Mohammed Sulaiman Al-Rumaih

Since April 2021, Mohammed bin Sulaiman Al-Rumaih has been the CEO of Tadawul, the Saudi Stock Exchange. He joined Tadawul in 2009, where he has held various administrative and leadership positions. He has extensive experience in the financial sector and has led Tadawul through numerous milestones and a period of exponential growth. Over the past years, he has successfully led various key projects at Tadawul, including facilitating the smooth public listing of Saudi Aramco in 2019, the world’s largest IPO. Mohammed holds a Bachelor’s degree in Management Information Systems from King Fahd University of Petroleum and Minerals, and an MBA from Manchester Business School.

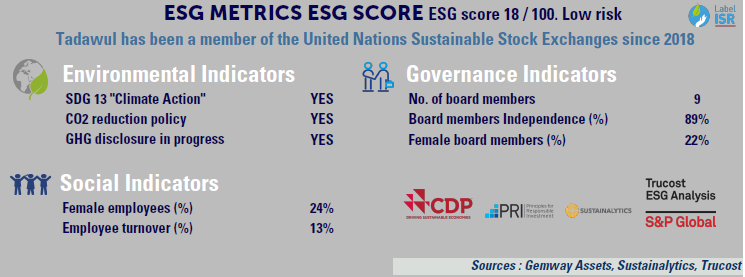

Founded in 2007, Saudi Tadawul Group operates the only authorized security exchange in Saudi Arabia (KSA) for listing, trading and settlement of equities, fixed income, derivatives, and traded funds.

Tadawul, a holding company since last year, is now fully integrated with four wholly owned subsidiaries: Saudi Exchange (exchange), Muqassa (clearing), Edaa (depository) and WAMID (technology and data solutions). It is 70% owned by Public Investment Fund, the sovereign wealth fund of Saudi Arabia.

Over the past few years, Tadawul achieved momentous development with KSA total market capitalization expanding 5x from SAR2tn in 2018 to SAR10tn ($2.7tn) in 2021.

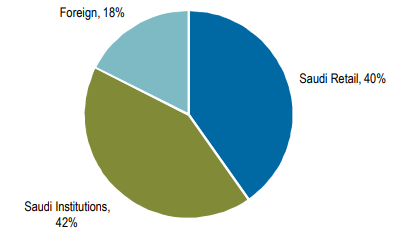

It is today the largest equity market in the Middle East (76% of the total market capitalization) and amongst the top 12 markets globally. While local investors still play an important role (96% of market cap and 82% of Free Float as of December 2021), KSA’s inclusion into key EM indices (MSCI, FTSE and S&P) in 2019, reforms around foreign investors ownership (both QFI and non-QFI) and a strong listing pipeline (including Saudi Aramco) have helped the country to attract more and more international investors (18% of Free Float market cap vs. 11% in 2019). As the only domestic listing venue with high operating leverage, Tadawul also benefits from the development of Saudi capital markets which is set to accelerate under government’s ambitious Vision 2030 plan. The latter, calls for higher contribution from private sector (from 40% in 2020 to 65% of GDP by 2030) and SME (from 20% to 35% of GDP), among many other initiatives. As such, the stock market capitalization to GDP (excluding Saudi Aramco) would be increased from 66% in 2019 to 88% by 2030, state-owned assets would be privatized, on top of the development of new economic sectors. Therefore, the listing activities would remain active (75 new IPO applications are currently pending with the regulator or the exchange) and provide a multi-year tailwind.

It is today the largest equity market in the Middle East (76% of the total market capitalization) and amongst the top 12 markets globally. While local investors still play an important role (96% of market cap and 82% of Free Float as of December 2021), KSA’s inclusion into key EM indices (MSCI, FTSE and S&P) in 2019, reforms around foreign investors ownership (both QFI and non-QFI) and a strong listing pipeline (including Saudi Aramco) have helped the country to attract more and more international investors (18% of Free Float market cap vs. 11% in 2019). As the only domestic listing venue with high operating leverage, Tadawul also benefits from the development of Saudi capital markets which is set to accelerate under government’s ambitious Vision 2030 plan. The latter, calls for higher contribution from private sector (from 40% in 2020 to 65% of GDP by 2030) and SME (from 20% to 35% of GDP), among many other initiatives. As such, the stock market capitalization to GDP (excluding Saudi Aramco) would be increased from 66% in 2019 to 88% by 2030, state-owned assets would be privatized, on top of the development of new economic sectors. Therefore, the listing activities would remain active (75 new IPO applications are currently pending with the regulator or the exchange) and provide a multi-year tailwind.

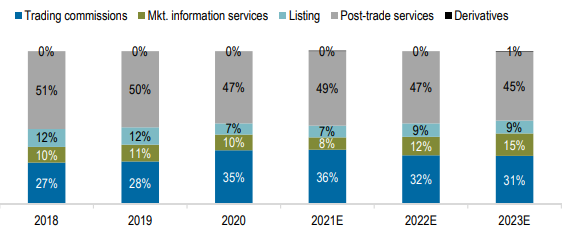

With equity trading accounting for c70% of revenues, Tadawul aims to increase the breadth of offerings across asset classes beyond equities, as well as to expand into new sources (pre-trade, post trade) and emerging themes (ESG indices).

Most of these new initiatives have been launched in the past 1-2 years and are still at early stage. We expect strong growth from its non-equity trading revenues in midterm. Data & technology related revenues’ minor contribution of 11% vs. 30% peer average implies a clear catch-up potential to be realized by its tech-arm WAMID. The development of derivatives (new launches of single stock derivatives) is also promising.

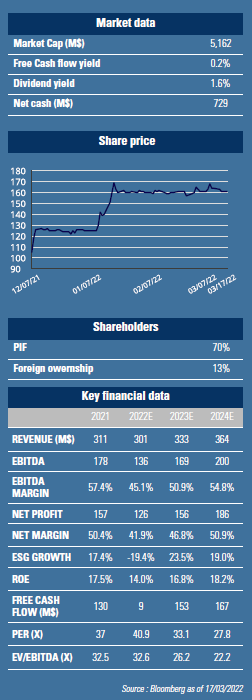

Despite the near-term risk from retail ADTV normalization post covid lockdown, Tadawul trades at a 2022 PER in excess of 40x, a significant premium vs. its EM peers (36x for Hong Kong Stock Exchanges & Clear and 21x for B3 in Brazil).

The group benefits from its unique position as a direct play on Saudi reforms and its sticky investor base. It also enjoys a strong cash position and targets a dividend payout ratio of 70% over the medium term.

GemEquity has invested 1.5% of its funds in the company.