/premiums) currently at 87%. By way of comparison, the ratio stands at 73% for an integrated player such as Hapvida in Brazil. The medical insurance market is highly consolidated with two players sharing 77% of the insurance premium market: Bupa 46% and Tawuniya 31%. Regarding car insurance, only 50% of cars are insured, i.e. 7M vehicles, while insurance is compulsory. As large cities like Riyadh become denser, law enforcement becomes stricter. In addition, the cost of insurance, which represents about 5% of the value of the vehicle, is not prohibitive. In sum, both insurance segments were strongly affected during the two years of the pandemic. However, they remain structurally well oriented and favor players in the sector both in terms of growth in premiums and in terms of profitability. Premiums written should therefore grow by 15% per year on average between now and 2024, and profits by 28%.

ector. Already in 2022, the insured population has increased by 18%. In addition, a recent legislative change should allow insurers to integrate vertically by investing in the clinics and hospitals segment. During our interview, the CEO of Tawuniya shared with us his wish to launch clinics in order to improve the ratio of medical losses (costs of care/premiums) currently at 87%. By way of comparison, the ratio stands at 73% for an integrated player such as Hapvida in Brazil. The medical insurance market is highly consolidated with two players sharing 77% of the insurance premium market: Bupa 46% and Tawuniya 31%. Regarding car insurance, only 50% of cars are insured, i.e. 7M vehicles, while insurance is compulsory. As large cities like Riyadh become denser, law enforcement becomes stricter. In addition, the cost of insurance, which represents about 5% of the value of the vehicle, is not prohibitive. In sum, both insurance segments were strongly affected during the two years of the pandemic. However, they remain structurally well oriented and favor players in the sector both in terms of growth in premiums and in terms of profitability. Premiums written should therefore grow by 15% per year on average between now and 2024, and profits by 28%.

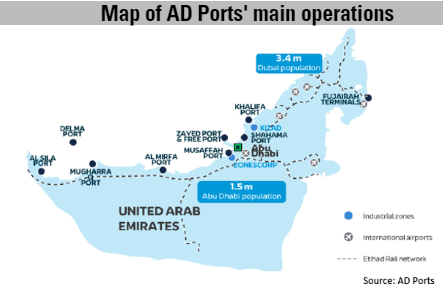

Company Focus : Adu Dhabi Ports (Sales : $1.5bn ; Market Cap : $8.6bn)

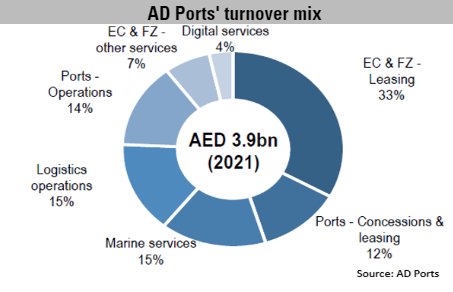

AD Ports is one of the main logistics players in the United Arab Emirates. It is 75% owned by the Abu Dhabi government through its sovereign wea

AD Ports is one of the main logistics players in the United Arab Emirates. It is 75% owned by the Abu Dhabi government through its sovereign wea lth fund ADQ. AD Ports contributes 21% to Abu Dhabi's non-oil GDP and is part of the economic activity diversification plan named Economic Vision 2030. The company's ecosystem includes five activities: the ownership and management of 13 ports (Abu Dhabi, Egypt and Guinea), the management of industrial parks and a free zone (EC & FZ) in Abu Dhabi, a logistics activity, and finally maritime services and digital solutions (e.g. management software of the supply chain). The company thus manages more than half of the Emirate's industrial land and operates its main port, Khalifa, whose handling capacity should double by 2030 to 15M TEU. Nearly 65% of turnover is contracted on the long term (25-30 years) which ensures a relatively predictable source of income, with only 10-15% of turnover linked to the economic cycle according to management. The company, founded in 2006, has seen strong growth of 27% per year between 2018 and 2021, driven by both organic expansion and acquisitions. In February 2022, the company went public and raised $1.1bn. As a regional champion, the company has an ambitious growth target: revenue increa

lth fund ADQ. AD Ports contributes 21% to Abu Dhabi's non-oil GDP and is part of the economic activity diversification plan named Economic Vision 2030. The company's ecosystem includes five activities: the ownership and management of 13 ports (Abu Dhabi, Egypt and Guinea), the management of industrial parks and a free zone (EC & FZ) in Abu Dhabi, a logistics activity, and finally maritime services and digital solutions (e.g. management software of the supply chain). The company thus manages more than half of the Emirate's industrial land and operates its main port, Khalifa, whose handling capacity should double by 2030 to 15M TEU. Nearly 65% of turnover is contracted on the long term (25-30 years) which ensures a relatively predictable source of income, with only 10-15% of turnover linked to the economic cycle according to management. The company, founded in 2006, has seen strong growth of 27% per year between 2018 and 2021, driven by both organic expansion and acquisitions. In February 2022, the company went public and raised $1.1bn. As a regional champion, the company has an ambitious growth target: revenue increa sing by 25-30% per year between 2022 and 2027; EBITDA +20-25%; $4bn spent in capex. Due to massive investments, the company does not generate positive FCF at the moment. Also, in order to finance the expansion, the level of indebtedness could reach 5x ND/EBITDA (vs. 2x currently) without deteriorating the financing costs because the company benefits from the sovereign rating of the Emirate (A+ by S&P). External growth is also under consideration with a focus on India, South East Asia, China, Turkey and Egypt as main markets. On the competitive level, the competition comes mainly from governments with Saudi Arabia, Qatar and Dubai (DP World) among the most ambitious. Nevertheless, the management thinks that there is room for everyone given the size of the market.

sing by 25-30% per year between 2022 and 2027; EBITDA +20-25%; $4bn spent in capex. Due to massive investments, the company does not generate positive FCF at the moment. Also, in order to finance the expansion, the level of indebtedness could reach 5x ND/EBITDA (vs. 2x currently) without deteriorating the financing costs because the company benefits from the sovereign rating of the Emirate (A+ by S&P). External growth is also under consideration with a focus on India, South East Asia, China, Turkey and Egypt as main markets. On the competitive level, the competition comes mainly from governments with Saudi Arabia, Qatar and Dubai (DP World) among the most ambitious. Nevertheless, the management thinks that there is room for everyone given the size of the market.