Sandeep Bakhshi

Sandeep Bakhshi is the Managing Director and CEO of ICICI Bank since October 2018. Prior to his promotion, he was the Chief Operating Officer (COO) of the Bank. Mr. Bakhshi has been with the ICICI Group since 1986 and has handled various assignments across the group in ICICI Limited, ICICI Lombard General Insurance, ICICI Bank and ICICI Prudential Life Insurance. He grew up in a defence services family and has attended several schools and colleges across India before completing his management studies from XLRI in Jamshedpur.

Incorporated in 1994 by ICICI group.

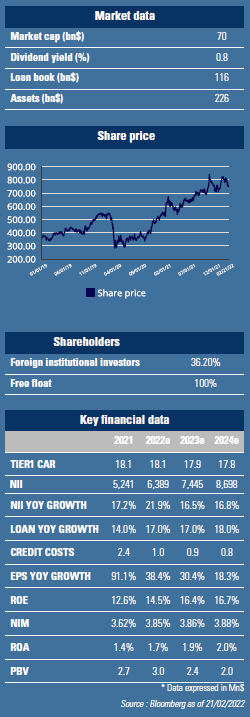

ICICI Bank is the second largest private bank in India by asset size ($223bn), of which $116bn are loans. With 5,300 branches and 13,800k ATMs across the country, the bank offers a diversified portfolio of financial products and services to retail, SME and corporate customers.

Driven by aggressive distribution expansion, enhanced capital bases and lower funding cost, the top 3 private sector banks (HDFC, ICICI, Axis) have grown their market share from 3% in 2000 to 20% in 2021, at the expense of continuous share losses by SOE banks (81% in 2000 to 64% in 2021).

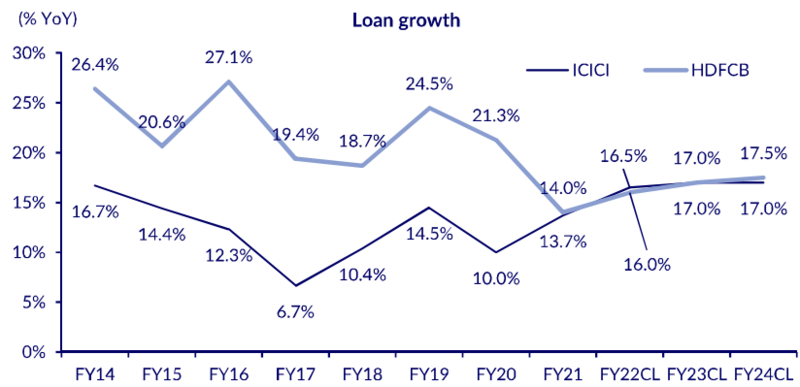

While the implementation of reforms (VAT, real estate related) and Covid-19 breakout had weighted on loan growth over the last few years, deposits continued to grow. This development has led to a general improvement of loan-to-deposit ratios at private sector banks. Their loss-absorption buffers have also been strengthened thanks to enhanced capital bases and more proactive risk management. Unlike in the past, private sector banks are entering into a new credit cycle with low NPLs. As IMF projects Indian GDP to grow 9% in 2022, loan growth could reach 14-15% for private sector banks and 7-8% for the public banks.

In the past, while aggressive expansion (large corporate clients, international development) and the default of large clients in selective sectors (steel, power generation, infrastructure) had led to asset quality issues.

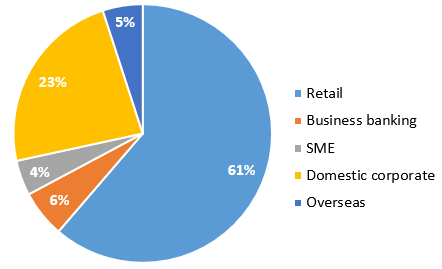

ICICI bank decided to overhaul its risk management process and to improve transparency in 2016. As Ms. Chandra Kochhar, the former CEO (2009-2018) was forced to resign and sued in court on accusations of accounting manipulation and capital misallocation in October 2018, half of top management team had also been changed. Mr. Sandeep Bakhshi, the highly respected CEO of ICICI Prudential Life Insurance (one the group’s best franchises) was appointed as new CEO. Since then, ICICI bank has cleaned its books: 90% of corporate loan book is now composed of “A” and above rating. Despite being still perceived as a corporate bank (23% of loan book vs 30% in 2014), 61% of its loan book is now categorized as retail (vs. 40% in 2014) and abroad pie was cut down to 5% (vs. 26%). During the pandemic, the bank put a strong accent on digital development so today it is the best digital bank in India with online transactional value 2x that of industry. Thanks to restructuring, ICICI Bank is particularly well positioned to benefit this new credit cycle.

The bank delivered a 18% domestic growth in 3QFY03/2022, 22% core PPOP (Pre-Provision Operating Profit) growth and an ROE of 15.5%.

Its capital position is sound with common equity Tier1 ratio at 17.6%. On the funding side,  CASA represents a healthy 47% of total deposits, mostly fixed rate which bods well in a rising rates environment. Benchmarked to the best Indian franchise, HDFC Bank, ICICI Bank has significantly improved its return on assets (cf chart above) hence the latter rerated. We expect a 17% loan CAGR over FY21-24E with margin improvements boosted by lower credit cost and a rising rate cycle. The bank trades at FY03/2023 BPV of 2.4X, which is attractive in an Indian context.

CASA represents a healthy 47% of total deposits, mostly fixed rate which bods well in a rising rates environment. Benchmarked to the best Indian franchise, HDFC Bank, ICICI Bank has significantly improved its return on assets (cf chart above) hence the latter rerated. We expect a 17% loan CAGR over FY21-24E with margin improvements boosted by lower credit cost and a rising rate cycle. The bank trades at FY03/2023 BPV of 2.4X, which is attractive in an Indian context.