Hou Xiaohai

Mr. Hou Xiaohai is the CEO of China Resources Beer (CR Beer). Since joining the group in 2001, Hou has held key management positions such as Director of Sales and Marketing, General Manager of China Resources Snow Breweries. Prior to CR Beer, he worked for Shougang Corporation, Gallup Poll and Pepsico. He received a B.S. degree in Statistics from Renmin University of China.

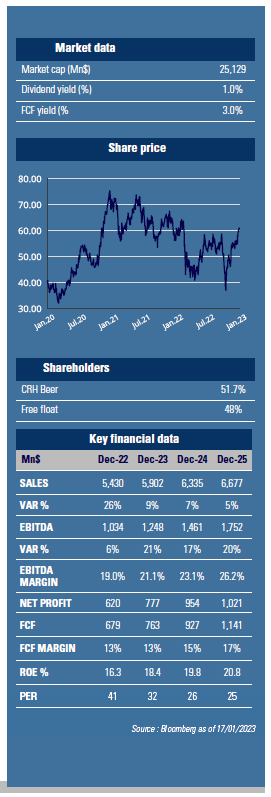

Backed by China Resources (Holdings) Company Limited (CRH), the powerful conglomerate and State-Owned Enterprise, China Resources Beer (CR Beer) is a listed subsidiary that focuses on the manufacturing and distribution of beer products.

The group entered the beer industry by acquiring Shenyang Snow brewery in 1993. Its partnership with South African Breweries (SAB), between 1994 and 2016, had also contributed to its rapid development. As the Snow brand topped both national and global best-selling rankings, CR Beer became China’s largest brewer by volume (25% m/s). Owning to the sector’s high exposure (50% of sales volume) to on-trade channel (restaurants, bars, hotels, nightclubs), CR Beer and its brewer counterparts are all by nature beneficiaries of China reopening.

Yet the group seems one of the best positioned to win “reopening & beyond”.

As a result of an aggressive capacity optimization in 2016-21, CR Beer reduced its brewery count from 98 to 65 while its employee base was more than halved from 58,200 to 25,000. Such effort had led to a significant improvement of its utilization rate which increased from 54% to 61%. The quality of its product portfolio has also been enhanced through the acquisition of Heineken China’s business and assets in 2019, in exchange for c. 20% of its shares. As well-established international brands such as Heineken, Amstel, and Edelweiss were added to its portfolio, the group has expanded its presence in the premium segment. This move has also helped CR Beer to gain the upper hand towards competition: as China domestic beer volume has stabilized at about 45m KL over the past years, after peaking in 2013, premiumization has created the only major opportunity of growth. While the group has started to test opportunities beyond beer segment (by acquiring 55.19% of Jinsha Winery, a baijiu company), its premium beer offering should generate the highest growth in next years.

The segment is set to grow at least at 20-30% pa post COVID normalization vs. steady China total beer volume.

Management seems quite confident about its enhanced product portfolio and upgraded distribution system (restructured based on premium segment volume and business potential). The group plans to expand the sales exposure to premium & sub-premium products to 30-40% of sales volume in 2025 (vs. 17% in 2021). As such, the profitability is likely to rise (GPM at 42.2% in 2023 vs. 40% in 2022), driven by mix upgrades, moderating cost pressures, and operating leverage. The stock trades at 32x 2023 PER against 23% pa of EPS growth. Its balance sheet remains unlevered with more than $2bn of net cash. GemEquity (1.5%), GemAsia (1.5%), GemChina (2%) have invested in the company.