XING WANG

Born in 1979, Xing Wang is the co-founder of Meituan Dianping and its current Chairman and CEO. Grown up in a business family, Wang received a bachelor’s degree in electronic engineering from Tsinghua University in 2001. Inspired by the success of Facebook, he gave up his pursuit of a PhD in computer engineering at the University of Delaware and returned to China to begin his journey as an entrepreneur. After a series of setbacks on different social network projects, Wang co-founded group buying platform Meituan in 2010 amid the success of US based Groupon. Since its IPO in September 2018, Meituan’s share price has increased 220% and the company now boasts a US$130bn market cap. Wang owns a 9.9% stake of the company with 46% voting rights.

Established in 2015 as a result of the strategic merger between Meituan Corporation (a Groupon-like platform for local deals co-founded in 2010 by Xing Wang) and Dianping Holdings (a Yelp-like platform for restaurant discovery), Meituan Dianping (Meituan) is China’ largest one stop e-commerce platform for services.

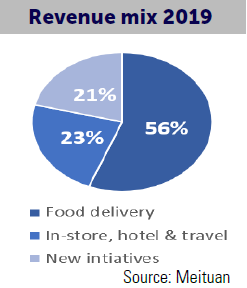

The company has 450M annual transacting users.  56% of its revenue is generated by the food delivery business in which the company enjoys a dominant position.

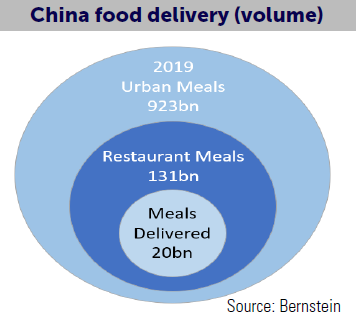

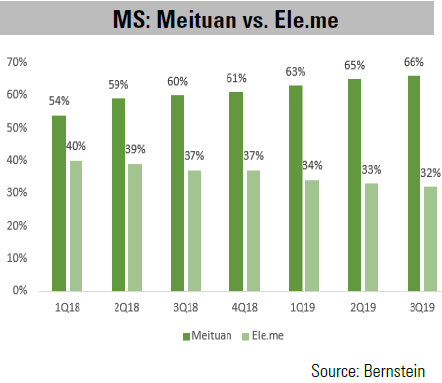

56% of its revenue is generated by the food delivery business in which the company enjoys a dominant position.  Meituan is also the domestic leader in in-store, hotel & travel businesses (21%) and has invested in new initiatives such as restaurant management system, bike sharing, grocery retailing and non-food deliveries. Driven by rising disposable income, China’s online food consumption is expected to grow >20% pa and on-demand food delivery being the most attractive segment as urban consumers seek convenience and time-efficient meals. Meituan and Ele.me (acquired by Alibaba is 2018) are best positioned to ride the tide as they compete in a duopoly. Meituan’s leading position (65% m/s) has been reinforced thanks to its strong delivery network (4M riders) with a particular advantage in lower-tier cities, intelligent order dispatching system and traffic support from Tencent, its strategic shareholder (20.7%).

Meituan is also the domestic leader in in-store, hotel & travel businesses (21%) and has invested in new initiatives such as restaurant management system, bike sharing, grocery retailing and non-food deliveries. Driven by rising disposable income, China’s online food consumption is expected to grow >20% pa and on-demand food delivery being the most attractive segment as urban consumers seek convenience and time-efficient meals. Meituan and Ele.me (acquired by Alibaba is 2018) are best positioned to ride the tide as they compete in a duopoly. Meituan’s leading position (65% m/s) has been reinforced thanks to its strong delivery network (4M riders) with a particular advantage in lower-tier cities, intelligent order dispatching system and traffic support from Tencent, its strategic shareholder (20.7%).

As such, it has built a solid ecosystem which connects over 6M merchants to its 450M users.

Its food delivery business became profitable in 2Q2019 thanks to improved economies of scale and growing advertising revenue. Despite temporary disruptio (1Q20 food delivery revenue -11% yoy), the company sees structural improvement post COVID-19 pandemic thanks to increased presence of high-end restaurants. It targets 100M daily orders in food plus grocery delivery by 2025 and reach EBIT of RMB 1 per order ($0.14, 5X vs. 4Q 2019). Meituan also leads in restaurant booking, travel and hotel business. It embraces the tremendous opportunities to cross-sell its low frequency, high margin consumer and merchant services (GPM 89% in 4Q19).

It became the largest hotel booking platform in China in 2019 (392M roomnights).

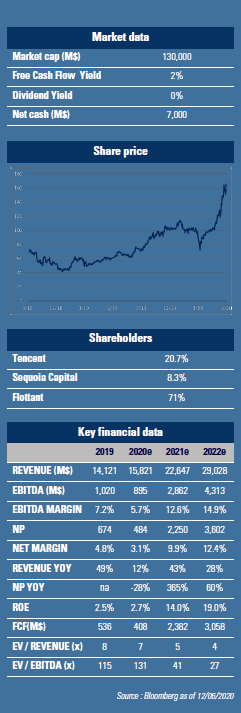

Although this segment has been hit by COVID, Meituan is relatively better off than its peers and should recover faster thanks to its high exposure to domestic market and lower-tier cities. As Wang has famously stated, “the second half of the internet-space battle is all about B2B”. Meituan has embarked on shifting its business model towards servicing merchants. In 2019, merchant advertising revenue grew 56% yoy.  The company also offers technology solutions to merchants including cloud-based ERP, integrated payment and supply chain solutions. Together with bike/car sharing, these new initiatives bring additional revenue streams while allowing Meituan to gain more control over the entire value chain, further sustaining and stimulating growth. We expect the company to generate 12% of sales growth this year with lower EPS (-28% yoy) as a result of COVID-19 and new investments. However, a strong earning recovery is expected next year (EPS at $0.4 vs. $0.1 in 2019). With net cash of $7bn, Meituan is able to finance itself. The stock trades at EV/Sales of 7x in 2020 and 5x 2021. We find the company highly attractive because of its dominant position as the go-to e-commerce platform for services. Our 3 funds (GemEquity, GemAsia and GemChina) are invested in the company.

The company also offers technology solutions to merchants including cloud-based ERP, integrated payment and supply chain solutions. Together with bike/car sharing, these new initiatives bring additional revenue streams while allowing Meituan to gain more control over the entire value chain, further sustaining and stimulating growth. We expect the company to generate 12% of sales growth this year with lower EPS (-28% yoy) as a result of COVID-19 and new investments. However, a strong earning recovery is expected next year (EPS at $0.4 vs. $0.1 in 2019). With net cash of $7bn, Meituan is able to finance itself. The stock trades at EV/Sales of 7x in 2020 and 5x 2021. We find the company highly attractive because of its dominant position as the go-to e-commerce platform for services. Our 3 funds (GemEquity, GemAsia and GemChina) are invested in the company.