Song-Zhu ZENG

Born in 1957, Song-Zhu ZENG is the second-generation leader of Merida. Having started to help out with the family business since his teenage years, Mr. ZENG officially joined Merida in 1983 and has since accumulated extensive experience in all key departments of the company. After his late father Ding Huang ZENG, founder of Merida, passed away in 2012, Mr. ZENG took over Merida's Chairman position and has since led the company and helped its market cap to expand by nearly 5x.

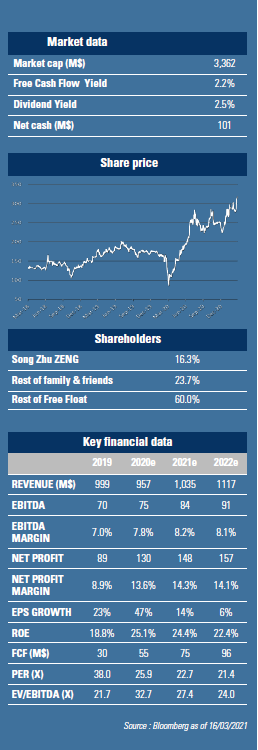

Zeng is Merida's major shareholder and controls 16.28% of capital.

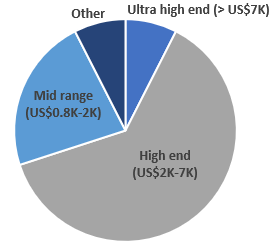

Merida Industry is the second-largest bike manufacturer in Taiwan and among the largest in the world. Since it was founded in 1972, Merida had grown from a contract manufacturer to one of the leading bike manufacturers. The group manufactures 1.2m bicycles per year. It has built 4 production plants in Taiwan and China, plus an assembly line in Germany to support its 3 key markets including Europe (55% of sales), the US (26%) and China (c.8%).On top of its own Merida brand (launched in 1986), the group also provides OEM services to brand partners, namely Specialized (USA), Centurion (Germany) and Miyata (Japan). Its product focus has been primarily in the mid-to high end price range. Over 60% of Merida’s sales revenue is generated by bikes priced between US$2,000- US$6,000 and an additional c.7-8% of its sales exposure is to the ultra-high end segment (US$8,000+). The key driver behind its success in the high-end segment consists of its exposure to Specialized, an American brand dominating the US high-end market with over 20% market share. Specialized is both Merida’s biggest customer and affiliate (35% ownership). Such equity investment has not only forged its ties with major customers but also improved its bargaining power. Similar types of arrangement have also been made with other OEM partners (Centurion and Miyata).While the bicycle industry has experienced stable demand over decades, the emergence of e-bike in recent years has created

a new opportunity. The latter has become more relevant in the wake of Covid-19. As a growing number of governments promote cycling Merida sales mix by price range as a green & safe (social distanced) mobility solution, the demand for bikes soared. The adoption of e-bike also accelerated, especially in Europe, a market of strong cycling tradition. As key European markets’ e-bike penetration reached 20-30%, industry expects the adoption to further rise to 40-60% in the long run. North America remains also highly attractive because of its untapped potential. In the US, Biden Administration’s push for “Clean Energy Revolution” could meaningfully stimulate demand for e-bike from a low base (3% penetration now).

a new opportunity. The latter has become more relevant in the wake of Covid-19. As a growing number of governments promote cycling Merida sales mix by price range as a green & safe (social distanced) mobility solution, the demand for bikes soared. The adoption of e-bike also accelerated, especially in Europe, a market of strong cycling tradition. As key European markets’ e-bike penetration reached 20-30%, industry expects the adoption to further rise to 40-60% in the long run. North America remains also highly attractive because of its untapped potential. In the US, Biden Administration’s push for “Clean Energy Revolution” could meaningfully stimulate demand for e-bike from a low base (3% penetration now).  Merida is a key beneficiary of this trend as a result of its diversified geographic exposure and its larger exposure to the more profitable e-bike segment (21% of shipment and 51% of sales revenue). However, the group’s sales growth had been capped last year because of an industry-wide supply disruption. The prolonged lead time for key components (such as derailleurs and brake) to above 9 months has left a large unmet demand. We expect the overall demand for bike (especially e-bike) to be sustainable backed by rising transportation and recreation needs. As component supply gradually improves this year, Merida’s should be able to deliver its operating targets (e-bike shipment to increase by 70-90% yoy in 2021). We expect group sales growth to accelerate to c.20% yoy in 2021. Despite rising pressure from commodity cost and FX (NT$), we also expect its margin to remain stable thanks to better pricing and operating leverage. The stock trades at 2021 PER of 21x. GemEquity (1%), GemAsia (1%) and GemChina (1%) have invested in the company.

Merida is a key beneficiary of this trend as a result of its diversified geographic exposure and its larger exposure to the more profitable e-bike segment (21% of shipment and 51% of sales revenue). However, the group’s sales growth had been capped last year because of an industry-wide supply disruption. The prolonged lead time for key components (such as derailleurs and brake) to above 9 months has left a large unmet demand. We expect the overall demand for bike (especially e-bike) to be sustainable backed by rising transportation and recreation needs. As component supply gradually improves this year, Merida’s should be able to deliver its operating targets (e-bike shipment to increase by 70-90% yoy in 2021). We expect group sales growth to accelerate to c.20% yoy in 2021. Despite rising pressure from commodity cost and FX (NT$), we also expect its margin to remain stable thanks to better pricing and operating leverage. The stock trades at 2021 PER of 21x. GemEquity (1%), GemAsia (1%) and GemChina (1%) have invested in the company.