C K Venkataraman

C K Venkataraman became CEO of Titan in 2019 but his journey within the company started back in 1990. Like in most companies within the Tata Group, he rose through the ranks. Recruited in the Marketing division, CK became Sales Director for the Titan brand in 2003. In 2005, he focused on jewellery and took charge of the division. Eighteen years later, Jewellery generates a turnover of $3bn and CK is promoted to CEO at the age of 58.

Founded in 1984, Titan is jeweller and manufacturer of watches and eyewear in India.

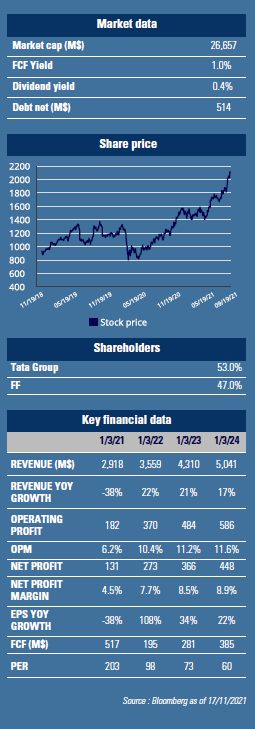

The Tata group is the founder and main shareholder at 53%.  Demand wise, the jewellery market is unique in India. Wedding jewellery represents 60% of purchases, considered as a dowry and an investment. With 10 million marriages each year and a young population, this market segment is buoyant. Then comes daily use at 30% of purchases. The market reached $65bn before COVID and after a 30% drop in 2020-21, it is expected to reach $90bn by 2025. Supply wise, 2/3 of the market is still in the hands of small traders who are gradually losing ground in favor of organized commerce. The government favours this trend with the introduction of new compliance rules and tax standardization. The watch and eyewear market weighs $3bn in aggregate but has a similar market structure. The opportunity for consolidation is immense. Titan is precisely the top beneficiary of this trend.

Demand wise, the jewellery market is unique in India. Wedding jewellery represents 60% of purchases, considered as a dowry and an investment. With 10 million marriages each year and a young population, this market segment is buoyant. Then comes daily use at 30% of purchases. The market reached $65bn before COVID and after a 30% drop in 2020-21, it is expected to reach $90bn by 2025. Supply wise, 2/3 of the market is still in the hands of small traders who are gradually losing ground in favor of organized commerce. The government favours this trend with the introduction of new compliance rules and tax standardization. The watch and eyewear market weighs $3bn in aggregate but has a similar market structure. The opportunity for consolidation is immense. Titan is precisely the top beneficiary of this trend.

A pioneer, the company now has 2,000 stores across 300 cities, mostly franchises, and controls 6% of the market.

The goal is to cross the 10% mark within 3 years. To do this, the management plans to enter 450 additional towns. In terms of sales mix, jewellery is 85%, watches 9% and glasses 2%. Titan has chosen a multi-brand strategy in order to expand the addressable market (see table on the left). In jewellery the price range varies from $80 to $3,000 a piece. Gold coins can also be purchased there, or even virtual gold, which represents 5% of Titan's total sales. The portfolio has been built over the years organically but also through acquisitions of local chains and brands, with the group historic brand

being Tanishq. The secret of the group's success lies on the one hand in customer service. More than 5,000 designers are working on the development of new products to meet local tastes. Remember that India is a country of many different tastes, languages and colors. It is essential to adapt.

On the other hand, the company has introduced several ingenious financing plans.

In 2016 Titan launched the Gold Exchange Program allowing customers to finance the purchase of a piece of jewellery by bringing in their own gold.  The customer can thus benefit from a discount while the jeweller buys the raw material at a more attractive. cost. Today 40% of Titan's gold needs are met through this scheme. In addition, there is the so-called Golden Harvest campaign (see opposite). This is a short-term savings plan with the ultimate possibility of buying a piece of jewellery at a discount. In addition, there is financing through bank credit cards. Thus, the bulk of customer purchases are financed through installments. In terms of manufacturing, 90% is outsourced thanks to the existence of an ecosystem. Gold and diamonds represent 7.5% of the GDP and 14% of India's exports. The country cuts and sets 70% of the diamonds sold in the world.

The customer can thus benefit from a discount while the jeweller buys the raw material at a more attractive. cost. Today 40% of Titan's gold needs are met through this scheme. In addition, there is the so-called Golden Harvest campaign (see opposite). This is a short-term savings plan with the ultimate possibility of buying a piece of jewellery at a discount. In addition, there is financing through bank credit cards. Thus, the bulk of customer purchases are financed through installments. In terms of manufacturing, 90% is outsourced thanks to the existence of an ecosystem. Gold and diamonds represent 7.5% of the GDP and 14% of India's exports. The country cuts and sets 70% of the diamonds sold in the world.

After a period marked by two lockdowns in one year, the recovery in demand is strong.

Management anticipates a 50%growth in the number of weddings, favorable to jewellery demand. Also given the lack of travel options, jewellery spending should be better. Management expects double-digit sales growth and OPM of 12-13% in jewellery. Undeniably the risk of a 3rd wave exists with the appearance of the Omicron variant. Currently 60% of the population has received at least one dose and 40% have a complete vaccination scheme. However, in the medium / long term, this crisis offers an opportunity for accelerated consolidation and the management will not fail to seize it. GemEquity and GemAsia both have 1% of thier respective assets in the company.