Dr. Che-Chia We

Dr. Che-Chia Wei is the CEO of Taiwan Semiconductor Manufacturing Company (TSMC). Since joining the company in 1998, Dr. Wei has held various key management positions such as co-CEO, co-COO and senior VP of business development. Prior to TSMC, he worked for ST Microelectronics and Texas Instruments R&D organization. He received a B.S. degree in electrical engineering from National Chiao Tung University and a Ph.D. from Yale University. Dr. Wei owns a 0.03% stake in the company.Dr. Che-Chia Wei

Founded in 1987, Taiwan Semiconductor Manufacturing Company (TSMC) is the first pure foundry (i.e. semiconductor fabrication company) and the largest semiconductor company in the world.

As the world becomes increasingly digitalized with the proliferation of PCs and smartphones, the global foundry industry’s size tripled over the past decade and reached $100bn in 2021. Going forward, the market is expected to continue its strong growth (close to 20% in 2022), driven by mega technology trends such as 5G, IoT, EV, AI and Metaverse.

Within global foundry, TSMC occupies a dominant 58% market share.

Within global foundry, TSMC occupies a dominant 58% market share.

Of its 12 wafer fabs, 9 are located in Taiwan, and the rest in China and the US. The company works with a diverse portfolio of top-notch customers, including leading smartphone makers like Apple, fabless chip designers like Mediatek, and integrated design manufacturers like Intel. Even after losing Huawei (its previous nb2 customer) under the Sino-US tension, the company still grew at full throttle with a 100% production utilization rate in 2021, as other customers quickly claimed its spare capacity post Huawei's withdrawal.

What is the secret behind TSMC’s undisputed market leadership

On the one hand, TSMC is the absolute leader in foundry technology. Boasting an R&D spending which is 10x that of UMC and 4x that of Samsung foundry, TSMC’s node upgrading has always been ahead of its peers. With its leading-edge 5nm and 7nm chips contributing to half of its total revenue (see Chart), the company takes up an unrivaled 80-100% share in the advanced nodes foundry market. Moreover, TSMC will ramp up its 3nm production by 2023 to meet customers’ further upgrade demand. Its unparalleled technology know-how has also allowed the company to consistently improve production yields, significantly reducing costs for customers. On the other hand, in order to meet the booming demand, TSMC invests massively into capacity expansion. Its capital expenditure has tripled over the past 5 years to $30bn in 2021 and will further increase to $40-44bn for 2022, of which the majority will be allocated to advanced nodes.

In 4Q21, TSMC achieved better-than-expected results and announced a strong mid-term outlook.

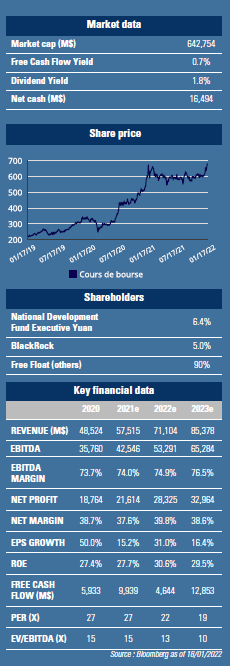

Despite its mammoth scale, TSMC targets to achieve an impressive 3-year revenue CAGR of 15-20%, higher than its previous guidance from 2Q21 of 10-15%. As such, its revenue could reach $100bn by 2025 or earlier. This strong growth is likely to be propelled by high performing computing related demand (HPC, 37% of 2021 revenue mix, see Chart), which could grow at a 30% CAGR by 2025 given the mega trends and the rising CPU outsourcing rate. On the margin side, the company lifted its long-term GPM target to ‘53% and above’, significantly higher than prior guidance (50% and above), led by wafer price increase and continued cost improvement. Depreciation expenses remain under control, well below revenue growth, dispelling GPM concerns over the past few quarters. The stock trades at 22x 2022 PER. Given its strong revenue growth and margin outlook, we find the valuation attractive. GemEquity (8.8%), GemAsia (9.6%), GemChina (3.2%) have invested in the company.

Despite its mammoth scale, TSMC targets to achieve an impressive 3-year revenue CAGR of 15-20%, higher than its previous guidance from 2Q21 of 10-15%. As such, its revenue could reach $100bn by 2025 or earlier. This strong growth is likely to be propelled by high performing computing related demand (HPC, 37% of 2021 revenue mix, see Chart), which could grow at a 30% CAGR by 2025 given the mega trends and the rising CPU outsourcing rate. On the margin side, the company lifted its long-term GPM target to ‘53% and above’, significantly higher than prior guidance (50% and above), led by wafer price increase and continued cost improvement. Depreciation expenses remain under control, well below revenue growth, dispelling GPM concerns over the past few quarters. The stock trades at 22x 2022 PER. Given its strong revenue growth and margin outlook, we find the valuation attractive. GemEquity (8.8%), GemAsia (9.6%), GemChina (3.2%) have invested in the company.