LEE YUAN SIONG

Aged 55, Mr LEE joined AIA Group as CEO and member of Risk Management Committee in June 2020. Prior to that he occupied Executive Director and Co-CEO position at Ping An Insurance since 2013. During his 30 year carrier in insurance industry he also occupied leadership positions at Prudential PLC in the UK and CITIC-Prudential in China. Mr LEE is expected to be a valuable leader to develop AIA operations in China.

AIA Group is the largest pan-Asian life insurance company operating in 18 markets across the region.

It is also the only foreign insurance company present in China with a 100% ownership structure since 1992.  Prudential for instance is present through a 50/50 JV with CITIC. AIA is headquartered in Hong-Kong but was founded in 1919 in Shanghai by an American businessman, C.V. Starr. As the company embraced international expansion and the headquarter was relocated to the US in 1939, the Asian business became a subsidiary of a world insurer later known as AIG. In 2008, in the aftermath of GFC US Federal Reserve bailed out AIG for$180Bn, assumed control and spinned off the Asian business under AIA Group. It got listed in Hong-Kong in 2010.

Prudential for instance is present through a 50/50 JV with CITIC. AIA is headquartered in Hong-Kong but was founded in 1919 in Shanghai by an American businessman, C.V. Starr. As the company embraced international expansion and the headquarter was relocated to the US in 1939, the Asian business became a subsidiary of a world insurer later known as AIG. In 2008, in the aftermath of GFC US Federal Reserve bailed out AIG for$180Bn, assumed control and spinned off the Asian business under AIA Group. It got listed in Hong-Kong in 2010.

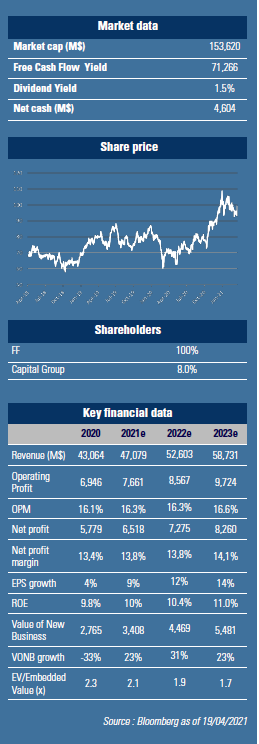

As of 2020 total assets and Embedded Value reach $32Bn and $67Bn respectively.

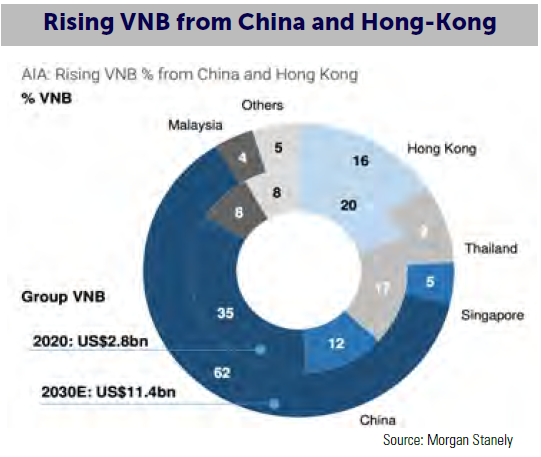

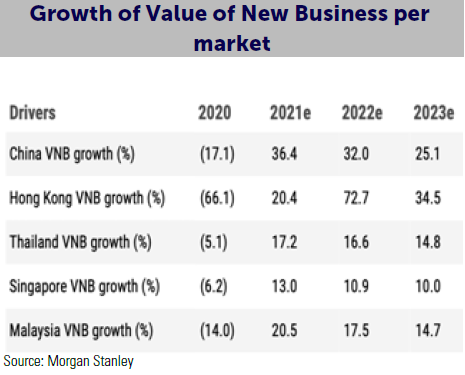

The company services 38M individual policies. Before the pandemic hit, in 2019 the value of new business of slightly over $4Bn was as follows: 39% contributed by Hong Kong (of which 50% came from Chinese cross border demand), 28% from mainland China and 33% from ASEAN countries such as Thailand, Malaysia, Singapore. Due to pandemic restrictions, the VNB dropped 33% in 2020 to $2.7Bn and the cross-border chunk went nearly to 0. Mainland China increased to 35% of the VNB mix in 2020 becoming the largest market for AIA Group as the mainland sales proved to be resilient. But as thevaccination is being rolled out, we should expect the cross border flows to recover and overall VNB to grow 25% CAGR by 2023, mostly driven by Chinese customers. In Mainland China, AIA is present in 3 provinces and 4 cities. They account for 40% of Chinese GDP in 2019 and cover 164M middle income population. With such a limited coverage, AIA already commands 0.8% market share nationwide but reached a descent 2.2% in cities such as Shanghai and Beijing. The firm continues to add licenses (aka Chengdu in November 2020) and targets to cover additional 11 provinces by 2030 (ie additional 630M Source: Morgan Stanley

as the mainland sales proved to be resilient. But as thevaccination is being rolled out, we should expect the cross border flows to recover and overall VNB to grow 25% CAGR by 2023, mostly driven by Chinese customers. In Mainland China, AIA is present in 3 provinces and 4 cities. They account for 40% of Chinese GDP in 2019 and cover 164M middle income population. With such a limited coverage, AIA already commands 0.8% market share nationwide but reached a descent 2.2% in cities such as Shanghai and Beijing. The firm continues to add licenses (aka Chengdu in November 2020) and targets to cover additional 11 provinces by 2030 (ie additional 630M Source: Morgan Stanley

middle income population). Interesting to note that life insurance growth accelerates as the per capita income surpasses $10,000 Today China counts 19 of such cities, 65 expected by 2030. In addition, as the government seeks to liberalize and institutionalize financial markets, insurers are best allies. Globally 40% of long only investors are insurers: they provide stability to the markets. As of today financial assets detained by Chinese households represents roughly $2Tr, expected to double by 2030. Around 45% of those are deposits and simple products. Insurance is only 10% of the mix.

Also nearly 100% of assets are invested in domestic market.

There are talks that a Wealth Management Connect might come on stream, similar to bond and equity connects, already operational. That would greatly benefit Hong Kong based insurers with local presence such as AIA. They offer differentiated products in foreign currencies and even in a pandemic 2020 year, 80% of new policies were sold through agencies. AIA China VNB grew at 35% CAGR over 2011-19 and is expected to grow 7x by 2030 to reach $7Bn mark. It a highly profitable region with 80% VNB margin. The stock trades at 2,1x EV/Embedded Value 2021e. AIA Group is a core holding in all our funds: 2.5% in GemEquity, 3.1% in GemAsia and 4% in GemChina.