Jay Y LEE

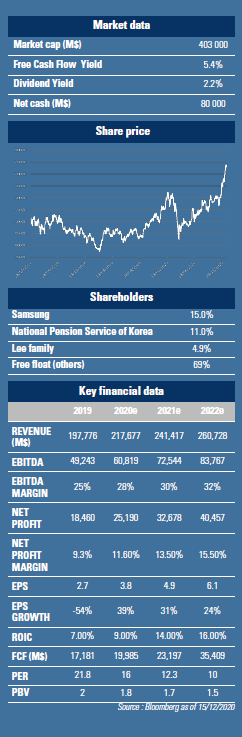

Grandson of the founder, JY Lee is the chairman of Samsung Group with a personal wealth estimated at $8.5bn according to Forbes. Following the death of his father two months ago, the family has to pay an enormous inheritance tax of $11bn. Given the $100bn of cash on Samsung Electronics' balance sheet, an increase in dividends would be the most optimal solution, benefiting minority shareholders as well.

Samsung Electronics is the jewel of the Samsung Group, the main Korean chaebol representing 17% of the country's GDP.

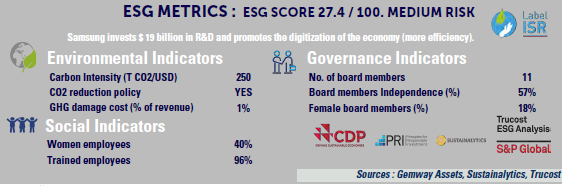

The beginning of the group dates back to 1938. In the late 1960s, Samsung made its debut in the electronics industry. It set up several divisions related to electronics, such as Samsung Electronics Devices, Samsung Electro-Mechanics and Samsung Semiconductor & Telecommunications. Its first product was a black and white television. In 1974, the group acquired Korea Semiconductor and in 1983, the founder Lee Byung-Chul decided to enter the market of random-access memory (DRAM). Half a century later and with a 43% market share, the company is the world leader in a structurally growing sector generating $72bn in combined sales. Over the years, the company's activity has diversified from chip to final product (see graph). The business model is based on cross-selling within the company. Thus, the Galaxys are equipped with memory chips, processors (Exynos) or state-of-the-art OLED displays produced in-house.

This increases the share of the added value captured internally and the technological lead. We will now review the dynamics of the main business lines.

Memory: In 2020, Samsung's memory business is expected to generate $51bn in revenues: DRAM (random access memory) accounting for 60% and NAND (storage memory) for 40%. The digitization of our daily life is the source of structural growth. The demand for DRAM has been growing on an average by 20% per year in volume since 2015 and that of NAND by 40%. The world is migrating towards the Cloud, connected objects and tomorrow's Smart City and Smart Manufacturing. Smartphones and servers are also seeing memory density increase (i.e. amount of GB/machine) to improve performance. Nevertheless, this remains a cyclical market. On the one hand, the addition of new capacity is not linear, and on the other hand, orders vary according to product launches or peaks in demand, as was the case in the first half of the year for servers and PCs. In NAND, Samsung is expected to record 24% volume growth in 2020 and to benefit from a 3% price increase. In 2021, volume growth is expected to be 34% while price is expected to fall by 10%. Enjoying the lowest production costs due to its technological leadership, Samsung is seeking to further consolidate the market, of which it already holds 33%.

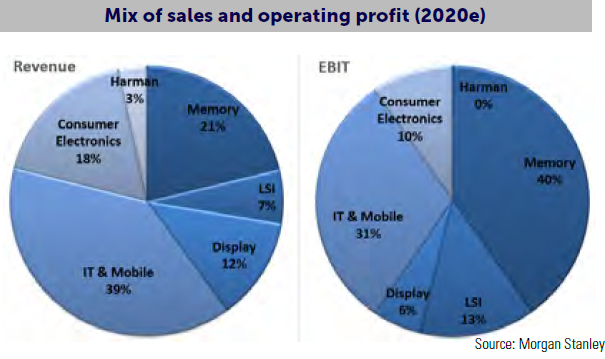

Memory: In 2020, Samsung's memory business is expected to generate $51bn in revenues: DRAM (random access memory) accounting for 60% and NAND (storage memory) for 40%. The digitization of our daily life is the source of structural growth. The demand for DRAM has been growing on an average by 20% per year in volume since 2015 and that of NAND by 40%. The world is migrating towards the Cloud, connected objects and tomorrow's Smart City and Smart Manufacturing. Smartphones and servers are also seeing memory density increase (i.e. amount of GB/machine) to improve performance. Nevertheless, this remains a cyclical market. On the one hand, the addition of new capacity is not linear, and on the other hand, orders vary according to product launches or peaks in demand, as was the case in the first half of the year for servers and PCs. In NAND, Samsung is expected to record 24% volume growth in 2020 and to benefit from a 3% price increase. In 2021, volume growth is expected to be 34% while price is expected to fall by 10%. Enjoying the lowest production costs due to its technological leadership, Samsung is seeking to further consolidate the market, of which it already holds 33%.  In DRAM, as shown in the graph, the market is recovering from two years of falling prices. Unlike NAND, the DRAM market is well consolidated: Samsung, Hynix and Micron own 95% of market share. While demand has been gradually recovering since 2018, the year in which it fell to +15% in volume (vs. +38% in 2016), supply remains under control. The business is a cash cow for producers. In 2020, Samsung records a 40% operating margin in DRAM. Demand this year will grow by 20%. Such growth is also expected in 2021, driven by servers, PCs and especially by 5G phones (doubling in 2021 to 500M units) which are more demanding for DRAM. At the same time, inventories are low and the supply, which is up 14% in 2020, is not expected to grow by more than 17% in 2021. The environment is therefore very promising for a rebound in prices. Operating leverage is exceptional in this segment: the operating margin had reached 70% at the end of the last DRAM uptrend cycle.

In DRAM, as shown in the graph, the market is recovering from two years of falling prices. Unlike NAND, the DRAM market is well consolidated: Samsung, Hynix and Micron own 95% of market share. While demand has been gradually recovering since 2018, the year in which it fell to +15% in volume (vs. +38% in 2016), supply remains under control. The business is a cash cow for producers. In 2020, Samsung records a 40% operating margin in DRAM. Demand this year will grow by 20%. Such growth is also expected in 2021, driven by servers, PCs and especially by 5G phones (doubling in 2021 to 500M units) which are more demanding for DRAM. At the same time, inventories are low and the supply, which is up 14% in 2020, is not expected to grow by more than 17% in 2021. The environment is therefore very promising for a rebound in prices. Operating leverage is exceptional in this segment: the operating margin had reached 70% at the end of the last DRAM uptrend cycle.

LSI (processors and image sensors): Historically in difficulty, this business line was successfully reorganized in 2016. In fact, Samsung together with the Taiwanese TSMC (7% of GemEquity), are the only players to offer the latest foundry technologies (below 7nm). Intel has just announced this summer its exit from the business, acknowledging that technologically it is at least 2 years behind. Today, the division contributes little to the company's P&L (7% of sales and 13% of Operating Profit), but the opportunity to be seized is important. The market is worth $80bn and is growing by 9% pa. Therefore, since this year, Samsung is accelerating its operational investments ($10-12bn pa, or 1/4 of its total investments).

Mobile & IT: The first Samsung phone came out in 1988, when Motorola controlled 60% of the market. Today Samsung sells 310M phones/tablets, holds 23% of the global market and has established itself at the high-end with the Galaxy line (30% of volume). The Korean was the first to introduce a flexible model in 2019. In addition, Samsung is one of the main beneficiaries of the Huawei mishap. After a 24% decline between 2013 and 2020, sales are expected to grow by 20% in 2021. The operating margin has been fluctuating between 10 and 11% since 2013.

Finally, the pandemic has had a positive impact on sales of household appliances and televisions, where Samsung holds 30% of the global market (50% in high-end TVs). The Displays business is enjoying better demand for OLED screens.

In conclusion, Samsung Electronics possesses several growth drivers with a better DRAM environment in 2021. The company has $100bn of net cash (vs. a market capitalization of $400bn) and should increase dividend payouts. We have invested 8,5% in GemEquity and 10% in GemAsia, making it the first position in each of the portfolios.