Federico Trajano

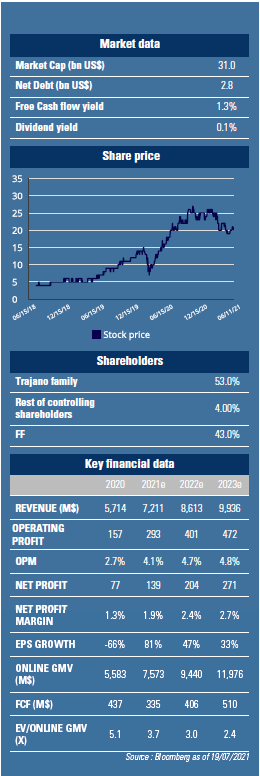

Federico Trajano, aged 45, has served as the General Manager of Magazine Luiza since 2015. He is the grandson of the chain's founding couple and his mother Luiza Trajano, 72, still sits on the Board of Directors. With a double degree in his pocket (including Berkley), Federico joined the family business in 2000 as manager of the "e-commerce" division. He moved on to the Marketing and Sales department and modernized the company. He was responsible for the company's strategic shift to online sales in 2015, when the company was on the verge of bankruptcy. The stock price bottomed out at BRL 0.031 in December 2015 to reach BRL 23.9 today (x770). The family holding company owns 52.2% of the capital, with an estimated fortune of $16bn.

This month we return to Magazine Luiza, the leader in e-commerce in Brazil.

We previously featured it in January 2019 when we visited the country.

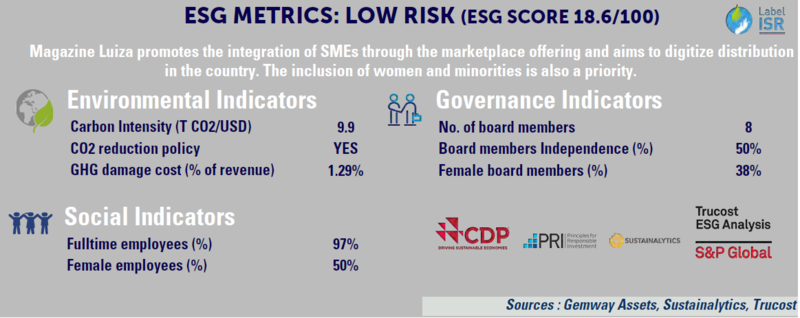

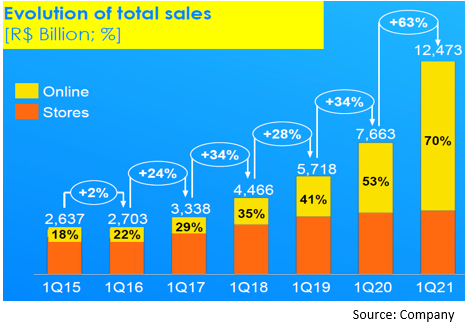

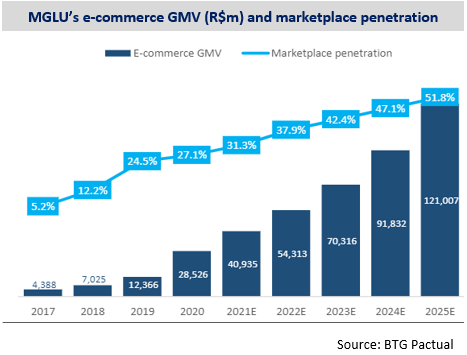

In three years the company's turnover has doubled to reach BRL 37bn ($7.2bn) in 2021 while the market capitalization has been multiplied by 4x to $30bn. At the time, the company was presented as a Brazilian "Darty". The specialist in household appliances and home goods, generated most of its sales from its physical stores (64%) and was pursuing the shift towards online sales. In 2021, and thanks in particular to the pandemic, the share of e-commerce has risen to 70% of sales (2/3 1P and 1/ 3 marketplace). Furthermore, through several small acquisitions and the opening of the platform to third party sellers, the assortment has also evolved. In fact, today the company presents itself as a digital platform with a presence in physical commerce and aims to become the operational system of distribution in Brazil.

In three years the company's turnover has doubled to reach BRL 37bn ($7.2bn) in 2021 while the market capitalization has been multiplied by 4x to $30bn. At the time, the company was presented as a Brazilian "Darty". The specialist in household appliances and home goods, generated most of its sales from its physical stores (64%) and was pursuing the shift towards online sales. In 2021, and thanks in particular to the pandemic, the share of e-commerce has risen to 70% of sales (2/3 1P and 1/ 3 marketplace). Furthermore, through several small acquisitions and the opening of the platform to third party sellers, the assortment has also evolved. In fact, today the company presents itself as a digital platform with a presence in physical commerce and aims to become the operational system of distribution in Brazil.

The company's strategic focuses are : 1/ New categories (ready-to-wear, sports goods, games etc...); 2/ SuperApp (a marketplace of products and services - online courses, food delivery etc...); 3/Logistics (speed, customer satisfaction); 4/ Magalu-as-a-Service (software offer and solutions for sellers - inventory management, payments etc...) and 5/ Fintech.

The Magalu SuperApp currently has 21M users (vs. 32M total for the group) and generates 75% of the company's online sales. The assortment has grown from 50,000 to 29M items between 2016 (when the marketplace was launched) and March 2021. In addition, there is a strong focus on logistics: 100% of 1P (B2C) deliveries and 57% of marketplace deliveries are made with the in-house solution (Uber style).

By June 2021, 67% of deliveries are made within 48 hours and 50% within 24 hours.

The company recently launched a 1-hour delivery project in 75 stores across 11 cities. This strategy expands the addressable market for online shopping by $140bn by adding categories such as food, health care products and medicines. The company is signing partnerships with restaurants, convenience stores and pharmacies to expand the offering and increase the frequency of use of the platform.

Finally, Fintech is also a strategic focus: payment, credit solutions for sellers and consumers, insurance, etc... 20% of sales are made with Luizacard, the store's credit card (in partnership with Itau bank). And in 2020, the group launched the e-wallet MagaluPay, which has already attracted 5M users with little promotion. For the moment, the contribution of Fintech is small, but has every chance of becoming important in view of recent initiatives (note that the No. 1 in the market, Mercadolibre, generates 40% of its revenue through Fintech). Between 2020 and 2023, Magazine Luiza is expected to grow its revenues by 21% and its profits by 68% per year. GemEquity has a 1% investment in the company.