Despite the covid disruption, the world added 280GW of renewable capacity last year, a 45% increase vs. 2019.

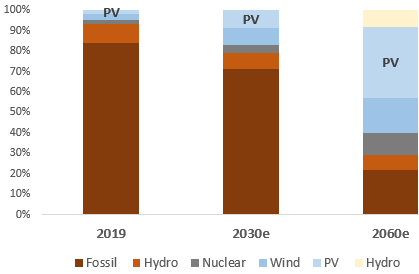

The necessity to reduce carbon emission and renewables massive cost reduction (90% for solar and 70% for wind over last decade) remain 2 powerful catalysts to drive a structural shift in the global energy mix. As more and more countries hit grid parity, the demand for solar photovoltaic (PV) is particularly promising. In China (representing 1/3 of global solar demand and over 80% of supply), solar PV could contribute up to 35% of energy mix in 2060 vs. 2% in 2019. Longi Green Energy Technology (Longi) is a direct beneficiary of this mega trend.

The necessity to reduce carbon emission and renewables massive cost reduction (90% for solar and 70% for wind over last decade) remain 2 powerful catalysts to drive a structural shift in the global energy mix. As more and more countries hit grid parity, the demand for solar photovoltaic (PV) is particularly promising. In China (representing 1/3 of global solar demand and over 80% of supply), solar PV could contribute up to 35% of energy mix in 2060 vs. 2% in 2019. Longi Green Energy Technology (Longi) is a direct beneficiary of this mega trend.

Established in 2000 as a semiconductor materials manufacturer under the name of Xi’an Xinming Electronic Technology, Longi has made the shift to the solar PV industry in 2006.

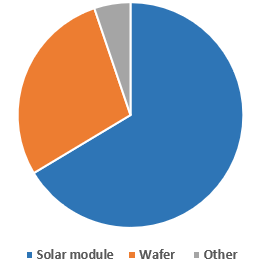

The group has led the development of monocrystalline silicon (mono-Si) technologies, a new route of higher conversion efficiency which has become the mainstream solar technology (over 85% market share). It has also grown into the world’s largest mono-Si solar producer in terms of sales volume with strong leadership in solar wafer (46% m/s) and solar module markets (19% m/s).  As of 2020, domestic market contributed 61% of its sales revenue with the balance generated from international markets including America and Europe.

As of 2020, domestic market contributed 61% of its sales revenue with the balance generated from international markets including America and Europe.

As a result of its vertical expansion (wafer-> cell-> module) started in 2014, the capacity for Longi’s wafer/cell/module reached 85/30/50 GW in 2020. The group aims to improve its scale advantage and further enhance its self-sufficiency ratio (75-80% in 2021) through continuous capacity expansion along the value chain. Its wafer/cell/module capacity could reach 105/38/65GW in 2021.

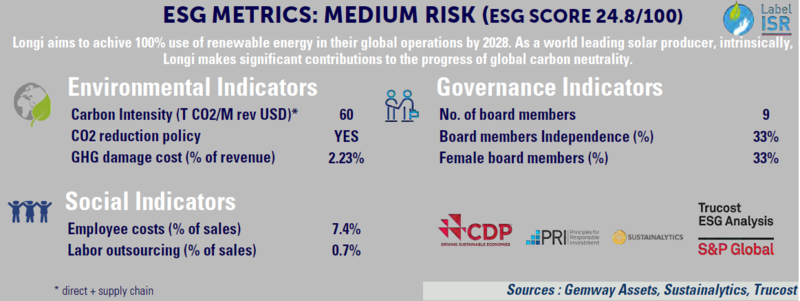

The group also promised to use 100% renewables for its production energy consumption by 2028, vs. 45% in 2020.

While the surge of polysilicon (50% of wafer cost) price (over 250% ytd) has weighted on short term solar demand and on downstream margins, Longi has been able to partially offset this pressure through long-term supply contracts, lower non-polysilicon cost structure and final price increases. As we expect polysilicon prices to gradually normalize (supply expansion by 30% in 2021), Longi is well positioned to enjoy the improving demand outlook.

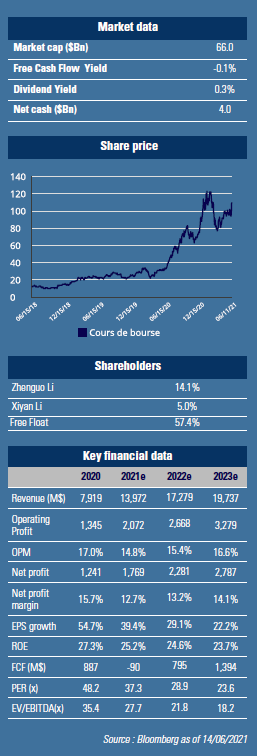

The stock trades at a 2021 PER of 37x. Consensus forecasts call for growth of 19% pa for sales and 26% pa for earnings in the next 2 years. We believe there is potential upward revision should polysilicon price declines. GemEquity (2.5%), GemAsia (2.5%) and GemChina (3.2%) are invested in this company.

Zhenguo LI

At 53, Zhenguo Li is the founder and CEO of Longi Green Energy Technology (Longi). Graduated from the Physical Department of Lanzhou University, Li started his careers at the Huashan Semiconductor Materials Factory, a SOE directly affiliated to the then-called Ministry of Metallurgical Industry. In 2000, Li founded Xi’an Xinming Electronic Technology, the predecessor of Longi. Since its IPO in Shanghai in 2012, Longi’s market cap has expanded over 40x to $66Bn. Li and his wife own 19.1% of the company. He is also a well-known expert in mono-Si technology of the transverse magnetic field.