Despite Beijing’s “zero-tolerance” approach to Covid-19 which made traveling to China extremely troublesome, our analyst Dian managed to visit her homeland in June.

Since March 2020, China has imposed a “one flight per week per country” rule on all airlines, significantly reducing its daily number of inbound air passengers to ~3,000 from ~25,000 previously. Once a flight is found to carry more than 4 Covid-positive passengers, the next two weekly flights will be canceled. Getting a plane ticket home felt like a lottery draw. Upon arrival, all passengers are immediately tested at the airport and then taken to quarantine regardless of the test results.

Dian was confined in a hotel room in Shanghai for two weeks under close monitoring. Each day at 7am and 13pm, a doctor came to take her temperature and government prepared meals were placed outside of the door three times a day. After 5 rounds of Covid tests during the 14 days, Dian was free for 24 hours to reach her home city, Yantai. When arriving, she was picked up by a local medical team directly at the aircraft and taken to a hotel for 3 more days of confinement and 2 more rounds of Covid tests. After all that, Dian was finally released to finish the last week of confinement at home, during which a local-government-designated guard remained outside her apartment 24/7. Thanks to e-commerce platforms and local life service providers such as Meituan (1.54% of GemE, 1.55% of GemA, 2.25% of GemC), JD.com (1.51% of GemE, 1.53% of GemA, 2.04% of GemC) and Dada Nexus (0.88% of GemC), those confined can order food and FMCG products conveniently from their rooms (see picture on the right for a giant snack package from JD supermarket). The orders are often delivered within an hour. In addition, as the cracking-down of antitrust behaviors progresses, all platforms now accept both AliPay (Ant) and WechatPay (Tencent, 4.76% of GemE, 5.23% of GemA, 8.48% of GemC) as payment methods. No more “2-choose1".

Once free, Dian was able to enjoy the restaurants and indoor entertainment activities.

Once free, Dian was able to enjoy the restaurants and indoor entertainment activities.

As the pandemic was rapidly contained in China, public facilities such as shopping malls and cinemas have been open since 2Q20. Many restaurants, tea shops and stores like PopMart had good level of traffic. Popular places like Haidilao and Nayuki had queues waiting to be seated or to have a cup of tea. To enter indoor places, one needs to show her/his sanitary pass – a QR code, but mask-wearing has become voluntary as you can see from this picture on the right of an audience at a comedy show inside a mall, where most people did not wear masks while sitting close to each other.

Touring around the city, one astonishing observation emerged : from the newly opened stores to pedestrians’ outfits, Chinese brands are as prevalent as ever.

Touring around the city, one astonishing observation emerged : from the newly opened stores to pedestrians’ outfits, Chinese brands are as prevalent as ever.

Indeed, Chinese brands have been gaining share in markets previously dominated by Western firms such as smartphones, sportswear, and cosmetics. Local brands made up 85% of the domestic smartphone market in 1H21, up from 17% in 2012. Over the past 5 years, domestic sportswear leaders such as Li Ning (1.6% of GemEquity, 1.5% of GemAsia, 1.5% of GemChina) and Anta’s market share increased from 17% to 22%. Within cosmetics, Chinese brands such as Proya (0.9% of GemE, 0.9% of GemA, 0.9% of GemC) represented 29% of the market in 2019, up from 14% in 2010.

Why are Chinese brands gaining traction at home?

From the supply side, thanks to China’s manufacturing scale and ample supply of engineers, Chinese brands are able to upgrade their product quality and aesthetic designs while offering affordable prices. Moreover, local brands are more responsive to Chinese consumers’ diverse and rapidly changing tastes. They closely observe and deeply understand local consumer needs, are agile in changing product offerings thanks to the flexible supply chain in China and master the hottest sales channels such as e-commerce and live-streaming.

From the demand point of view, on the one hand, Chinese consumers’ growing purchasing power nourished the boom of brands.

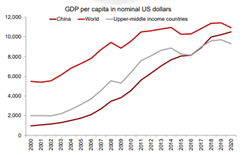

From the demand point of view, on the one hand, Chinese consumers’ growing purchasing power nourished the boom of brands.  China’s GDP per capita rose from $960 in 2000 to $10,500 in 2020 (see chart on the left) with disposable income per urban household grew at 8.7% per year since 2010 and reached around $7,000 in 2020, propelling its retail market to expand from $44bn in 2000 to $588bn in 2021, almost at par with the US. With rising incomes, consumers became more discerning with a stronger need for brands. This year’s “618 shopping festival” on TMall (Alibaba, 3.59% of GemE, 3.95% of GemA, 6.75% of GemC) introduced around 7,000 of new Chinese brands. In addition, Chinese consumer startups raised $5.2bn during the 8 months in 2021, doubling the total amount raised in 2019. New local brands such as Zhongxuegao who produces premium ice cream, Yuanqi Forest that pioneers in healthy soft drinks, Maia Active which focuses on sportswear for Asian women, and Huaxizi which is a flower-based oriental cosmetics brand (see picture on the right) have become the rising stars in China’s consumer space.

China’s GDP per capita rose from $960 in 2000 to $10,500 in 2020 (see chart on the left) with disposable income per urban household grew at 8.7% per year since 2010 and reached around $7,000 in 2020, propelling its retail market to expand from $44bn in 2000 to $588bn in 2021, almost at par with the US. With rising incomes, consumers became more discerning with a stronger need for brands. This year’s “618 shopping festival” on TMall (Alibaba, 3.59% of GemE, 3.95% of GemA, 6.75% of GemC) introduced around 7,000 of new Chinese brands. In addition, Chinese consumer startups raised $5.2bn during the 8 months in 2021, doubling the total amount raised in 2019. New local brands such as Zhongxuegao who produces premium ice cream, Yuanqi Forest that pioneers in healthy soft drinks, Maia Active which focuses on sportswear for Asian women, and Huaxizi which is a flower-based oriental cosmetics brand (see picture on the right) have become the rising stars in China’s consumer space.

On the other hand, as China went through an unprecedented economic transformation within a few decades, Chinese consumers, especially younger generations, now possess much greater confidence and pride in local brands that resonate with their identity. They are proud to be Chinese hence keen on purchasing “made-in-China” products. Baidu’s search engine analysis published in May 2021 reveals that Chinese consumers’ interest in local brands increased from 45% in 2016 to 75% in 2021 while their interest for foreign brands dropped from 55% in 2016 to 25% in 2021. Furthermore, as living standards rise, consumers pay more attention to health and beauty, the two fastest growing consumer categories in China over the past 5 years. In 2021, 37% of Chinese people do sports regularly vs. 28% in 2010. Supported by the government’s “National Fitness Program 2021-25”, this rate is expected to further improve. Furthermore, nowadays, sportswear is not just for sports but also commonly worn as daily fashion (see picture above taken at a Li Ning store). On the beauty side, consumers are becoming more open minded beyond just using cosmetics. CLSA’s survey with 1600 women discovers that 42% of them have taken aesthetic medicine, among which 72% tried it for the first time during the past two years.

On the other hand, as China went through an unprecedented economic transformation within a few decades, Chinese consumers, especially younger generations, now possess much greater confidence and pride in local brands that resonate with their identity. They are proud to be Chinese hence keen on purchasing “made-in-China” products. Baidu’s search engine analysis published in May 2021 reveals that Chinese consumers’ interest in local brands increased from 45% in 2016 to 75% in 2021 while their interest for foreign brands dropped from 55% in 2016 to 25% in 2021. Furthermore, as living standards rise, consumers pay more attention to health and beauty, the two fastest growing consumer categories in China over the past 5 years. In 2021, 37% of Chinese people do sports regularly vs. 28% in 2010. Supported by the government’s “National Fitness Program 2021-25”, this rate is expected to further improve. Furthermore, nowadays, sportswear is not just for sports but also commonly worn as daily fashion (see picture above taken at a Li Ning store). On the beauty side, consumers are becoming more open minded beyond just using cosmetics. CLSA’s survey with 1600 women discovers that 42% of them have taken aesthetic medicine, among which 72% tried it for the first time during the past two years.

Besides consumption, it is also evident that the adoption of green mobility has accelerated.

Pure electric vehicles and hybrids can be seen all over the city.

Pure electric vehicles and hybrids can be seen all over the city.  Showrooms of electric vehicles such as NIO (1.4% of GemE, 1.4% of GemA, 1.9% of GemC), Xpeng and Li Auto appeared in the most visited shopping malls (see pictures on the left). Even for shared mobility, electric scooters such as HelloBike and Meituan (1.5% of GemE, 1.5% of GemA and 2.3% of GemC) have been gaining a lot of traction. The scooters are so frequently used that stations are often near empty (see picture on the right). We look forward to seeing China’s carbon peak goal to be reached by 2030. We believe that as China transitions into a more self-reliance and sustainable modern economy, our stocks in its consumer (20.5% of GemE, 22.5% of GemA, 33% of GemC) and green energy (4% of GemE, 4.5% of GemA, 6% of GemC) sectors are well poised to achieve exceptional growth and continuously outperform the market.

Showrooms of electric vehicles such as NIO (1.4% of GemE, 1.4% of GemA, 1.9% of GemC), Xpeng and Li Auto appeared in the most visited shopping malls (see pictures on the left). Even for shared mobility, electric scooters such as HelloBike and Meituan (1.5% of GemE, 1.5% of GemA and 2.3% of GemC) have been gaining a lot of traction. The scooters are so frequently used that stations are often near empty (see picture on the right). We look forward to seeing China’s carbon peak goal to be reached by 2030. We believe that as China transitions into a more self-reliance and sustainable modern economy, our stocks in its consumer (20.5% of GemE, 22.5% of GemA, 33% of GemC) and green energy (4% of GemE, 4.5% of GemA, 6% of GemC) sectors are well poised to achieve exceptional growth and continuously outperform the market.