Charles Xiaojia, LI

Joined in October 2009 as CEO, Charles Li is the first mainland Chinese to run HKEX. Having announced his intention to step down at the end of his term of office (15 Oct. 2021), the Beijing-born former oilfield worker, journalist, lawyer and investment banker is one of the longest-serving chief executives of a global financial marketplace. Among his many achievements at HKEX, he led the acquisition of LME in 2012 and initiated the Stock Connect (the most important cross boarder trading platform between Hong Kong and Shanghai/Shenzhen). He also pushed for the largest listing rule reform in 30 years in order to reinvigorate the HK IPO market.

Hong Kong Exchanges & Clearing Ltd (HKEX) was created in 1999 as a result of a merger between the Stock Exchange of Hong Kong, Hong Kong Futures Exchange and Hong Kong Securities Clearing Company.

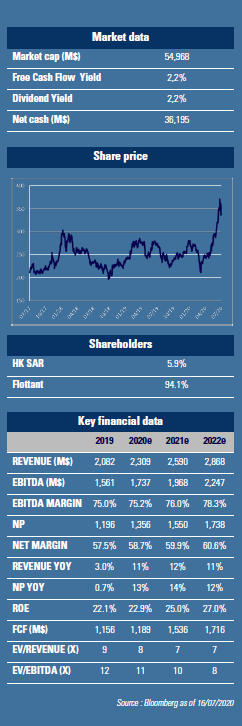

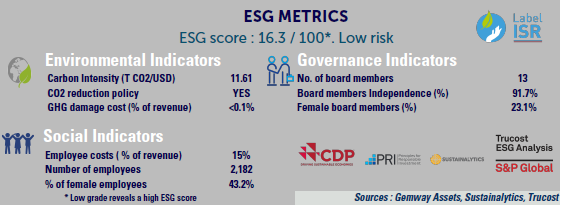

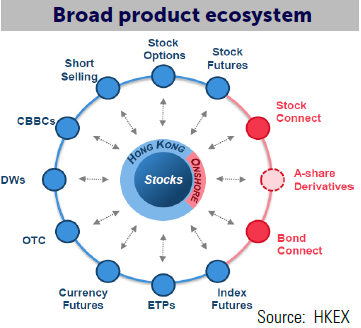

The group went public in 2000 and the HK SAR government has since remained its largest shareholder (5.93%). Following the acquisition of London Metal Exchange, the world’s largest marketplace for base metals contracts, HKEX has diversified its businesses into commodities in 2012.  As such, the group enjoys highly diversified revenue streams from a vertically integrated business model across different asset classes. Cash equities, derivatives and commodities trading contribute to half of its revenue, while post trade operations and market access technologies make up the rest.

As such, the group enjoys highly diversified revenue streams from a vertically integrated business model across different asset classes. Cash equities, derivatives and commodities trading contribute to half of its revenue, while post trade operations and market access technologies make up the rest.

As a monopoly of Cash and Derivatives markets in Hong Kong, Asia’s leading financial hub, HKEX is uniquely positioned at the intersection of Chinese and international capital flows. Although its home city faces a somewhat cloudy prospect due to the newly introduced national security law and the subsequent removal of US special status, we do not expect any meaningful changes to the fundamentals of its international financial market.

In our opinion, the national security law could safeguard Hong Kong’s long-term stability despite its controversial nature.

The success of Stock Connect, the cross boarder equity trading scheme pioneered by HKEX has further reinforced its position of preeminent intermediary of financial flows in and out of China. From almost nothing 4 years ago, Stock Connect contributed HK$1bn of revenue last year and continues to show strong momentum: both volumes and revenue (HK$404m, +74% yoy) were at record high in 1Q2020. Other than international investors’ increased interest in A shares (Northbound ADT of RMB78b, +103% yoy), mainland investors have also stepped up their participation in Southbound (ADT of HK$22b in 1Q, +83% yoy) and we see further upside as more companies (like Alibaba, JD.com, Netease ) will become eligible to the Southbound Connect.

Following the success of above-mentioned companies’ secondary listing, we expect to see accelerated homecoming of Chinese ADRs because of elevated US-China tensions.

Furthermore, we also expect HKEX to remain the world’s leading IPO venue (ranked #1 in 7 of the past 11 years) as its 2018 reform of listing rules (allowing Weighted Voting Rights) has greatly improved its appeal to companies from innovative sectors such as internet and biotech. On the product front, HKEX has just launched the first batch (10 out of 37 contracts) of MSCI futures contracts. ETF is also an interesting opportunity (2% and 6% of HKEX market cap and ADT last year, significantly lower vs. developed markets). However, we believe A-share derivatives offer the most upside in terms of revenue (potential volume opportunity of US$30-40bn after 5 years of launch). Its chance of being approved by regulator has increased after CSRC vice-chairman’s positive comment on 22 May, 2020. The stock trades at a 2021 P/E of 38x. Consensus forecasts revenue and earnings growth of 10 and 11% for this year. We see upgrade potential as trading volume is likely to be positively affected by increased global money supply. Our 3 funds (GemEquity, GemAsia and GemChina) are invested in the compnay.