We just spent a week in Seoul, where we met 20 companies and spoke to sector experts and strategist.

While half of the MSCI Korea index is composed of semiconductor stocks, we prefered to focus on industrial and consumer companies in our meetings. We met with the world's top three battery manufacturers outside of China: LG Energy Solutions, Samsung SDI and SK Innovation. We were particularly interested in the battery and renewable energy value chain. We met with POSCO Chemical, Chunbo, SKC, L&F Materials, Doosan Fuel Cell, Hansol Chemical and OCI. We also met with Hyundai and Kia, the two leading car manufacturers, Coupang, leading online shopping site in Korea and LG H&H, the parent company of luxury cosmetics brand History of Whoo. We also visited the factory of the biotech sub contractor Samsung Biologics.

South Korea is a country of fascinating contrasts. On the one hand, the society is turned towards the future driven by the dynamism of the technological sector (Samsung, LG, SK Group) and the hyper connectivity of the young Koreans. On the other hand, the society is held back by a hierarchical tradition based structure, inspired on conficuanism. Women have to defend their independence and entrepreneurship is hardly valued. A young graduate generally aims to join one of the famous "chaebols" (Korean conglomerates) as the latter employ nearly half of the working population. South Koera counts 52M population but is suffering from a demographic decline. In 2021 the country recorded its first population decline since 1949 while it is still fairly closed to immigration and women birth rate is as low as 0.7. The participation rate of women is increasing, but very slowly. Today, 52% of the women over 15 years work (46% in 2000) compared to 72% of men (stable). However, the wage gap remains very high at 35% compared to an OECD average of 14% and even higher than Japan (25%). The office culture remains strongly male-dominated even though women now have the same level of education. At the executive level, barely 5% are women compared to 43% in France. This being said, changes could happen. On the one hand, the main conglomerates are transferring the reins over to the new generation (see the image opposite) which is more open as most of them were educated abroad. As a reminder, the parents experienced the opening of the financial market to foreign investors only in 1992. This was followed by a devasting financial crisis in 1997-98, when many conglomerates disappeared. On the other hand, ESG issues do not spare Korean companies, which are subject to scrutiny of both their western customers and foreign investors. In fact, the Korean economy is still strongly export-oriented and we were surprised by the enthusiam expressed by the companies we met, in front of the opportunities offered by the Climate thematic (electric vehicles and renewable energies).

young Koreans. On the other hand, the society is held back by a hierarchical tradition based structure, inspired on conficuanism. Women have to defend their independence and entrepreneurship is hardly valued. A young graduate generally aims to join one of the famous "chaebols" (Korean conglomerates) as the latter employ nearly half of the working population. South Koera counts 52M population but is suffering from a demographic decline. In 2021 the country recorded its first population decline since 1949 while it is still fairly closed to immigration and women birth rate is as low as 0.7. The participation rate of women is increasing, but very slowly. Today, 52% of the women over 15 years work (46% in 2000) compared to 72% of men (stable). However, the wage gap remains very high at 35% compared to an OECD average of 14% and even higher than Japan (25%). The office culture remains strongly male-dominated even though women now have the same level of education. At the executive level, barely 5% are women compared to 43% in France. This being said, changes could happen. On the one hand, the main conglomerates are transferring the reins over to the new generation (see the image opposite) which is more open as most of them were educated abroad. As a reminder, the parents experienced the opening of the financial market to foreign investors only in 1992. This was followed by a devasting financial crisis in 1997-98, when many conglomerates disappeared. On the other hand, ESG issues do not spare Korean companies, which are subject to scrutiny of both their western customers and foreign investors. In fact, the Korean economy is still strongly export-oriented and we were surprised by the enthusiam expressed by the companies we met, in front of the opportunities offered by the Climate thematic (electric vehicles and renewable energies).

Industry focus: The EV battery value chain and the implications of the US Inflation Reduction Act (IRA)

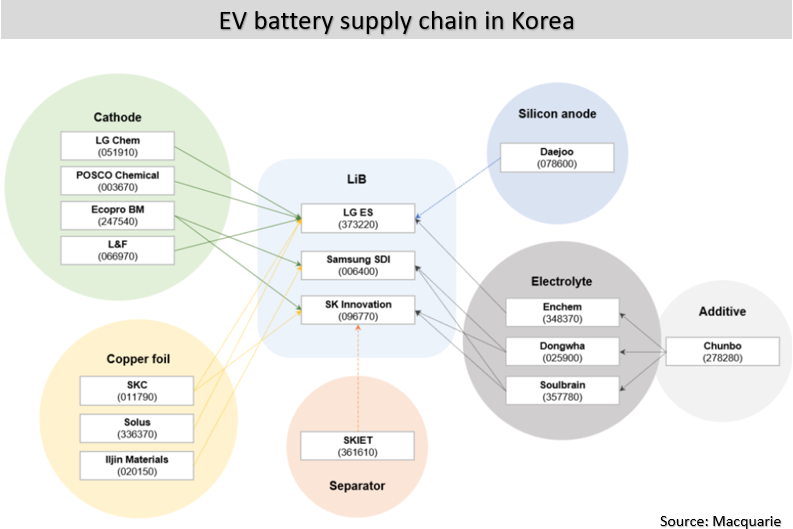

During our trip we discussed a lot about the Inflation Reduction Act (IRA) enacted in the United States on August 16th. The act is a set of measures allowing the United States to reduce their greenhouse gas emissions by 50% by 2030. It is a $400Bn funding package, to be deployed over the next ten years in the green vehicles and renewable energy industries. For the green vehicles in particular, the subsidies are in twofold: the consumer credit o f $ 7,500 per vehicle and manufacturing credit of $35 to $ 45/kWh for the battery manufactrer, or 20-28% of the cost of battery. In-order to benefit from these credits, automakers and battery makers should install capacities in the US and gradually divert the supply of key raw materials from China to FTA countries. The requirement as it is announced now will be hard to implement and could be inflationary as 70 to 90% of key raw materials come from China. There might be some adjustments annonced by early 2023. But the trend is settled and Korean companies plan to benefit from it. Indeed Korea is the only country with a fairly sophisticated value chain (see chart opposite). To start with, it is home to the 3 largest manufacturers outside of China: G Energy Solutions (1% of GemEquity), Samsung SDI and SK Innovation. All three have signed contracts with automakers for 400GWh of new capacity to be built in the US by 2026. Battery demand is expected to grow from 800GWh in 2022 to 3,500GWh in 2030. Electric vehicle penetration should grow from 14% in 2022 to 50% by 2030. Currently, 57% of global EV sales occur in China, 24% in Europe and only 10% in the US. The base is small in the US and that is where the strongest growth should come from in the years to come.

f $ 7,500 per vehicle and manufacturing credit of $35 to $ 45/kWh for the battery manufactrer, or 20-28% of the cost of battery. In-order to benefit from these credits, automakers and battery makers should install capacities in the US and gradually divert the supply of key raw materials from China to FTA countries. The requirement as it is announced now will be hard to implement and could be inflationary as 70 to 90% of key raw materials come from China. There might be some adjustments annonced by early 2023. But the trend is settled and Korean companies plan to benefit from it. Indeed Korea is the only country with a fairly sophisticated value chain (see chart opposite). To start with, it is home to the 3 largest manufacturers outside of China: G Energy Solutions (1% of GemEquity), Samsung SDI and SK Innovation. All three have signed contracts with automakers for 400GWh of new capacity to be built in the US by 2026. Battery demand is expected to grow from 800GWh in 2022 to 3,500GWh in 2030. Electric vehicle penetration should grow from 14% in 2022 to 50% by 2030. Currently, 57% of global EV sales occur in China, 24% in Europe and only 10% in the US. The base is small in the US and that is where the strongest growth should come from in the years to come.

Stock focus: POSCO Chemical (Market Cap $11Bn; Sales $2.7Bn)

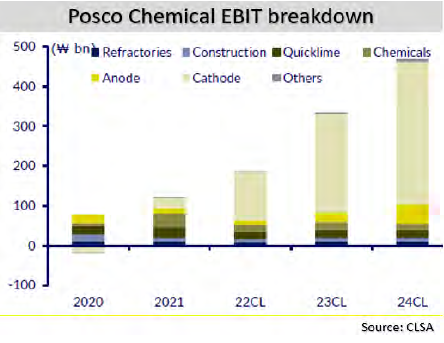

Posco Chemical, a 60% owned subsidiary of POSCO Group, is a chemical specialist with future growth dependant on battery components. Indeed, the company manufactures two of the four main EV battery components: the  cathode (45% of a battery's cost) and the anode (10-20% of the cost). The cathode is the component responsible for the density of a battery while the anode determines the charging speed and lifespan. The cathode is composed of lithium, nickel, aluminum, manganese, cobalt. The recipe changes according to the technology but the trend is to gradually eliminate cobalt and increase the share of nickel. The cathode market is expected to grow in line with the battery market. Posco Chemical expects to increase its capacity by 6x by 2030 (vs 100KT in 2022) and secure 20% of the market. As for the anode, which is mainly made from graphite, synthetic silicon and copper, PoscoChem is the only player outside China with sufficient scale effect. The goal is also to have 20% of the market by 2030, with capacity increasing from 85KT in 2022 to 170KT in 2026 and 320KT in 2030. In addition, Posco Chemical is supported by its parent company. The latter is investing worldwide in the exploration, production and recycling of the main raw materials. Posco Holding is expected to supply more than 80% of Posco Chemical's nickel and lithium requirements. In terms of geograhical location, Posco Chemical is already established in Canada through a JV with General Motors. By 2025, based on current contracts and company projections, Korea is expected to account for 50% of cathode production capacity, followed by the US at 17%, China 10%, Canada 9%, EU 9% and Indonesia 6%. The company adds capacity after signing binding contracts. Those ensure a minimum sales volumes, an operating margin of around 8% and a ROIC of 12%. The company seems to have little concern about contract cancellations in the event of a market downturn. At the R&D level, the subsidiary also benefits from synergies with the parent company, as teams are shared. The company has a healthy balance sheet with ND/Equity ratio of 20%. The cathode and the anode will allow the company to grow by about 50% CAGR by 2024 (vs. 8% CAGR between 2018 and 2020) and ensure an EBITDA margin of nearly 10%. The valuation seems high at 30x EV/EBITDA 2023, but the execution could surpise.

cathode (45% of a battery's cost) and the anode (10-20% of the cost). The cathode is the component responsible for the density of a battery while the anode determines the charging speed and lifespan. The cathode is composed of lithium, nickel, aluminum, manganese, cobalt. The recipe changes according to the technology but the trend is to gradually eliminate cobalt and increase the share of nickel. The cathode market is expected to grow in line with the battery market. Posco Chemical expects to increase its capacity by 6x by 2030 (vs 100KT in 2022) and secure 20% of the market. As for the anode, which is mainly made from graphite, synthetic silicon and copper, PoscoChem is the only player outside China with sufficient scale effect. The goal is also to have 20% of the market by 2030, with capacity increasing from 85KT in 2022 to 170KT in 2026 and 320KT in 2030. In addition, Posco Chemical is supported by its parent company. The latter is investing worldwide in the exploration, production and recycling of the main raw materials. Posco Holding is expected to supply more than 80% of Posco Chemical's nickel and lithium requirements. In terms of geograhical location, Posco Chemical is already established in Canada through a JV with General Motors. By 2025, based on current contracts and company projections, Korea is expected to account for 50% of cathode production capacity, followed by the US at 17%, China 10%, Canada 9%, EU 9% and Indonesia 6%. The company adds capacity after signing binding contracts. Those ensure a minimum sales volumes, an operating margin of around 8% and a ROIC of 12%. The company seems to have little concern about contract cancellations in the event of a market downturn. At the R&D level, the subsidiary also benefits from synergies with the parent company, as teams are shared. The company has a healthy balance sheet with ND/Equity ratio of 20%. The cathode and the anode will allow the company to grow by about 50% CAGR by 2024 (vs. 8% CAGR between 2018 and 2020) and ensure an EBITDA margin of nearly 10%. The valuation seems high at 30x EV/EBITDA 2023, but the execution could surpise.

Stock focus: SKC (Market Cap $2.9Bn; Sales $2.9Bn)

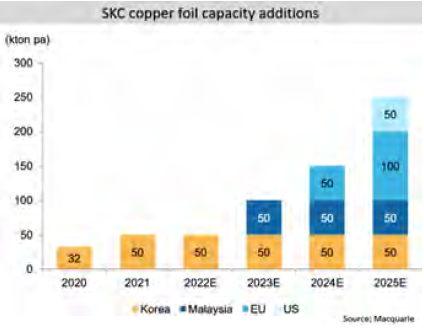

SKC, 47% owned by the SK Group, is another interesting company in the battery value chain. Founded in 1976, it used to be a chemical company, specializing in plastic film, semiconductor materials and cosmetics. However, for the past two years the company has been transforming its business model. In 2021, SKC divested the plastic film business, which was barely profitable but consumed cash flow. That triggered balance sheet improvement with ND/E falling from 100 to 10%. In additions in January 2020, SKC acquired the largest ex-China copper foil producer, renamed SK Nexilis. Copper foil is an indispensable component in the anode. In fact today SKC controls 50% of the copper foil capacity outside of China and plans to increase its capacity by 5x by 2025, following its customers in Poland and the US. In order to meet their ambitious investment program, SKC has secured the supply of equipment from Japanese suppliers till 2025. In addition, it has just signed a contract with the Malaysian government to secure the supply of hydroelectricity for their next plant in the country and all the raw materials are from a recycled source, abundant in Korea. The company fully embraces the renewable story. Among customers, LG ES accounts for 50% of sales, followed by CATL and SK Innovation at 15% each; SDI and Panasonic at 10% each. By 2025 the share of Korean customers is expected to increase. The operating margin in copper foil is 13%, stable and the segment share in sales is expected to grow from 20% in 2022 to 70% by 2026. For the time being, the rest of the chemical business is still creating volatility in sales and profits. In addition, the company continues to invest, both organically and through acquisitions in synthetic silicon (a component that could replace graphite in the anode) and new semiconductor materials. It is a good example of a company that restructures itself over the years to adapt to new growth opportunities. In the short term, 2023 might be affected by the slowdown in the chemical segment given recession risks worldwide. But starting from 2024, sales are set to rebound as the copper foil should contribute more significantly to the earnings. The stock is currently trading at P/E 2024 of 15x.

SKC, 47% owned by the SK Group, is another interesting company in the battery value chain. Founded in 1976, it used to be a chemical company, specializing in plastic film, semiconductor materials and cosmetics. However, for the past two years the company has been transforming its business model. In 2021, SKC divested the plastic film business, which was barely profitable but consumed cash flow. That triggered balance sheet improvement with ND/E falling from 100 to 10%. In additions in January 2020, SKC acquired the largest ex-China copper foil producer, renamed SK Nexilis. Copper foil is an indispensable component in the anode. In fact today SKC controls 50% of the copper foil capacity outside of China and plans to increase its capacity by 5x by 2025, following its customers in Poland and the US. In order to meet their ambitious investment program, SKC has secured the supply of equipment from Japanese suppliers till 2025. In addition, it has just signed a contract with the Malaysian government to secure the supply of hydroelectricity for their next plant in the country and all the raw materials are from a recycled source, abundant in Korea. The company fully embraces the renewable story. Among customers, LG ES accounts for 50% of sales, followed by CATL and SK Innovation at 15% each; SDI and Panasonic at 10% each. By 2025 the share of Korean customers is expected to increase. The operating margin in copper foil is 13%, stable and the segment share in sales is expected to grow from 20% in 2022 to 70% by 2026. For the time being, the rest of the chemical business is still creating volatility in sales and profits. In addition, the company continues to invest, both organically and through acquisitions in synthetic silicon (a component that could replace graphite in the anode) and new semiconductor materials. It is a good example of a company that restructures itself over the years to adapt to new growth opportunities. In the short term, 2023 might be affected by the slowdown in the chemical segment given recession risks worldwide. But starting from 2024, sales are set to rebound as the copper foil should contribute more significantly to the earnings. The stock is currently trading at P/E 2024 of 15x.