Guoqiang Chen

Guoqiang Chen is the CEO of China Tourism Group Duty Free Corporation. He joined the group in 1987 and has worked in various leadership positions, including Director of the Liquor Sales and Marketing departments, Chief Representative of the European Office, Assistant President & Vice President… Chen is one of the most experienced and respected travel retail executives in Asia. Since he became CEO in 2019, the share price of CTGDF has more than tripled.

China Tourism Group Duty Free Corporation (CTGDF) is the undisputed leader in China duty-free market.

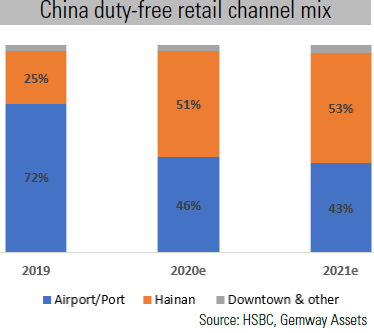

Backed by Chinese government, its actual controller through China Tourism Group (53.3%), CTGDF is the only player authorized to operate nationwide with full-service license across different channels (airports/downtown/resort island/ferry terminal DFS). After acquiring majority ownership of its key regional competitors (Sunrise Shanghai in 2018, Hainan Duty Free in 2020), CTGDF has further consolidated its leading position in China Duty-Free market.  Its market share has increased from c40-45% in 2011-16 to >90% in 2019. As a monopoly, the group has built up high barriers to entry including hard-to-get licenses, most diversified channels, direct procurement capabilities and strong bargaining power. As such, CTGDF is best positioned to capture the secular growth trend in China duty-free market. Driven by rising outbound tourism (155m travelers in 2019, 20m incremental pa till 2025) and higher income, China DF consumption has grown rapidly in the past years (US$7.6bn in 2019 vs. US$1.5bn in 2011). Nevertheless, the domestic market remains underdeveloped. It represented only 9% of global DF market while Chinese consumers contributed 1/3 of global duty-free sales (US$27bn of US$82bn) in 2019. In order to entice consumers to spend at home, Chinese government has introduced a series of favorable policies over the years, including tariff/consumption tax cuts, shopping quota increases, and pilot testing downtown duty-free shops. Such policy relaxation accelerated in 2020 as airport DF shops (72% of sector sales in 2019) had been hit hard by COVID 19 restrictions. By increasing Hainan DF shopping quota (from US$4,600 to US$15,400 pa), expanding product categories and opening more DF stores,

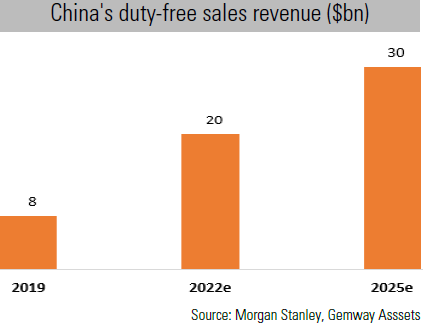

Its market share has increased from c40-45% in 2011-16 to >90% in 2019. As a monopoly, the group has built up high barriers to entry including hard-to-get licenses, most diversified channels, direct procurement capabilities and strong bargaining power. As such, CTGDF is best positioned to capture the secular growth trend in China duty-free market. Driven by rising outbound tourism (155m travelers in 2019, 20m incremental pa till 2025) and higher income, China DF consumption has grown rapidly in the past years (US$7.6bn in 2019 vs. US$1.5bn in 2011). Nevertheless, the domestic market remains underdeveloped. It represented only 9% of global DF market while Chinese consumers contributed 1/3 of global duty-free sales (US$27bn of US$82bn) in 2019. In order to entice consumers to spend at home, Chinese government has introduced a series of favorable policies over the years, including tariff/consumption tax cuts, shopping quota increases, and pilot testing downtown duty-free shops. Such policy relaxation accelerated in 2020 as airport DF shops (72% of sector sales in 2019) had been hit hard by COVID 19 restrictions. By increasing Hainan DF shopping quota (from US$4,600 to US$15,400 pa), expanding product categories and opening more DF stores,  China aims to accelerate DF consumption repatriation to Hainan, mainland China’s only DF destination.

China aims to accelerate DF consumption repatriation to Hainan, mainland China’s only DF destination.

This tropical island’s contribution to China DF market has doubled in 2020 to over 50%.

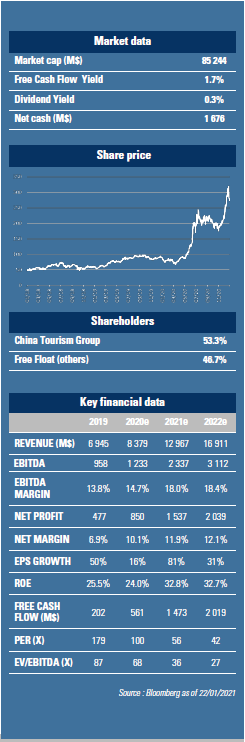

While the recovery of international travel from COVID 19 could affect Hainan’s DF revenue growth, we don’t anticipate any meaningful impact. The tourist numbers (c83m per year) could continue to grow as China has set ambitious plan to further develop the island into a free trade port. This is likely to further expand Hainan’s tourist market. With this strong driver, we expect China DF market growth to accelerate and reach US$25bn in 2025 (x4 vs. 2019). This environment favors CTGDF as it is a dominant national player and the sole DF operator on the Hainan island. Despite COVID19 disruption, its 2020 revenue increased by 12% yoy as a result of increased contribution from Hainan (from 21% in 2019 to 52%). CTGDF became the global DF leader, up from the 4th position in 2019 as its global peers suffered sharp revenue decline (-68% yoy for Dufry, -43% yoy for Hotel Shilla). However, Hainan DF market’s promising perspective and relaxed regulatory environment have attracted new entrants. 4 regional operators in partnerships with global players are expected to enter the market from this year. Despite rising competition, we expect CTGDF to remain market leader and capture a dominant revenue share (>80%) in the near/ mid-term. We expect its revenue to grow 33% pa over 2020-23 and EPS to increase by 45% pa over the same period. The stock trades at 41x PER 2022. GemEquity (1%), GemAasia (1%), and GemChina (2%) have invested in this company.