The travel diary is back with our first physical trip this year to Brazil.

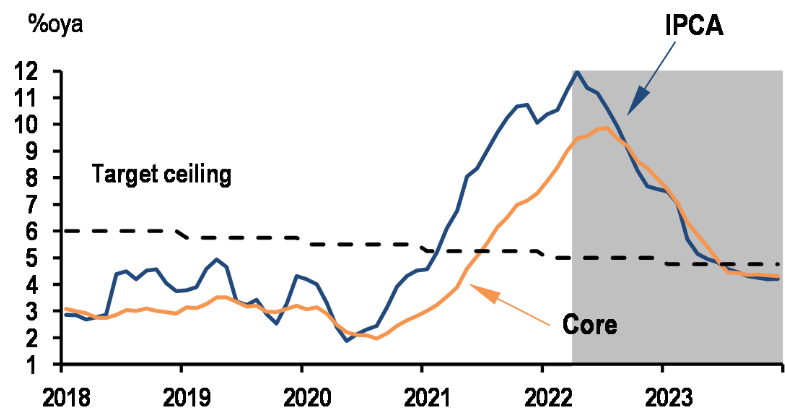

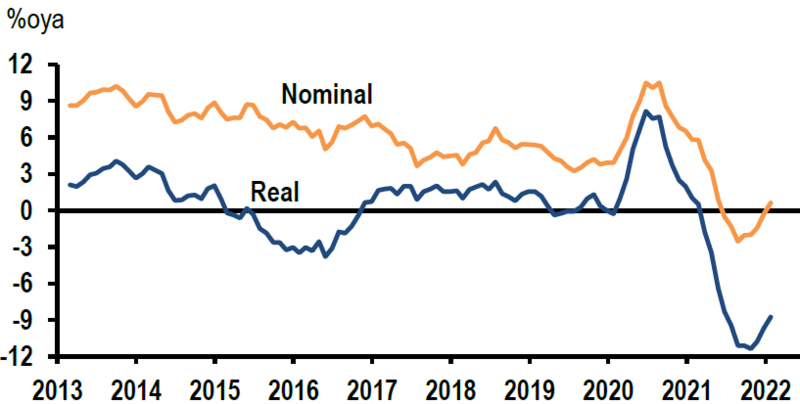

We spent a week there, met around twenty companies and discussed with local managers and strategists. In the financial sector, we met Bradesco, BTG Pactual, Banco Inter and BB Seguros; in consumption, Assai, Arezzo, Centauro, Mercadolibre, Magazine Luiza and Vivara; in the industrial sector, Weg, Rumo and Localiza; in energy and materials, Petrorio and Gerdau. Driven  by the rebound in commodities, the Brazilian market achieved the best performance in the emerging world year-to-date in dollar: +38%, of which 19% contributed by the currency. Big players in commodities such as Vale (+42% YTD in $) and Petrobras (+45% YTD) account for most of this performance. The two stock combined represent nearly 30% of the MSCI Brazil index. On the other hand, many sectors are lagging behind or even in the red. This polarity is explained in particular by the flows. Foreign flows are strong at +$14bn year-to-date (vs. +$10bn in 2021) and are usually favoring commodity names. On the other hand, domestic flows into equities have remained negative since last July, due to the rise in local interest rates. The SELIC rate went from 2% in February 2021 to 11.75% currently. We expect a stabilization by May/June at 13.25% and a reversal of the trend in early 2023. But inflation continues to rise: the March figure came out above 11% and economists are revising their targets upwards: +7.6% at the end of 2022 and +4.2% at the end of 2023. Nevertheless, inflation seems to be close to its peak (see graph on the left).

by the rebound in commodities, the Brazilian market achieved the best performance in the emerging world year-to-date in dollar: +38%, of which 19% contributed by the currency. Big players in commodities such as Vale (+42% YTD in $) and Petrobras (+45% YTD) account for most of this performance. The two stock combined represent nearly 30% of the MSCI Brazil index. On the other hand, many sectors are lagging behind or even in the red. This polarity is explained in particular by the flows. Foreign flows are strong at +$14bn year-to-date (vs. +$10bn in 2021) and are usually favoring commodity names. On the other hand, domestic flows into equities have remained negative since last July, due to the rise in local interest rates. The SELIC rate went from 2% in February 2021 to 11.75% currently. We expect a stabilization by May/June at 13.25% and a reversal of the trend in early 2023. But inflation continues to rise: the March figure came out above 11% and economists are revising their targets upwards: +7.6% at the end of 2022 and +4.2% at the end of 2023. Nevertheless, inflation seems to be close to its peak (see graph on the left).

In addition, GDP growth is revised upwards month after month, now expected at +0.6% in real terms in 2022 vs. -0.2% forecast last December. On the one hand, activity is rebounding after a complicated period of COVID (2nd country in terms of number of casualties). More than 80% of the population received at least two vaccine doses. The restaurants are full and the waiting time is long. We feel that they are short-handed and the staff lacks experience. The unemployment rate fell and reached 11% (2.5% for the upper middle class) in April. On the other hand, fiscal revenues are increasing with the rise in raw materials (more taxes) and the budget deficit has improved since the 4Q21. The government is taking advantage of this windfall to distribute subsidies, in particular before the presidential elections next October. High inflation in 2021 has particularly affected the poorest. For example, the monthly salary of an Uber driver has dropped from BRL 2,500 before the pandemic to BRL 1,700 ($360) today.

In addition, GDP growth is revised upwards month after month, now expected at +0.6% in real terms in 2022 vs. -0.2% forecast last December. On the one hand, activity is rebounding after a complicated period of COVID (2nd country in terms of number of casualties). More than 80% of the population received at least two vaccine doses. The restaurants are full and the waiting time is long. We feel that they are short-handed and the staff lacks experience. The unemployment rate fell and reached 11% (2.5% for the upper middle class) in April. On the other hand, fiscal revenues are increasing with the rise in raw materials (more taxes) and the budget deficit has improved since the 4Q21. The government is taking advantage of this windfall to distribute subsidies, in particular before the presidential elections next October. High inflation in 2021 has particularly affected the poorest. For example, the monthly salary of an Uber driver has dropped from BRL 2,500 before the pandemic to BRL 1,700 ($360) today.

Social discontent is mounting, which explains the spectacular progress of former President Luiz Ignacio Lula in the polls ahead of the presidential elections next October.

He is favored with 43% support against 26% for outgoing President Jair Bolsonaro. However, according to former finance minister Nelson Barbosa, the outgoing government, by opening the budgetary floodgates, could regain ground for Bolsonaro. In the end, the two candidates seem to have few differences in terms of proposed policy and the election does not seem to worry local investors. It is nevertheless true that Lula will put an end to privatizations of large SOEs, but many have already been carried out. Also in recent years the parliament has gained in decision-making power and the hands of the two candidates are tied by their lack of majority in the Congress. The independence of the Central Bank is not questioned and the continuity of the monetary policy assured. In fact, the mandate of current governor Roberto Campos does not expire before February 2025. Thus there is little enthusiasm for the electoral program in a country where education and infrastructure remain the main obstacles to stronger structural growth.

Stock focus: WEG (revenue of $6bn, market capitalization of $29bn, 0.5% of GemEquity)

WEG is a Brazilian specialist in electrical motors and equipment, competing with ABB and Siemens with a 20% more attractive price. We had visited their factory in Santa Catarina in 2018. Having started in the short cycle, namely industrial equipment (48% of turnover in 2021), the company is continuously diversifying into generation, transmission and distribution (GTD) energy (37% of turnover). WEG is a leader in renewable energy projects in Brazil and should benefit from the same trend internationally. With factories in North America, Europe, Africa, India and China, also thanks to its exports, the company is present on international markets (55% of turnover). The order book in the GTD is assured until the beginning of 2024. Among the new projects, management mentioned wind power in India (start of commercialization in 2023). Water treatment and irrigation projects also offer opportunities. WEG is currently supporting such projects in Saudi Arabia and Brazil. The current rise in the price of raw materials is putting pressure on margins, but the company is increasing its prices (admittedly with a lag). Turnover of the company should grow by 15% CAGR between now and 2025 and return on investment should stabilize around 25%.This quality stock trades at a 2022 PER of 36x and remains a core portfolio investment.

WEG is a Brazilian specialist in electrical motors and equipment, competing with ABB and Siemens with a 20% more attractive price. We had visited their factory in Santa Catarina in 2018. Having started in the short cycle, namely industrial equipment (48% of turnover in 2021), the company is continuously diversifying into generation, transmission and distribution (GTD) energy (37% of turnover). WEG is a leader in renewable energy projects in Brazil and should benefit from the same trend internationally. With factories in North America, Europe, Africa, India and China, also thanks to its exports, the company is present on international markets (55% of turnover). The order book in the GTD is assured until the beginning of 2024. Among the new projects, management mentioned wind power in India (start of commercialization in 2023). Water treatment and irrigation projects also offer opportunities. WEG is currently supporting such projects in Saudi Arabia and Brazil. The current rise in the price of raw materials is putting pressure on margins, but the company is increasing its prices (admittedly with a lag). Turnover of the company should grow by 15% CAGR between now and 2025 and return on investment should stabilize around 25%.This quality stock trades at a 2022 PER of 36x and remains a core portfolio investment.

Stock focus: ASSAI (revenue of $7.8bn, market capitalization of $4.7bn)

Assai is a Cash & Carry food distribution chain. It is a spin-off from Casino group which owns 41.2%. The food distribution market amounts to $95bn in Brazil and grows by 7% per year on average. The Cash & Carry segment, which is more attractive in terms of prices for consumers, gains market share: from 39% in 2016 to 50% in 2020. Buyers are 60% individuals and 40% wholesalers (restaurants, small shops). The success of this segment is explained on the one hand by the fragile purchasing power of the Brazilian consumer and on the other hand by the development of national chains, capable of offering a wide assortment at attractive prices.

Assai is a Cash & Carry food distribution chain. It is a spin-off from Casino group which owns 41.2%. The food distribution market amounts to $95bn in Brazil and grows by 7% per year on average. The Cash & Carry segment, which is more attractive in terms of prices for consumers, gains market share: from 39% in 2016 to 50% in 2020. Buyers are 60% individuals and 40% wholesalers (restaurants, small shops). The success of this segment is explained on the one hand by the fragile purchasing power of the Brazilian consumer and on the other hand by the development of national chains, capable of offering a wide assortment at attractive prices.

Assai is the 2nd largest market player behind Atacadao (Carrefour group). The company was born within CBD, Brazilian branch of the French Casino group. For years the EXTRA hypermarkets have been converted to Cash & Carry format, which is three times more profitable. In March 2021, the format with 200 stores was IPOed. Last October the company announced the acquisition of 71 EXTRA hypermarkets from CBD (also 41% owned by Casino) for $850M. Although this transaction raises questions of governance, it seems very attractive to Assai. The stores are in very dense areas, with little competition and offer a higher average ticket and better margins. Management expects to convert 40 stores in 2022 and another 30 in 2023. After conversion, the sales of these stores should reach $6bn and offer a higher EBITDA margin of 100-150bps, resulting in an EV/EBITDA valuation of 4x (vs. 10x for Assai at the time of the announcement). In addition, the group plans to open 20 stores this year. Debt is increasing this year to 2.5x ND/EBITDA, but should drop rapidly in 2023, with stores being profitable after 12 months. Furthermore, the business model is a winner in an inflationary environment and management expects like-for-like growth of 5-8% this year. Also according to management, sales should reach $16bn in 2023, doubling from 2021 level. EBITDA margin, after a drop of 50bp this year, should reach 8% by the end of 2023 (vs. 7.5% in 21). Earnings growth is expected to average 35% per annum over the next three years. The stock trades with an attractive PER of 24x 2022 and 12x 2023.

Stock focus: MERCADOLIBRE (Revenue of $9.7bn, market capitalization of $53bn, 3.2% of GemEquity)

MercadoLibre (MELI) is the leader in e-commerce and fintech in Latin America with a third of the market and 140M users. At the end of 2021, GMV stood at $28.4bn (+36% y/y) and the total payment transacting value at $77.4bn (+55% y/y). Turnover is as follows: 64% comes from e-commerce and 36% from fintech. 57% of sales are made in Brazil, 21% in Argentina, 16% in Mexico and 6% elsewhere in Latin America. We visited their Sao Paulo campus and discussed with the country strategic director. Without providing speficic targets, management is confident in strong business growth and sees good opportunities in credit despite a higher interest rates environment.

MercadoLibre (MELI) is the leader in e-commerce and fintech in Latin America with a third of the market and 140M users. At the end of 2021, GMV stood at $28.4bn (+36% y/y) and the total payment transacting value at $77.4bn (+55% y/y). Turnover is as follows: 64% comes from e-commerce and 36% from fintech. 57% of sales are made in Brazil, 21% in Argentina, 16% in Mexico and 6% elsewhere in Latin America. We visited their Sao Paulo campus and discussed with the country strategic director. Without providing speficic targets, management is confident in strong business growth and sees good opportunities in credit despite a higher interest rates environment.

In e-commerce, MELI continues to diversify the product offering by focusing on the most profitable categories, such as ready-to-wear. It should be noted that MELI already offers the largest products range and serves as a reference for consumers. Management admits to invest in a better knowledge of the customers in order to offer them personalized offers. In addition, MELI continues to optimize its logistics.  Now 90% of deliveries are made with solutions developed in-house, whereas before the pandemic, the company depended almost entirely on the post office. The company offers an uberized delivery solution and rents warehouses and collection/delivery points. With the effect of scale, operating cost drops while the company tests the cost elasticity of the sellers and gradually makes them pay for logistics services. In addition, advertising is an underdeveloped source of revenue at the moment. Taking Amazon as a reference, MELI could add 4% to its e-commerce monetization rate, currently at 13.5%. In terms of competition, the company acknowledges the rise of Shopee (subsidiary of SEA Ltd., 1.4% of GemEquity), which has gained a market share of 7% in three years. Both companies share the same users. Nevertheless, for the moment the average Shopee ticket remains well below that of MELI as they do not sell the same products: 4-5$ vs. $10-15 for MELI. Shopee's strategy is to be followed and the management of MELI consider them a formidable competitor. In fintech, management would like to seize opportunities in credit, insurance and brokerage. Like e-commerce, the company would like to develop the marketplace offer in financial services (open architecture for financial solution providers) and thus monetize its large user base (thus low customer acquisition cost). Since the highs of last September, the stock has strongly derated: EV/GMV (Gross Merchandise Value) has fallen from 2.5x to less than 1x currently. However, medium/long-term sales growth is expected to be strong: +28% CAGR to 2026. The quality of execution is very good and profitability is a key criterion in investment decisions. So we remain confident in our investment.

Now 90% of deliveries are made with solutions developed in-house, whereas before the pandemic, the company depended almost entirely on the post office. The company offers an uberized delivery solution and rents warehouses and collection/delivery points. With the effect of scale, operating cost drops while the company tests the cost elasticity of the sellers and gradually makes them pay for logistics services. In addition, advertising is an underdeveloped source of revenue at the moment. Taking Amazon as a reference, MELI could add 4% to its e-commerce monetization rate, currently at 13.5%. In terms of competition, the company acknowledges the rise of Shopee (subsidiary of SEA Ltd., 1.4% of GemEquity), which has gained a market share of 7% in three years. Both companies share the same users. Nevertheless, for the moment the average Shopee ticket remains well below that of MELI as they do not sell the same products: 4-5$ vs. $10-15 for MELI. Shopee's strategy is to be followed and the management of MELI consider them a formidable competitor. In fintech, management would like to seize opportunities in credit, insurance and brokerage. Like e-commerce, the company would like to develop the marketplace offer in financial services (open architecture for financial solution providers) and thus monetize its large user base (thus low customer acquisition cost). Since the highs of last September, the stock has strongly derated: EV/GMV (Gross Merchandise Value) has fallen from 2.5x to less than 1x currently. However, medium/long-term sales growth is expected to be strong: +28% CAGR to 2026. The quality of execution is very good and profitability is a key criterion in investment decisions. So we remain confident in our investment.