Jack Ma

Now 56, Jack Ma is a legendary corporate leader and China's richest man. Formerly an English teacher, Ma founded Alibaba in 1999 and led it to become the largest internet company in China (current market cap $761bn). After building his e-commerce empire into the absolute industry leader, Ma handed over Alibaba's CEO position to Daniel Zhang in 2013 and later stepped down as chairman in 2019, although he remains a partner and controls 4.8% of the group. Ma also holds a 17,2% indirect stake in Ant Financial, the largest fintech in China. Currently valued at $200 to 300bn, Ant is about to list in Hong Kong and Shanghai (around $30bn IPO). Ma is also a major philanthropist who made massive donations worldwide during the pandemic.

Alibaba Group is the largest online consumer platform in China allowing 840M users to shop, watch videos, order food, store documents, book tickets, among other things.

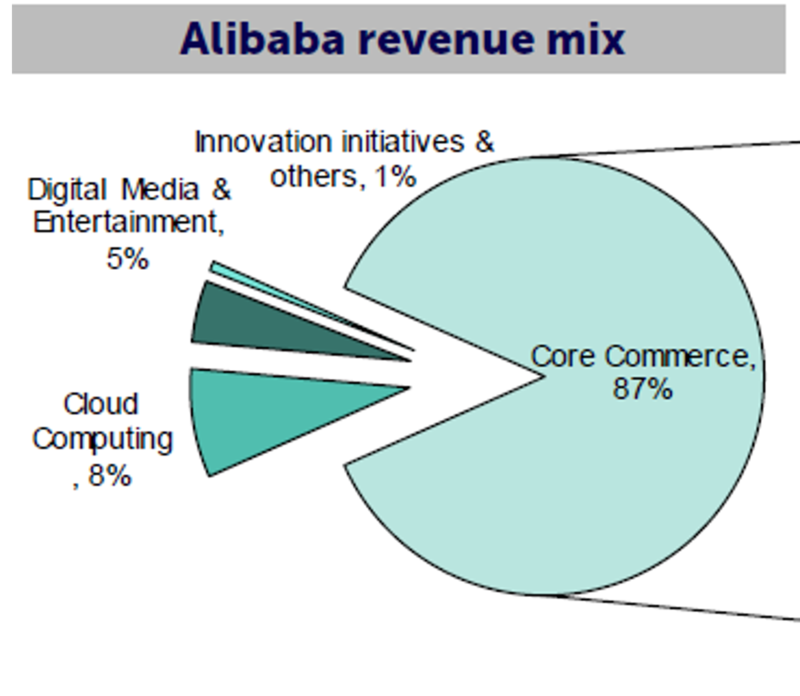

The core commerce business generates 87% of revenue and 100%of earnings. Cloud computing (8% of revenue); digital entertainment (5%) and other innovations are still loss making. Alibaba is also a 33%

shareholder of the upcoming mega IPO Ant Financial, which plans to raise circa$30bn in Shanghai and in Hong-Kong next October.

shareholder of the upcoming mega IPO Ant Financial, which plans to raise circa$30bn in Shanghai and in Hong-Kong next October.

In China, the e-commerce service is offered through two platforms: Taobao for C2C and Tmall for B2C. Today both platforms generate circa $1tr in GMV, evenly shared, and command a combined

64% market share in China online retail. While e-commerce has already reached 30% penetration, it keeps on growing 3x faster than total retail market (15% vs 5% respectively) in China. With Covid-19 pandemic, growth has accelerated even further. During 2Q20 results call, management mentioned 27% growth in Tmall GMV over the quarter, echoed by 26% GMV growth at nb2 player JD.com (2% of GemEquity).

Penetration and hence growth are uneven among cities and categories.

First, penetration is much higher in big cities where Alibaba has 80% market share and addresses a more sophisticated clientele through premiumization strategy. It focuses on service, convenience and higher ticket items (luxury products, international brands through crossborder portal). Over the last two years, it has also started focusing on lower tier cities where category expansion, attractive price and reach (reliable delivery) are key drivers. Today 80% of new customers come from lower tier cities. Another source of growth is category expansion: online supermarket and food delivery are still underpenetrated (below 10% mark). Groceries are offered through its internal initiative Freshippo (214 new retail format connected stores) and partnership with SunArt, largest supermarket chain in the country. Food delivery (1/3 of the market) and local based services are offered through Ele.me platform. The latter also generates 60% of digital wallet Alipay traffic.

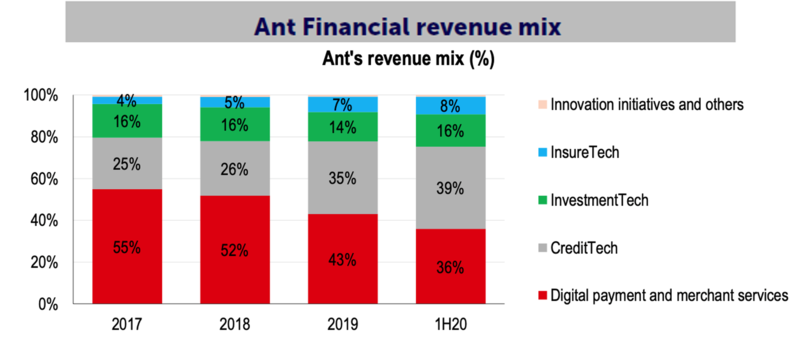

Pioneered in 2004, Alipay is today part of Ant Financial. It commands a 55% payment market share in China and generates 36% of Ant's revenue (cf chart hereby). As of June 2020 TPV (total payment value) transacted on the platform reached $17tr in China and $88bn abroad, on a 12-month basis.

It has 1bn registered and 711M monthly active users, connecting with 80M merchants.

Payment is more a source of traffic rather than a source of profit. Transaction rate is 0.05% vs 2.3% for PayPal for instance. Also 25% of Alipay users are already located abroad but they generate below 1% of TPV. The company managed to diversify its source of revenue, so the bulk of profit now comes from credit, asset management and insurance. The platform operates as a broker. It partners with 100 banks to whom 98% of loans are being passed: 170 asset managers and 90 insurance firms. Credit is mostly composed of consumer loans: 500M users, $300bn credit originated over the last 12 months, i.e. 16 loans every second. As of 1H20, the company generated $10.3bn in revenues and $3.3bn in net profit.

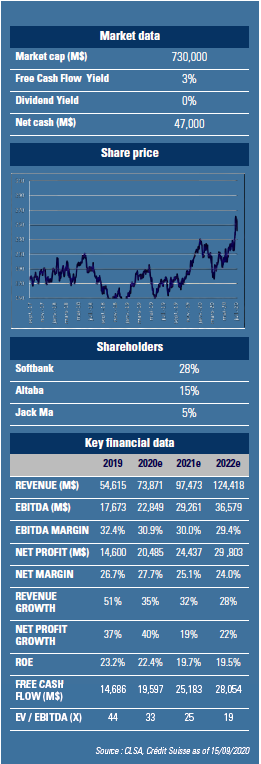

To complement the ecosystem, Alibaba offers a series of content products along with cloud services. In FYE 03/21, the company is expected to generate $98bn in revenues and $25bn in profit. Earnings growth rate should reach 25% CAGR over the next 3 years. The company has $47bn in net cash and valuation is reasonable: PER of 30x for FYE 03/21.