In June, our management team spent a week in New Delhi, India.

We visited various chains of hospitals and stores, met with 15 companies and discussed various macroeconomic topics (infrastructure, real estate, digital transformation) with the experts. This visit confirmed our feeling that the economy is not immune to exogenous risks: the rise in commodity and energy prices is weighting on the country's inflation, currently at 7%, and is pushing the central bank to raise the prime rate (+50bp in June to 4.9%). On the other hand, we have become more confident about the country's structural growth. The Indian government is determined to benefit from the changing world order. The question remains as to how India will position itself on the current world stage. In the industrial sector we met the management teams of Reliance Industries, Larsen & Toubro, Hindalco Industries, GAIL and Amber Enterprise. We met with the Chairman of Aditya Birla Group ($46bn in total revenue). In the consumer sector we met Varum Beverage, Maruti Suzuki, Aditya Birla Fashion & Retail, Havells and Zomato for food delivery. In the hospital sector we visited Max Healthcare, Fortis and Medanta.

Since the election of Narendra Modi in 2014, the Indian economy has suffered a series of shocks. First of all, demonetization (disappearance of small banknotes) and the standardization of VAT affected the private sector, which at the time was responsible for more than 85% of economic activity. After having weighed on growth, these reforms are now resulting in better tax revenues, faster growth of the public sector and a consolidation of parts of the economy. Logistics, for example, is still cited as one of the main obstacles to investment. Indeed, logistics costs account for 14% of  India's GDP compared to 7-9% in developed countries. The government's objective is to reduce the threshold to 10% by 2027. Among the projects, the construction of a 3,500 km long rail dedicated to the transport of goods linking Delhi to the port of Mumbai in the west and Ludhiana to Calcutta, passing through Delhi in the east. The project is scheduled for completion in 2023. While India has the third longest rail network in the world (66,000 km), it is mainly used for passenger transport (65% of volumes). In the case of freight, rail accounts for 35% of domestic volumes and 20% of import-export volumes. However, for distances over 300 km, rail transport is more efficient in terms of time and cost. This project will support the government's ambition to become a manufacturing hub and increase exports from the current $440bn to $1tr by 2030. Several government initiatives are underway: 1/ the corporate tax rate has been reduced from 25% to 15% for new industrial investments; 2/ a subsidy scheme, known as the PLI Scheme, in 18 key sectors where the government will invest $35bn to increase localization. For example, the government wants to become an hydrogen hub. Total Energies has just announced the purchase of a 25% stake in the JV with Adani Group with the objective of investing $50bn to produce 1M tons of green hydrogen by 2030.

India's GDP compared to 7-9% in developed countries. The government's objective is to reduce the threshold to 10% by 2027. Among the projects, the construction of a 3,500 km long rail dedicated to the transport of goods linking Delhi to the port of Mumbai in the west and Ludhiana to Calcutta, passing through Delhi in the east. The project is scheduled for completion in 2023. While India has the third longest rail network in the world (66,000 km), it is mainly used for passenger transport (65% of volumes). In the case of freight, rail accounts for 35% of domestic volumes and 20% of import-export volumes. However, for distances over 300 km, rail transport is more efficient in terms of time and cost. This project will support the government's ambition to become a manufacturing hub and increase exports from the current $440bn to $1tr by 2030. Several government initiatives are underway: 1/ the corporate tax rate has been reduced from 25% to 15% for new industrial investments; 2/ a subsidy scheme, known as the PLI Scheme, in 18 key sectors where the government will invest $35bn to increase localization. For example, the government wants to become an hydrogen hub. Total Energies has just announced the purchase of a 25% stake in the JV with Adani Group with the objective of investing $50bn to produce 1M tons of green hydrogen by 2030.

This is happening in a context of increasing digitization of the economy. On the one hand, let's remember that India is the largest exporter of IT services in the world with a value of $180bn in 2021, which is equivalent to the oil exports of Saudi Arabia in the same year. The sector employs 5M engineers, a figure that is set to double by 2030 given the global need to digitalize processes. In fact, every year India produces as many engineers as the US and China combined. On the other hand, the breakthrough of telecom operator Reliance Jio, Reliance Group (3% of GemEquity) has allowed a widespread use of mobile internet. Thus today the country has 830M internet users who consume an average of 14GB of data per month (compared to 200MB in 2014, i.e. 70x more) with an average cost of 9 cents per GB, i.e. 40 times cheaper than in 2014. In this favorable context, the government is multiplying private-public partnerships and has launched a series of initiatives whose results are visible years later. Firstly, all individuals have a social security number, known as Adhaar, which has a fingerprint. It allows people to open a bank account, receive a rice ration or register for a PCR test. So for example 80% of people now have a bank account, but only 3% have a credit card. In 2016 the government launched the open system of financial transfers known as UPI. Long criticized, it now represents 25% of financial transactions. Google Pay uses this infrastructure, free of charge. Following the same principle, the government has recently launched an open architecture for online commerce called ONDC. Supposed to connect seller, deliverer and buyer, its practical use is still unclear. But in a few years we will surely see business models based on this infrastructure.

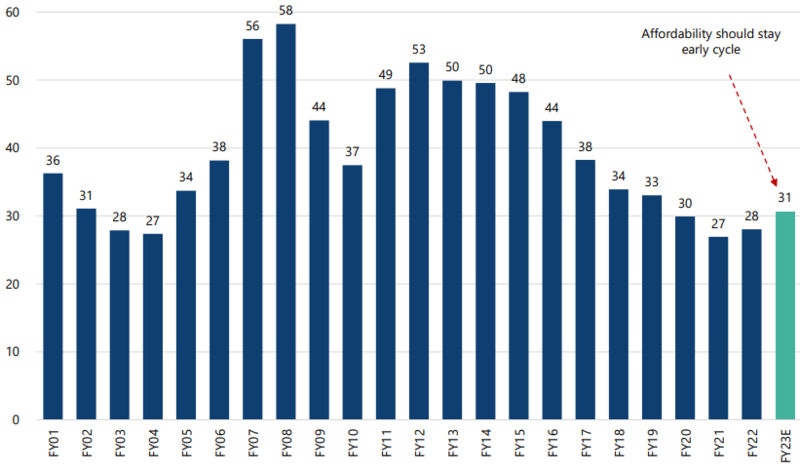

Elsewhere, the real estate sector seems to have turned positive after a lost decade. The structure of the market has changed. On the one hand, the 2017 real estate reform has greatly reduced the number of fraudulent developers who disappear with clients' money without finishing the projects: now 70% of clients' advances must be put into an escrow account and used for the relevant project. On the other hand, the default of a major non-banking financial company IL&FS in the fall of 2019 has cleaned up the project finance sector. As a result, the number of real estate developers has dropped from 22,000 ten years ago to 800 today and the percentage of transactions to end customers has doubled to 80%. With the decrease in the cost of acquisition and an increase in household disposable income, the level of affordability has improved significantly (see chart above). The market has not yet returned to the 2013-14 high of 3.2M units (3M in 2021). Thus, the sector is expected to grow by 15% per year in volume by 2030 and 7-8% in value, i.e. nearly 23% annual growth on average.

Elsewhere, the real estate sector seems to have turned positive after a lost decade. The structure of the market has changed. On the one hand, the 2017 real estate reform has greatly reduced the number of fraudulent developers who disappear with clients' money without finishing the projects: now 70% of clients' advances must be put into an escrow account and used for the relevant project. On the other hand, the default of a major non-banking financial company IL&FS in the fall of 2019 has cleaned up the project finance sector. As a result, the number of real estate developers has dropped from 22,000 ten years ago to 800 today and the percentage of transactions to end customers has doubled to 80%. With the decrease in the cost of acquisition and an increase in household disposable income, the level of affordability has improved significantly (see chart above). The market has not yet returned to the 2013-14 high of 3.2M units (3M in 2021). Thus, the sector is expected to grow by 15% per year in volume by 2030 and 7-8% in value, i.e. nearly 23% annual growth on average.

Stock focus : Larsen & Toubro (revenue of $21bn, market capitalization of $27bn, 1% of GemEquity)

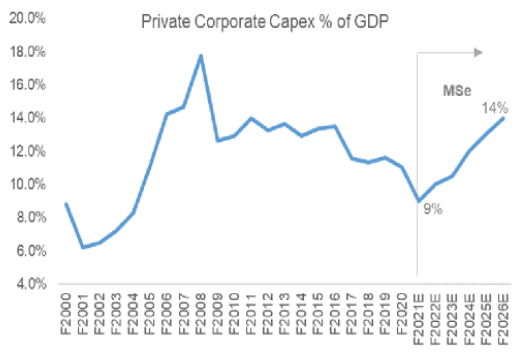

Larsen & Toubro is an Indian civil engineering conglomerate and the Indian government's main partner in major construction projects, such as the dedicated freight railroad mentioned above. Moreover, 27% of the order book comes from outside the country, especially from the Middle East. But today the management seems very optimistic about India. Driven by economic growth of 7-7.5% in the coming years, the company expects the order book and turnover to grow by 15% per year by 2025. While in 2022 85% of the orders will come from the public sector, in the future the share of private projects is expected to accelerate (see graph below). In

Larsen & Toubro is an Indian civil engineering conglomerate and the Indian government's main partner in major construction projects, such as the dedicated freight railroad mentioned above. Moreover, 27% of the order book comes from outside the country, especially from the Middle East. But today the management seems very optimistic about India. Driven by economic growth of 7-7.5% in the coming years, the company expects the order book and turnover to grow by 15% per year by 2025. While in 2022 85% of the orders will come from the public sector, in the future the share of private projects is expected to accelerate (see graph below). In  total, the private sector is committed to investing some $140bn over the next five years. In the meantime, management remains confident that public spending will be maintained, despite the budgetary pressure caused by the surge in energy prices. Indeed, in India the government intervenes through subsidies to limit the pressure on domestic inflation. Nevertheless, the parliamentary elections of March 2024 are an important milestone and the government is urging L&T to finish the projects as soon as possible. On the other hand, profitability is currently under pressure. Most of the current contracts were signed in 2019-21. However, in the meantime, the prices of raw materials and energy have soared and the company has to partially absorb them. As a result, ROE has fallen to 11% (vs. 15% 4 years ago). Management aims to reach 18% by 2025. Furthermore, the company aims to reach zero emissions by 2040 and plans to increase the share of renewable energy from 11% to 40% of the energy mix. Also the share of women is planned to increase from 6% to 10% by 2026. GemEquity and GemAsia have a 1% stake in the company, which is valued at 14x EV/EBITDA March-2023.

total, the private sector is committed to investing some $140bn over the next five years. In the meantime, management remains confident that public spending will be maintained, despite the budgetary pressure caused by the surge in energy prices. Indeed, in India the government intervenes through subsidies to limit the pressure on domestic inflation. Nevertheless, the parliamentary elections of March 2024 are an important milestone and the government is urging L&T to finish the projects as soon as possible. On the other hand, profitability is currently under pressure. Most of the current contracts were signed in 2019-21. However, in the meantime, the prices of raw materials and energy have soared and the company has to partially absorb them. As a result, ROE has fallen to 11% (vs. 15% 4 years ago). Management aims to reach 18% by 2025. Furthermore, the company aims to reach zero emissions by 2040 and plans to increase the share of renewable energy from 11% to 40% of the energy mix. Also the share of women is planned to increase from 6% to 10% by 2026. GemEquity and GemAsia have a 1% stake in the company, which is valued at 14x EV/EBITDA March-2023.

Stock focus : Maruti Suzuki (revenue of $14bn, market capitalization of $30bn)

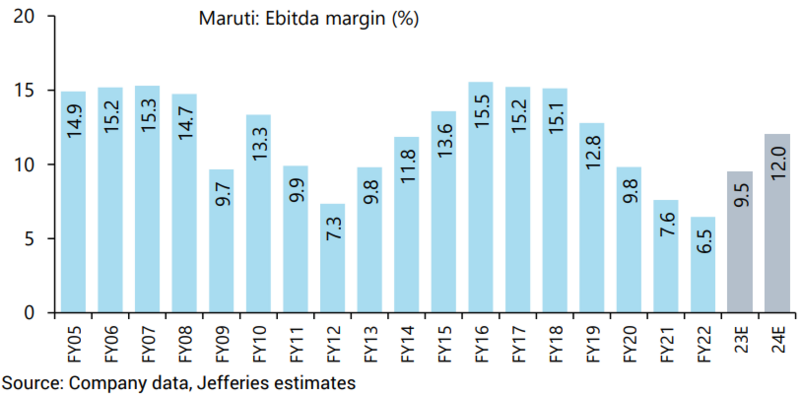

A 56% subsidiary of Japan's Suzuki, Maruti Suzuki is the country's largest automaker with 43% market share in 2021 (vs. 51% in 2019). Affected by the non-banking financial companies crisis in late 2019 and then COVID (demand and supply disruption), auto sales remain 10% below 2019 levels at 3.5M units. Nevertheless, underlying demand is strong and lead times are approaching 6 months. Maruti has an order book of 300,000 units. In addition to this, there is the desire for individual transportation post COVID. The market is expected to grow by 15% per year over the next three years. Furthermore, Maruti having lost ground over the last four years finally tells us that it is very excited about the pipeline that is expected to hit the outlets over the next 12-18 months. The company has suffered from the lack of new models, especially in the trendy SUV

A 56% subsidiary of Japan's Suzuki, Maruti Suzuki is the country's largest automaker with 43% market share in 2021 (vs. 51% in 2019). Affected by the non-banking financial companies crisis in late 2019 and then COVID (demand and supply disruption), auto sales remain 10% below 2019 levels at 3.5M units. Nevertheless, underlying demand is strong and lead times are approaching 6 months. Maruti has an order book of 300,000 units. In addition to this, there is the desire for individual transportation post COVID. The market is expected to grow by 15% per year over the next three years. Furthermore, Maruti having lost ground over the last four years finally tells us that it is very excited about the pipeline that is expected to hit the outlets over the next 12-18 months. The company has suffered from the lack of new models, especially in the trendy SUV  segment and a revival of Tata Motors whose market share has grown from 5% in 2019 to 12% currently. With the partnership with Toyota bearing fruit, Maruti is expected to launch new models in the hybrid version, offering a gain of 25 to 30% in fuel efficiency. Moreover, diesel only accounts for 18% of the market, after the passage of the BS6 standard in 2020 and the objective then announced by Maruti to exit diesel vehicles in the medium term. The pure electric vehicle is planned for 2025. The parent company is investing $1.5bn to build a battery factory and develop models. The choice is vertical integration, especially since the Indian government supports this initiative. The company is also planning models running on other energy sources: biomass, ethanol, gas. In terms of margins, the lack of new launches and the recent rise in raw materials have taken a toll: the EBITDA margin has fallen from 15%+ between 2015-17 to 6.5% in 2021 (fiscal year March-22). Management sees prices stabilizing and expects quarterly margins to do the same. The launch of new models in September, at a higher price, should accompany the increase in margins (see graph). Thus, we expect a tripling of profits over the next three years. The stock trades at a March 2023 P/E of 30x.

segment and a revival of Tata Motors whose market share has grown from 5% in 2019 to 12% currently. With the partnership with Toyota bearing fruit, Maruti is expected to launch new models in the hybrid version, offering a gain of 25 to 30% in fuel efficiency. Moreover, diesel only accounts for 18% of the market, after the passage of the BS6 standard in 2020 and the objective then announced by Maruti to exit diesel vehicles in the medium term. The pure electric vehicle is planned for 2025. The parent company is investing $1.5bn to build a battery factory and develop models. The choice is vertical integration, especially since the Indian government supports this initiative. The company is also planning models running on other energy sources: biomass, ethanol, gas. In terms of margins, the lack of new launches and the recent rise in raw materials have taken a toll: the EBITDA margin has fallen from 15%+ between 2015-17 to 6.5% in 2021 (fiscal year March-22). Management sees prices stabilizing and expects quarterly margins to do the same. The launch of new models in September, at a higher price, should accompany the increase in margins (see graph). Thus, we expect a tripling of profits over the next three years. The stock trades at a March 2023 P/E of 30x.

Elena Kosheleva