HAK-CHEOL SHIN

Joined in March 2019 as CEO and Vice Chairman, Hak-Cheol Shin is the first LG Chem CEO from outside the company since its foundation in 1947. Shin has been selected for his global perspective and experience in operating a global material and component business. Having spent 3 decades at 3M Co, Shin climbed the corporate ladder to become the first South Korean senior executive to lead 3M’s overseas business and was appointed to the position of Vice Chairman and Executive VP in 2017.

As part of one of the most prominent Corean chaebols, LG Chem can trace its roots back to 1947.

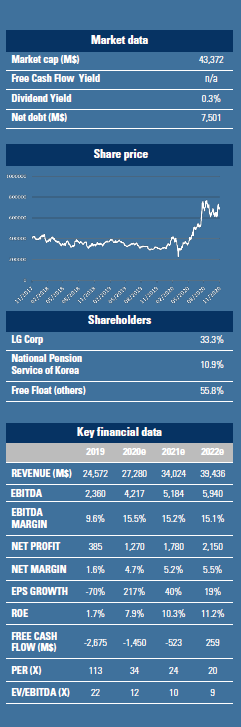

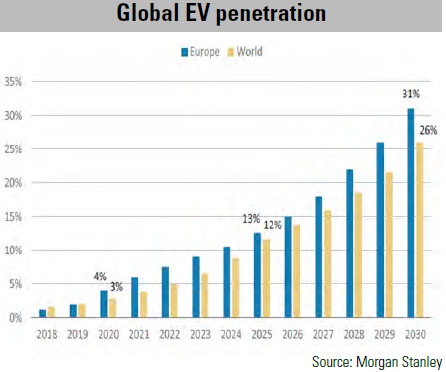

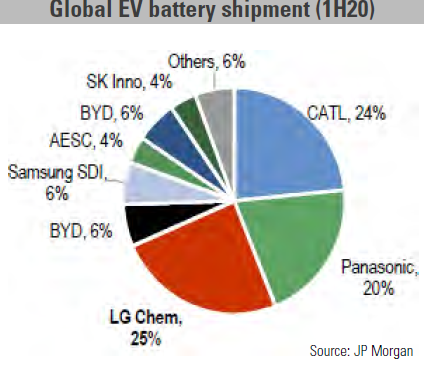

LG Corp (33.3%) and National Pension Service of Korea (10.9%) are its two largest shareholders. As the most diversified and vertically integrated petchem company in Korea, LG Chem also covers energy solutions (lithium-ion battery, energy storage system), advanced materials (cathode materials, OLED polarizers), and biosimilars.  On a combined basis, non-petchem businesses contribute to less than 30% of group operating profit. However, this contribution is expected to rise to >50% in upcoming years driven by the turnaround of its electric vehicle (EV) battery business. After years of struggle due to massive capex and operating loss, this division is today the best positioned to benefit from long term structural tailwinds in EV battery industry. Not to mention that LG Chem has now become the world largest battery maker with unrivaled economies of scale. Amid Covid wreckage, global EV adoption has accelerated in 2020. On one hand, advances in battery technology (longer driving range, lower cost) and new flagship EV models launches have lus package (especially in Europe) have further accelerated this trend. We estimate EV market is approaching an inflection point in 2020. As such, global EV penetration should accelerate in a significant manner over next 10 years to c26% from a very low base (barely 3% in 2019). Backed by its regional dominance (>50% of European EV battery capacity in 2020-22e), LG Chem emerges as the major winner of a strong European demand (almost doubling its global m/s to 42% vs. 23% in 2019).

On a combined basis, non-petchem businesses contribute to less than 30% of group operating profit. However, this contribution is expected to rise to >50% in upcoming years driven by the turnaround of its electric vehicle (EV) battery business. After years of struggle due to massive capex and operating loss, this division is today the best positioned to benefit from long term structural tailwinds in EV battery industry. Not to mention that LG Chem has now become the world largest battery maker with unrivaled economies of scale. Amid Covid wreckage, global EV adoption has accelerated in 2020. On one hand, advances in battery technology (longer driving range, lower cost) and new flagship EV models launches have lus package (especially in Europe) have further accelerated this trend. We estimate EV market is approaching an inflection point in 2020. As such, global EV penetration should accelerate in a significant manner over next 10 years to c26% from a very low base (barely 3% in 2019). Backed by its regional dominance (>50% of European EV battery capacity in 2020-22e), LG Chem emerges as the major winner of a strong European demand (almost doubling its global m/s to 42% vs. 23% in 2019).  It is also well positioned to benefit from the eventual opening-up of Chinese EV market as key supplier to Tesla’s Shanghai Gigafactory. By leveraging its steady cash flow generated by chemical division.

It is also well positioned to benefit from the eventual opening-up of Chinese EV market as key supplier to Tesla’s Shanghai Gigafactory. By leveraging its steady cash flow generated by chemical division.

LG Chem has led the aggressive capex race.

The group has increased its EV battery capacity from 15 GWh in 2017 to 120 GWh by end this year and the management has set further ambitious new target for 2023 : 260 GWh. This aggressive expansion is a response to a strong demand as the group has secured $125Bn of order backlog, representing about 5 years of revenue. It’s worth noting that as EV battery market moves in favor of suppliers, LG Chem enjoys better bargaining power vs. its OEM customers: new contracts signed in last 2 years are on 100% pass-through basis, the creation of JVs with major OEMs (GM, Hyundai Motor, Geely) help to ease financial burden required by new capacity and secure long-term partnerships. These arrangements and improving utilization rate have made important contribution to earning recovery. As its EV battery business reached breakeven in the beginning of this year, LG Chem now targets steady revenue growth and further margin improvement. Its CEO aims to generate $25Bn of sales (c14% cagr) at “high single digit OPM” in 2024 from EV battery business. We expect the consolidated FCF to return to positive from 2022 as its battery division’s EBITDA surpasses its capex requirement at $2.5Bn. Having announced its battery split up recently (transfer 100% of this business to a parent company with an option to sell a 20-30% stake via an IPO in the future), LG Chem has generated concerns over ownership dilution among its minority shareholders. However, we expect the value of the battery business to increase post the split up as EV growth is likely to gain momentum in 2021 and this transaction enhances transparency on capital allocation and operating efficiency. The stock trades at a 2021 P/E of 26x. Consensus forecasts revenue and earning growth of 25% and 40% for next year. We still see room for rerating as LG Chem’s battery business appears under valued vs. peers due to an excessive conglomerate discount: the group’s market cap is at $45Bn (25% global EV m/s) vs. $3Bbn for Samsung SDI (6% m/s) and $89Bn for CATL (24% m/s). GemEquity (2.4%) and GemAsia (2.9%) have invested in the company.