Yanqing Wang

Born in 1966, Mr. Yanqing Wang is the founder and CEO of Wuxi Lead. After graduating from Changzhou Radio Engineenrig School in 1982, Mr. Wang worked as an radio equipment engineer for more than 10 years. He first founded Wuxi Xiandao Capacitor Equipment Factory in 1999 and later expanded its business scope and changed its name to Wuxi Lead in 2002. Mr. Wang led the company to be listed on A-share in 2015 and built it into today's green equipment giant. Mr. Wang holds a 29% stake in the company.

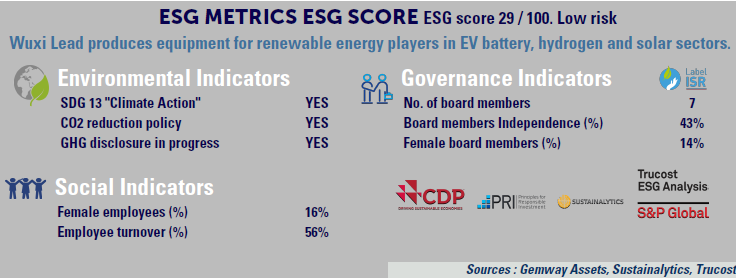

Founded in 1999, Wuxi Lead is a leading Chinese manufacturer of high tech equipment.

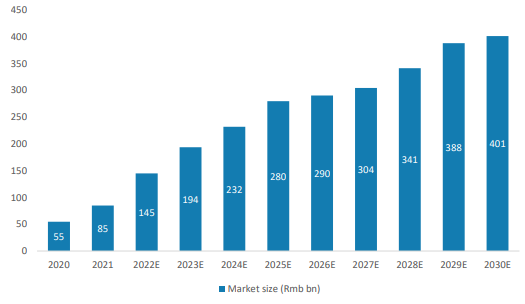

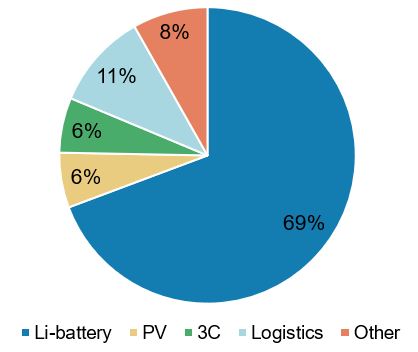

It designs and manufacture electric capacitors, solar energy equipment and lithium battery equipement (70% of total sales). T he company commands a 20% share in China’s Rmb34bn ($5bn) lithium battery equipment market. Driven by vehicle electrification across the globe, EV battery demand continues to surge, hence EV battery makers worldwide plan to aggressively expand their production capacity. Total global EV battery capacity is on track to reach over 2,000GW in 2025, tripling from the 750GW in 2021. Given the massive expansion, global lithium battery equipment market is hence estimated to grow at a CAGR of 25% over the next 3 years and to reach Rmb280bn ($42bn) by 2025 (graph). We expect Wuxi Lead to outgrow this exciting market, further expanding its global market share from 12% now to 20% by 2025.

he company commands a 20% share in China’s Rmb34bn ($5bn) lithium battery equipment market. Driven by vehicle electrification across the globe, EV battery demand continues to surge, hence EV battery makers worldwide plan to aggressively expand their production capacity. Total global EV battery capacity is on track to reach over 2,000GW in 2025, tripling from the 750GW in 2021. Given the massive expansion, global lithium battery equipment market is hence estimated to grow at a CAGR of 25% over the next 3 years and to reach Rmb280bn ($42bn) by 2025 (graph). We expect Wuxi Lead to outgrow this exciting market, further expanding its global market share from 12% now to 20% by 2025.

Wuxi Lead is a rare one-stop solution provider for battery manufacturers, offering a full range of equipment (from cathode coating, electrode making, to cutting, welding, and sealing) that covers the entire production process.

Furthermore, Wuxi Lead can also supply clients with an in-house developed manufacturing execution system that enables clients to digitalize and run a smart factory. Its customer base includes leading global cell makers such as LG Energy Solution and Panasonic, emerging international cell makers like Northvolt, Chinese cell makers like CATL, and global OEMs like Volkswagen, etc.  Each customer has its own dedicated production line, as all products are custom-made according to the customer’s needs. As a result, continuous battery technology iteration and diversification will keep generating extra equipment demand. Wuxi Lead’s largest customer CATL (= 40% of total sales) is the world’s nb1 battery maker with 50% market share in China and 32% globally. Wuxi Lead, as its key supplier and strategic partner, is a major beneficiary of the battery giant’s ambitious capacity expansion plan to reach 1,000GW in 2025. Moreover, on the one hand, Wuxi Lead as a key supplier has a strong bargaining power over its customers. This can be demonstrated by the fact that all raw material cost increases are passed through even with top customer like CATL. On the other hand, the company continues to gain wallet share from other customers. According to the management’s recent update, their Top 2-5 customers’ average order size has tripled since last year. In addition, Wuxi Lead continues to diversify its customer base by expanding overseas.

Each customer has its own dedicated production line, as all products are custom-made according to the customer’s needs. As a result, continuous battery technology iteration and diversification will keep generating extra equipment demand. Wuxi Lead’s largest customer CATL (= 40% of total sales) is the world’s nb1 battery maker with 50% market share in China and 32% globally. Wuxi Lead, as its key supplier and strategic partner, is a major beneficiary of the battery giant’s ambitious capacity expansion plan to reach 1,000GW in 2025. Moreover, on the one hand, Wuxi Lead as a key supplier has a strong bargaining power over its customers. This can be demonstrated by the fact that all raw material cost increases are passed through even with top customer like CATL. On the other hand, the company continues to gain wallet share from other customers. According to the management’s recent update, their Top 2-5 customers’ average order size has tripled since last year. In addition, Wuxi Lead continues to diversify its customer base by expanding overseas.

These markets have been historically dominated by Korean and Japanese equipment makers.

However, these players can no longer fulfill the strong expansion demand given their limited capacity scale in terms of both production and after-sales service, leaving room for new entrants like Wuxi Lead. Wuxi Lead’s capacity expansion plan closely matches orderbook. Having experiment strong downstream demand, Wuxi Lead increased its staff from 5k in 2018 to 15k in 2021 vs. almost flat for international peers. Its after-sales service network has more than 50 branches that cover over 20 countries. The company also invests more in R&D than its international competitors with an R&D expense ratio of 8% vs. ~4% for peers. Thanks to these efforts, the company’s overseas revenue contribution rose from 2% in 2018 to 15% in 2021. It is now the largest battery equipment supplier of Volkswagen and Northvolt.

The company also manufactures machines and equipment for other fast-growing sectors such as solar and hydrogen, industries strongly supported by the Chinese government since its vow to reach carbon neutrality by 2060.

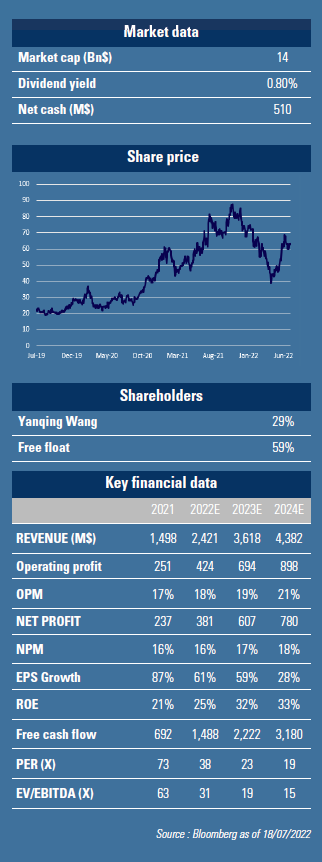

Over the past 10 years, Wuxi Lead achieved stellar sales/earning CAGRs of 59%/49%. Going forward, we expect the company’s revenue to grow +43% pa over the next 3 years given the strong EV battery maker capacity expansions, battery technology changes and huge overseas opportunities. The company has stable margins and a solid balance sheet with over Rmb3bn ($510M) of net cash. The stock trades at a 2023 PER of 23x. Considering the high multiple of other players in the value chain, we find this valuation level attractive.