MR. HISASHI TAKEUCHI

Aged 58, Mr Hitashi Takeuchi was promoted to the position of Managing Director of Maruti Suzuki in April 2022. A graduate of economic studies at Yokohama National University in 1986, he began his career with the Suzuki group in Japan. Over the years he rose through the ranks to become Commercial Director of Maruti World in 2019. In his new role within Maruti Suzuki, he brings 33 years of commercial experience with the Japanese brand.

Maruti Suzuki is the heir of an Indian joint venture founded in 1981 between the Indian government and the Japanese car manufacturer Suzuki.

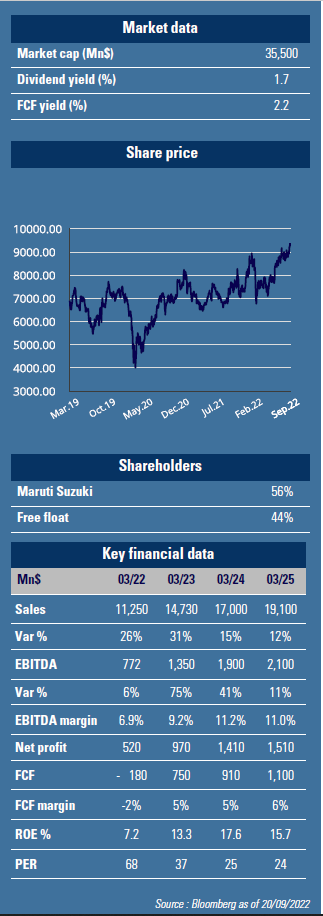

From 1991, the decade of economic liberation in India, Suzuki gradually increased its stake to reach 56.4% in 2003. It was also the year of Maruti's IPO and complet stake sale by the government.

The automotive market in India is anecdotally small considering the size of the population (1.3 billion people). In 2022, it should reach 3M vehicles sold, in line with 2019. That is the equivalent of the Brazilian market, a country with 1/4 of the Indian population. Also at an equivalent population size, China sells 25M vehicles per year. The issues in India are the affordability and the infrastructure. In India the GDP/capita is $2,000 vs. $7,000 in Brazil and $11,000 in China. India is currently at the same stage of development as China was in 2005, after which the market growth got exponential. On the other hand, unlike China at the time, vehicle purchases are already financed on credit up to 75% while the average price of a vehicle is $10,000. The post-COVID recovery is strong, while the disruption of the supply chain increases waiting times. By 2026, market growth is expected to be around 10% per year. Given the opening of new roads and the resumption of private investment in the country, the figure could surprise on the upside.

The automotive market in India is anecdotally small considering the size of the population (1.3 billion people). In 2022, it should reach 3M vehicles sold, in line with 2019. That is the equivalent of the Brazilian market, a country with 1/4 of the Indian population. Also at an equivalent population size, China sells 25M vehicles per year. The issues in India are the affordability and the infrastructure. In India the GDP/capita is $2,000 vs. $7,000 in Brazil and $11,000 in China. India is currently at the same stage of development as China was in 2005, after which the market growth got exponential. On the other hand, unlike China at the time, vehicle purchases are already financed on credit up to 75% while the average price of a vehicle is $10,000. The post-COVID recovery is strong, while the disruption of the supply chain increases waiting times. By 2026, market growth is expected to be around 10% per year. Given the opening of new roads and the resumption of private investment in the country, the figure could surprise on the upside.

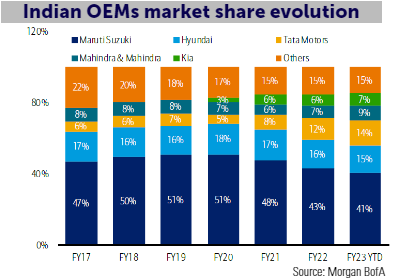

Given this historical context, Maruti Suzuki has established itself as a leader with 51% of the market at the peak of 2019, thanks to their compact vehicles.

But since 2020 the SUV appeal got traction and now accounts for 50% of the market. Co mpetitors like Hyundai, Kia, Mahindra & Mahindra and Tata Motors have launched a series of new models in the segment. In the meantime Maruti was mainly focused on bringing its existing fleet up to standard. Indeed, recent years have also been marked by stricter regulations: compulsory insurance, airbags, jump in terms of emission requirments from Euro 4 directly to Euro 6 (known as BS6 in India). But the trend should reverse over the next 24 months. Maruti has 4 new models in its pipeline, including 3 SUVs, all of which have a hybrid version. Since 2017, Suzuki and Toyota have joined forces to promote vehicle electrification. Hybrid technology is Japanese and Toyota is the master. The partnership involves sharing technology from Toyota and manufacturing facility from Maruti. According to Maruti management, a hybrid version offers a productivity gain of 25 to 30% compared to a traditional model. The company does not plan to launch 100% electric models before 2025.

mpetitors like Hyundai, Kia, Mahindra & Mahindra and Tata Motors have launched a series of new models in the segment. In the meantime Maruti was mainly focused on bringing its existing fleet up to standard. Indeed, recent years have also been marked by stricter regulations: compulsory insurance, airbags, jump in terms of emission requirments from Euro 4 directly to Euro 6 (known as BS6 in India). But the trend should reverse over the next 24 months. Maruti has 4 new models in its pipeline, including 3 SUVs, all of which have a hybrid version. Since 2017, Suzuki and Toyota have joined forces to promote vehicle electrification. Hybrid technology is Japanese and Toyota is the master. The partnership involves sharing technology from Toyota and manufacturing facility from Maruti. According to Maruti management, a hybrid version offers a productivity gain of 25 to 30% compared to a traditional model. The company does not plan to launch 100% electric models before 2025.

Given the infrastructure, the price of vehicles and the driving habits of Indians, the hybrid version can find takers.

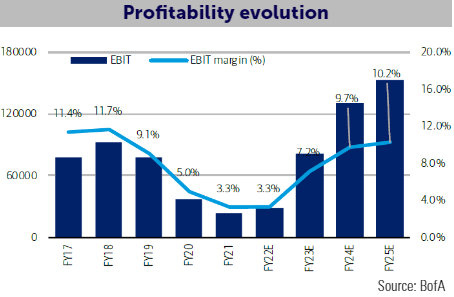

Indeed, on average, families have one vehicle per household which is used both for daily drives and must also ensure inter-city travel. The driving distances of a pure electric vehicle are still too short. Added to this new product cycle, at the time of the market recovery, recent fall in materials prices. The increase of the latter since 2021 has weighed on costs in recent quarters. Margins have corrected by 15 points since 4Q21 and overall Maruti's profitability is down sharply compared to 2018-19 (see chart above). This trend should be reversed. Volumes are expected to grow by 14% and prices by 6-7% per year by 2025. GemEquity and GemAsia are shareholders of Maruti at 1.2% and 1.7% respectively.