Michael Wells

Michael Wells, aged 61, has served as the CEO of Prudential Plc since 2015. After graduating from San Diego State University, Michael gained more than three decades of experience in insurance and retirement services. He joined Prudential Group in 1995, became COO of US subsidiary Jackson Financial in 2003 and CEO in 2011. Under his leadership, Prudential expanded its operations to Myanmar and 5 more countries in Africa including Zambia and Nigeria. Furthermore, he led the company to demerge Jackson to accelerate Prudential's transformation into a business purely focused on Asia and Africa, markets with strong growth prospects.

Following the demergers of its UK & European assets and US operations, Prudential has transformed itself from a global life insurer into a Pan-Asia/Africa focused player.

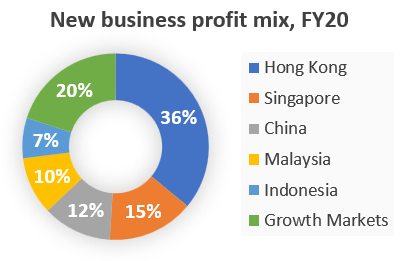

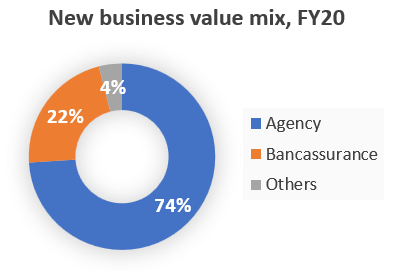

The UK headquartered group is dual listed in London and Hong Kong. It now targets exclusively fast-growing Asian and African markets where its customer base is expected to expand from 17m as of today to 50m in 2025.  Structural growth drivers such as these regions’ superior economic growth and low insurance penetration are strong supports for the group’s long-term prospects. On top of a large footprint in Asia Pacific (11 markets, 3.6bn combined population), Prudential has expanded its business in 8 African markets (400m of combined population). It also owns Eastspring, the leading asset manager in Asia ex. Japan region (AUM of $254bn). In core region Asia, the group enjoys Top 3 position in most of its markets. Through a strong and diversified distribution network across agency (560,000 agents), bancassurance (130 bank partnerships, 28,000 bank branches) and digital solutions (Super-app Pulse by Prudential), Prudential offers its customers a large product portfolio with a focus on health & protection solutions.

Structural growth drivers such as these regions’ superior economic growth and low insurance penetration are strong supports for the group’s long-term prospects. On top of a large footprint in Asia Pacific (11 markets, 3.6bn combined population), Prudential has expanded its business in 8 African markets (400m of combined population). It also owns Eastspring, the leading asset manager in Asia ex. Japan region (AUM of $254bn). In core region Asia, the group enjoys Top 3 position in most of its markets. Through a strong and diversified distribution network across agency (560,000 agents), bancassurance (130 bank partnerships, 28,000 bank branches) and digital solutions (Super-app Pulse by Prudential), Prudential offers its customers a large product portfolio with a focus on health & protection solutions.

Just like AIA, it is also well positioned in this high margin segment thanks to its large and highly qualified advisory agent force.

While Prudential is better positioned in some emerging Asian markets (Indonesia, Malaysia), AIA leads in China with distinctive competitive advantages such as 100% ownership of its Mainland China business and expanding coverage (targets 1 new provisional license every 6 months). However, Prudential’s strong CITIC partnership (50/50 JV, access to 80% of the population) enables it to expand rapidly without heavy investment. Its profitability should further improve thanks to a more focused agency channel (53% of New Business Profit in 1H21, 81% of margin vs. 42% for banca channel). Prudential is also well positioned to capture China opportunities from a strong position in Hong Kong where mainland Chinese visitors are already an important source of sales. Elsewhere in India, the group is a dominant private player (16% m/s) through its JV with ICICI Bank. ICICI Pru’s New Business Profit (NBP) has grown from $57M in FY16 to $222M in FY21 (+32% pa). Its 2019 NBP could double over the next 4 years, solely from increased penetration. Although Prudential might be able to acquire its non-controlling stakes in both countries thanks to improved regulatory flexibility, we don’t expect this option to be exercised soon as the group’s current focus is deleveraging. Its balance sheet flexibility should be

Although Prudential might be able to acquire its non-controlling stakes in both countries thanks to improved regulatory flexibility, we don’t expect this option to be exercised soon as the group’s current focus is deleveraging. Its balance sheet flexibility should be

significantly improved after its upcoming fund raising ($2.5-3bn of equity vs. net debt at $5bn). At current level, Prudential trades at 1.2x embedded value, a significant discount to AIA (2x). We expect this discount to narrow in next years as the group benefit from a better capital management and dedicates itself to markets with strong fundamentals. We expect its new business sales growth to be at >20% pa over 2021-23e. GemEquity and GemAsia are invested in AIA (4% and 5%) and Prudential (both 1%). GemChina is invested in AIA (5.5%).