MARCOS CALPERIN

While still a student at Stanford, Marcos Calperin, an Argentinian citizen had the great idea to launch an e-commerce platform in Latin America. One of his teachers, an early investor, helped the young man to find funding. After a conference, Marcos drove Hicks Muse private equity founder John Muse to his private plane and pitched him the idea. John was seduced and invested, along with a list of other big names such as Goldman Sachs and JP Morgan. The platform was launched in 1999. In 2001 eBay acquired a 19.5% stake and sold to MercadoLibre its Brazilian operations. In 2007 the company got listed on NASDAQ (MELI US), raising US$333m at US$18. Since then the share price went up 43x. In 2016 eBay exited and in 2019 MELI signed a cooperation deal with Paypal, which became its investor (US$750M injection). CEO Mr. Calperin fortune is now estimated at US$3.3bn (9% stake).

MercadoLibre is the largest online commerce and payment platform in Latin America, headquartered in Buenos Aires.

The region hosts a mostly young population of 644 million people with  average age at 30-35 (in Brazil for example only 9% of the population is above 60).

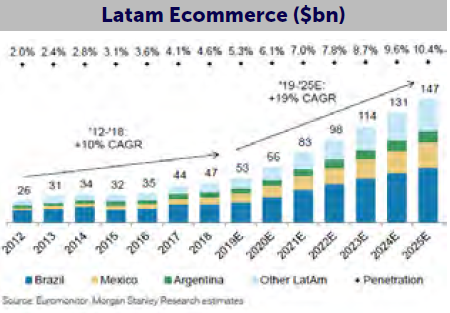

average age at 30-35 (in Brazil for example only 9% of the population is above 60).  Over 2010-18, Latin America e-commerce has been growing 10% pa in US$ as major players were building up their value propositions, platforms and logistics networks and as connectivity was expanding. Today 60% of the population is connected to Internet and e-commerce reached 4-5% of the overall highly fragmented retail market. Prior to the COVID19 outbreak the market growth was expected to accelerate to 19% CAGR by 2025 to reach$150bn but the quarantine may well prove to be an accelerator. As the reporting season unfolds, all players are posting accelerated growth in April vs. March 2020. MercadoLibre operates across 18 Latam countries with 95% of revenues coming from top 3 countries: Brazil (65% as of 2019), Argentina (19%) and Mexico (12%). It is the largest player across all 3 countries with 32% GMV market share in Brazil for instance (20% for B2W and 15% for Magazine Luiza (1.5% of GemEquity), both Brazilian competitors). International players such as Amazon have little presence because of being late comers.

Over 2010-18, Latin America e-commerce has been growing 10% pa in US$ as major players were building up their value propositions, platforms and logistics networks and as connectivity was expanding. Today 60% of the population is connected to Internet and e-commerce reached 4-5% of the overall highly fragmented retail market. Prior to the COVID19 outbreak the market growth was expected to accelerate to 19% CAGR by 2025 to reach$150bn but the quarantine may well prove to be an accelerator. As the reporting season unfolds, all players are posting accelerated growth in April vs. March 2020. MercadoLibre operates across 18 Latam countries with 95% of revenues coming from top 3 countries: Brazil (65% as of 2019), Argentina (19%) and Mexico (12%). It is the largest player across all 3 countries with 32% GMV market share in Brazil for instance (20% for B2W and 15% for Magazine Luiza (1.5% of GemEquity), both Brazilian competitors). International players such as Amazon have little presence because of being late comers.  MercadoLibre operates a marketplace platform connecting 43M unique buyers with 11M unique sellers (as of 1Q20).

MercadoLibre operates a marketplace platform connecting 43M unique buyers with 11M unique sellers (as of 1Q20).

Overall it has 320M registered users.

MELI has the largest assortment across the region (136M SKUs) with key categories being electronics (40% of GMV), apparel (20%), home & industries (17%) and auto-parts (13%). Electronics is the most penetrated category in Latam (28%) hence the company has been investing into logistics in order to promote other categories such as apparel (only 2% penetration) or personal goods. It launched MercadoEnvios smart logistics solution, similar to Alibaba's Cainiao in China. It is an Uber-like platform connecting drivers with sellers in order to optimize the dispatching. The company claims to be more efficient and cheaper than logistics companies. Today 88% of parcels are being delivered through the internal solution (vs. barely 30% 2 years ago). The solution is still very much subsidized in order to create stickiness and is surely a competitive edge in current quarantine times: GMV growth accelerated from 34%in 1Q20 to 73% in April (in local currency).

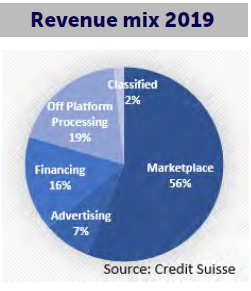

In 2003, the company launched payment solution MercadoPago.

First satisfying the internal online demand, it later expanded to 3rd party platforms and physical stores.

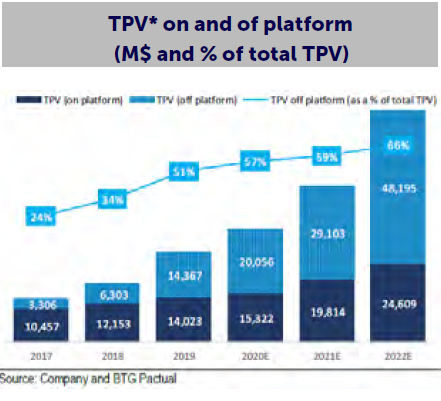

Alternative financial providers are more than welcome in Latam due to 1/still low bankarisation levels (55% on average, 70% in Brazil but 40% in Mexico) and 2/ high commissions and interests implemented by leading banks. Today MercadoLibre provides mobile point of sales solutions to 2.5M merchants and counts 8M active payers in digital wallet. As illustrated on the side, 57% of the total payment value is generated outside of MELI's platform in 2020e. To complement the offering in 2017 the company launched a credit solution for merchants and consumers. In 1Q20 consolidated credit portfolio reached $148M. The Fintech initiave is still highly subsidized as the company focuses on market share and early adoption. TPV* growth also accelerated recently: + 120% in April vs 84% in 1Q20.

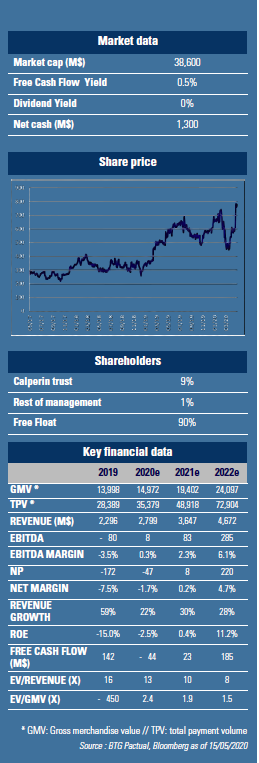

In 2019, MELI raised $1.85bn in equity to fund its growth initiatives. The balance sheet is healthy with a $1.3bn net cash position. Growth, service quality and market share are the key names of the game today so little profit but high growth is to be expected. Over the next 3 years GMV and TPV are expected to grow 20% and 37% CAGR respectively in US$ terms. Revenues are expected to grow 27% CAGR (US$). GemEquity has 1.5% of the portfolio invested in the company and 3% in the overall Latam e-commerce sector.