Li Weiguo

Li Weiguo is the main-founder & Chairman of Oriental Yuhoung. Born in 1965, Li founded Changsha Changhong Construction Waterproof Engieering Co., Ltd in 1995. Since 1998, he has been the Chairman of the Board of the Company. Li remains a key shareholder of Oriental Yuhong (22.7%). He is also the Presient of China Builing Waterproof Association. Prior to Oriental Yuhoung and its predecessor company, Li worked as a Teacher in Hunan University and in Bureau of Statistics of Hunan Province. He received a B.S. degree from Hunan Agricultural University.

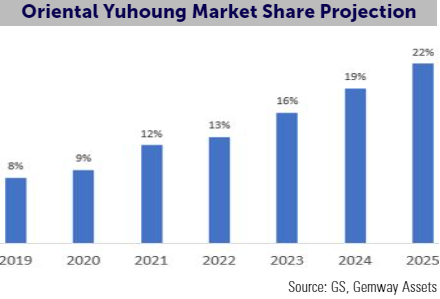

As China’s largest producer of waterproofing materials (12% m/s), Beijing Oriental Yuhong Waterproof Technology Co. (Yuhong) can trace its history back to 1995.

That, when its predecessor company, Changsha Changhong Waterproof Engineering Co. Ltd was founded to undertook waterproof construction projects.

The company has gained national notoriety upon its success in providing waterproof maintenance for the Mausoleum of Mao Zedong, and gradually grows into a leadership position which is three times larger than the second player. On top of Oriental Yuhong, a master brand for waterproof material, the company has also developed several standalone brands in other construction material sectors (e.g. DAW for architectural coatings, Vasa for special motor, and Wonesun for insulation and energy-saving ). These latter power brands generate strong growth by leveraging Yuhong’s superior distribution capabilities and low penetration in their respective categories.

). These latter power brands generate strong growth by leveraging Yuhong’s superior distribution capabilities and low penetration in their respective categories.

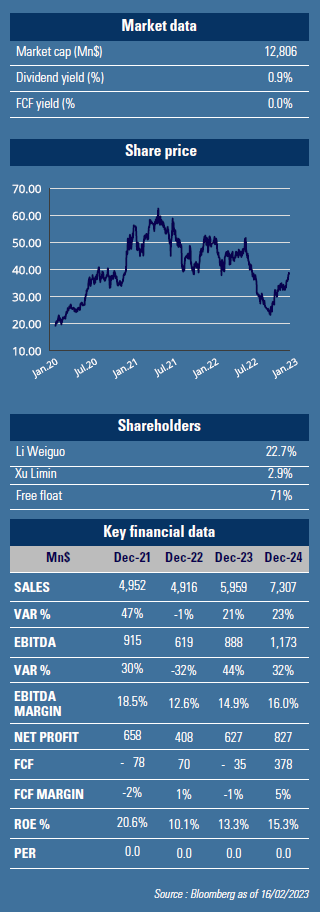

As a result of China property slump (35% of revenue exposure) and strong raw material cost pressure, Yuhong suffered multiple headwinds last year.

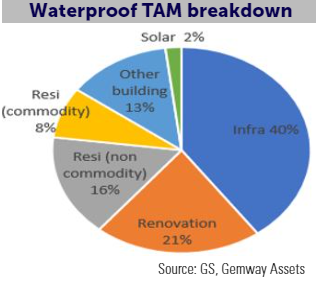

The company saw mild decline in revenue with big drop in margin (estimated GPM to 26.1%, -440 bps yoy). It also booked US$94m of receivable impairments for 9M22 (4% of net receivable). However, such challenges are set to reverse as 2023 opens up a favorable environment in which its revenue could grow at least 15-20 % yoy. On the one hand, the Chinese property sector is bottoming out with supportive government measures, on the other hand, the company could benefit from accelerating infrastructure construction (40% of revenue) as Beijing refocuses on growth. With lower raw material prices and optimized labor structure, the earnings prospects could be even stronger thanks to the operating leverage (EPS +49% yoy)!

% yoy. On the one hand, the Chinese property sector is bottoming out with supportive government measures, on the other hand, the company could benefit from accelerating infrastructure construction (40% of revenue) as Beijing refocuses on growth. With lower raw material prices and optimized labor structure, the earnings prospects could be even stronger thanks to the operating leverage (EPS +49% yoy)!

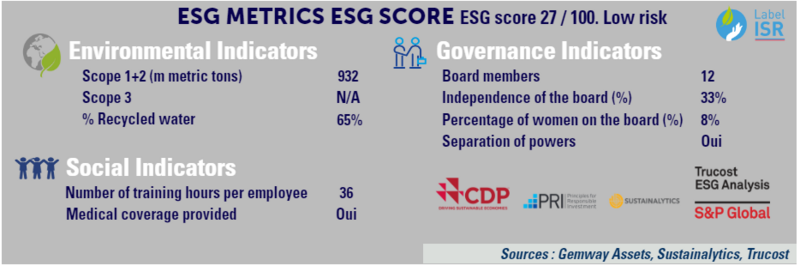

In the longer term, the implementation of new waterproofing regulations in China (80% incremental waterproofing area required with longer durability) effective on April 1 could boost the total addressable market (+60%).

However, market consolidation is also likely to accelerate as small players are being squeezed out of the market. Such changes, create structural opportunities favoring established players of scale such as Beijing Oriental Yuhong. The stock trades at FY23 P/E of 22x with a strong balance sheet (net gearing at 27%). GemEquity (2%), GemAsia (2%), GemChina (2.6%) have invested in the company.