Horst Julius Pudwill

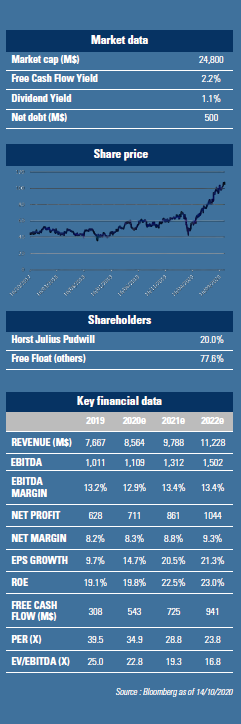

Horst Julius Pudwill, a 75-year-old German citizen residing in Hong Kong, is the cofounder and chairman of Techtronic Industries (TTI). He obtained a Master of Science Degree in Engineering from the Technical College in Flensburg. Before cofounding TTI, Pudwill was an engineer at Volkswagen in Germany then transferred to Hong Kong in the mid-1970s to become a general manager. He led the company to be listed on the Hong Kong Stock Exchange in 1990. Pudwill stepped down as the CEO in 2008 yet continues to oversee TTI’s operations alongside his son and vice chairman, Stephan Pudwill, as well as the company’s chief executive, Joseph Galli. Pudwell still owns 20% of TTI.

Founded in 1985 in Hong Kong, Techtronic Industries (TTI) is currently the world's second largest manufacturer (24% m/s) of small power tools (screwdrivers, drills, etc.), a $30bn market in 2020, which is expected to grow by an average of 5% per year until 2027.

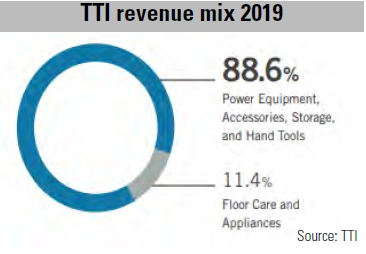

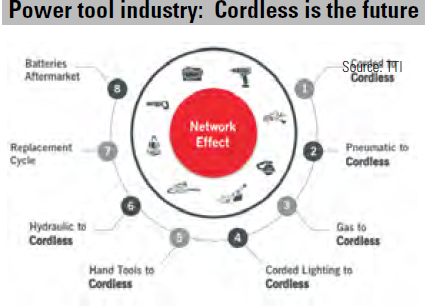

Within the industry, the wireless tools segment is experiencing the strongest growth (7% pa) and should reach 50% of the market by 2023.  This segment is the core of TTI's business (89% of sales, or $6.9bn in 2019), complemented by a portfolio of floor and garden care products. 95% of the products sold by TTI are cordless. This explains, among other things, the company's strong growth (+12% pa between 2016-19) and 10 consecutive years of record revenues. TTI sells its products worldwid

This segment is the core of TTI's business (89% of sales, or $6.9bn in 2019), complemented by a portfolio of floor and garden care products. 95% of the products sold by TTI are cordless. This explains, among other things, the company's strong growth (+12% pa between 2016-19) and 10 consecutive years of record revenues. TTI sells its products worldwid through an extensive distribution network. The legacy market, North America, remains the key market and accounts for 77% of sales in 2019 (50% of sales come from The Home Depot). Europe represents 15% and the rest of the world 8%. Over the years, through a few acquisitions, the company has built a portfolio of strong and recognized brands such as MILWAUKEE, RYOBI and HOOVER. MILWAUKEE is aimed at a professional clientele (50% of the company's sales) and is distinguished by its red color. RYOBI, whose distinguishing feature is its green color, is popular with individual users (DIYers, contractors in small jobs, sub-contractors in infrastructure). In the United States, for example, TTI dominates the DIY segment with a 60% market share. HOOVER is the brand for floor care appliances, acquired in 2007 and relaunched by TTI in 2019 with a wide range of cordless products.

As a leader in the field of cordless tools, TTI continues to gain market share, especially in the under-penetrated professional segment (cordless: 30-40%).

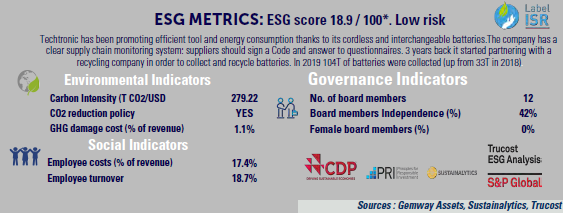

On the one hand, the replacement cycle for wireless products is shorter: 2-3 years vs. 4-6 years for traditional corded tools. On the other hand, the company is constantly innovating: 3% of revenue is invested in R&D vs. 2.3% for the industry and 1/3 of the annual sales comes from new products. In 2020, as the world slows down due to the pandemic and competitors adopt a defensive policy, Techtronic has accelerated the launch of new products. Moreover, it should be noted that the company had no supply problems this year, unlike the industry, and was even able to increase production in order to capture market shares. As CEO Galli says: "a crisis reveals character". We have seen that this year.  In 1H20 the company recorded a sales growth of nearly 13% and 30 bps net margin expansion to 7.9%. Conversely, Stanley Black & Decker, its biggest competitor, experienced a double-digit decline in sales. In addition, at the time of the half-yearly publication this summer, management announced a five-year sales target of $20bn (vs. $7.7bn in 2019). This demonstrates the confidence of the management team and marks an acceleration of the company's growth (+21% in sales and improved margins). On the production side, 70% is currently realized in China. Since 2018-19 the company has focused on diversifying the production base towards the United States, Mexico and Vietnam in order to mitigate potential geopolitical risks. Currently production in China is flat, while the rest is growing strongly. By 2025 the mix is expected to change towards 50/50 as per management. Overall, TTI is well positioned to strengthen its presence in the US while expanding its footprint in Asia and Europe. The stock is trading at a PER of 29x in 2021, which is justified by a healthy financial situation (low debt, WCR of less than 20% of sales) and strong growth prospects. Our 3 funds GemEquity (2.7%), GemAsia (3.6%) and GemChina (3%) are invested in this company.

In 1H20 the company recorded a sales growth of nearly 13% and 30 bps net margin expansion to 7.9%. Conversely, Stanley Black & Decker, its biggest competitor, experienced a double-digit decline in sales. In addition, at the time of the half-yearly publication this summer, management announced a five-year sales target of $20bn (vs. $7.7bn in 2019). This demonstrates the confidence of the management team and marks an acceleration of the company's growth (+21% in sales and improved margins). On the production side, 70% is currently realized in China. Since 2018-19 the company has focused on diversifying the production base towards the United States, Mexico and Vietnam in order to mitigate potential geopolitical risks. Currently production in China is flat, while the rest is growing strongly. By 2025 the mix is expected to change towards 50/50 as per management. Overall, TTI is well positioned to strengthen its presence in the US while expanding its footprint in Asia and Europe. The stock is trading at a PER of 29x in 2021, which is justified by a healthy financial situation (low debt, WCR of less than 20% of sales) and strong growth prospects. Our 3 funds GemEquity (2.7%), GemAsia (3.6%) and GemChina (3%) are invested in this company.