Rick Tsai

CEO of Mediatek since 2017, Rick Tsai has ample experience in the semiconductor andtelecom space. From 1989 to 2014, Mr. Tsai served various important roles at TSMC, from VP of global marketing and sales and COO, to CEO and chairman. He had also held the CEO and chairman positions at Chunghwa Telecom. Mr. Tsai received a BA degree in physics from National Taiwan Univeristy and a PHD degree in Materials Science and Engineering from Cornell University.

Founded in 1997 in Taiwan as a spin-off of UMC, Mediatek is the specialist in integrated circuits design and ARM architecture solutions.

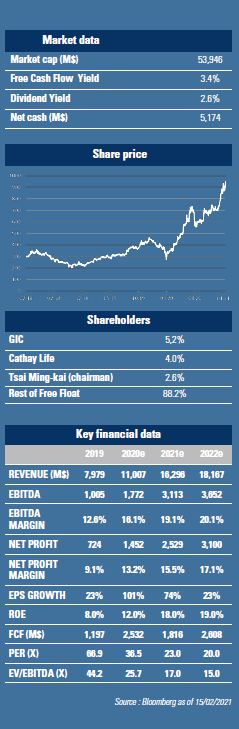

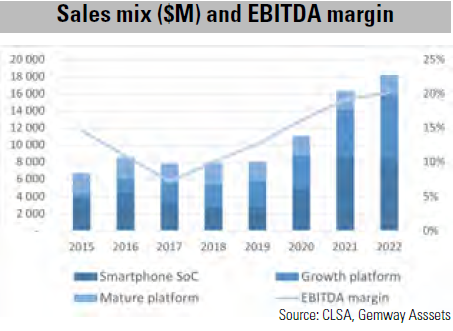

Its chips can be found in smartphones, televisions, game consoles, connected objects and servers. In 2020, the company's $11bn revenue breaks down as follows: 45% from smartphone platforms; 35% from growth platforms (connected objects, servers, etc.) and 20% from mature platforms (TV, traditional phones). Smartphone segment: with the launch of 5G technology in 2020, sales of smartphone solutions jumped by 68%. In the smartphone segment, the share of 5G chips reached nearly 50% of sales in value (vs. 11% in volume), with unit prices more than 4x higher than 4G chips.  In 2020 Mediatek sold 45M 5G chips in a 272M market, making its market share 17%. Qualcomm remains the leader with 54% of the market (including 2/3 for Apple, who is not a customer of Mediatek). The rest of the market is held by HiSilicon (subsidiary of Huawei - 21%) and Samsung (Exynos - 9%). In 2021 Mediatek plans to sell 160M 5G chips and thus capture 26% of an expected market of 625M units. Meditatek should be able to increase its market share for at least two reasons. First, Qualcomm is limited by capacity at Samsung, its main foundry supplier. Mediatek works almost exclusively with TSMC and has been able to secure production capacity in advance. On the other hand, Huawei's in-house solution is being penalized due to U.S. sanctions. The Chinese company had to sell its Honor brand in order to maintain a certain presence in the smartphone market. As a result, the

In 2020 Mediatek sold 45M 5G chips in a 272M market, making its market share 17%. Qualcomm remains the leader with 54% of the market (including 2/3 for Apple, who is not a customer of Mediatek). The rest of the market is held by HiSilicon (subsidiary of Huawei - 21%) and Samsung (Exynos - 9%). In 2021 Mediatek plans to sell 160M 5G chips and thus capture 26% of an expected market of 625M units. Meditatek should be able to increase its market share for at least two reasons. First, Qualcomm is limited by capacity at Samsung, its main foundry supplier. Mediatek works almost exclusively with TSMC and has been able to secure production capacity in advance. On the other hand, Huawei's in-house solution is being penalized due to U.S. sanctions. The Chinese company had to sell its Honor brand in order to maintain a certain presence in the smartphone market. As a result, the

telephone chip design market has become a virtual duopoly.

The "growth platforms" segment grew by 37% in 2020 and is expected to accelerate to 46% in 2021.

The "growth platforms" segment grew by 37% in 2020 and is expected to accelerate to 46% in 2021.

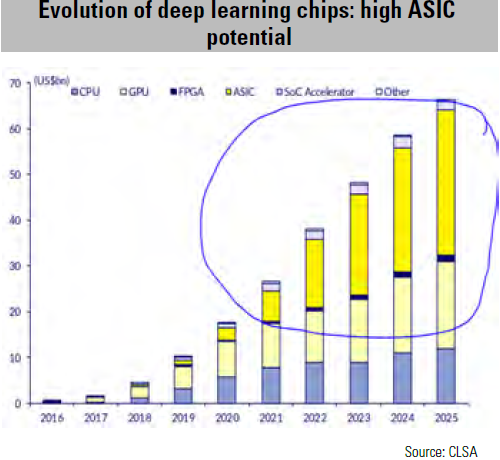

Game consoles are boosted by new launches, notably the PS5. Connected objects, especially smart speakers, are becoming popular in homes. Integrated circuit technologies for power management and WiFi are also evolving to high end thanks to 5G. In fact, all computer systems are moving upmarket to ensure better usability. In addition, following a partnership with Cisco, Mediatek has recently entered the so-called ASIC segment. These are customized chips found on switches and servers for example. In switches, Broadcom provides 90% of the market ($2-3bn per year). Mediatek is starting to break through and has generated nearly$100M in sales in this segment in 2020. The company has started Source: CLSA to collaborate with Google, Amazon and Chinese customers on other projects involving ASIC designs, especially in "deep learning". The growth potential of the market is significant as illustrated in the graph.

In the shorter term, the entire semiconductor chain is currently under pressure as demand is recovering strongly while capacities are limited. Mediatek was able to pass on a price increase to its customers in 1Q21 and thus pass on the cost increase. The announced objective for 1Q21 positively surprised the market: sales up 0-8% sequentially (vs.-5% expected) and an operating margin around 17% (vs. 16% in 4Q20). In 2021, as shown in the 1st graph, sales growth should be strong at +40%, which should generate a 70% increase in profit. Valuation is attractive with a PER 21 of 23x. Portfolios exposure is as follows: GemEquity at 3.4%; GemAsia at 4%; GemChina at 4.2%.