Herman Gref

Herman Gref, aged 57, has served as Sberbank's CEO and Chairman of the Executive Board since November 2007. Under his leadership, Sberbank has gone through transformational changes toward efficiency. He has also led Sberbank's digitalization and developing its best-in-class client ecosystem beyond banking. Prior joining the bank, Gref was Minister of Economic Development and Trade of Russia from May 2000 to September 2007. He did postgraduate studies in the Law Department of St. Petersburg State University.

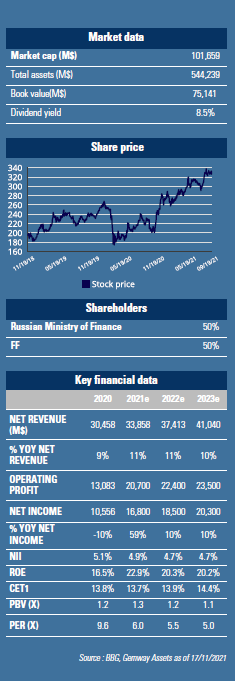

As a State-owned (50%+1 share) universal bank, Sberbank is the largest bank in EEMEA region by total assets.

It has built a strong foothold in Russia, where it enjoys a dominant market position especially in retail banking (42% of lending and 45% of deposits) and corporate lending (32% m/s). The bank serves its 103M active retail clients through a large branch network (14,000 branches) and advanced online solutions. It is also a digital frontrunner which has developed a platform-based ecosystem encompassing the core banking businesses, various financial services activities (payment, wealth management, insurance services, etc.) as well as non-financial businesses (e-commerce, video streaming, cyber security, etc...). Thanks to strong retail demand (consumer and mortgage portfolio +19% and +29% yoy respectively at 3Q21) and mproving corporate leading (+5% yoy), Sberbank’s core banking businesses (78% of group operating income) has recovered strongly from Covid downturn. Its net interest income (NII) continues to beat consensus (+14% yoy and 7% qoq at 3Q21). As a key beneficiary of Russia’s solid macro tailwinds, Sberbank’s loan book has promising growth prospects. Mortgage and corporate lending should continue to exhibit strong growth in 2022. While Russian Central Bank’s aggressive rate hikes (325 bps ytd to 7.5%) have weighted on Sberbank’s net interest margin this year (3Q21 NIM at 5.36%), the bank’s strong growth and higher-than-historical exposure to variable rate assets (40% of corporate loans) could help to offset the pressure. It will benefit from Russia’s higher interest rates from 2022 onwards.

For financial services business group, payment business (15% of group operating income) enjoys a particularly strong momentum: higher client transactional activity has provided a solid support for both its payment & transfer and acquiring business.

While its non-financial businesses are still loss-making, this business group’s revenue grew almost 3x yoy in 3Q2021.

E-commerce, entertainment (video streaming), cloud services are among the key drivers. After Sberbank and Yandex ended their partnership in 2020, Sberbank continues to explore e-commerce opportunities it self and also through JVs with Mail.ru. E-grocery has become the bright spot. It has gained over 30% m/s through CBEP Market and Camkat. As Covid pandemic has accelerated existing trends, we expect this business group to continue to grow strongly. It could contribute up to 5% of group operating income in the next 2-3 years and offers upside to valuation.

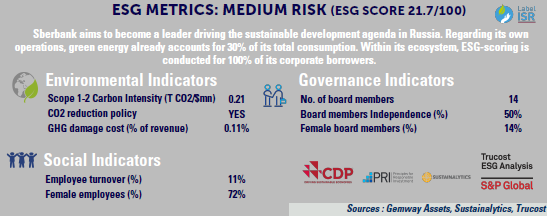

Sberbank trades at 1.2x 2022 P/BV and 5.5x earnings, at a discount to its EEMEA peers despite its better ROE (sustainable at 20%+). While this is mainly related to the higher country risk premium, we find it attractive because of its strong growth, solid capital buffer (CET1 13.9%) and high dividend yield (8.7% for 2022). GemEquity is invested in this company (3%).